The ADOBE Paradox: Consistent Growth or AI Cannibalization & Stagnation?

What are the issues and evidence pressuring the stock and whats already in the price? An AI investigation.

Disclaimer: The following discussion and analysis is provided for educational purposes only and is not financial advice or a recommendation to buy or sell the stock. It is subject to The Inferential Investor’s Disclaimer here.

Following Q3 earnings I have been spending my time investigating stocks that are on their knees, to look for opportunities away from the usual momentum crowd: NIKE, PAYPAL, RIVIAN, WAYFAIR and now ADOBE have all been broken down using advanced AI investment research techniques available from the prompt library that help me surface whats driving them and synthesize where I think the stock is headed and under what conditions I find the stock attractive to own.

There’s many frogs to kiss doing this, but its incredibly efficient now with AI and each one of these has conditions under which a re-rating can be a substantial opportunity. Think of Google at the height of the AI search cannibalization concerns or Oracle before it showed its hyperscaler capabilities. Companies and conditions don’t stand still. They evolve in the face of concerns and I find it instructive to intimately know the issues and what it will take to change investor perception in order to capture these opportunities at some point down the road.

From this AI-driven research activity, I save my AI chats on the stock to build later analysis on and store notes and alerts in Koyfin to record my conclusions and remind me later, as conditions change, why the stock may become attractive again. This has been a 20-year habit. There’s nothing better than being prepared to pounce when something unexpected occurs.

Onto ADOBE - its fair to say the market is hating on this traditional golden child of SaaS with the stock down 50% from its early 2024 highs. This is what bear porn looks like for investors:

ADOBE - 2021-2025

For decades, Adobe was the undisputed king of the creative economy - a software compounder with a wide moat, sticky enterprise customers, and pricing power that few could rival. Yet, throughout fiscal 2025, a dissonance has emerged. Adobe, consistently across Q1-Q3, continues to post double-digit revenue and EPS growth and beat earnings targets, but its stock remains under significant pressure, trading at multiples that suggest its best days are behind it (now 14x forward P/E vs most of the last decade above 30x).

Adobe - Forward P/E multiple, last 20 years. Not far from historic lows.

The market has moved from viewing Adobe as a growth inevitability (which saw the stock trade at 30x to 50x forward earnings) to an “AI is eating me” story. The central question is no longer about margins or cash flow conversion, both remain stellar, but about existential relevance in an AI world. Is Generative AI simply a reorganization of industry growth drivers (from seats over price to price (value uplift from AI) over volume? Or is it a deflationary force that will hollow out the professional user base, reducing the need for “seats” of Photoshop and Illustrator and pressure prices due to the proliferation of GenAI low-priced image generators?

This analysis dissects the issues weighing on the stock, explores the fierce analyst debate, and performs a forensic audit of Adobe’s growth engine - all conducted using our AI techniques and workflows.

By stripping away the noise of price hikes and currency fluctuations, I reveal a slowing core business based on seat volume, but this is offset by clearly accelerating price hikes that reflect Adobe sharing in the efficiency dividend of its clients. However, the market is now pricing Adobe as if it were the “new” Oracle, the way Oracle was viewed more than 5 years ago.

…..things that make me go “hmmmmmmmm”.

The Core Issue: The “Seat Risk” Conundrum

The pressure on Adobe’s stock stems from a single, pervasive fear: AI Cannibalization.

For years, Adobe’s growth algorithm was simple: P x Q (Price times Quantity). They raised prices periodically, but the primary driver was always Quantity—more designers, more marketers, and more students entering the creative workforce as cloud based software and the digital marketing shift made digital media an incredible force for growth.

Generative AI threatens to break the “Q” part of that equation and some believe the “P” as well. The bear case, often summarized as “AI eating software,” posits that tools like Midjourney, OpenAI’s Sora, Nano Banana and Adobe’s own Firefly make individual creatives significantly more efficient. If one designer using AI can do the work of three, enterprise clients, who are aggressively cutting costs, will eventually reduce their seat count.

