NVIDIA ($NVDA) Q3 FY26 Earnings Analysis Report

Beat on Revenue and EPS. Guidance ahead of consensus and sequential acceleration. Gross margin guidance is strong, addressing margin fears.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Equity Research: NVIDIA Corp. (NVDA) - Q3 FY26 Analysis

Date: November 20, 2025

Subject: Q3 FY26 Earnings Review

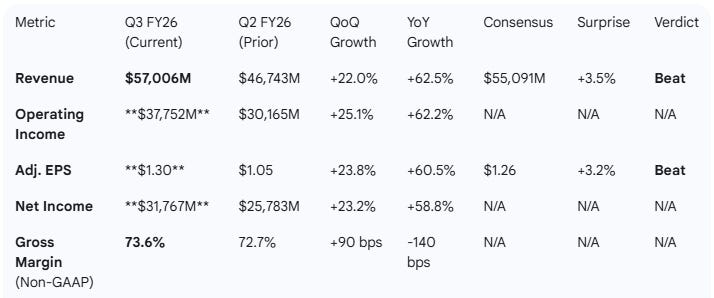

1. Performance Highlights and Quantitative Comparison

Verdict: NVIDIA delivered a robust beat against consensus expectations for both Revenue and EPS, though the magnitude of the beat has normalized compared to previous fiscal years. Revenue growth remains explosive at +62% YoY, driven almost entirely by the Data Center segment.

Financial Performance Summary

Segment Performance:

Data Center: $51.2B (+66% YoY, +25% QoQ). Key Driver.

Networking: $8.2B (+162% YoY, +13% QoQ). Acceleration.

Gaming: $4.3B (+30% YoY, -1% QoQ). Seasonal normalization.

Auto: $592M (+32% YoY, +1% QoQ). Steady growth.

Key Drivers & Performance Indicators:

Blackwell Ultra: Identified as the “leading architecture” across customer categories, signaling a faster-than-expected transition from Hopper.

Agentic AI: New emphasis on “agentic applications” driving inference demand, a shift from pure “training” narratives.

Supply Chain: Inventory rose to $19.8B (up from $15.0B in Q2) to secure long lead-time components for the Blackwell ramp.

China H20: Sales were “insignificant” in Q3, confirming the effective zeroing out of the China data center revenue stream due to export controls.

Growth Assessment:

Overall, the company’s Q3 results beat consensus expectations, with 62% revenue growth and 60% EPS growth. Growth appears to be accelerating sequentially (22% QoQ vs 6% QoQ in Q2) due to the successful initial ramp of the Blackwell architecture and massive scaling in Networking revenue.

2. Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3 FY26)

Management’s narrative has shifted decisively to execution and product transition. The primary focus is the “Blackwell Ultra” architecture, which is now the leading driver of demand. The tone is operationally confident but grounded in the reality of supply constraints, noted by the significant rise in inventory to secure components. A new thematic pillar, “Agentic AI,” was introduced to explain the broadening demand for inference compute. The discussion on China (H20) was brief and final: sales are now insignificant.

Management Discussion (Prior Quarter - Q2 FY26)

In Q2, the narrative was characterized by anticipation and reassurance. Management focused heavily on the “beginning” of the Blackwell ramp and defending the H20 inventory situation (releasing reserves). There was a strong emphasis on “Sovereign AI” as a new customer class ($20B pipeline mentioned). The tone was more promotional regarding the “industrial revolution” of AI to manage investor expectations during the product transition gap.

Sentiment & Tone Analysis:

Sentiment Score: Q3: 17/20 (High Confidence) vs. Q2: 16/20 (Optimistic but Defensive).

Delta: +1.0 (Shift from defense on China/margins to offense on Blackwell execution).

Recurring Themes: “Blackwell,” “Data Center,” “Hopper,” “Generative AI.”

New/Emerging Themes: “Agentic AI” (strong new focus), “Blackwell Ultra” (specific product differentiation), “Supply-related commitments.”

Missing Themes: “Sovereign AI” (less prominent in Q3 text than Q2), “H20 Inventory Release” (no longer a factor).

