The Fascinating Turnaround of NIKE as revealed through Transcript Analysis

Our detailed analysis highlights the state of progress and remaining challenges in NIKE's turnaround story

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Disclaimer: The following discussion and analysis is provided for educational purposes only and is not financial advice or a recommendation to buy or sell the stock. It is subject to The Inferential Investor’s Disclaimer here.

Just Undo It - Nike’s Struggles

Nike, the undisputed titan of sportswear, currently finds itself navigating one of the most complex periods in its history. After years of aggressive direct-to-consumer expansion, the company has hit a “perfect storm” of headwinds: a structural decline in digital traffic, oversaturation of its “Classics” franchises like the Air Force 1 and Air Jordan, and a persistent slowdown in the critical Greater China market. Compounding these operational struggles are external shocks, including escalating tariffs that are projected to cost the company approximately $1.5 billion annually, pressuring margins just as the brand attempts to reset. Management has candidly admitted that recent results have not met the “Nike standard,” acknowledging that the company became too siloed and lost some of its sharpness in serving the athlete and the broader marketplace.

In response, CEO Elliott Hill has initiated an aggressive turnaround plan defined by two strategic pillars: the “Win Now” actions and a reorganization known as the “Sport Offense”. This pivot involves a deliberate reduction of legacy inventory to clean up the marketplace, a renewed embrace of wholesale partners after years of prioritizing Nike Direct, and a relentless focus on new performance innovation in categories like Running. By restructuring teams around specific sports rather than gender or category, Nike aims to regain its “brand voice,” accelerate product creation cycles, and return to sustainable growth despite the volatile macroeconomic environment.

I performed a transcript analysis exercise to track the evolution of the turnaround plan over the last 3 quarters, its KPIs, its progress and its remaining challenges. This analysis reveals a very tangible picture of where Nike is at. Following this analysis, I include some thoughts on Nike’s valuation.

You can perform these exercises on any stock using The Transcript Analysis Workflow in the Prompt Library.

The following discussion and analysis is provided for educational purposes only and is not a recommendation to buy or sell the stock. It is subject to The Inferential Investor’s Disclaimer here.

Nike, Inc. share price (last 5 years) - down 65%

Earnings Transcript Analysis: Nike Inc. (NKE)

Q3 FY25 to Q1 FY26 (latest qtr)

Executive Summary

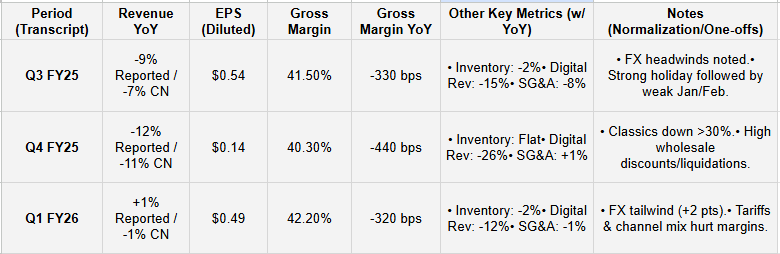

Turnaround Trajectory: Nike is in the midst of a multi-quarter strategic pivot (”Win Now” actions followed by “Sport Offense” reorganization). While revenue declines are moderating (from -12% in Q4’25 to +1% in Q1’26), the company remains in a “reset” phase.

Wholesale Shift: A major strategic reversal is evident. Management is aggressively pivoting back to Wholesale partners, evidenced by positive spring order books, after years of prioritizing Direct/Digital.

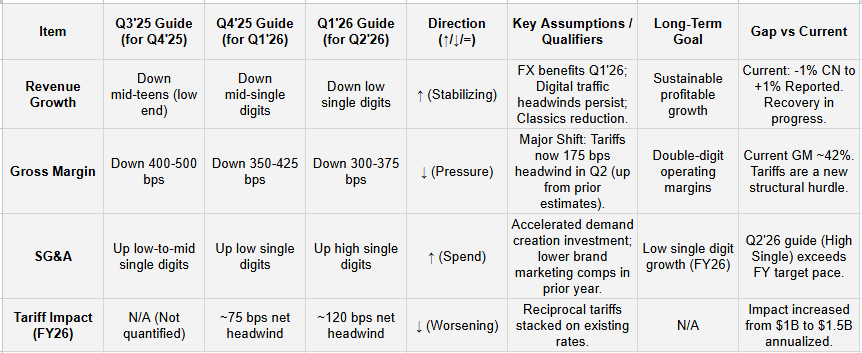

Tariff Headwinds: A significant escalating risk. The estimated gross impact of new tariffs rose from $1 billion (cited in Q4’25) to $1.5 billion (cited in Q1’26), pressuring gross margins.

