MSFT Q2 FY26 Earnings Analysis Report

Steady growth in revenue and earnings but likely not enough for investors

The following report was generated with the Earnings Analysis Report workflow from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

This analysis evaluates Microsoft’s Q2 FY2026 performance by comparing it to the prior quarter (Q1 FY2026), management commentary, and current market consensus targets. [Author’s note: Full guidance for Q3 is not provided until the earnings call and will be profiled in a later transcript analysis report. This analysis implies guidance from forward looking statements and data that is subject to revision]

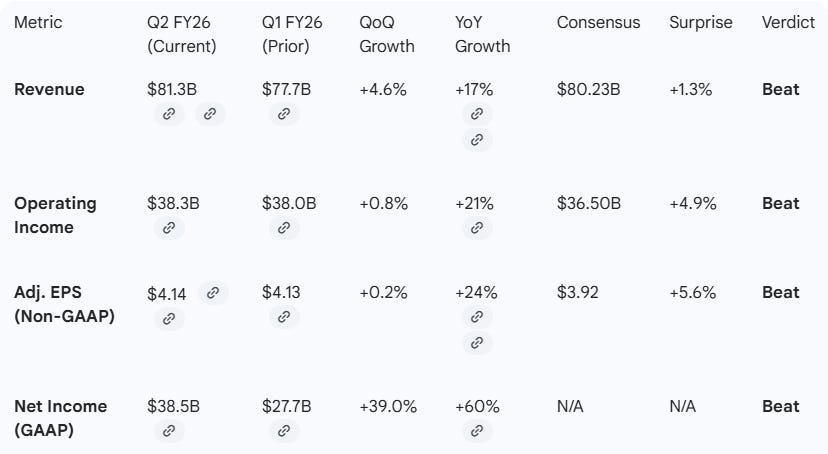

Step 1. Performance Highlights and Quantitative Comparison

Microsoft delivered a beat on both the top and bottom lines for Q2, primarily driven by the OpenAI recapitalization impact on GAAP figures (normalized out in Non-GAAP) and sustained 26% growth in Microsoft Cloud revenue. However, Cloud revenue growth slowed slightly and gross margin fell for another quarter driven by AI investments. Capacity constraints (GPUs and data centers) are called out as a constraint on growth with demand strong and greater than can be served in the short term, constraining any near term re-acceleration.

Performance Summary Table

Key Business Drivers

Cloud Dominance: Microsoft Cloud revenue crossed the $50B milestone, reaching $51.5B (up 26% YoY). Cloud gross margin continued to slowly decline driven by up-front AI investments that management expect to underpin future growth over the medium term.

Commercial RPO accelerated to 110% yoy growth driven by OpenAI which is quoted as 45% of backlog.

Azure Resilience: Azure and other cloud services grew 39% (38% CC), maintaining high momentum albeit with a slight deceleration from Q1’s 40% growth. This is a key investor focus point.

Gross margins: declined 1 percentage point, continuing a trend over recent quarters and driven by high up front AI infrastructure investments that are two-thirds in short lived, depreciating assets (GPUs, CPUs).

OpenAI Impact: Q2 GAAP results benefited from a $7.6B net gain related to an OpenAI recapitalization, a sharp reversal from the $3.1B loss recognized in Q1.

Capital Expenditures: CapEx surged to $37.5B (including finance leases) to support massive AI infrastructure demand, up from $34.9B in Q1.

Summary on Performance: Overall, Microsoft’s Q2 results beat consensus expectations across all major metrics. Revenue growth remains steady at 17%, while adjusted EPS growth of 24% reflects high operational efficiency. Growth appears to be stable and high-quality, driven by the “diffusion” of AI into core franchises.

Despite this “double beat” on both revenue and earnings per share, Microsoft ($MSFT) shares fell approximately 5% in extended trading following the Q2 FY2026 results. Investors appear focused on a few specific areas of the report that signaled potential headwinds or required massive capital intensity to sustain.

The following aspects of the results were the primary drivers of investor disappointment:

1. Azure’s Marginal Growth Deceleration

The “Intelligent Cloud” segment remains Microsoft’s most critical growth engine, but the market reacted to a slight decline in momentum:

The “Dip”: Azure and other cloud services revenue grew 39% YoY. While this exceeded management’s previous guidance of 37%, it represented a deceleration from the 40% growth recorded in Q1 FY2026.

Investor Sensitivity: In the high-valuation AI environment, any sequential slowdown—even by a single percentage point—can trigger concerns about a peak in AI-driven demand or increasing competition.

2. Weakness in More Personal Computing (MPC)

The More Personal Computing segment was the clear laggard, failing to match the double-digit growth seen in Cloud and Productivity:

Segment Decline: Revenue in this segment fell to $14.3 billion, a 3% decrease compared to the prior year.

Gaming & Hardware Struggles: Xbox content and services revenue decreased 5%, while Xbox hardware revenue plummeted 32%.

Flat Windows Growth: Windows OEM and Devices revenue increased only 1%, reflecting a sluggish PC market recovery despite the “AI PC” marketing push.

3. Surging Capital Expenditures (CapEx)

Microsoft continues to spend aggressively to build out its AI infrastructure, which is weighing on near-term cash flow and margin expectations:

Massive Spend: Capital expenditures (including finance leases) surged to $37.5 billion this quarter, up from $34.9 billion in Q1.

