The Curious Case of PayPal: From 2025 Upgrades to Downside Risk for 2026?

I show how to use AI to analyze contextual signals from transcript language evolution to assess consensus estimates. This unearths some important insights on PayPal for 2026.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Paypal’s Q3 2025 result on October 28 was a generally triumphant event for a stock effecting a multiyear turnaround targeted to restore it to a 20%+ earnings growth rate in the medium term. Management upgraded 2025 guidance to 15%-16% EPS growth, introduced a dividend alongside the substantial and accretive buyback and drove the turnaround message home, “we are a stronger company today than two years ago”.

However, there were a couple of soft warnings delivered alongside the better than expected result. Heading into Q4, low to middle income consumers were observed to be slowing spending in Europe and the US and the company needed to strategically reinvest in “contra-revenue” initiatives and the technology stack to win in the long run (read that as match pricing and improve tech capabilities to stop losing market share).

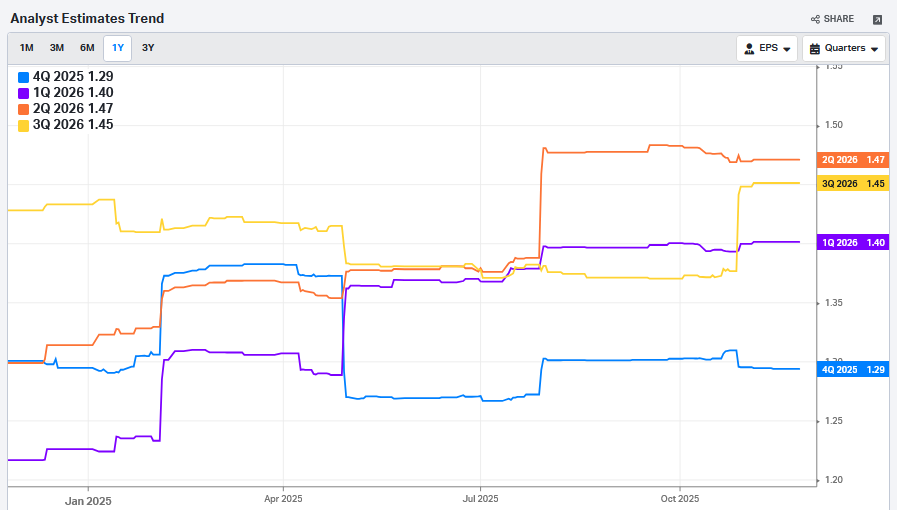

These combined forces would pressure transaction dollar margin growth and bottom line margins from Q4 into FY26. Analysts were cautious but unfazed. There was a minor downward adjustment made to consensus 4Q FY25 EPS, but analysts put upgrades through 3Q and 4Q FY26 EPS that more than offset. They had already been conservative on FY26 forecasts after all.

Figure 1: Paypal Consensus EPS Estimate trends by Quarter

Source: Koyfin

Despite those messages, the stock reacted positively to the Q3 beat and raise that seemed to indicate the turnaround was on track. In the subsequent 3 weeks however, as PayPal has presumably made the rounds of investors in the usual non-deal, post results roadshow, the stock has fallen 23% from the initial 10% surge.

Figure 2: PayPal Holdings Share Price Chart - last 1 month

On the 19th November, PayPal’s CEO held a fireside chat with the Citi analyst at the Citi Fintech conference, just 3 weeks after Q3 results, and it was a chance for non-insto’s to finally hear what Wall St had probably already been hearing for that 3 week period. In that Q&A style chat were a few messages that belatedly explain the selling in the stock over that interim period.

So did anything really change in the CEO’s messaging to the market or did the market miss the signals at the Q3 result? If there is new information, what are the implications for PayPal’s consensus estimates over 2026? Does the selling suggest that PayPal is cum-downgrade at some point?

I attacked that set of questions by leading Gemini 3.0 PRO through a structured multi-step approach as follows:

Transcript Analysis: Using the Inferential Investor’s structured transcript analysis workflow, I had the model compare and contrast the Q3 results call with the Citi Conference transcript. Rather than just focus on key themes as you often see with simple transcript summaries, this workflow examines sentiment scoring changes, term frequency usage, term frequency-inverse document frequency (TF-IDF) comparisons, extracted quotes and comparison of themes and any change in medium term guidance language or soft signals with implications noted at each step. It is a far more comprehensive synthesis of insights than you will see from the usual stock research websites.