Product Lifecycle: The company is intentionally reducing supply of “Classics” (Air Force 1, Air Jordan 1, Dunk) to clean the marketplace, creating a persistent revenue headwind that masks growth in Performance categories like Running.

Digital Weakness: Nike Digital traffic is structurally down (double-digit declines expected to continue), driven by a reduction in promotions and a pull-back on performance marketing.

China Struggle: Greater China remains a drag (down 10-20% across calls) due to macro softness and a highly promotional digital environment, with recovery expected to take longer than other geographies.

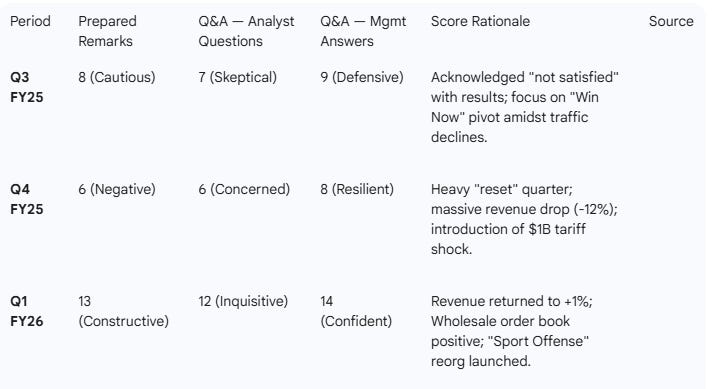

Sentiment Evolution: Sentiment has shifted from defensive (Q3/Q4’25) to cautiously constructive (Q1’26) as the “Sport Offense” reorg takes shape and Wholesale order books turn positive.

Guidance Trend: Revenue guidance is stabilizing (less negative), but Gross Margin guidance is deteriorating due to the increasing tariff burden.

Table 1 — Results & YoY Growth

Note: CN = Currency Neutral.

Table 2 — Guidance & Goals Evolution

Management Quotes on Outlook:

Q1 FY26 (Most Recent): “We expect wholesale revenue to return to modest growth for fiscal ‘26... we do not expect NIKE Direct to return to growth for fiscal ‘26.”

Q4 FY25: “We expect the headwinds to revenue and gross margin to begin to moderate from here... continued liquidating excess inventory through our value stores.”

Table 3 — Sentiment Analysis (0–20)

Q1 FY26 represents the first quarter where sentiment scores have turned positive (above the neutral 10) and show a notable improvement over a very negative Q4 FY25. Even analyst questioning reveals a step up in sentiment potentially indicating a emerging belief in the strategy.

Thematic Summary (Prepared Remarks)

Q1 FY26 (Most Recent)

Growth Drivers: Momentum in Running (up 20%), North America (+4%), and Wholesale (+5%) drove the quarter.

Evidence: “Running... growing over 20% this quarter.” 13“North America... Q1 revenue grew 4%.”

Challenges: Tariffs have escalated significantly, and China remains a drag.

Evidence: “Gross incremental cost to NIKE on an annualized basis to be approximately $1.5 billion.” “Greater China... business was down 10%.”

Strategy: The company has reorganized under a “Sport Offense” model to align brands by sport rather than gender/category.

Evidence: “Align our 3 brands... into more nimble, focused teams by sport.”

Margins: Gross margin declined 320 bps due to promotions, product costs, and tariffs.

Evidence: “Gross margins declined 320 basis points to 42.2%.”

Risks: Digital traffic is structurally down as the company pulls back on promotions and performance marketing.

Evidence: “Organic traffic has slowed... working to find the right assortment.” 19“NIKE Digital declining 12%.”

Q4 FY25

Growth Drivers: Performance categories (Running/Training) showed growth, offsetting lifestyle declines.

