RIVIAN AUTOMOTIVE INC Q3 FY25 Earnings Call Transcript Analysis

Everything riding on the R2 launch in the hunt for profitability

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

1. Executive Summary

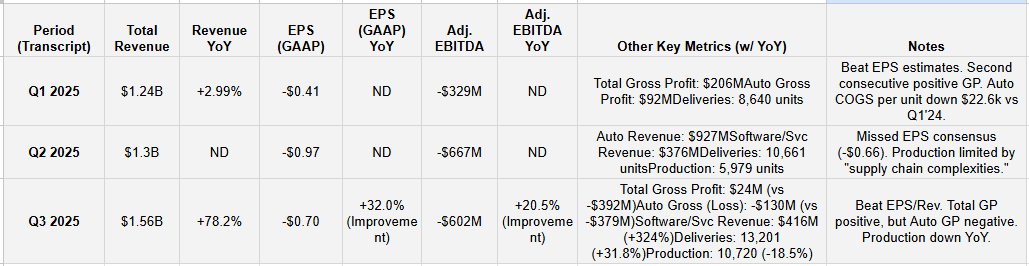

Q3 Beat Overshadowed by Core Automotive Weakness: Rivian beat Q3 2025 revenue and EPS estimates. However, total Gross Profit of $24M was entirely driven by the Software & Services segment ($154M profit), which is roughly 50% attributable to the Volkswagen JV. The core Automotive segment still posted a gross loss of -$130M.

Production vs. Deliveries Divergence: A key red flag in Q3 was a YoY decline in production (10,720 units vs. 13,157 in Q3’24), even as deliveries rose (13,201 vs. 10,018). This indicates the company is selling down inventory rather than accelerating production.

Guidance Story is “Hold and Tighten”: After a major Adj. EBITDA loss guide-down in Q2 (from -$1.8B midpoint to -$2.125B midpoint), management reaffirmed this negative guidance in Q3. The 2025 delivery guide was tightened to 41.5k-43.5k units from 40k-46k, a slight raise at the midpoint but not a significant change in trajectory.

Narrative Shift to R2 & Cost Control: The strategic narrative has firmly shifted from R1 volume growth to cost reduction (”unit economics”) and execution on the R2 platform, which is positioned as the key to long-term profitability and market share.

Software & Services (VW JV) is a Bright Spot: The Software segment has emerged as a major financial contributor, delivering $416M in revenue and $154M in gross profit in Q3, significantly buffering losses from the automotive business.

Persistent Headwinds: Management commentary has become more cautious since Q1, consistently citing “uncertainty from trade, tariff, and regulatory policy” as a headwind impacting results and guidance.

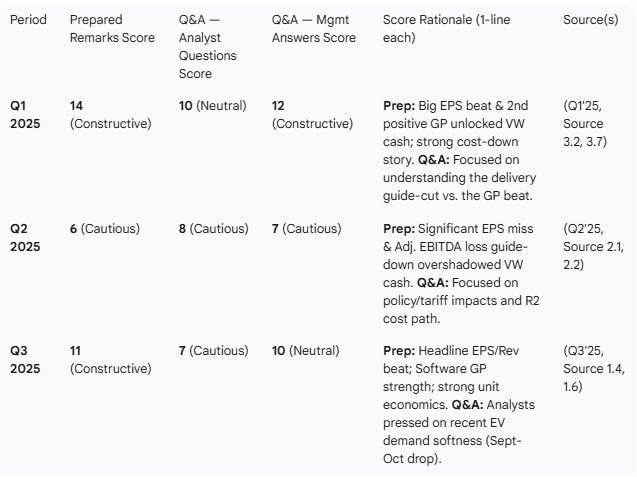

Sentiment is Cautious: Sentiment peaked in Q1 with the gross profit inflection. Q2 saw a sharp drop with the EPS miss and EBITDA guide-down. Q3 sentiment recovered slightly on the headline beat, but analyst questions on EV demand softness reveal underlying market concerns.

2. Table 1: Results & YoY Growth (RIVN)

3. Table 2: Guidance & Long-Term Goals Evolution (RIVN)

Key Management Quotes on Guidance

Q3 2025: “Finally, for our guidance. We are reaffirming our 2025 delivery guidance range of 41,500 to 43,500 units. We are reaffirming our 2025 adjusted EBITDA loss guidance range of $2 billion to $2.25 billion and 2025 capital expenditures guidance of $1.8 billion to $1.9 billion. We continue to expect our gross profit for the full year of 2025 to be roughly breakeven.” (Q3’25, Prep., Source 1.6)

Q2 2025: “The company is maintaining its 2025 delivery guidance range of 40,000 to 46,000. Because of some of the recent changes associated with regulatory credits and its second quarter performance, the company is increasing its guidance for adjusted EBITDA losses to ($2,000) million - ($2,250) million.” (Q2’25, Prep., Source 2.2)