Anecdotal evidence has fueled this fear. In early 2025, fintech giant Klarna revealed it had cut sales and marketing agency spend by 25% using GenAI, implying downstream pressure on the agencies that buy Adobe licenses. Major ad holding companies like WPP and Publicis have slowed headcount growth while ramping up AI investment. The fear is that we are entering a period of “jobless creative growth,” where the volume of content explodes, but the number of paid human subscribers flatlines. That is a drag on Adobe.

The Analyst Debate: A House Divided

Wall Street is deeply polarized on how to interpret these signals, particularly now that Adobe has de-rated so far, splitting into two distinct camps.

The Bulls: “The Democratization and Price Thesis”

Bulls argue that the “AI death” narrative is vastly overblown, just as it was for Google. They view AI not as a replacement for humans, but as an on-ramp. Their thesis is that AI lowers the barrier to entry, allowing millions of non-professionals to become subscribers via accessible tools like Adobe Express (and Nano Banana etc). After all, how many digital images have you been creating or viewing since GenAI came on the scene? (The header image at the top is from Adobe Firefly inside Express). They point to Adobe’s proprietary data and “commercially safe” Firefly models as a wide moat that enterprise CIOs will pay a premium for, protecting Adobe and clients from the legal risks associated with open models. The second bull argument is one already made above - that building in new advanced capabilities increases the value of the software and facilitates more price increases. The drivers potentially shift to price from seats as Adobe gets to share in the “efficiency dividend”.

The Bears: “The Deflationary Thesis”

Bears, such as Melius Research (who downgraded the stock to Sell), argue that AI is structurally deflationary for seat-based software. They believe the “democratization” users will flock to cheaper, “good enough” web-based alternatives like Canva or Figma, while the high-end professional base shrinks due to efficiency gains. For them, every “efficiency” feature Adobe releases, like Generative Fill or Text-to-Video, is a double-edged sword that increases the value of the software but decreases the necessity of the human operator. Fast evolving capabilities (like Nano Banana PRO in Gemini 3) cut the gap (drain the moat?) between Adobe’s professional software and what can be done cheaply in-house.

Where do you sit in this debate? I find myself split due to the evidence below but also the poor performance of these low priced competitors like Canva. I have used their AI offering many times and find myself giving up and moving on to Adobe or Nano. Canva’s AI offering is quite frankly disappointing and in my personal experience, a waste of my time. I have also seen business models move from the volume to value phase. Think Real Estate platform stocks like Realestate.com.au that has continued to grow for the last decade almost exclusively by price alone. That path does exist as a viable business model provided value for customers is at the core.

Forensic Analysis of the Actual Evidence: Deconstructing the “Double Digit” Growth

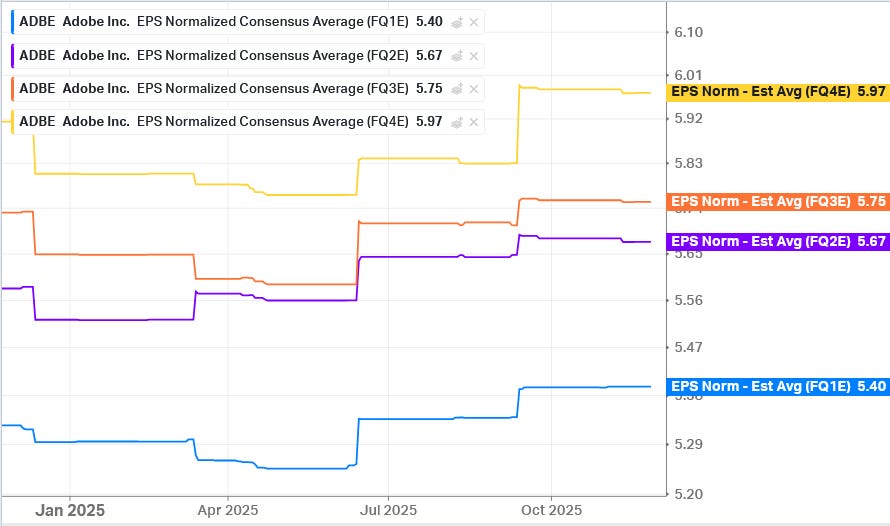

To determine which camp is right, we cannot rely on headline numbers. Adobe reported consistent 11% revenue growth in Q1, Q2, and Q3 of fiscal 2025. On the surface, this looks stable and has been beating guidance. Just look at analyst estimate trends rising - typically you see analysts cutting estimates in a stock experiencing such pressure.