Evidence: “Running and training delivered growth, offset by declines in our Sportswear business.”

Challenges: A massive “reset” of the Classics franchises (Air Force 1, Dunk, AJ1) reduced revenue significantly.

Evidence: “Declines accelerated to more than 30% representing almost a $1 billion headwind to revenue.”

Risks: Introduction of the tariff narrative.

Evidence: “Tariffs represent a new and meaningful cost headwind... approximately $1 billion.”

Capital Structure: Share repurchases moderated due to uncertainty.

Evidence: “We have moderated our share repurchases in the near term.”

Q3 FY25

Strategy: Introduction of “Win Now” actions to reignite culture and speed.

Evidence: “5 priority actions... Win Now... ignite our winning culture.”

Growth Drivers: New innovation (Pegasus Premium, Vomero 18) started scaling.

Evidence: “Peg 41 is continuing to drive healthy volume... launched the Vomero 18.”

Challenges: Inconsistency in execution and China macro weakness.

Evidence: “We’re not satisfied with our overall results.” 27“Greater China... revenue declined 15%.”

Analyst Q&A Themes & Evolution

Q1 FY26 (Most Recent)

Theme: Wholesale Recovery & Order Book. Analysts probed the validity of the positive spring order book given current volatility.

Mgmt Response: Confirmed order book is up YoY in NA, EMEA, and APLA, offsetting China. Wholesale grew 5% in Q1.

Theme: Margin Recovery vs. Tariffs. Questions on how long tariffs will pressure margins and the path back to double digits.

Mgmt Response: Tariffs are a $1.5B annualized cost. Mitigation (sourcing shifts, pricing) will take time. FY26 margin outlook moderated due to tariffs.

Theme: Digital Traffic. Concerns about the persistent double-digit decline in digital traffic.

Mgmt Response: Intentional pivot away from promotions and paid media. Digital will not return to growth in FY26; focus is on profitable, full-price mix. 31313131

Q4 FY25

Theme: The “Air Pocket” in Revenue. Analysts asked if the Q4 drop (-12%) is the bottom and if the “Classics” cleanup is on track.

Mgmt Response: Q4 was the peak impact of “Win Now” actions (inventory cleanup). Classics down >30%. Headwinds expected to moderate.

Theme: China Structural Issues. Questions on whether China is a cyclical or structural problem.

Mgmt Response: Structural differences (monobrand market). Recovery will take longer than other geos.

Theme: Tariff Mechanics. Clarification on the $1B tariff impact and timing.

Mgmt Response: Impact is net of mitigation. Heaviest impact in H1 FY26.

Q3 FY25

Theme: Wholesale Re-engagement. Questions on the shift back to wholesale partners after years of Direct focus.

Mgmt Response: Admitted to being “too siloed.” Now investing in partner growth plans and commercial terms. 35353535

Theme: Innovation Pipeline. Queries on when new products will offset the decline of Classics.

Mgmt Response: “Spring ‘26” product review cited as a turning point where innovation scales enough to offset headwinds. 36

