NVIDIA ($NVDA) Q3 FY26 Detailed Earnings Call Transcript Analysis: $0.5 trillion visibility

Earnings Call reveals $0.5 Trillion revenue visibility (Cal 2025 + 2026) with constraints being supply. Input costs rising. Management and Analyst sentiment accelerated.

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Detailed Transcript Analysis:

Refer to II’s NVDA Q3 Earnings Analysis Report for more detailed analysis of financials, consensus, analyst upgrades etc.

Executive Summary: NVDA FY26 Trajectory (Q1–Q3)

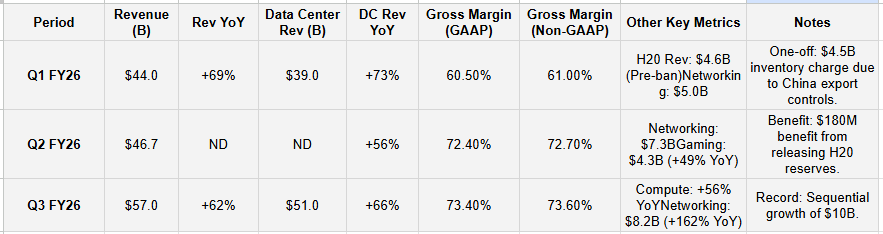

Growth Acceleration: Revenue growth remains hyper-expansive, accelerating from $44 billion in Q1 (+69% YoY) to $57 billion in Q3 (+62% YoY), consistently beating guidance. Data Center revenue continues to drive the topline, growing 66% YoY in Q3.

China Reset: A major narrative shift occurred in Q1 with a $4.5 billion inventory write-down due to export controls. By Q3, management explicitly removed China compute revenue from the outlook, signaling a pivot to non-China growth drivers.

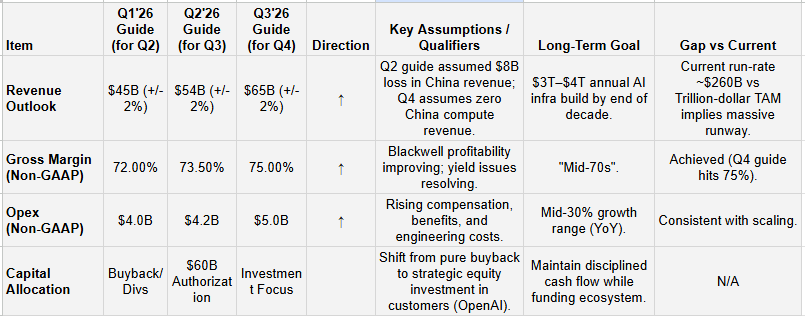

Margin Expansion: Despite the Q1 inventory charge compressing GAAP margins to 60.5%, gross margins recovered, hitting 73.4% (GAAP) in Q3 with guidance for 74.8% in Q4, driven by improved cost structure and Blackwell mix.

Demand Visibility: Management rhetoric shifted from “firm” commitments in Q1 to being “sold out” and having visibility to $0.5 trillion in revenue in Q3, indicating supply is the governing constraint.

The “Reasoning” Shift: A thematic evolution from “Generative AI” to “Reasoning/Agentic AI” has occurred, used to justify exponential compute requirements due to “long thinking” models.

Strategic Capital Deployment: In Q3, a new strategy emerged: direct investment in partners like OpenAI and Anthropic to cement ecosystem dominance and secure “offtake”.

Supply Chain Evolution: Production ramped from “improving supply” in Q1 to “1,000 racks per week” in Q2, to “executed distinct Blackwell/Rubin roadmaps” in Q3.

Infrastructure TAM: Management established a long-term anchor of $3 trillion to $4 trillion in infrastructure build-out, framing current capex as early-cycle.

Table 1 — Results & YoY Growth

(extracted from transcripts. refer the NVDA Q3 Earnings Analysis Report for more detailed analysis of financials, consensus, analyst upgrades etc)

Table 2 — Guidance & Goals Evolution

Management Forward-Looking Commentary:

Q3 FY26 (Latest): “We currently have visibility to $0.5 trillion in Blackwell and Ruben revenue from the start of this year through the end of calendar year 2026.”

Q3 FY26 (Latest): “Demand for AI infrastructure continues to exceed our expectations. The clouds are sold out and our GPU installed base... is fully utilized.”

Q2 FY26: “We are at the beginning of an industrial revolution... We see $3 trillion to $4 trillion in AI infrastructure spend... by the end of the decade.”

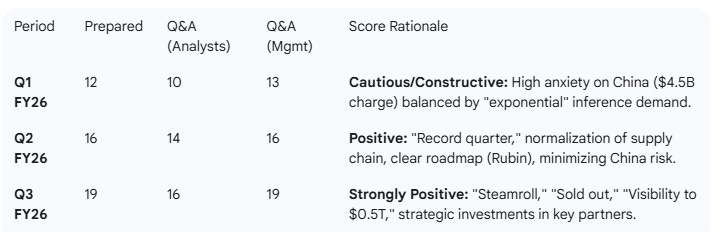

Table 3 — Sentiment (0–20 Scale)

Thematic Summary (Prepared Remarks)

Q3 FY26 Themes

Growth Drivers: The emergence of “Agentic AI” and “Physical AI” (Robotics) alongside Generative AI. “Demand... exceeds our expectations. The clouds are sold out.”