ADOBE - Consensus estimate trends for next 4 quarters.

Source: Koyfin

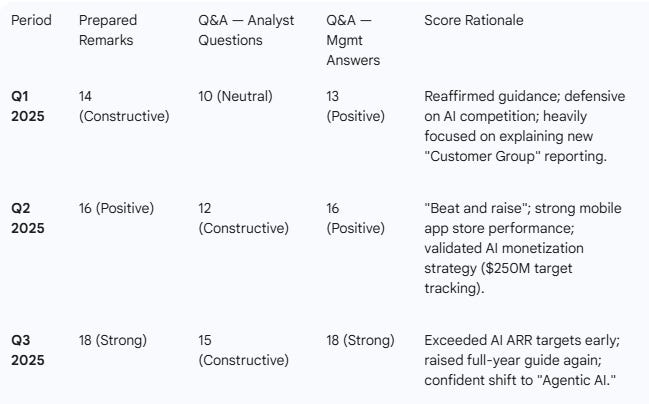

Sentiment scoring, revealed through transcript analysis has also shown a positive inflection in the latest quarter - even for analyst questioning as well as management discussion and answers. Management became more bullish in Q2 and analyst questions followed this in Q3:

ADOBE Transcript sentiment scores: Prepared remarks, vs Q&A

However, a forensic analysis of the earnings transcripts and financial drivers demonstrates that the components of that growth are shifting.

1. Transcript Analysis: The Narrative Shift

Analyzing the Q1 through Q3 transcripts reveals a telling evolution in management’s language.

Q1 2025: The focus was on “Generative AI” and “Firefly” as a novel creative tool. Management introduced a new reporting structure (”Customer Groups”) to highlight growth in non-creative segments, perhaps anticipating weakness in the core?.

Q3 2025: The narrative pivoted aggressively to “Agentic AI” - autonomous agents that perform tasks without human intervention. While technologically impressive, this pivot implicitly acknowledges a future with fewer human operators. If software becomes “agentic,” the business model must shift from selling seats to selling outcomes / consumption / value, a transition that could be difficult and vastly more competitive.

2. Synthesizing Evidence of Core Organic Growth

The most damning trend is visible when we strip away the external boosters of growth: Price and Currency.

In Q3 2025, Adobe reported 11% revenue growth. However, this figure was propped up by two non-operational factors:

FX Tailwinds: Currency fluctuations flipped from a headwind earlier in the year to a +1% tailwind in Q3. Without this, reported growth would have been 10%.

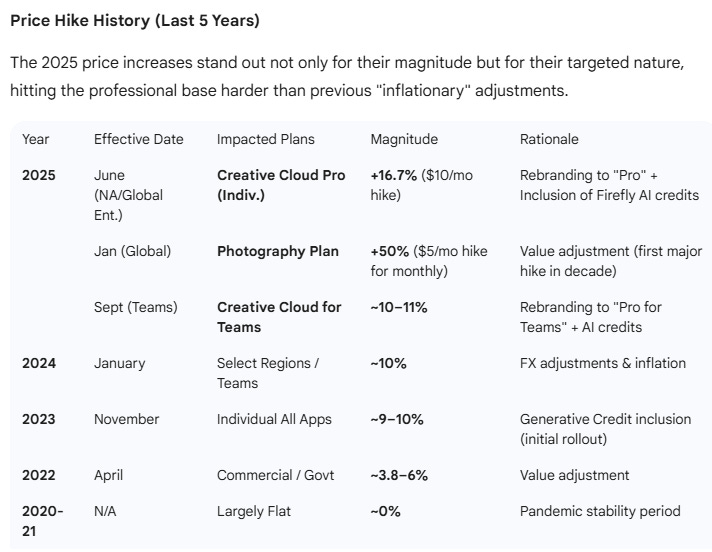

Pricing Actions: Adobe implemented aggressive price hikes in fiscal 2025. This included a ~16% increase on Creative Cloud Pro plans (effective June 2025) and a 50% hike on the Photography plan (effective January 2025).