Q1 2025: “As a result of these impacts [tariffs/policy], Rivian has revised its delivery outlook to 40,000 to 46,000 vehicles... Rivian is maintaining its outlook range for adjusted EBITDA of a $1.7 billion loss to a $1.9 billion loss. Rivian also relayed an expectation to achieve ‘modest positive gross profit for the full 2025 fiscal year.’” (Q1’25, Prep., Source 3.7)

4. Table 3: Sentiment Score (0-20)

5. Management’s Key Themes (Prepared Remarks)

Q3 2025 (Call: Nov 4/5, 2025)

Growth/Strategy: Focus is on the R2 platform, which “is addressing the largest market opportunity with the right product” (the ~$50k, 5-seat SUV segment). (Q3’25, Prep., Source 1.6, 2.6)

Margins/Costs: Management highlighted “strong progress in our unit economics with one of the best quarters ever in automotive cost of goods sold per unit delivered” despite the ongoing automotive gross loss. (Q3’25, Prep., Source 1.6)

Software & Services (VW JV): This segment is a major financial driver, with $416M revenue and $154M gross profit. “About half of the revenue... was a result of the software and electrical hardware joint venture we created with Volkswagen Group.” (Q3’25, Prep., Source 1.6)

Challenges/Risks: Management cited “near-term uncertainty from trade, tariff, and regulatory policy” as an ongoing headwind. (Q3’25, Prep., Source 1.6)

Key Quote: “I’ve never been more confident in the opportunity ahead for Rivian than I am today... I believe our technology and our products will position Rivian as a market share leader over the long term.” (RJ Scaringe, Q3’25, Prep., Source 1.6)

Q2 2025 (Call: Aug 5, 2025)

Challenges/Risks: This was the dominant theme. “Changes to EV tax credits, regulatory credits, trade regulation and tariffs are expected to have an impact on the results and the cash flow of our business.” (Q2’25, Prep., Source 2.1)

Production: Production was “limited primarily due to a variety of supply chain complexities partially driven by shifts in trade policy.” (Q2’25, Prep., Source 2.2)

Strategy (R2): The R2 is positioned as the path to profitability. “R2 estimated to be less than half the cost of revenues per unit as compared to R1.” (Q2’25, Prep., Source 2.7)

Capital Structure: The $1B equity investment from Volkswagen Group was received, bolstering the cash position to $7.5B. (Q2’25, Prep., Source 2.1, 2.2)

Key Quote: “Our long term view on electrification and the opportunity in front of us remains the same. However, there have been changes in the external operating environment that affect the nature of this transition.” (Q2’25, Prep., Source 2.1)

Q1 2025 (Call: May 6, 2025)

Margins/Costs: This was the primary focus. “Rivian delivered a second consecutive quarter of positive gross profit with a gross profit of $206 million.” This was driven by a “$22,600 reduction in automotive cost of goods sold per vehicle delivered in Q1 2025 compared to Q1 2024.” (Q1’25, Prep., Source 3.2, 3.7)

Capital Structure: Hitting the gross profit milestone “unlocked an expected $1 billion investment from Volkswagen Group.” (Q1’25, Prep., Source 3.3)

Strategy (Product/AI): “R1S remained the bestselling SUV with a starting price over $70,000 in California.” (Q1’25, Prep., Source 3.2)

Strategy (AI/Autonomy): Management highlighted the “data flywheel” from the fleet, stating it is “enabling an important acceleration to our technology” and that the “Rivian Autonomy platform” is a “most critical technology focus area.” (Q1’25, Prep., Source 3.2)

Key Quote: “I’m excited that Rivian delivered a second consecutive quarter of positive gross profit... This reflects an outstanding effort from the team and a continued focus on cost and operational efficiency.” (RJ Scaringe, Q1’25, Prep., Source 3.2)

6. Analyst Q&A Themes & Evolution

Q3 2025: The dominant theme was EV demand softness. Analysts explicitly asked about the “quite a bit of a drop” in EV industry sales from September to October and Rivian’s “level of comfort around the demand levels.” Management’s response was to deflect from near-term softness and focus on the long-term, stating “ultimately, customers are going to be making decisions around what’s the best product for them.” (Q3’25, Q&A, Source 1.6)

Q2 2025: The focus was on digesting the negative guidance. Analysts’ questions centered on the path to profitability given the new, higher Adj. EBITDA loss guide. Key themes included:

R2 Cost Reduction: How to achieve the steep cost-down targets for R2.

Policy Impacts: Seeking more color on how tariffs and tax credits were impacting financials.

Autonomy: Questions on the autonomy development plans. (Q2’25, Q&A, Source 2.1)

Q1 2025: (Inferred from transcript summaries) The primary theme was reconciling the two conflicting data points: the positive gross profit beat versus the negative delivery guidance cut. Analysts were likely probing the drivers for the guidance cut (tariffs, demand) and the sustainability of the gross profit achievement.

