WALMART ($WMT) Q3 FY26 Earnings & Transcript Analysis Report

Strong sales quarter but EPS guidance for Q4 hit by drug pricing headwinds. Management transition and agentic e-commerce in focus in Analyst QA.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Walmart Inc. (WMT) Q3 FY26 Earnings Analysis

1. Performance Highlights and Quantitative Comparison

Walmart delivered a strong “beat and raise” quarter. Revenue growth accelerated to 5.8% YoY, driven by sustained momentum in eCommerce (+27%) and strong same-store sales in the U.S. (+4.5%). Adjusted operating income surged 8.0% in constant currency, demonstrating strong underlying leverage despite reported operating income being flat due to a one-time charge.

Financial Summary Table

Note: Q3 Adjusted EPS excludes a $0.20 gain on equity investments and a $0.02 legal settlement benefit, partially offset by a $0.07 non-cash charge for PhonePe.

Key Business Drivers:

eCommerce Acceleration: Global eCommerce sales grew 27% (vs. 25% in Q2), marking the seventh consecutive quarter of >20% growth.

Advertising Velocity: Global advertising business grew 53% (including VIZIO), with Walmart Connect (U.S.) up 33%.

Market Share Gains: Continued share gains in the U.S. across grocery and general merchandise, driven primarily by upper-income households.

Membership Strength: Membership and other income grew 9.0%, with membership fee income specifically up 16.7% globally.

Fulfillment Speed: 35% of U.S. store-fulfilled digital orders were delivered in under 3 hours; expedited delivery sales grew nearly 70%.

Performance Verdict: Overall, the company’s Q3 results beat consensus expectations, with 5.8% revenue growth and 6.9% adjusted EPS growth. Growth appears to be accelerating due to strong execution in eCommerce fulfillment and high-margin advertising revenue.

2. Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3 FY26)

In Q3, management projected a tone of “offense” and confidence. CEO Doug McMillon highlighted the company’s momentum across all segments, particularly the acceleration in eCommerce and the successful integration of automation in the supply chain. A major focus was the leadership transition, with John Furner announced as the incoming CEO (effective Feb 1, 2026). Management emphasized that higher-income households continue to drive growth and that the company is managing inventory effectively despite tariff concerns.

Management Discussion (Prior Quarter - Q2 FY26)

In Q2, the tone was cautiously optimistic but defensive regarding specific cost headwinds. Management focused on “value” and “price leadership” to combat economic uncertainty. A significant portion of the narrative was dedicated to explaining a 560 basis point headwind from higher-than-expected general liability claims. While they noted “playing offense,” the discussion was heavily weighted toward managing cost pressures and proving that the high-margin profit wedges could offset core retail squeezes.

Analyst Discussion (Current Quarter - Q3 FY26)

The Q3 Q&A session focused on future-proofing and strategy. Analysts probed the “agentic AI” roadmap, the sustainability of international growth (particularly Flipkart’s Big Billion Days), and the specifics of the leadership transition. There was less scrutiny on immediate cost pressures and more interest in the long-term impact of automation and new revenue streams like the “OnePay” credit card. Questions regarding tariffs were met with confident responses about the team’s ability to manage mix and inventory.

Analyst Discussion (Prior Quarter - Q2 FY26)

The Q2 Q&A was dominated by concerns over the “surprise” spike in general liability claims and whether it signaled a recurring issue. Analysts pressed for details on the gross margin outlook given the merchandise mix headwinds. There was skepticism regarding the consumer’s health, with questions focusing on trade-down behavior and the sustainability of the “value” strategy.

Semantic & Sentiment Comparison:

Sentiment Score:

Q3 Score: 17/20 (Confident, Aggressive, Strategic)

Q2 Score: 12/20 (Defensive, Explanatory, Resilient)

Delta: +5.0 (Significant positive shift toward growth)

Recurring Themes: “Value,” “Rollbacks,” “Market Share,” “eCommerce,” “Advertising.”

New/Emerging Themes (Q3): “Agentic AI,” “Leadership Transition,” “PhonePe IPO,” “OnePay,” “Expedited Delivery.”

Disappearing Themes (vs Q2): “General Liability Claims” (mentioned as a headwind but no longer the central topic), “Deflation” (replaced with stable low-inflation commentary).

Narrative Summary:

Compared to Q2, management’s tone in Q3 shifted from defensive explanation of costs to aggressive strategic confidence. The anxiety around insurance claims present in Q2 was replaced by an emphasis on accelerating high-margin digital businesses and a smooth CEO succession plan.