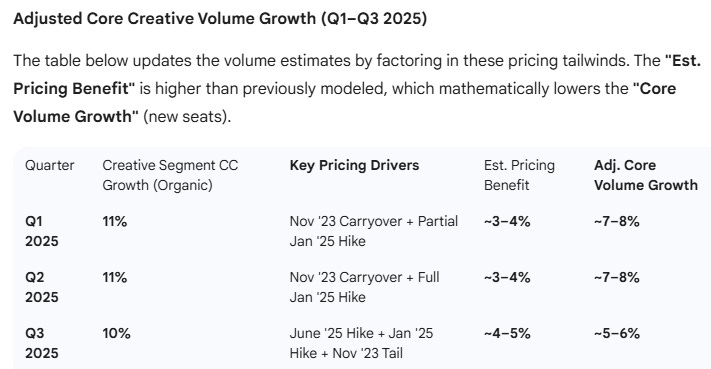

When we isolate the Creative & Marketing Professionals segment which is the core business exposed to “seat risk” and adjust for these factors, the picture is stark.

To do this I led Gemini 3 through a series of chain of thought steps: first stripping away the FX impacts each quarter (-1% headwind in Q1 and Q2 to +1% tailwind in Q3), researching and isolating price hikes announced by Adobe over the last few years and their phasing, then having the model estimate the pricing benefit to revenue growth taking into account contract lengths, timing of hike and relative materiality of product line. This can only ever be an estimation as certain assumptions have to be made in the analysis, however the table below shows AI’s best guess as to the underlying “volume only” trends:

Reported CC revenue growth for the creative segment in Q1 was 11% with an estimated ~7-8% being adjusted core volume growth. By the time of Q3, this analysis shows core volume growth having slowed to 5-6%. Its still growth, but it feeds into the bear case narrative.

This analysis consequently suggests that the actual number of new professional creative seats grew only in the mid-single digits in Q3, a significant deceleration from the double-digit volume growth of Adobe’s heyday.

Adobe is successfully pulling the pricing lever to offset this slowdown:

Scan upwards in the above table and you can see clearly how price increases are actually accelerating and targeting the professional base. The bears will suggest that this price hike driver is finite and brittle and may be timed to try and maintain the optics of revenue growth. Once the industry cuts seats, pricing power may vanish.

However that argument is at odds with the rationale behind these price hikes - GenAI inclusion is increasing the value of these plans as shown in their first major adjustment in Photography plan pricing in a decade and the inclusion, at the times of these hikes, with AI credits across products. This is the efficiency and value inclusion dividend.

Meanwhile, seat growth may have slowed, but its still growing. The evidence on the combination of these factors - accelerating price drivers and slowing but still growing core volumes, is more aligned with the “continued growth / different drivers” thesis for Adobe.

3. Further Surfaced Trends: The “Masking” Effect

The stability of the topline is also being maintained by a divergence between Adobe’s two main clouds. The Document Cloud (Acrobat/PDF) business is growing at 15% YoY. This segment is less exposed to “creative” displacement risks and is benefiting from the return-to-office and digital workflow trends.

Effectively, growth in the PDF business is helping to offset the full effect of the structural slowdown in volumes in Adobe’s creative franchise. While this diversification is a credit to management, it obscures the reality that the “crown jewel”, Photoshop and the Creative Cloud, is now a lower growth business.