Tone Shift:

Compared to Q2, management’s tone in Q3 became more assertive and execution-oriented. The earlier defensiveness regarding China revenue and gross margin compression has been replaced by a confident focus on the Blackwell Ultra ramp and the operational complexity of securing supply for “agentic” workloads.

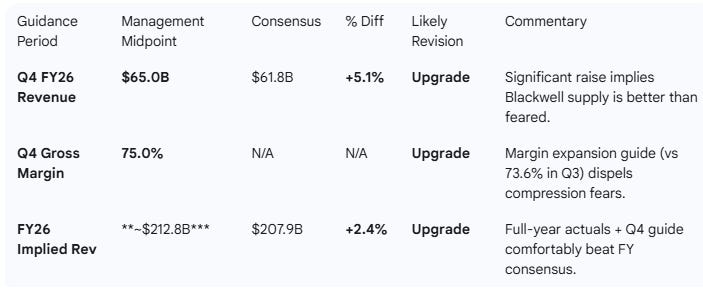

3. Guidance Evaluation and Consensus Implications

Management provided strong guidance for Q4 FY26, signaling that the Blackwell ramp is accelerating faster than Street models anticipated.

*( Calculation: Q1($44.0B) + Q2($46.7B) + Q3($57.0B) + Q4 Guide($65.0B) = $212.7B)

Assessment:

The guidance is a “Beat and Raise”. The Q4 revenue guide of $65.0B is ~5% above the consensus of $61.8B. More importantly, the gross margin guidance of 75.0% (Non-GAAP) represents a recovery from Q3’s 73.6%, suggesting that the initial manufacturing yield costs associated with new products are stabilizing quickly.

Analyst Revisions:

Expect upward revisions for both FY26 and FY27. The “Agentic AI” narrative provides a new long-term TAM expansion argument, while the margin recovery creates room for EPS upgrades.

4. What is Missing?

Despite the strong report, several key areas of market focus were notably absent or under-addressed compared to pre-earnings expectations:

Rebuttal to Overheating Rumors: Leading into earnings, media reports suggested Blackwell servers faced overheating issues necessitating design changes. The report mentions “Blackwell Ultra is ramping” and “ordering to secure components” but does not explicitly address thermal challenges or potential deployment delays at the rack level.

Updated “Sovereign AI” Quantification: In Q2, NVIDIA explicitly touted a “$20 billion” pipeline for sovereign AI. The Q3 report mentions the sector generally but lacks an updated dollar figure, leaving investors guessing if this volatile segment has stalled.

Rubin Roadmap Details: With the acceleration of Blackwell Ultra, the market (whisper expectation) was looking for updated timelines on the subsequent “Rubin” architecture to confirm the one-year cadence. This was largely absent from the commentary.

Specific “Whisper” Miss: While a beat on paper, buy-side “whisper” numbers for Q3 Revenue were likely closer to $57-58B. Meeting the top end of whispers but not blowing them away may result in a muted immediate stock reaction despite the fundamental strength.

5. Executive Summary

Stock: NVIDIA Corp. (NVDA)

Quarter: Q3 FY26

Result:

NVIDIA delivered a comprehensive beat, surpassing consensus revenue by 3.5% and Adj. EPS by 3.2%. The company effectively navigated a critical product transition, with the new Blackwell Ultra architecture driving a sequential revenue acceleration to +22% QoQ (up from +6% in Q2).

Management Commentary:

The narrative has shifted from “anticipating demand” to “executing supply.” The tone is highly confident, characterized by the introduction of “Agentic AI” as a driver for inference demand—a critical counter-argument to fears that AI training demand might plateau. The “insignificant” China revenue confirms that NVDA has successfully diversified growth away from restricted markets.

Guidance Implications:

Guidance is the highlight of the report. The Q4 forecast of $65.0B is significantly above the $61.8B consensus, and the projected gross margin recovery to 75.0% (from 73.6%) removes the primary bear case regarding margin compression during the Blackwell ramp.

Conclusion:

NVIDIA remains the undisputed engine of the AI infrastructure buildout. While the “beat” magnitude has normalized (3-4% vs historical 10%+), the acceleration in sequential growth and the margin-accretive guidance for Q4 demonstrate that the Blackwell cycle is fundamentally intact. The emergence of “Agentic AI” extends the growth runway into FY27. The thesis remains robust.