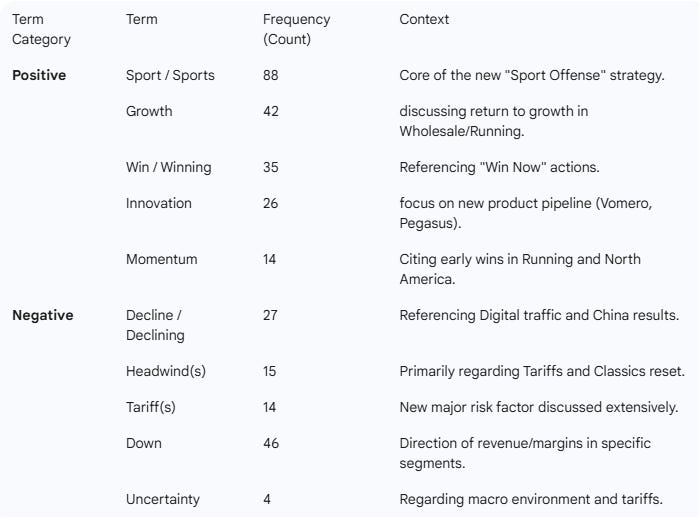

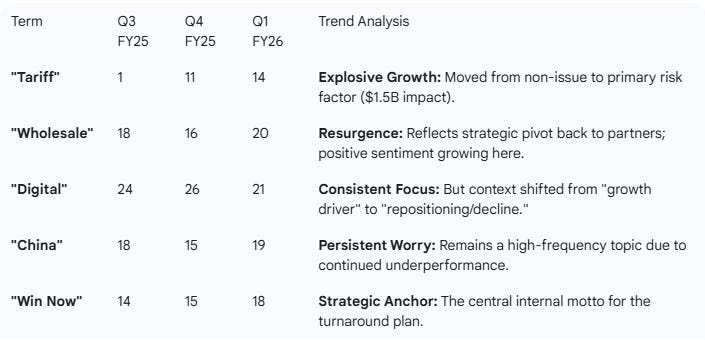

Term Frequency Analysis

Table 4: Top 5 Positive & Negative Terms (Most Recent Transcript - Q1 FY26)

Term Frequency Evolution (Select Terms across Transcripts)

TF/IDF Key Themes Analysis

Q3 FY25: “Win Now,” “Actions,” “Running.” Significance: The introduction of the turnaround plan.

Q4 FY25: “Tariffs,” “Classics,” “Reset.” Significance: The realization of pain points; cleaning up the “Classics” franchises and the arrival of trade barriers.

Q1 FY26: “Sport Offense,” “Order Book,” “Running.” Significance: The structural reorganization and the first green shoots of demand (Order Book) appearing.

Red Flags & Open Questions

Escalating Tariff Costs: The estimated annualized cost of tariffs jumped from $1 billion (Q4’25 call) to $1.5 billion (Q1’26 call) in just 90 days. This is a rapidly moving adverse variable.

Digital Demand Collapse: NIKE Digital traffic is expected to be down double digits for the entirety of fiscal ‘26. While management claims this is intentional (pulling back promotions), the magnitude suggests a potential structural loss of direct consumer engagement.

China Disconnect: Despite “investments” and “green shoots” mentioned in every call, Greater China revenue remains negative (-15% in Q3, -20% in Q4, -10% in Q1). The recovery timeline is undefined.

Inventory Mismatch: While total inventory is down/flat, APLA (Asia Pacific Latin America) inventory grew “high single digits” in Q1’26, requiring “additional actions,” suggesting pockets of clearing are still needed.

Dependence on “Classics” Reduction: Management repeatedly attributes revenue declines to the intentional reduction of Air Force 1/Dunk/AJ1. This narrative provides cover for overall weakness, and the pivot to “Innovation” needs to fill a massive revenue hole (>$1B referenced in Q4).

Conclusion: When does Nike become the glass slipper?

As shown very clearly in the evolution of transcript themes, guidance, sentiment signals and term frequency analysis, Nike’s turnaround is currently in a “mixed signal” phase where decisive operational pivots, specifically the “Sport Offense” reorganization and a strategic return to Wholesale growth, are yielding tangible wins like a 20% surge in Running revenue, a more stable top line and a positive Spring 2026 order book, yet the recovery remains fragile due to significant structural headwinds.

While the stabilization in North America and wholesale partners are positives, the market has shown no sign yet of buying into the turnaround story due to the overhang of structural offsets such as tariff impacts, China headwinds and the Digital Direct and Classics unwinds.