Synthesis of Implications and Comparison against Consensus Assumptions: Within the same chat, I then use Gemini’s advanced multi-modal capabilities to upload a screenshot of consensus estimates and growth rates for all key P&L lines for the last 6 quarter actuals and the next 5 forecast quarters. The model is then given the task of synthesizing the noted changes in management’s language, discussion of business drivers and forward looking statements into a critical appraisal of consensus forecasts and their achievability.

The results of these interrogations are presented below with a short conclusion. Investors must form their own judgement, but the analysis tells an interesting story that explains the post results fall in Paypal’s share price. It appears to me personally that the CEO has used the last 3 weeks and this conference to clarify messages about 2026 to analysts and institutions that perhaps were not fully made clear at the Q3 result.

Transcript Comparison: Citi Conference (Nov 19th) vs Q3 Result Call (Oct 28th)

A) Guidance & Long-Term Goals Evolution

1. Forward-Looking Statements & Explicit Guidance

Citi FinTech Conference (Nov 19, 2025)

Transaction Margin (TM): On pace for 6% to 7% growth this year1.

Venmo: On track to eclipse $2 billion in revenue “in the near term”2.

BNPL: Expected to be a $40 billion volume business this year3.

Branded Checkout: Expected to grow in Q4, but “grow slower than Q3 if this [macro pressure] persists”4.

2026 Outlook (Qualitative): Management expects to “lean in and invest” which “comes at a headwind of transaction margin dollar growth in ‘26”5.

Long-Term Targets: Management signaled a potential deviation from the “linear path” laid out at Analyst Day regarding EPS and margin growth to prioritize winning in Agentic and BNPL markets6.

Q3 2025 Earnings Call (Oct 28, 2025)

FY 2025 TM Dollars: Raised guidance to $15.45–$15.55 billion (5–6% growth reported; 6–7% ex-interest)7.

FY 2025 Non-GAAP EPS: Raised to $5.35–$5.39 (15–16% growth)8.

Q4 2025 Revenue: Currency-neutral growth in “mid-single digits”9.

Q4 2025 EPS: $1.27–$1.31 (up 7–10%)10.

Capital Allocation: ~$6 billion in share buybacks and $6–$7 billion in Adjusted FCF for the year11. Initiating a dividend based on a 10% payout ratio of net income12.

2. Evolution View & Key Quotes

Evolution: Between late October and mid-November, the company maintained its FY25 guidance but introduced a more cautious tone regarding Q4 branded checkout due to macro headwinds (”middle to low income” pressure). Crucially, the tone on 2026 shifted from a general “we will guide later” to a specific warning at the Citi conference that 2026 TM growth faces headwinds due to necessary strategic investments.

Key Quotes (Citi Conference - Nov 19)

On 2026 Investment/Margin: “So expect us to actually invest and that comes at a headwind of transaction margin dollar growth in ‘26, but we will invest in order to win these markets over the next year.”

On Macro: “We called out sort of mid-Q3 that we started to see a slowdown on consumers... That slowdown has persisted into Q4.”

Key Quotes (Q3 Earnings - Oct 28)

On Guidance Raise: “We are raising our full year TM dollar guidance... [and] raising our full year non-GAAP earnings per share guidance.”

On Capital Return: “I’m also excited to announce that we are initiating a dividend... working in conjunction with our ongoing share buybacks.”

B) Sentiment Scoring (0–20 scale)

C) Management’s Key Themes (Prepared Remarks/Opening Statements)

Citi Conference (Nov 19)

Transformation Status: The company is “fundamentally stronger” than 2 years ago, inflecting transaction margin from negative to positive 6-7% growth19.

Branded Checkout Delays: The CEO admitted estimating the speed of fixing the customer experience was the piece he “underestimated the most,” citing it has “gone slower than I expected”20.

Ecosystem Connection: A major focus is connecting the consumer and merchant ecosystems (e.g., distributing NIL payments to Venmo wallets to drive spend)21.

Agentic Commerce: PayPal aims to be the trust layer for AI agents, leveraging their 2-sided network to prevent fraud and “hallucinations” in payments22.

Macro Headwinds: Acknowledged a slowdown in discretionary spend in the U.S. and Europe starting mid-September, affecting middle-to-low income brackets23.

Q3 Earnings Call (Oct 28)

Financial Inflection: Emphasized the shift from defense to offense, highlighting the acceleration of revenue and transaction margin growth24.

Capital Return Strategy: Announced the initiation of a dividend to complement the $6 billion share buyback program, signaling balance sheet strength25.

Omnichannel Expansion: “PayPal Everywhere” and the debit card strategy are driving offline spend, with debit card actives transacting 6x more than checkout-only accounts26.

