VISA Q1 FY26 Earnings Analysis Report

Small beats across revenue and EPS with both growing at ~15% pa

The following report was generated with the Earnings Analysis Report workflow from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

This equity analyst report provides a comprehensive evaluation of Visa Inc. (V) following its Fiscal First Quarter 2026 results.

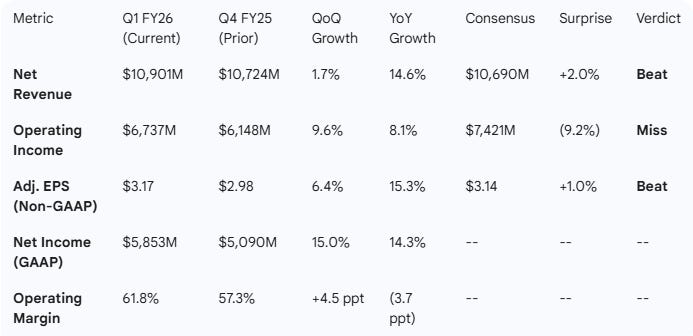

Performance Highlights and Quantitative Comparison

Visa delivered a robust start to fiscal 2026, characterized by strong consumer spending and double-digit growth in net revenue.

Performance Summary Table

Key Business Drivers (YoY Constant Dollars)

Payments Volume: Increased 8%, slightly decelerating from 9% in Q4.

Cross-Border Volume (ex. Intra-Europe): Remained stable at 11% growth.

Processed Transactions: Grew 9%, compared to 10% in the prior quarter.

Data Processing Revenue: Surged 17% to $5.5B, driven by high transaction counts.

Performance and Growth Summary: Overall, Visa’s Q1 results beat consensus expectations on the top line and adjusted EPS, with 15% revenue growth and 15% non-GAAP EPS growth. Growth appears to be steady, though slightly lower in transaction volume compared to Q4, sustained by a strong holiday season and resilient consumer spending.

Management Discussion & Analysis (MD&A) Comparison

Management Narrative

Current Quarter (Q1 FY26): CEO Ryan McInerney emphasized a “very strong” start to the year, highlighting the resilience of consumer spending and the success of “Visa as a Service” as a payments hyperscaler. Focus was placed on the strong holiday season and growth in value-added services and money movement solutions.

Prior Quarter (Q4 FY25): The narrative centered on the “durability of the diverse business model” and the conclusion of a strong fiscal year. Management highlighted investments in AI-driven commerce, tokenization, and stablecoins as the next frontier for commerce transformation.

Semantic Comparison & Sentiment

Sentiment Scores:

Q1 FY26: 18/20

Q4 FY25: 17/20

Delta: +1.0 (Increased Optimism)

Recurring Themes: Resilient consumer spending, “Visa as a Service” hyperscaler, money movement solutions.

New Themes: “Strong holiday season” and specific mention of “payments hyperscaler” technology impact.

Missing Themes: Extensive discussion on stablecoins and tokenization was less prominent in the Q1 summary compared to the Q4 vision statement.

Tone Shift: Management’s tone shifted from visionary/strategic in Q4 to execution-focused/optimistic in Q1. The Q1 commentary reflects high confidence following a successful peak spending period. The upward sentiment trend suggests that management sees no immediate macro-economic headwinds to spending.

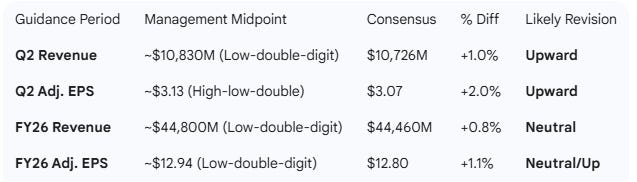

Guidance Evaluation and Consensus Implications

Visa provided detailed guidance for Q2 FY26 and maintained its full-year outlook.

Guidance vs. Consensus

Guidance Analysis

YoY Growth Trajectory: The implied Q2 revenue growth (low-double-digits) is slightly lower than the 15% achieved in Q1, suggesting a seasonal normalization.

Analyst Direction: Following the Q1 beat and solid Q2 guidance, analysts are likely to perform modest upgrades to Q2 estimates. However, because full-year guidance was kept in the “low-double-digit” range, full-year revisions will likely be capped to account for macro-uncertainty.

What is Missing?

Interchange Litigation Resolution: While Visa recognized a $707M litigation provision and mentioned a superseding settlement, the exact long-term impact on merchant discount rates and future revenue remains an area where the market seeks more granular quantitative impact data.

Specific AI Monetization: Management mentions being an “AI-driven commerce” leader, but lacks specific revenue contribution figures from AI-enhanced value-added services.

Russia Suspension Comparatives: While operations were suspended in 2022, the market is now looking for more clarity on how International growth is being structurally re-baselined without this volume long-term.

Executive Summary Output

Stock: $V (Visa Inc.)

Quarter: Q1 FY2026

Result: Beat consensus on Revenue (+2.0%) and Adjusted EPS (+1.0%).

Performance Summary

Visa started FY26 with $10.9B in Net Revenue, a 15% YoY increase, outperforming the 12% growth seen in Q4 FY25. Non-GAAP EPS grew 15% to $3.17, benefiting from a strong holiday season. Operating Income missed GAAP consensus due to a significant $707M litigation provision charge.

Management Commentary

CEO Ryan McInerney expressed high confidence, describing Visa as a “payments hyperscaler”. The tone has shifted from long-term strategic positioning (Q4) to a focus on resilient, high-volume execution (Q1). The sentiment is increasingly positive regarding the consumer’s ability to maintain spending levels.

Guidance Implications

Management expects “low-double-digit” growth for the remainder of the year. This aligns with or slightly exceeds consensus, likely leading to a neutral-to-positive drift in analyst models.

Conclusion

Visa continues to demonstrate its ability to scale revenue faster than expenses (excluding one-time legal items). The business is in a steady state of acceleration in its core processing and value-added segments. While litigation remains a “known unknown,” the underlying operational trajectory signals continued dominance in the global digital payment landscape.

Disclosure: The publisher holds a position in Visa Inc.