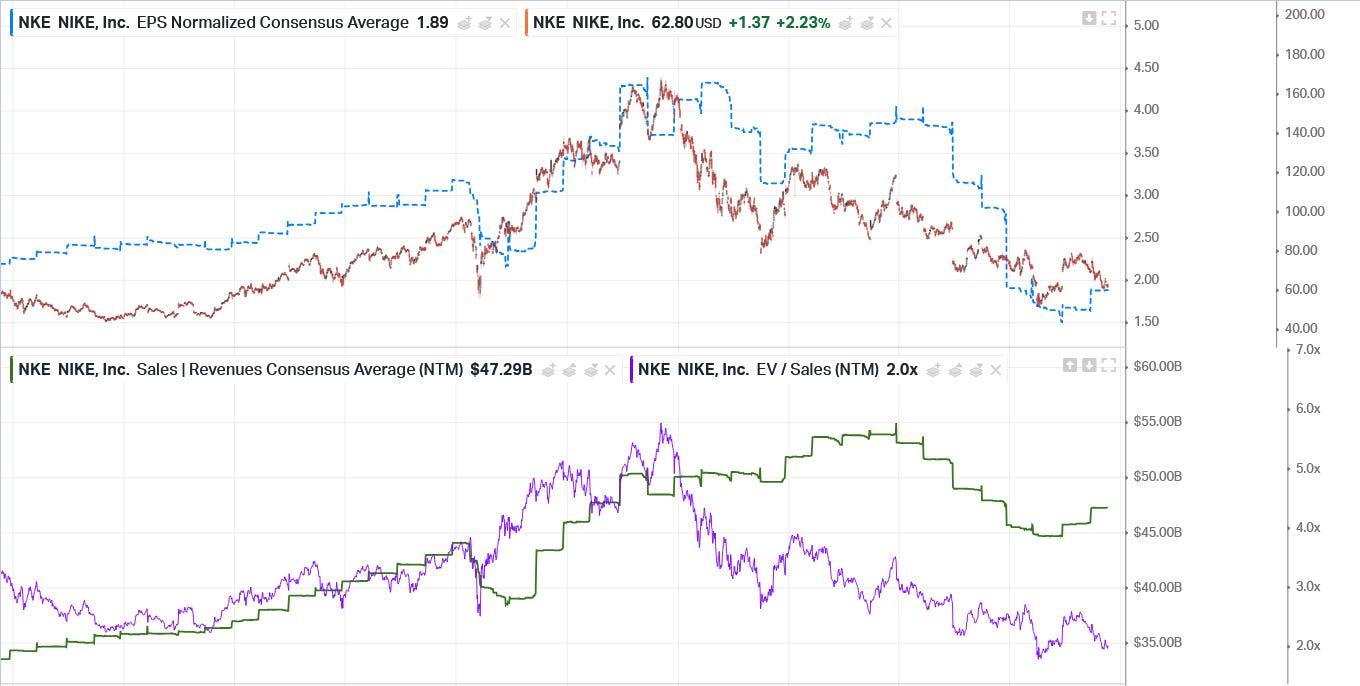

However, the transcript analysis also reveals sentiment scores for both management language and analyst questioning that have inflected positively in the latest quarter. As we often see when analyst sentiment inflects positively within this style of transcript analysis, consensus estimates also start to inflect:

The charts above show that after more than 2 years of declining estimates, sales (green) and EPS (blue, dotted) show a trough and positive inflection. Nike’s challenges are continuing however management are achieving top line results that are better than analysts feared. Analysts currently have FY26 as the trough for Nike’s EPS with a rapid rebound on margin improvement in FY27 from only moderate levels of revenue growth.