Venmo Monetization: Venmo revenue growth accelerated 10 points vs 2 years ago; focus on moving users from P2P to commercial transactions (Debit, Pay with Venmo)27.

Innovation Velocity: Cited rapid partnerships (Global, OpenAI, Perplexity) and new product rollouts (Fastlane, biometrics) as proof of increased execution speed28.

D) Analyst Q&A Themes & Evolution

Citi Conference (Nov 19)

Theme: “Agentic” Commerce:

Analyst: Asked why PayPal is differentiated in Agentic and how the revenue model works.

Mgmt: Consumers have “0 tolerance for hallucinations” regarding money. PayPal provides the “trust” layer and KYB/KYC for merchants/consumers. Revenue is treated as branded checkout volume. 29

Theme: Legacy Tech Debt:

Analyst: Pressed on why checkout redesign is slower than expected.

Mgmt: Cited “15-plus years of really bespoke integrations.” Strategy shifting from “carrot” (better conversion) to “stick” (deprecating old integrations) likely in 2027. 30

Theme: Macro Weakness:

Analyst: Asked if consumer weakness was sudden.

Mgmt: Yes, became “more pronounced mid-September” regarding discretionary retail spend. 31

Q3 Earnings Call (Oct 28)

Theme: Buy Now, Pay Later (BNPL) Strategy:

Analyst: Asked about market share and the Blue Owl externalization deal.

Mgmt: BNPL volume growing 20%+. Moving to “upstream presentment” (showing BNPL options on the product page, not just at checkout) to drive conversion. 32

Theme: Guidance & Investment:

Analyst: Asked about the exit growth rate for TM dollars and investment impact on 2026.

Mgmt: Q4 faces tougher comps in credit. Confirmed investments in product/marketing will be a headwind to flow-through but are necessary for “generational shifts.” 33

Theme: Venmo Upside:

Analyst: Asked to map out the “multiplier of upside” for Venmo.

Mgmt: Current ARPA is $1/3$ to $1/4$ of potential. Only 5-10% of users utilize the debit card or Pay with Venmo; converting them drives 4x-6x higher ARPA.

Evolution of Themes:

The Q3 call was a “victory lap” focused on financial discipline, the dividend, and broadly raising guidance. By the Citi conference (3 weeks later), the focus shifted to defending the pace of technical upgrades (legacy integrations) and justifying a potential margin compression in 2026 due to the need to invest in “Agentic” and “BNPL.” The macro warning also became more explicit in November.

E) Term Frequency Tracking

Top 5 Positive Terms (Recent Transcript - Citi)

Growth: Used frequently regarding Venmo (6-7% transaction margin growth) and BNPL (20% growth).

Win: Management repeatedly mentions “winning” the deal (NIL athletes) or “winning” in Agentic commerce.

Excited: CEO uses this to describe the “turnaround,” Venmo asset, and “Agentic” opportunities.

Trust/Trusted: Central to the Agentic commerce pitch (”trust layer,” “trusted relationship”).

Stronger: “Fundamentally stronger company than we were 2 years ago.”

Top 5 Negative/Cautionary Terms (Recent Transcript - Citi)

Slower: “Gone slower than I expected” (regarding checkout rollout).

Pressure: “Pressure on consumer right now,” “Pressure for middle to low income.”

Deprecating: Discussing the need to force merchants off old integrations (”stick moment”).

Friction: Describing the old mobile checkout experience (”full of friction”).

Headwind: Investment in 2026 will be a “headwind to transaction margin.”

TF-IDF Analysis & Narrative Summary

Q3 Transcript Unique Terms: “Dividend,” “Blue Owl,” “EPS,” “Buyback,” “Authorization.”

Narrative: The Q3 call was heavily weighted toward financial engineering and capital structure. The terminology signaled a mature company returning value to shareholders and optimizing its credit receivables.

Citi Transcript Unique Terms: “Agentic,” “Hallucinations,” “Integrations,” “Deprecate,” “Upstream.”

Narrative: The Citi conference pivoted toward product architecture and future tech. The high frequency of “Agentic” and “Integrations” indicates the company is now focused on the heavy lifting required to modernize the tech stack and position for AI-driven commerce.

Implications: The shift from “Dividend/EPS” (Oct) to “Integrations/Agentic/Headwinds” (Nov) suggests that while the financial floor is stable, the ceiling for 2026 growth may be capped by significant required R&D and platform re-architecture. The “linear” margin expansion previously hoped for is likely paused for investment.

F) Red Flags Extraction

Citi Conference (Nov 19)

Guidance Walk-Back: Explicit admission that the “linear path” for EPS/Margin growth discussed at Analyst Day may be disrupted in 2026 due to investment needs35.

