META Q4 FY25 Earnings Analysis Report

Revenue acceleration guided but cost growth may drive small FY26 EPS downgrade. Nonetheless, investor relief on cost quantification and AI driven ad impression acceleration may be the key focus.

The following report was generated with the Earnings Analysis Report workflow from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Performance Highlights and Quantitative Comparison

Financial Results Extraction

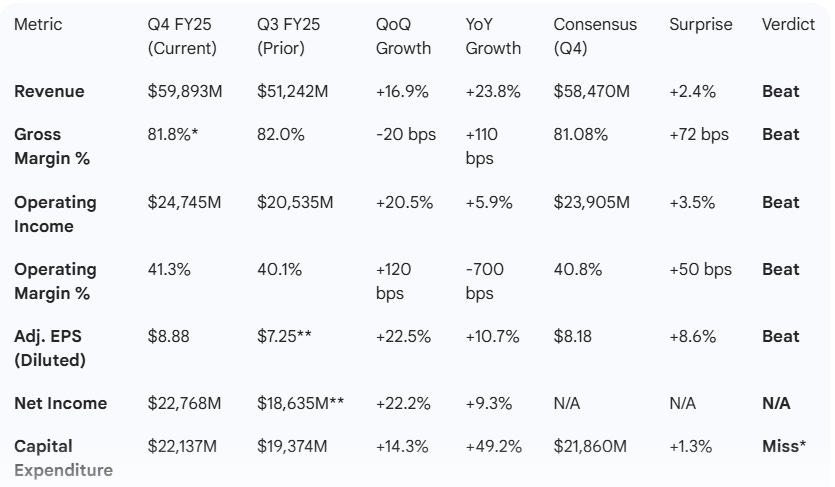

The following table compares Meta’s reported results for Q4 FY25 and Q3 FY25 against consensus expectations.

*Gross Margin calculated as (Revenue - Cost of Revenue) / Revenue. Q4 Cost of Revenue: $10,905M. **Q3 figures are adjusted to exclude the $15.93B one-time tax charge for comparability. ***CapEx “miss” in this context refers to spending exceeding the consensus estimate, reflecting higher-than-expected investment.

Key Business Drivers & Indicators

Ad Impression Growth: Increased 18% YoY in Q4, a significant acceleration from 14% in Q3.

Pricing Trends: Average price per ad grew 6% YoY, decelerating from the 10% growth seen in the prior quarter.

User Scale: Family Daily Active People (DAP) reached 3.58 billion in December, up 7% YoY.

Segment Performance: Family of Apps (FoA) revenue grew 25% YoY to $58.94B, while Reality Labs (RL) revenue was $955M, declining from its $1.07B peak in Q4’24.

Operational Efficiency: Total headcount grew only 6% YoY to 78,865, demonstrating continued discipline despite massive infrastructure scaling.

Summary on Performance, Growth, and CapEx:

Overall, Meta’s Q4 results beat consensus expectations across all major profitability metrics, headlined by a 2.4% revenue beat and 8.6% EPS surprise. This was delivered against arguably cautious investor expectations following the cost and capex warnings from management in the Q3 result.

Revenue growth remains robust at 23.8% YoY, supported by an acceleration in ad impressions but a slowdown in price growth and is forecast to accelerate in Q1 26 which will be well received as it shows AI monetization. However, CapEx growth is accelerating aggressively, up 49% YoY to $22.1B, as the company enters a “notably larger” investment phase for AI superintelligence.

Management Discussion & Analysis (MD&A) Comparison

Management Discussion Summary

Current Quarter (Q4 FY25): CEO Mark Zuckerberg highlighted a “strong business performance” in 2025 and pivoted focus toward 2026 as the year to advance “personal superintelligence” globally. The narrative shifted from “year of efficiency” to an aggressive investment footing, with the CFO explicitly noting that 2026 would see a “meaningful step up” in infrastructure spending to support core AI efforts.

Prior Quarter (Q3 FY25): Management emphasized the successful launch of “Meta Superintelligence Labs” and leadership in AI glasses. The tone was celebratory regarding community growth but carried a stern warning that infrastructure needs were expanding “meaningfully” beyond previous expectations, signaling the start of the current high-CapEx cycle.

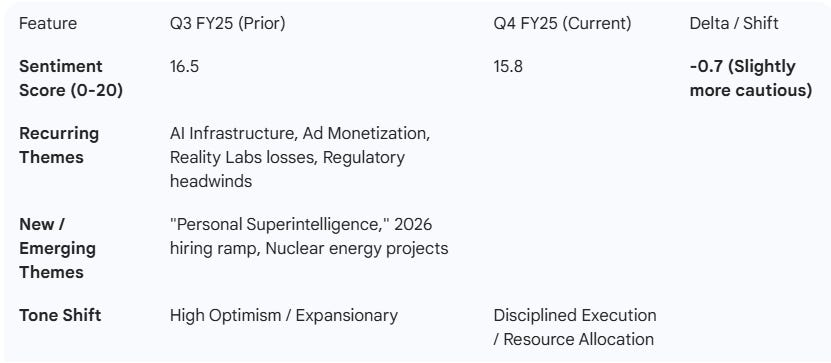

Semantic & Tone Comparison

Narrative Comparison:

Compared to Q3, management’s tone in Q4 has transitioned from visionary excitement to operational reality. While the long-term AI thesis is stronger (”Personal Superintelligence”), the focus has shifted to the cost of that vision, with detailed guidance on higher depreciation and technical talent acquisition. The earlier emphasis on “aggressive” investment has been replaced by a commitment to deliver 2026 operating income above 2025 levels, signaling that management aim to maintain operational earnings and slight growth even as expenses surge.