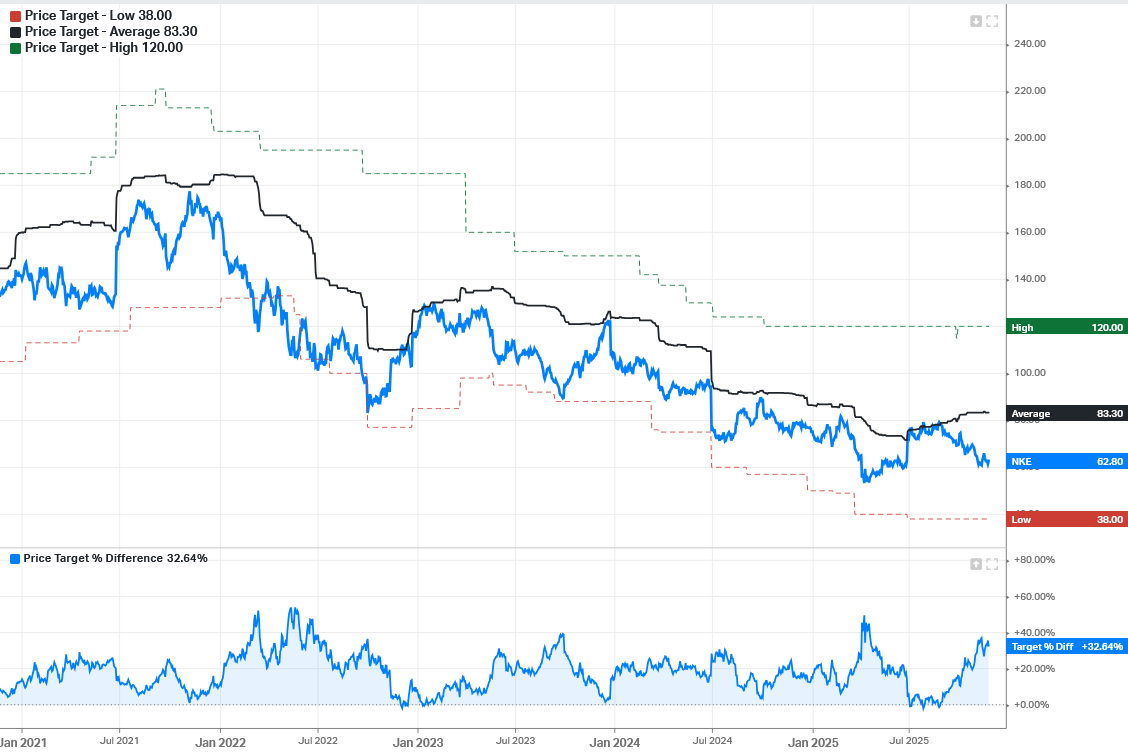

As analysts have started to positively revise estimates, they have also started to increase their price targets. The average target price amongst analysts has increased from $73 to $83 since July. Notably however, the high / low analyst price target range has also widened which typically reflects a period of increased risk and uncertainty.

Nike’s Valuation Question

So we see an unusual situation here. The emergence of a positive inflection in Nike’s consensus estimates, but still contracting multiples and share price. Why?

Nike is still showing an elevated P/E multiple but is on nearly the lowest Price/Sales multiple in a decade (~2x). This divergence highlights Nike’s margin struggles with consensus expecting an operating margin of around 6.5% in FY26 compared to most of the last decade sitting between 12%-15%. That comparison also reveals the potential operating leverage to the upside when the turnaround gains traction as Nike will seek to restore traditional operating margins. However, with Nike’s margins at potential cyclical lows, P/E ratios become questionable barometers of intrinsic value.

That brings us to the Price/Sales multiple which may be more reliable at this juncture of Nike’s turnaround as a measure of value. Zooming out to a 20 year view, its notable that Nike more commonly traded in the period between 2005 and 2013 on a Price/Sales multiple of between 1-2x ( vs today’s 2x). That period was typically characterized by high single digit to low double digit revenue growth rates and operating margins typically between 12-14% - ie a better period of performance for Nike than today’s challenges.

So is Nike expensive or cheap? Barring a retraction of tariffs (watch the Supreme court into year end), I fear the answer is that Nike remains prone to further de-rating in the short term while structural challenges remain at the forefront keeping risks elevated and most investors on the sidelines. If current tariffs are ruled against by the Supreme Court we could see a bounce in Nike, however that could prove short lived as the Trump Administration announces other tariff mechanisms.

The market will need to see evidence of mid single digit revenue growth returning and a margin rebound emerge (or be signaled by management) to return en-mass to the stock. Over the longer term, Nike could very well prove to be cheap on the long horizon view of operating margins eventually nearly doubling to return to traditional levels around 12%.

The challenges Nike are facing are well signaled, sensibly embedded in consensus estimates for FY26 and management is executing upon a plan that is already showing early signs of changing the perception towards the stock - if only at this stage in consensus estimates, not the share price. If management continue to stabilize and ultimately improve the outlook for the business, then at some point those two factors (share price and estimates) will once again align. One of the main questions remaining for investors interested in Nike is where the multiple troughs. Nike remains a fascinating turnaround story to follow and one that I keep on my watchlist. There are numerous research workflows in the Prompt Library that aid monitoring of situations like this.

As always,

Inference never stops. Neither should you.

Andy West

The Inferential Investor

The author has no position in Nike.

Excellent analysis! Re-arhitecting a brand voice sounds like a huge pivot.