Evolution: The Q&A focus has shifted significantly. In Q1, it was about the internal story (costs vs. guidance). By Q2, it had shifted to external pressures (policy, tariffs). In Q3, the focus has become macro and cyclical, zeroing in on end-market demand for EVs, a new and more cautious line of questioning.

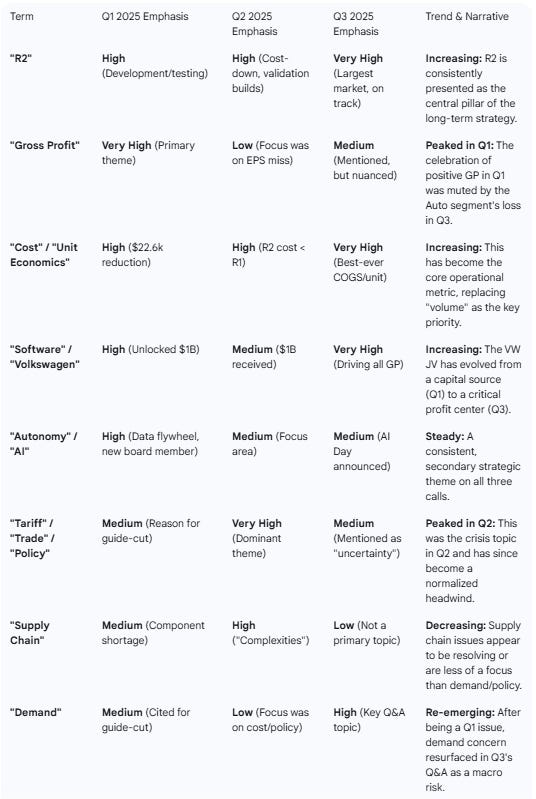

7. Term Frequency Tracking (Qualitative Analysis)

This analysis qualitatively tracks the frequency and emphasis of key terms identified in the Q3 2025 transcript across the last three calls.

8. TF/IDF Key Theme Evolution (Qualitative)

This analysis identifies the single most important, differentiating theme of each call.

Q1 2025: Gross Profit Inflection. The entire narrative was built around achieving a second consecutive quarter of positive gross profit, which validated cost-control efforts and, crucially, unlocked $1B in funding from Volkswagen.

Q2 2025: Policy & Cost Crisis. The story was dominated by negative revisions. The significant EPS miss and, more importantly, the $325M (midpoint) increase in the Adj. EBITDA loss guidance were explicitly blamed on the “complex and rapidly evolving” policy environment (tariffs, regulatory credits).

Q3 2025: Segment Divergence (Software vs. Auto). The headline beat masked a critical divergence: the core Automotive business is still losing money on a gross basis, while the Software & Services segment, buoyed by the VW JV, is highly profitable and responsible for all of the company’s positive gross profit.

Narrative Summary: The company’s story has evolved from “We are fixing costs” (Q1) to “External headwinds are hurting us” (Q2) to “Our core product is still losing money, but our software JV and cost-cutting are keeping us afloat as we race to R2” (Q3).

9. Red Flags & Open Questions (from Q3 2025 Call)

Production vs. Delivery Mismatch: This is the largest red flag. Production fell 18.5% YoY to 10,720 units, while deliveries rose 31.8% to 13,201 units. (Source 1.4) This implies a significant inventory drawdown of over 2,400 vehicles in the quarter. This is not sustainable and raises serious questions about Q4 production and underlying demand.

Automotive Gross Loss: Management highlighted “strong progress in our unit economics.” (Source 1.6) However, the Automotive segment still posted a gross loss of $130M. (Source 1.4) The total company gross profit of $24M is entirely dependent on the Software segment’s $154M profit. (Source 1.4) This masks the fact that the core business of building and selling cars remains unprofitable.

Source of Software Profit: “About half of the revenue within Software and Services was a result of the... joint venture we created with Volkswagen Group.” (Source 1.6) This raises questions about the quality and sustainability of this profit stream versus recurring software revenue.

Q&A on Demand: Analysts’ direct questions about a “drop” in EV sales (Source 1.6) signal real-time market concern. Management’s pivot to a “long-term horizon” view, while typical, does not address the near-term concern.

“Roughly Breakeven” GP: The full-year 2025 gross profit guidance was softened from “modest positive” (Q1) to “roughly breakeven” (Q3). (Source 3.3, 1.6) This change in language, combined with the Q3 Auto gross loss, suggests pressure on full-year profitability.

10. Follow-On Analysis Options

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis

Couldn't agree more. This analysis goes right to the hart of Rivian's current challenges. That production vs deliveries divergence is a stark point. The software segment is clearly doing all the heavy lifting. It makes you really think about their future trajectory. Very sharp.