Strategic Investments: A new capital deployment strategy involving equity stakes in customers. “We have the opportunity to invest in the company [OpenAI]... we are establishing a deep technology partnership [Anthropic].”

Product Trends: Blackwell momentum is overtaking Hopper. “GB300 crossed over GB200 and contributed roughly 2/3 of the total Blackwell revenue.”

Challenges: Geopolitical lockout. “We are not assuming any data center compute revenue from China.”

Q2 FY26 Themes

Strategy (TAM): Framing the long-term opportunity. “We see $3 trillion to $4 trillion in AI infrastructure spend... by the end of the decade.”

Supply Chain: Rapid scaling of production. “Current run rate is back at full speed, producing approximately 1,000 racks per week.”

Networking: Diversification of the stack. “Spectrum-X Ethernet... annualized revenue exceeding $10 billion.”

Risks: Regulatory limbo. “USG officials have expressed an expectation that the USG will receive 15% of the revenue... but to date, the USG has not published a regulation.”

Q1 FY26 Themes

Challenges (China): Immediate financial hit from export controls. “Recognized a $4.5 billion charge as we wrote down inventory... tied to orders we had received prior to April 9.”

Product Trends (Inference): The shift to reasoning. “We are witnessing a sharp jump in inference demand... Microsoft processed over 100 trillion tokens.”

Sovereign AI: National infrastructure build-outs. “Projects requiring tens of gigawatts of NVIDIA AI infrastructure in the not-too-distant future.”

Analyst Q&A Themes & Evolution

Q3 FY26: Supply Constraints & Capital Returns

Themes: Supply vs. Demand balance, Capital allocation (buybacks vs investments), Margins in light of rising input costs.

Analyst Focus: “Do you see a realistic path for supply to catch up with demand over the next 12 to 18 months?”

Management Response: Supply chain is fully engaged, but demand for “long thinking” (reasoning) models is exponential. Investments in OpenAI/Anthropic are to “expand our ecosystem” and secure returns on “once-in-a-generation” companies.

Q2 FY26: Competitive Moat & ASIC Threat

Themes: Custom Silicon (ASIC) vs. NVDA GPU, Sustainability of growth (CAGR), China re-entry.

Analyst Focus: “Any scenario in which you see the market moving more towards ASICs and away from NVIDIA GPU?”

Management Response: NVDA is an “infrastructure company,” not a chip company. The complexity of rack-scale computing (NVLink 72) makes one-off ASICs less viable. “Accelerated computing is a full-stack co-design problem.”

Q1 FY26: The China Shock & Reasoning Models

Themes: Navigating the export ban, the emergence of “Reasoning” AI (DeepSeek/Qwen), Inference scaling.

Analyst Focus: “How big the inference business is for you guys... do we need full on NVL72 rack scale solutions for reasoning?”

Management Response: Reasoning requires 100x-1,000x more tokens (thinking time). This necessitates rack-scale systems (NVL72) to maintain latency. China is effectively closed, but “Reasoning AI really busted through.”

Term Frequency Tracking

Q3 FY26 (Most Recent)

Positive: Growth (23 mentions), Demand (16 mentions), Record (5 mentions), Opportunity (12 mentions), Incredible (9 mentions).

Negative: Issues (2 mentions), Limits (Context: physical limits), Charge (0 mentions), Restricted (0 mentions).

Evolution Narrative:

“China”: Frequency remains high but context shifts from “Crisis/Charge” in Q1 (mentioned 16 times in negative context) to “Zeroed out/Geopolitical” in Q3 (mentioned as non-contributor).

“Reasoning” / “Agentic”: Explodes in frequency from Q1 to Q3. Q1 introduces “Reasoning” (12 mentions). Q3 expands to “Agentic” (15+ mentions), signaling the new demand driver.

“Blackwell”: Consistent increase in frequency and confidence, moving from “Ramp” (Q1) to “Sold Out” (Q3).

TF/IDF Analysis:

Q1 Top Terms: Inventory, Charge, Export, H20, Sovereign. (Reflects the immediate shock of the ban).

Q2 Top Terms: Racks, Spectrum-X, Rubin, 1,000, Licenses. (Reflects operational stabilization and product roadmap).

Q3 Top Terms: Agentic, Physical AI, OpenAI, Anthropic, $0.5 Trillion. (Reflects ecosystem dominance and financial scale).

Open Questions

China Revenue Zero-Bound: Management has explicitly removed China compute revenue from guidance. While this de-risks the guide, it confirms the permanent loss of a ~$50B TAM.

Supply Chain “Sold Out”: While bullish for demand, the phrase “clouds are sold out” implies a hard revenue ceiling dictated by manufacturing capacity (CoWoS/HBM) rather than customer appetite.

Inventory Volatility: Inventory spiked from $11B to $15B in Q2 and grew another 32% in Q3. While attributed to the Blackwell ramp, this is a massive working capital build.

Gross Margin Pressure (Input Costs): Management noted “input costs are on the rise” for FY27, though they aim to hold mid-70s. This suggests the easy margin expansion from pricing power may be plateauing against component inflation.

Customer Concentration: The heavy reliance on “top 4 hyperscalers” (reaching $600B capex) and the need to invest equity into customers (OpenAI/Anthropic) raises questions about organic demand sustainability vs. vendor-financed growth.