PALANTIR TECHNOLOGIES INC. Q3 FY25 Earnings Analysis Report

Another beat and guidance upgrade. "Anomalous quarter" description may signal growth peak?

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Palantir (PLTR) Q3 2025 Earnings Analysis

Report Date: November 4, 2025

Overall Result: Significant Beat & Raise

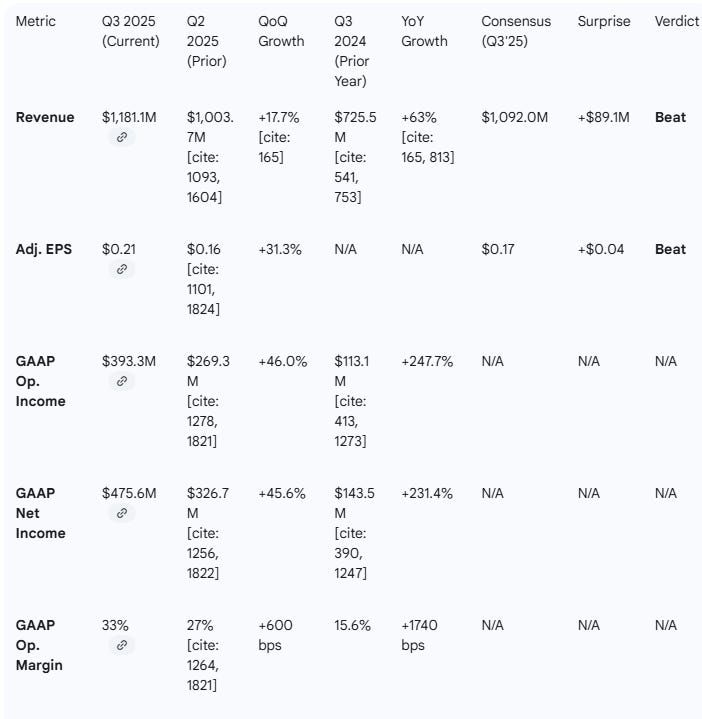

Step 1: Performance Highlights and Quantitative Comparison

Overall, Palantir’s Q3 2025 results emphatically beat consensus expectations, with an 8.2% revenue surprise and a 23.5% adjusted EPS beat. Growth appears to be accelerating significantly, driven by a massive surge in the U.S. Commercial segment (+121% YoY) 111and record-breaking Total Contract Value (TCV) bookings2.

Performance Summary Table

Q3 2025 Results vs. Consensus

Revenue:

|■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■| $1,181.1M (Actual)

|■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■| $1,092.0M (Consensus)

(Beat by +$89.1M or +8.2%)

Adjusted EPS:

|■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■| $0.21 (Actual)

|■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■| $0.17 (Consensus)

(Beat by +$0.04 or +23.5%)

Growth Trajectory (YoY)

70% | +63%

| (Q3 ‘25)

60% | ■

|

50% | +48%

| (Q2 ‘25)

40% | ■

|-------------------------------------------

Q2 2025 Q3 2025

Key Business Drivers (Q3 2025)

U.S. Business Growth: The U.S. segment is the primary growth engine, with revenue up 77% YoY to $883M.

U.S. Commercial Acceleration: This key segment showed exceptional growth, increasing 121% YoY to $397M 999, a significant acceleration from Q2’s (already high) 93% YoY growth10101010.

Record Deal Velocity: The company closed a record $2.76B in TCV, up 151% YoY 11, including a record $1.31B in U.S. Commercial TCV (+342% YoY)12.

Exceptional Profitability (Rule of 40): Management highlighted a “Rule of 40” score of 114% (calculated as 63% YoY revenue growth + 51% adjusted operating margin)131313. This is a massive increase from 94% in Q214141414.

Strong Cash Flow: Generated $540M in Adjusted Free Cash Flow (46% margin)151515.

Sustained GAAP Profitability: Achieved a strong GAAP operating margin of 33% 16and a GAAP net income margin of 40%17.

Step 2: Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3 2025)

Management’s narrative is one of extreme confidence and market validation. CEO Alex Karp highlighted the 114% “Rule of 40” score as “undeniable” proof of the “transformational impact” of their Artificial Intelligence Platform (AIP)18. The focus is squarely on the compounding leverage from AIP, which is credited for the surge in U.S. business (+77% YoY) and U.S. commercial (+121% YoY)19. The company also announced its highest-ever sequential quarterly revenue growth guide in its history, framing the results as a historic validation of its strategy20.

Management Discussion (Prior Quarter - Q2 2025)

In Q2, management’s tone was similarly “bombastic” and “bullish on America”212121. The narrative focused on the U.S. business as the “engine of transformation,” with U.S. Commercial leading at 93% YoY growth. The core thesis, which continues into Q3, was that LLMs “don’t work in the real world without Palantir” and its ontology23. The Q2 call celebrated surpassing $1B in quarterly revenue for the first time and achieving a 94% Rule of 40 score, setting the stage for the acceleration seen in Q3.