Execution Delays: CEO frankly admitted that fixing the branded checkout experience has been “slower than expected” and underestimated the complexity of 15 years of bespoke integrations36.

Macro Deterioration: Confirmed that the consumer slowdown observed mid-Q3 has “persisted into Q4,” specifically impacting branded checkout growth37.

Q3 Earnings Call (Oct 28)

Lower Basket Sizes: While transaction counts are stable, “Average Order Value (AOV) has decreased,” indicating consumers are trading down38.

Credit Normalization: Mentioned that credit outperformance (low losses) is starting to “normalize,” creating tougher comps for Q439.

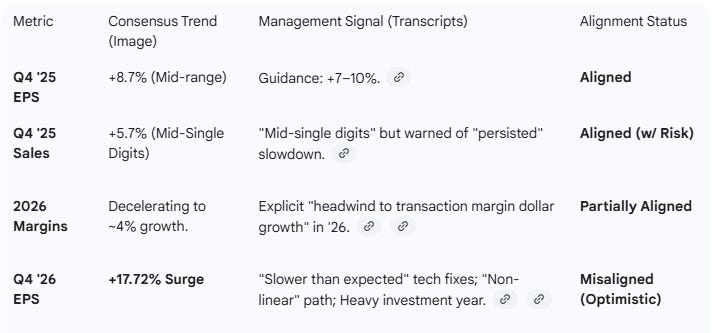

Implications of CEO Signals for Consensus Forecasts

Follow-on Prompt: The attached screenshot shows the YoY percentage growth rates for sales, gross profit, EBITDA, EBIT and EPS implied by current consensus estimates for PayPal over the prior 6 quarter actuals (to 3Q FY2025) and the next 5 forecast quarters (4Q FY2025 to 4Q FY2026).

Based on the transcript analysis signals from the CEO in the two analyzed transcripts with weight placed on the most recent, provide an analysis of whether consensus assumptions are in alignment with the CEO’s guidance and forward looking indications.Gemini Response: Based on the consensus data provided in the image and the management commentary from the Q3 Earnings Call and the subsequent Citi Conference, here is an analysis of the alignment between street expectations and the CEO’s forward-looking signals.

Executive Summary: Near-Term Alignment, Long-Term Optimism Risk

Current consensus estimates appear aligned for the immediate term (Q4 2025) but show signs of misalignment and over-optimism for late 2026, particularly regarding the steep re-acceleration of earnings growth.

While the consensus correctly models a deceleration in Gross Profit growth for 2026 (reflecting the “investment year” rhetoric), the implied 17.72% EPS surge in Q4 2026 contradicts the CEO’s cautious tone at the Citi conference regarding the “slower than expected” technical fixes and the “non-linear” path to long-term targets.

Q4 2025 Outlook: Aligned, with Top-Line Risk

Consensus Assumption: Sales growth of 5.71% and Adj. EPS growth of 8.74%.

Management Signal:

Guidance: Management guided Q4 revenue to “mid-single digits” and EPS to $1.27–$1.31 (up 7–10%)111.

Alignment: The consensus EPS estimate (8.74%) sits perfectly within management’s 7–10% range. The Sales estimate (5.71%) is at the high end of “mid-single digits.”

Risk Factor: At the Citi conference (Nov 19), the CEO noted that the consumer slowdown observed in mid-Q3 has “persisted into Q4” and branded checkout may “grow slower than Q3”222.

Verdict: Consensus is technically aligned with guidance, but the Citi commentary suggests the 5.71% revenue growth estimate has downside risk if the “persisted” slowdown impacts holiday volume.

2026 Gross Profit & Transaction Margin: The “Headwind” Disconnect

Consensus Assumption: Gross Profit growth is modeled to decelerate from 5.93% in Q3 2025 to a range of 3.95% – 4.33% throughout most of 2026.

Management Signal:

Headwinds: At the Citi conference, the CEO explicitly stated that strategic investments in 2026 (BNPL rewards, Agentic commerce) would come at a “headwind of transaction margin dollar growth in ‘26”33.

Non-Linearity: Management walked back the “linear path” of margin expansion outlined at Investor Day4.

Verdict: Consensus correctly models a deceleration (dropping from ~6% to ~4%). However, if the company aggressively pursues “upstream presentment” and 5% cash-back offers on BNPL as mentioned5, Gross Profit growth could face pressure to remain flat or drop to low-single digits. The current consensus of ~4% seems to acknowledge the “investment year” but perhaps not the full extent of the “headwind” described in November.

