Western Digital (WDC) Q2 FY26 Earnings Analysis Report

10% EPS beat & Q3 guidance 15% ahead of consensus. Strong margin increases evident and revenue guidance forecasts growth to accelerate to 40% in Q3.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Stock: WDC (Western Digital Corporation) Quarter: Q2 FY2026 (Ended January 2, 2026)

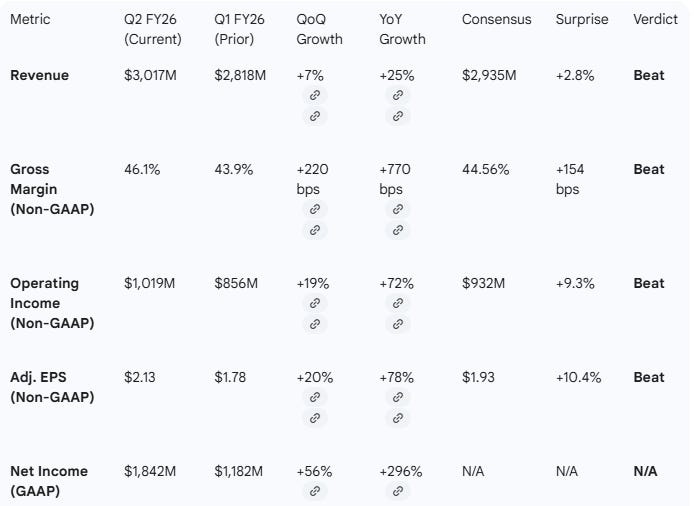

Performance Highlights and Quantitative Comparison

Western Digital delivered a significant beat in Q2 FY26, driven by robust demand for high-capacity drives in the AI-driven data economy.

Performance Summary Table

Key Business Drivers

Cloud Dominance: Cloud revenue reached $2,673M, representing 89% of total revenue.

ePMR Shipments: Shipped over 3.5 million units of the latest generation ePMR, up from 2.2 million in Q1.

Exabyte Growth: Total exabytes shipped grew to 215 EB, a QoQ increase from 204 EB.

Shareholder Returns: Returned over 100% of free cash flow via $615M in share repurchases and $48M in dividends.

YoY Growth Trends (Last 2 Quarters)

Q1 FY26 Revenue YoY: +27%

Q2 FY26 Revenue YoY: +25%

Summary on Performance: Overall, the company’s Q2 results beat consensus expectations across all major metrics, with 25% revenue growth and 78% non-GAAP EPS growth. Growth appears to be stable in the quarter at high levels due to the adoption of high-capacity drives and sustained data center demand however Q3 guidance flags an acceleration to 40% revenue growth ahead (see guidance section).

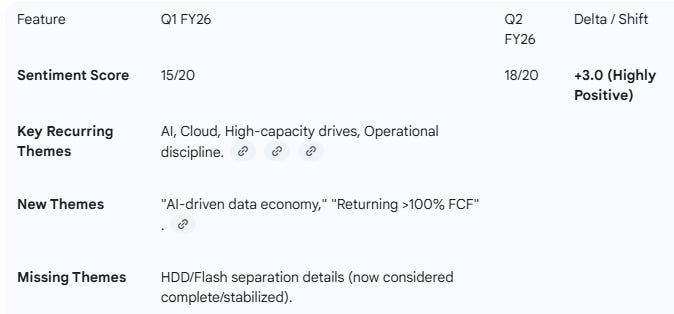

Management Discussion & Analysis (MD&A) Comparison

Narrative Summary

Management Discussion (Current Quarter): CEO Irving Tan highlighted “disciplined execution” to meet demand in the “AI-driven data economy”. The focus has shifted toward the scale of high-capacity HDDs and returning significant capital to shareholders, with over 100% of free cash flow distributed this quarter.

Management Discussion (Prior Quarter): In Q1, the narrative was centered on the initial “strong demand environment” and the immediate success of the HDD/Flash separation. There was a heavy emphasis on innovation and “operational discipline” as the primary tools to capture new AI opportunities.

Semantic & Tone Comparison

Tone Shift: Compared to Q1, management’s tone in Q2 became more confident and aggressive, transitioning from “executing well” to “disciplined execution at scale”. The focus shifted from the internal separation process toward aggressive shareholder returns and market leadership in the AI infrastructure space.

Guidance Evaluation and Consensus Implications

Guidance Comparison Table

Growth Implication Analysis

Q3 Guidance YoY: Guidance of $3.2B implies ~40% YoY growth (vs. $2.29B in Q3FY25). This is a massive acceleration compared to the ~25-27% seen in the first half of the year.

FY26 Implied: With $5,835M revenue in H1 and $3,200M guided for Q3, WDC needs only $2,888M in Q4 to hit the full-year consensus of $11,923M. Given the trajectory, the full-year consensus is likely too low.

Analyst Impact: Consensus is likely to see strong upgrades. The Q3 EPS guidance midpoint ($2.30) is 15.6% above current market expectations, and the revenue acceleration to 40% YoY will likely force analysts to raise full-year FY26 estimates significantly.

What is Missing?

Segment-Specific Flash Detail: While the HDD/Flash separation is complete, the reports focus heavily on HDD metrics (ePMR, Nearline). Market expectations for more granular roadmaps on the “separate” entities’ future synergy or competitive landscape in Flash remain somewhat thin.

Long-term AI Contribution: Management mentions the “AI-driven data economy” frequently, but lacks a specific percentage breakdown of revenue directly attributed to AI workloads vs. general cloud storage.

Specific Tariff Impacts: While mentioned as a “Key Risk”, there is no quantitative discussion on how potential 2026 trade policy shifts might impact the manufacturing supply chain.

Executive Summary

Stock: WDC | Quarter: Q2 FY2026 Result: Beat consensus on Revenue (+2.8%) and Adj. EPS (+10.4%).

Growth Momentum: Accelerating. Q3 guidance implies a jump to ~40% YoY revenue growth.

Management Commentary: Management has moved into a “harvest” phase of their strategy, focusing on scaling high-capacity HDD shipments (3.5M+ units) and returning all generated free cash flow to shareholders. The tone is exceptionally bullish regarding the AI data cycle.

Guidance Implications: Strong Upgrades Expected. Q3 guidance midpoints for Revenue ($3.2B) and EPS ($2.30) are significantly higher than the current consensus.

Conclusion: Western Digital is successfully riding the AI tailwind, with its high-capacity HDD portfolio becoming a cornerstone of data center infrastructure. The combination of accelerating revenue, expanding margins (guided to 47.5%), and aggressive share buybacks suggests the business is in a powerful cyclical upswing that has yet to be fully captured by full-year analyst estimates.

Would you like me to generate a detailed comparison of the Nearline vs. Non-Nearline exabyte shipment trends across the last four quarters?