3. Guidance Evaluation and Consensus Implications

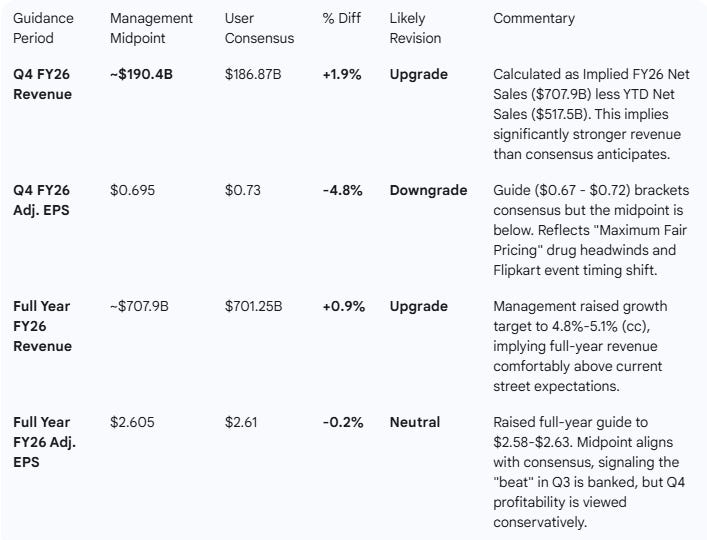

Management raised full-year guidance for both sales and operating income. Using the implied calculation method based on the raised full-year outlook, the Q4 revenue guidance suggests a beat against consensus, contrary to a simple QoQ extrapolation.

Guidance Table

Calculation Detail for Q4 Revenue Implication:

FY25 Net Sales Base: $674.5 billion.

FY26 Growth Guidance: 4.8% to 5.1%.

FY26 Implied Net Sales: ~$706.9B (Low) to ~$708.9B (High); Midpoint ~$707.9B.

YTD Q3 FY26 Net Sales: $517.5 billion.

Implied Q4 Net Sales: $707.9B - $517.5B = $190.4B.

Note: Using Total Revenue figures would likely yield an even higher implied Q4 figure (~$192B+), further supporting the “Beat” verdict.

Consensus Implications:

Q4 Revisions: Mixed. Revenue targets will likely be revised upward given the strong implied sales volume (~$190B vs $186.9B consensus). However, EPS estimates may be trimmed slightly to align with the $0.695 midpoint guidance vs $0.73 consensus, reflecting the specific headwinds in pharmacy and event timing.

FY Revisions: Positive. The raised sales floor (4.8% growth vs 3.75% prior) and the maintained operating income growth acceleration suggest analysts will lift FY26 revenue targets.

4. What is missing?

Quantification of Drug Pricing Impact: Management flagged “Maximum Fair Pricing” legislation as a headwind for Health & Wellness sales in January (Q4) but did not provide a specific dollar impact, leaving a variable for modeling Q4 margin risk.

FY27 Initial Outlook: While typical for Q3 to focus on the holiday, the market often looks for “initial thoughts” on the next fiscal year. No specific FY27 quantitative preview was offered beyond general confidence in the long-term algorithm.

Tariff Specifics: While management stated they are “managing” potential tariff increases, they did not detail specific exposure percentages for FY27/28, leaving some ambiguity regarding future gross margin pressure if trade policy tightens significantly.

5. Executive Summary

Stock: Walmart Inc. (WMT)

Quarter: Q3 FY26

Consensus Comparison: Beat. Walmart delivered a strong beat on both top and bottom lines for Q3. Furthermore, the implied Q4 revenue guidance ($190.4B) is significantly above the street consensus of $186.9B.

Performance Summary:

Revenue: $179.5B (+5.8% YoY), accelerating from +4.8% in Q2.

Adj. EPS: $0.62 (+6.9% YoY), beating consensus of $0.60.

Momentum: eCommerce growth has accelerated to 28% in the U.S., and high-margin advertising revenue (+53%) is increasingly protecting profitability against core retail cost pressures.

Management Commentary:

The tone has shifted decidedly to “offense.” Outgoing CEO Doug McMillon and incoming CEO John Furner projected high confidence in the strategy to use digital growth to expand margins. Key themes included the success of the “marketplace” model and the use of automation to lower delivery costs. The narrative is no longer about “resilience” but about “gaining share” from competitors.

Guidance Implications:

FY26 Outlook: Raised. Sales growth upgraded to 4.8%-5.1% (from 3.75%-4.75%).

Q4 Outlook: Revenue Beat / EPS Cautious. The implied Q4 revenue of ~$190.4B is well above consensus ($186.9B), indicating strong holiday volume expectations. However, EPS guidance ($0.67-$0.72) is slightly below consensus ($0.73), reflecting regulatory headwinds in pharmacy and the timing shift of the Flipkart sales event.

Conclusion:

Walmart is successfully executing a complex pivot from a traditional retailer to an omni-channel technology platform. The acceleration in eCommerce and advertising validates the high valuation multiple. The implied Q4 revenue beat suggests the company is capturing significant market share during the critical holiday period, although profitability may be slightly dampened by specific timing and regulatory factors. The leadership transition appears seamless, and the underlying business trajectory signals continued outperformance.

Sentiment Shift:

Q2: Cautious/Defensive (Focus on Costs/Claims)

Q3: Confident/Aggressive (Focus on Growth/Share Gains/Offense)