Margin Pressure: Management noted that gross margin percentage decreased slightly to 67% (down from 68% in previous quarters), specifically citing continued investments in AI infrastructure. Investors are increasingly wary of when this massive spending will result in expanded profitability rather than just sustained growth.

4. Conservative Outlook and Capacity Constraints

While not explicitly detailed in the press release, market sentiment was impacted by the ongoing reality of supply constraints:

Capacity Limits: Management indicated that Azure growth continues to be constrained by physical capacity (GPUs and data center power) rather than a lack of demand. This suggests that Microsoft may be unable to “capture” the full upside of the AI boom in the immediate term.

Management Discussion & Analysis (MD&A) Comparison

Management Narrative

Management Discussion (Current Quarter): CEO Satya Nadella emphasized that Microsoft has already built an AI business larger than some of its biggest existing franchises. The focus has shifted from “building” to “diffusion” and “pushing the frontier” of the AI stack. CFO Amy Hood highlighted the $50B cloud milestone as evidence of “differentiated” demand. However, capacity constraints are restricting any potential growth acceleration with shortages in AI infrastructure noted and high investment driving a decline in gross margin sequentially. Forward looking discussion referencing these constraints suggests a tempered outlook that isn’t meeting high investor expectations.

Management Discussion (Prior Quarter): In Q1, the narrative was centered on the “AI factory” and “planet-scale cloud”. Commentary focused on increasing investments in capital and talent to meet “massive opportunity,” suggesting a more foundational, build-out phase.

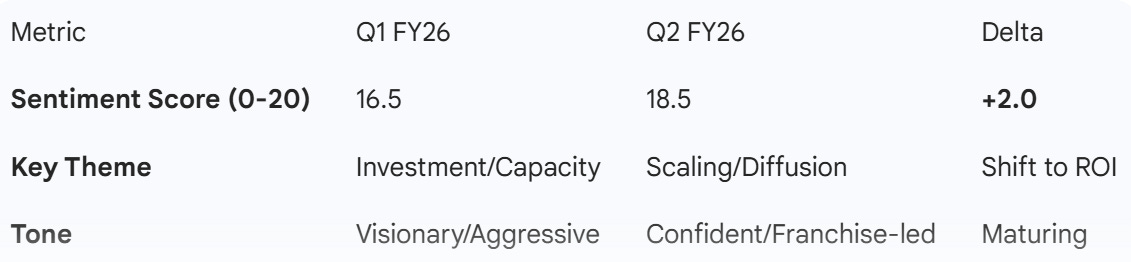

Sentiment and Tone Analysis

Tone Shift Detection: Compared to Q1, management’s tone in Q2 became more confident and results-oriented. The Q1 emphasis on “massive opportunity” and “investing in talent” was replaced in Q2 by the assertion that AI is already a massive, established business “larger than some of our biggest franchises”. The language moved from “meeting opportunity” to “driving new value”.

Guidance Evaluation and Consensus Implications

Guidance Assessment

While the press release directs investors to the conference call for specific numbers, the “Business Outlook” and “Forward-Looking Statements” identify key trends.

*Implied based on current momentum and 110% growth in Commercial RPO.

Analyst Impact: Analysts are likely to maintain or slightly upgrade estimates. The 110% surge in Commercial Remaining Performance Obligation (RPO) to $625B (up from 51% and $392B in Q1 ) is a leading indicator of future revenue that significantly exceeds current consensus for the second half of the year. It is likely given quoted supply constraints that this will drive medium term forecast upgrades as opposed to near quarters.

What is missing?

Copilot Specifics: While Nadella mentioned AI diffusion, specific revenue contribution from M365 Copilot remains opaque. Markets expected more granular “attach rates.”

Hardware Recovery: More Personal Computing revenue decreased 3%, and Xbox hardware declined 32%. Management provided little detail on when the devices cycle will trough.

OpenAI Structure: Despite the recapitalization gain, the long-term financial structure and Microsoft’s ultimate “equity-like” stake remains complex and not fully disclosed.

Executive Summary

Stock: MSFT

Quarter: Q2 2026

Result: Small beat on Revenue (+1.3% vs consensus) and Adj. EPS (+5.6% vs consensus).

Microsoft Cloud: Crossed $51.5B, up 26%.

Azure Growth: 39% YoY growth (38% CC) but marginal deceleration

Gross margin: 68% down from 69% driven by AI investments

Commercial RPO: $625B, a staggering 110% increase YoY.

Growth Momentum: Steady, supply constrained.

MD&A Tone: Highly confident; shifted from “investment mode” to “scale mode.”

Analyst Impact: Consensus likely to be steady to marginally higher based on RPO strength.

Conclusion: Microsoft’s transition from AI infrastructure builder to AI value extractor is apparent in these results however growing investments are maintaining, not accelerating top line growth. The 110% jump in RPO suggests a massive wave of enterprise AI spending is now under contract and needs to be delivered however data center and GPU constraints spread this out. CapEx remains high and is growing ($37.5B), with returns on investment remaining as a key investor concern given the cloud revenue growth rate and gross margin trend evident in this result.

Note: This report is AI generated with additional author edits using The Inferential Investor’s professional analysis workflows from the Professional Prompt Library. AI can make mistakes. Verify all information. Not financial advice.