Guidance Evaluation and Consensus Implications

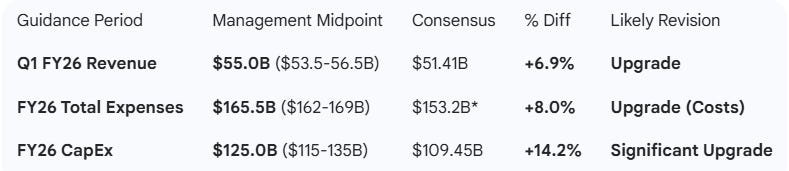

Guidance vs. Consensus Comparison

*Implied consensus based on prior 2025 trend + 30% growth expectations.

Growth Implication & Analyst Impact

The Q1 revenue guidance midpoint of $55.0B implies ~30% YoY growth (vs. Q1’25 $42.3B), representing a significant acceleration from the 24% growth achieved in Q4 and well above market expectations. However, the $125B CapEx midpoint and total FY26 expense guidance are also shocks to the upside and larger in magnitude than the revenue upside.

Revision Assessment:

Revenue: Expect upward revisions of ~7% for FY26 as Meta’s ad engine shows overall acceleration and AI initiatives are supporting continued impression growth. Ad impression growth is accelerating (up to 18% in Q4) even as ad price growth slows (down again to 6% in Q4).

FY26 Earnings: Revisions will likely be neutral to a small downgrade. While revenue is higher, the massive depreciation from $125B in CapEx and talent expense growth, encapsulated in the total expense guidance of $162-169bn (10% higher than the market expected), may weigh on EPS across 2026.

Calculation: FY26 revenue of $250bn (25% YoY growth) less total OpEx of $162bn - $169bn (midpoint $166)bn leads to Op Income for FY26 of $84bn which is below consensus of $86bn (FY25 $82.4bn). This scenario would meet management’s commitment to grow operating income in FY26 but align with the CFO’s warnings on costs.

Guidance comparison to market expectations and implications: The market had been concerned regarding prior warnings on costs and capex and Meta’s unspecified AI monetization pathway. Despite potential for small FY26 operating earnings downgrades, this report likely reduces some uncertainty as it (1) demonstrates a revenue acceleration for Q1 FY26 implicit in guidance that supports returns being achieved from AI investments and (2) provides quantification of previously vague cost warnings. Those latter factors are likely behind the after hours stock price increase coupled with potential short covering on lack of a “worse” guidance scenario.

What is Missing?

Reality Labs Pivot Details: Pre-earnings, the market expected clarity on whether Meta would “reframe Reality Labs as a lower-cost bet” given the AI focus. Instead, management guided for losses to remain “similar to 2025 levels” (~$19B/year) without a clear reduction timeline.

AI Monetization Quantities: While management mentions “strong ad revenue” from AI, the report lacks specific “Greenfield” revenue figures from new AI products (e.g., Meta AI Assistant or Superintelligence Lab grants) that analysts need to model 12-18 month ROI.

Regulatory Loss Contingency: Management warned of “material loss” from upcoming youth-related trials but provided no specific accrual or range for potential settlements.

Executive Summary

Stock: $META

Quarter: Q4 2025

Result: Beat consensus on Revenue (+2.4%) and EPS (+8.6%).

Performance Summary:

Meta delivered a strong Q4, generating $59.9B in revenue (up 24% YoY) and $8.88 EPS. Operating margins remained resilient at 41% (but down YoY), as the company successfully monetized a large step-up in holiday ad impressions (+18%).

Management Commentary:

Zuckerberg has pivoted the company’s North Star to “Personal Superintelligence”. The narrative is no longer about cutting costs but about winning the AI arms race. CFO guidance was transparent but heavy: FY26 CapEx will grow to $115-135B, funded by the core advertising “flywheel” and total expenses will grow by 40% compared to likely 25% revenue growth (with potential upside to 30% based on Q1 guidance continuing).

Guidance Implications:

Q1 FY26 revenue guidance was a major “beat and raise,” but the FY26 CapEx and expense outlooks are significantly higher than the Street expected. This signals a “Capex and expense heavy, Revenue-strong” trajectory that may result in slight operating earnngs downgrades for FY26. However, some uncertainties such as the path to AI monetization (ad impression growth accelerating) and unspecified cost warnings (now quantified) have been defined that likely were weighing on the stock through Q4.

Conclusion: Meta is in a “Hyper-Investment” phase. The core business (FoA) is performing well enough to fund $120B+ in annual infrastructure spend albeit at the expense of near term margins. For investors, the Q1 near term revenue acceleration will likely be taken as a positive showing some traction on the “Superintelligence” strategy monetization.

This report is AI generated using workflows from The Inferential Investor’s professional prompt library along with author edits. AI can make mistakes. Verify all information. Not financial advice.