Tone & Thematic Shift Analysis

Sentiment Score (Q2 ‘25): 18/20 (Extremely Optimistic)

Sentiment Score (Q3 ‘25): 19/20 (Triumphant / Validated)

Sentiment Delta: +1.0

Compared to Q2, management’s tone in Q3 has become even more triumphant. The Q2 narrative was one of a “bombastic” 26but “anomalous” 27 quarter that proved its thesis. The Q3 narrative shifts to one of “undeniable” 28 and compounding acceleration, where the thesis is no longer just proven but is actively reshaping the company’s financial trajectory at a historic rate.

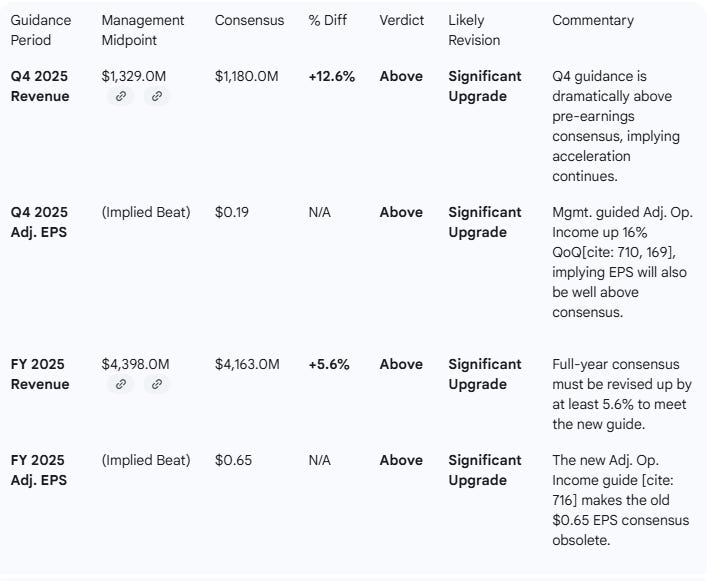

Step 3: Guidance Evaluation and Consensus Implications

Management issued new guidance for Q4 2025 and raised its Full-Year 2025 outlook. This guidance is significantly above all pre-earnings consensus estimates, which will force substantial upward revisions from analysts.

Q4 2025 Revenue: Management’s midpoint of $1,329M is 12.6% higher than the $1,180M consensus.

FY 2025 Revenue: Management’s midpoint of $4,398M is 5.6% higher than the $4,163M consensus.

The Q4 guidance implies a sustained YoY growth rate of +60.6%, demonstrating management’s high confidence in the accelerating business momentum.

Guidance & Revisions Table

Step 4: What is Missing?

The report was comprehensive and overwhelmingly positive, directly addressing the market’s primary concern: growth sustainability.

International Growth Details: The report’s narrative is laser-focused on the U.S. business explosion (+77% YoY)4040. It does not provide a specific growth rate for the international business. By subtraction (Total Revenue $1,181.1M 41minus U.S. Revenue $883M 4242), the international segment was $298.1M. This represents a solid 10% QoQ growth from Q2’s $270.7M (Total $1,003.7M 43minus U.S. $733M 44), but it is clearly not the growth engine and was not a focus of management’s commentary.

Segment Profitability: The company does not break out operating margins by segment (e.g., Commercial vs. Government) in the initial release, focusing instead on consolidated profitability.

Step 5: Executive Summary

Stock: $PLTR

Quarter: Q3 2025

Result: Massive Beat & Raise. Palantir beat consensus on revenue by +8.2% ($1,181.1M vs $1,092M) 45and on adjusted EPS by +23.5% ($0.21 vs $0.17)46.

Performance Summary:

This was a major acceleration quarter. YoY revenue growth jumped to 63% from 48% in Q2. The growth was entirely driven by the U.S. business (+77% YoY), and specifically the U.S. Commercial segment, which exploded by 121% YoY to $397M494949. Profitability and cash flow were exceptional, with the company highlighting a 114% “Rule of 40” score (up from 94% in Q2) and $540M in adjusted free cash flow (46% margin).

Management Commentary:

Management’s tone was triumphant, labeling the results as “undeniable” proof of AIP’s “transformational impact”52. The narrative has shifted from proving its AI-driven thesis (Q2) to compounding it (Q3).

Guidance Implications:

Guidance for Q4 and the Full Year 2025 was significantly above all consensus estimates, which will force large, immediate upward revisions from analysts.

Q4 Revenue Guide: $1,329M (midpoint) vs. $1,180M (consensus), a +12.6% beat53535353.

FY 2025 Revenue Guide: Raised to $4,398M (midpoint) vs. $4,163M (consensus), a +5.6% raise54545454.

Conclusion:

This was a blowout quarter that validates the thesis that Palantir’s AIP is capturing massive demand in the U.S. market. The acceleration in the U.S. Commercial segment (+121% YoY) 55 is the key data point, proving the company is successfully transitioning its government-grade AI platform to the enterprise sector at scale. The combination of +63% revenue growth and a 51% adjusted operating margin 56 is exceptionally rare. The stock’s next phase will be defined by whether it can maintain this explosive (and profitable) U.S. momentum and begin to replicate it internationally.

Step 7: Follow-up Analysis

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis

That 121% US Commercial growth is the real story here beyond the headline beat. The Rule of 40 score hitting 114% shows they're finally achiving what many thought impossible in enterprise AI - combining hypergrowth with legitimate profitability at scale. The question now is if international can replicate even half of this US momentum.

Insightful