The 2026 EPS Ramp: Significant Misalignment

Consensus Assumption: Adj. EPS growth is modest in H1 2026 (~5%) but ramps aggressively to 8.31% in Q3 and 17.72% in Q4 2026.

Management Signal:

Tech Debt: The CEO admitted the checkout redesign is “slower than expected” due to 15 years of bespoke integrations6.

Capital Allocation: While the dividend 7and buybacks help EPS, the CEO emphasized that 2026 is an investment year to position for “Agentic” and “BNPL” shifts, which implies operating leverage may be muted8.

Verdict: High Risk of Disappointment. The consensus model implies a “hockey stick” recovery where the benefits of the transition materialize rapidly by year-end 2026. Given the CEO’s admission that the technical overhaul is grindingly slow and the macro environment is challenging, expecting EPS growth to nearly triple from Q1 2026 (5.38%) to Q4 2026 (17.72%) appears overly optimistic. This J-curve likely relies on a “mission accomplished” scenario for the tech stack overhaul that management has signaled is actually delayed.

Revenue Acceleration in Q1 2026

Consensus Assumption: Sales growth accelerates from 5.71% in Q4 ‘25 to 6.72% in Q1 ‘26.

Management Signal:

Macro: The CEO described the consumer environment as facing “pressure” that has “persisted”9.

Execution: With the branded checkout fix being “slower than expected”10, there is no clear catalyst cited in the transcripts for a 100bps revenue acceleration immediately following the holiday quarter.

Verdict: This acceleration appears inconsistent with the “slower” progress and “persisted” macro headwinds cited at the Citi conference.

Summary Table: Consensus vs. Reality

Note that this table and associated analysis represents Gemini 3.0 PRO’s own assessment of the potential alignment / misalignment of consensus forecasts to the forward looking statements across 2 events from management. It is based solely on an assessment of transcript inputs, not detailed financial modeling. AI models can get things wrong and we highlight that this is provided as a demonstration of how AI can use contextual, unstructured data signals from language and text to create informative assessments of quantitative data, just as human analysts do. It is indicative only and not investment advice. Always do your own research and financial modeling.

Conclusion

It is not often a result generates a 10% initial positive surge in a share price that then leads to a 23% fall. Of course, this has likely been exacerbated by similar market dynamics see across a number of stocks over that period, although those were usually high growth names, not a turnaround story then on 13x forward P/E (now 10.6x).

The message unearthed by Gemini’s analysis is one of near term caution. Pressure on total transaction values from soft consumer demand have clearly continued through Q4, the CEO has overestimated the speed at which the new paysheet can be rolled out across merchants (that drives higher conversion and transaction volumes) and the company is backing away from the linear margin expansion story. This is all captured by the sentiment score on management answers (and analyst questioning) falling from the Q3 result to the November Citi conference. However, analysts have (as shown in the estimate trends chart) adopted a hockey stick rebound into 2027 which appears at odds with this sentiment deterioration.

These messages were touched on at the Q3 result, however post-Q3 information on these challenges has clearly been more granular. The dynamics that Gemini is highlighting signal a potential risk to 2H FY2026 EPS forecasts based on current conditions which have not yet shown signs of improvement. Management’s stronger language on 2026 margin impacts compared with Q3 statements have the hallmarks of “talking the market down”.

The fact that AI models can identify this dissonance between contextual signals and quantitative estimates is highly useful to investors across companies. This is a simple and fast exercise to run using The Inferential Investor prompt library and provides an independent “check and verify” capability to buy-side (and sell side) analysts to challenge any preconceived biases we all hold from time to time.

Personal View: In the end PayPal is still executing upon a multi-year turnaround and those large strategic pivots never unfold without bumps in the road. The stock, after the recent fall, is approximately 10% off its historic low P/E level of 9.5x, with a FCF yield of 11.5%, a large supportive buyback and new dividend. A future re-rating is a potential scenario if the company can sustainably stabilize take-rates, accelerate branded checkout volumes through its agentic, venmo and paysheet initiatives and re-accelerate top line and EPS growth back to the medium term strategic plan targets. However, none of those initiatives are likely to be quick wins. The company’s new Ad business is also a potential 2027/8 incremental growth story but is too insignificant and early stage to quantify. The current signals are suggestive however that this positive scenario is unlikely in the 1H FY26 and the analysis highlights risks to 2H estimates from these current trends, suggesting Paypal may be more of a 2027 story. There could be further disappointments over the next 12 months as this analysis highlights, however there is also some valuation and buyback support at the right levels.

Disclosure: The author has recently purchased a small position at the $60 level given the reset of buy-side expectations and attractive valuation.