So lets round that out. Adobe’s growth has slowed - there’s no denying that. Pre COVID, the company regularly reported 20-25% revenue growth YoY. Today it is half that level. The Document Cloud is growing mid-teens while the Creative segment is growing low double digits with pricing taking the reins as the primary driver and volume growth slowing.

What’s in the Price?

So, is the stock a trap, a bargain or somewhere in between? To answer this, we turn to valuation using a “whats in the price” methodology.

Using a Discounted Cash Flow (DCF) model, we can reverse-engineer what the market is currently paying for.

Base Year FCF: $10.0 billion (FY2026 estimate).

Cost of Capital (WACC): ~10.75%

Current Share Price: ~$319.

Our analysis shows that to justify a share price of ~$308—roughly where it trades today, you only need to assume that Adobe will grow free cashflows at 3% into perpetuity - ie the rate of inflation compared with low double digits today. At a lower WACC, you can justify that the current share price assumes zero growth forever. The market has de-rated Adobe such that it is currently pricing the company as if it will never grow organically again in real terms at the bottom line. The valuation implies zero net expansion in its customer base or product volume even though its has a 15% growing document cloud business. Adjust for that growth and it implies that market pricing actually assumes potential declines in perpetuity for the creative business that is still growing low double digits.

Conclusion

Adobe is under pressure because the market has successfully identified an important AI driven risk backed by evidence of a deceleration in core creative seat volume that it sees as long term, with underlying trends in Q3 feeding this narrative. Short interest has been creeping up over the last year in alignment with that view.

However, as I’ve shown using step by step AI analysis of Adobe’s transcripts and accounts, there is also strong evidence of the alternative argument - that price hikes are the new driver as more and more value from AI is embedded in products. As customers cut or slow creative employee growth, Adobe shares in that efficiency dividend as it maintains the gateway to safe, guard-railed, efficient commercial creative development in an AI world.

It may well be a slower growth future than 10 years ago, however as we’ve already seen with the Semrush acquisition, Adobe has the balance sheet (and the clear desire) to continue to bolt-on AI-aligned businesses that in aggregate, may one day change the narrative again - just as happened with Google recently.

There are a variety of wildcard events I will keep an eye out for as potential positive catalysts, even as the stock likely de-rates further:

Any sign of AI native competitors being forced to raise their own prices to manage losses. This would challenge analyst focus on the fragility of the pricing pathway which right now is anchored by a belief that these low cost AI competitors can keep a lid on price upside for Adobe. I feel this is inevitable given the extent of capital and spending commitments, however have no visibility on timing. Its a competition for users right now. OpenAI is likely the most pressured to do so without other cash cow businesses to lean on, but while the capital tap is gushing, will resist the temptation as long as they can.

Any sign that Adobe manages to launch in-house creative AI models that are their own Gemini 3.0 PRO moment - shifting it ahead of competition and delivering even greater embedded value for customers.

However, at ~$319, the market has, at least as far as theoretical cashflow valuations imply, priced one of the world’s highest-quality software companies as a stagnant utility. This doesn’t mean it can’t move even lower. Oracle, over its stagnant decades would regularly revisit a low of 9.5x P/E only to nearly double to 16-18x as it saw conditions improve. This is a potential path for Adobe as they navigate this AI transition. Slowdown, then reacceleration - rinse and repeat. The thing is those acceleration periods provided attractive returns for Oracle traders many times.

This does not mean that Adobe’s share price will increase anytime soon - the slowdown narrative is still firmly in control. A lower P/E right now appears more likely than the opposite. However, I continually remind myself to be alert for the rebound opportunities and knowing the drivers is the key step in that process.

Happy Thanksgiving,

Andy West

The Inferential Investor

"Scan upwards in the above table and you can see clearly how price increases are actually accelerating and targeting the professional base. The bears will suggest that this price hike driver is finite and brittle and may be timed to try and maintain the optics of revenue growth. Once the industry cuts seats, pricing power may vanish."

It seems any thesis will be a product thesis at its heart. As you concluded, the Street is notoriously skeptical of product strength once any weakness has occurred.