RESMED: Q1 2026 Earnings Analysis Report

In-line revenue / Small beat EPS. Deceleration in revenue and earnings growth with consistent management tone and sentiment.

The following report was generated with The INFERENTIAL INVESTOR’S Earnings Analysis Report prompt from the professional prompt library on the website www.inferentialinvestor.com. Subscribe to access these tools and stock research.

Stock: $RMD (Resmed Inc.)

Quarter: Q1 FY26 (Ended September 30, 2025)

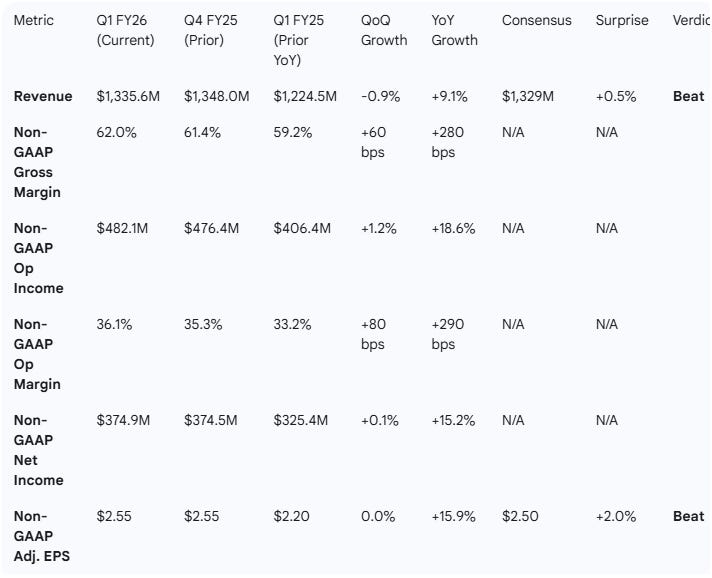

Step 1. Performance Highlights and Quantitative Comparison

Overall, the company’s Q1 FY26 results beat consensus expectations, with 9.1% revenue growth and 15.9% non-GAAP EPS growth. Growth appears to be decelerating slightly on a sequential YoY basis (down from 10% revenue and 23% EPS growth in Q4 FY25), but profitability improved significantly. The key driver was strong non-GAAP gross margin expansion of 280 bps YoY to 62.0%, attributed to manufacturing efficiencies and lower component costs.

Performance Summary Table

Charts: Performance vs. Consensus & Growth Trends

Chart 1: Q1 FY26 Performance vs. Consensus

Metric: Revenue

Actual: $1,335.6M |=======================================|

Consensus: $1,329.0M |=====================================|

Metric: Adjusted EPS

Actual: $2.55 |=======================================|

Consensus: $2.50 |===================================|

Chart 2: Key YoY Growth Trends

Metric: Revenue YoY Growth

Q4 FY25: 10.0% |====================|

Q1 FY26: 9.1% |==================|

Metric: Non-GAAP EPS YoY Growth

Q4 FY25: 23.0% |======================================|

Q1 FY26: 15.9% |===========================|

Key Business Drivers (Q1 FY26)

Core Growth: Revenue growth was driven by increased demand for the company’s portfolio of sleep devices, masks, and accessories.

Profitability: Non-GAAP gross margin expanded by 280 basis points year-over-year to 62.0%. This was attributed to manufacturing and logistics efficiencies, as well as improvements in component costs.

Operating Leverage: Non-GAAP income from operations grew 19%, significantly outpacing revenue growth, thanks to the strong sales and gross margin improvements.

Regional Performance:

U.S., Canada, and Latin America (ex-RCS) grew 10%.

Europe, Asia, and other markets (ex-RCS) grew 6% on a constant currency basis.

Residential Care Software (RCS) revenue grew 5% on a constant currency basis.

Strategic Repositioning: The company recorded $16 million in restructuring charges related to workforce planning, aimed at aligning the company with its “2030 strategic priorities”.

Capital Returns: Resmed was active in capital management, repurchasing 523,000 shares for $150 million and paying $88 million in dividends during the quarter. The board also declared a quarterly dividend of $0.60 per share.

Step 2. Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter: Q1 FY26)

CEO Mick Farrell highlighted a “strong start” to fiscal year 2026. The commentary focused on the 9% headline revenue growth, significant 280 basis points of non-GAAP gross margin expansion, and resulting 16% non-GAAP EPS growth. Management reinforced the success of their strategy to “transform healthcare in the home”. The outlook remains committed to “ongoing operational excellence” and “strategic investment in innovation” to deliver “strong, sustainable, profitable growth”. The discussion noted growth was driven by demand for sleep devices and masks, while the impressive margin gains were driven by manufacturing/logistics efficiencies and component cost improvements. A $16M restructuring charge was also introduced to align with “2030 strategic priorities”.

Management Discussion (Prior Quarter: Q4 FY25)

CEO Mick Farrell described Q4 as a “strong finish to fiscal year 2025,” highlighting 10% headline revenue growth, 230 basis points of non-GAAP gross margin expansion, and 23% non-GAAP EPS growth. The drivers were “robust global demand” for sleep/breathing devices and the expanding digital health ecosystem. The connected care platform was emphasized as setting the “standard for digital health innovation”. The look-ahead to FY26 focused on continued investment in innovation and scaling digital health capabilities. The discussion noted growth was driven by demand for sleep devices and masks, plus solid growth in Residential Care Software, while margin drivers were procurement, manufacturing, and logistics efficiencies.

MD&A Tone & Thematic Shift

Sentiment Score (Q1 FY26): 18/20 (Highly Optimistic)

Sentiment Score (Q4 FY25): 18/20 (Highly Optimistic)

Sentiment Delta: +0.0 (No Change)

Management’s tone remained highly optimistic and consistent between Q4 FY25 and Q1 FY26. The narrative in both periods centered on strong revenue growth driven by robust demand and significant non-GAAP gross margin expansion driven by operational efficiencies.

The primary thematic shift was from executing the “strong finish” to FY25 to establishing a “strong start” for FY26. Q1 FY26 introduced a new $16 million restructuring charge explicitly “aligned with our 2030 strategic priorities”, signaling a new focus on strategic cost alignment that was not present in the Q4 commentary.

Key Phrase Comparison

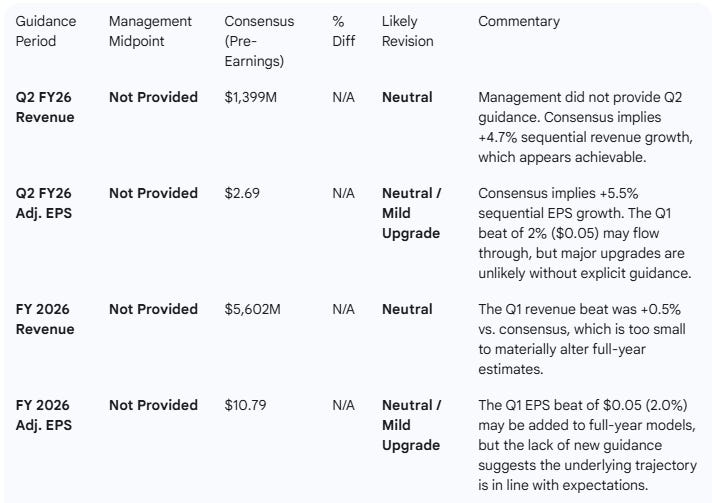

Step 3. Guidance Evaluation and Consensus Implications

Management did not provide explicit, quantitative guidance for Q2 FY26 or the full fiscal year 2026 in the earnings documents. The outlook was qualitative, with the CEO committing to “strong, sustainable, profitable growth”.

Based on the modest Q1 beat, the lack of new quantitative guidance, and the strong underlying profitability, analyst revisions are expected to be neutral to mildly positive.

Step 4. What is missing?

Quantitative Guidance: The most significant missing piece is explicit financial guidance for Q2 FY26 and the full fiscal year 2026. Management offered positive qualitative commentary but provided no new revenue or EPS targets, leaving analysts to rely on their existing models.

GLP-1 Concerns Addressed: A major pre-earnings concern for the market has been the long-term impact of GLP-1 weight-loss drugs. Resmed addressed this directly and robustly in its investor presentation.

Market TAM: The company presented analysis showing that even in a “high-pharma impact” scenario, the global OSA patient market is projected to be ~1.2 billion by 2050, emphasizing the market remains vast and underpenetrated.

Positive Correlation: More importantly, Resmed presented real-world data from an analysis of 1.84 million patients suggesting a positive correlation: OSA patients prescribed a GLP-1 were 11.0% more likely to initiate PAP therapy and had higher 1-year (+310 bps) and 2-year (+480 bps) resupply rates. This directly counters the bear thesis.

Restructuring Details: The company disclosed a $16 million restructuring charge but provided limited detail on which business units or geographies are impacted, beyond stating it was for “employee severance and other one-time termination benefits” to align with “2030 strategic priorities”.

Step 5. Executive Summary

Stock: $RMD (Resmed Inc.)

Quarter: Q1 FY26

Result: Beat. Resmed beat consensus expectations on Revenue (+0.5% vs. consensus) and Adjusted EPS (+2.0% vs. consensus).

Performance Summary: Revenue grew 9.1% YoY to $1,335.6M, while Non-GAAP EPS grew 15.9% to $2.55. The standout metric was a 280 basis point YoY expansion in non-GAAP gross margin to 62.0%.

Growth Momentum: Stable, with Strong Profitability. While top-line YoY growth moderated slightly from Q4 (9.1% vs 10.0%), profitability momentum is accelerating. Non-GAAP gross margins expanded 60 basis points sequentially from Q4, and non-GAAP operating income grew 18.6% YoY, nearly double the rate of revenue.

Management Commentary: The tone remains highly optimistic (”strong start”, “strong, sustainable, profitable growth”). Management directly addressed the GLP-1 overhang, presenting new real-world data suggesting GLP-1 drugs are a net positive for PAP therapy initiation and adherence. A new $16M restructuring charge was announced to align with “2030 strategic priorities”.

Guidance & Analyst Impact: No quantitative guidance was provided. The modest Q1 beat combined with strong qualitative commentary will likely lead to Neutral to Mild Upgrades for analyst EPS estimates, as the $0.05 beat flows through.

Conclusion: Resmed delivered a solid, profitable quarter that should reassure investors. The narrative is shifting from pure top-line growth to highly profitable, sustainable growth. The 280 bps expansion in non-GAAP gross margin is a significant achievement, driven by operational efficiencies and lower component costs. Management’s data-driven rebuttal to the GLP-1 bear case is a major positive. The key signal for investors is that Resmed is executing on profitability and shareholder returns (via a $150M buyback) while its core market remains robust.

Step 7: Follow-up Analysis

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis

Regarding the topic of Resmed's Q1 FY26 earnings, this analysis is super insightful, clearly outlining how they beat expectations despite the slight deceleration in growth. It makes me curious about those manufacturing efficiencies and how much modern process optimisation or even AI integration contributes to the improved gross margins.