MEDTRONIC PLC ($MDT) 2Q FY26 Earnings Analysis Report

Double beat and accelerated revenue growth. Upbeat management commentary, slight guidance upgrade and sentiment lift.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

This is an analysis of Medtronic plc (MDT) based on the Q2 FY26 and Q1 FY26 financial reports and management discussions.

Performance Highlights and Quantitative Comparison

Medtronic’s Q2 FY26 results demonstrated an acceleration in revenue growth and exceeded consensus expectations for both revenue and adjusted EPS.

Performance Summary Table

Note: Q2 FY25 Revenue was $8,403M, Q1 FY25 Revenue was $8,004M. Q2 FY25 Adj. Operating Profit was $2,041M, Q1 FY25 Adj. Operating Profit was $1,953M. Q2 FY25 Adj. EPS was $1.26, Q1 FY25 Adj. EPS was $1.23. Q2 FY25 GAAP Net Income was $1,271M (calculated from GAAP EPS of $1.07 * 1287.1M shares, not explicitly provided as $M) Q1 FY25 GAAP Net Income was $1,278M. Net Income Y/Y and QoQ growth are calculated using the stated GAAP Net Income for Q2 FY26 ($1,374M) and Q1 FY26 ($1,040M) compared to the prior year/quarter’s value in the table.

Segment Revenues (Organic Growth)

Key Business Drivers & Performance Indicators

Pulsed Field Ablation (PFA) / Cardiac Ablation Solutions (CAS): This was the primary growth accelerator, with CAS revenue increasing 71% (YoY) in Q2 FY26, including 128% in the U.S.. The PFA franchise grew over 300% in both the US and International markets.

Renal Denervation (RDN) / Symplicity™: CMS finalized the National Coverage Determination (NCD) for the Symplicity™ procedure for hypertension. Commercial payer wins covering 30 million lives were also secured.

Neuromodulation: Continues to perform strongly, growing +7.3% organically, driven by the Inceptiv™ SCS and BrainSense™ ADBS systems.

New Product Launches: Secured US FDA approval for Altaviva™ for urge urinary incontinence. MiniMed 780G system received US FDA clearance for integration with the Instinct sensor and approval for use in Type 2 diabetes.

Gross Margin: Adjusted gross margin expanded by 70 basis points (YoY) to 65.9%, benefiting from pricing and COGS efficiency programs, with headwinds from CAS and Diabetes business mix now being slightly offset by operational improvement.

R&D Investment: Adjusted R&D increased 8.9% (YoY), intentionally above reported revenue growth to fuel future growth drivers.

Overall, the company’s Q2 results beat consensus expectations, with +6.64% reported revenue growth and +7.94% adjusted EPS growth. Growth appears to be accelerating due to the significant momentum from the Pulsed Field Ablation (PFA) franchise and early wins in the Renal Denervation (RDN) and Altaviva™ markets.

Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q2 FY26)

Management expressed strong satisfaction with the Q2 performance, noting that the expected acceleration in financial results is “indeed underway”. The tone is one of confident execution and capitalizing on “incredible market opportunities”. The core message revolves around the enterprise growth drivers—specifically PFA, Symplicity™ for hypertension, Hugo™ RAS, and Altaviva™ for incontinence—which are described as “game-changers” that will “power our trajectory”. They highlighted the strategic decision to increase OpEx investments in sales and marketing for these drivers while still delivering outsized EPS growth. The Cardiovascular segment’s strong acceleration, led by the 71% growth in CAS, was a key point, along with major regulatory and coverage wins for Symplicity™.

Management Discussion (Prior Quarter - Q1 FY26)

The Q1 discussion set the stage for the current quarter, stating Medtronic was “on the cusp of an acceleration”. The tone was optimistic but anticipatory. Key highlights included delivering a consistent quarter of mid-single-digit revenue growth and raising full-year EPS guidance early. The focus was on the strength of the product pipeline and impending launches, particularly the continued rollout of the PFA portfolio and the expected final NCD for Renal Denervation. Management emphasized the laser focus on execution and the long-term strategy, including the Diabetes separation and the new Board committees (Growth and Operating) formed to enhance strategic clarity and drive efficiency.

Semantic Comparison and Tone Shifts

Sentiment Score: Q2 FY26: 16 Q1 FY26: 13 Delta: +3 (More Positive)

Scoring based on density of positive language related to growth, execution, and outlook.

Key Recurring Themes:

Pulsed Field Ablation (PFA) / CAS: Consistent theme, focusing on acceleration and market share gains.

Symplicity™ / Renal Denervation (RDN): High-potential growth driver, moving from anticipation (NCD expected) to execution (NCD finalized, commercial wins).

Hugo™ Robotic-Assisted Surgery (RAS): Mentioned in both as a future growth accelerator.

Diabetes Separation: Progressing according to plan and expected to be value-creating and EPS accretive.

Increased R&D Investment: Commitment to funding innovation to fuel durable growth.

New or Missing Themes (Q2 vs. Q1):

New Theme: Focus on Altaviva™ for urinary incontinence as a new, major enterprise growth driver, reflecting its FDA approval and early launch signs.

Shift in CAS Narrative: Moved from discussing product advantages (procedure time, ease of use) to tangible operational results (doubling install base, scaling manufacturing, 71% growth).

New Focus on OpEx Investment: Explicit mention of proactively increasing sales and marketing spend for PFA and RDN in Q2 to capitalize on market demand.

Missing Q1 Focus: The extensive detail on the formation of the Growth and Operating Board Committees from Q1 is summarized more briefly in Q2 as “newly formed Board committees are helping”.

Tone Shift Summary:

Compared to Q1, management’s tone in Q2 became more confident and present-tense, shifting from emphasizing the future acceleration (Q1: “on the cusp,” “poised to accelerate”) to celebrating the current acceleration (Q2: “acceleration is indeed underway,” “delivered a strong second quarter”). The focus has moved from planning the execution to scaling the results, notably by increasing strategic spending to capture market share in high-growth areas like PFA and RDN.

Guidance Evaluation and Consensus Implications

Medtronic raised its guidance for both the next quarter (Q3 FY26) and the full fiscal year (FY26) for revenue and adjusted EPS, positioning the company above the current consensus on full-year revenue and in line on EPS.

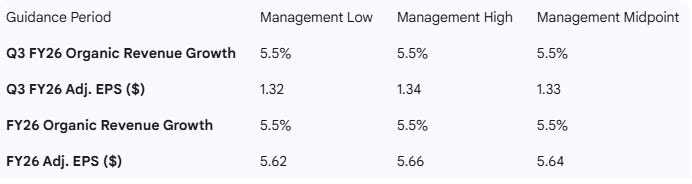

Guidance Ranges and Midpoints

Guidance Comparison Table

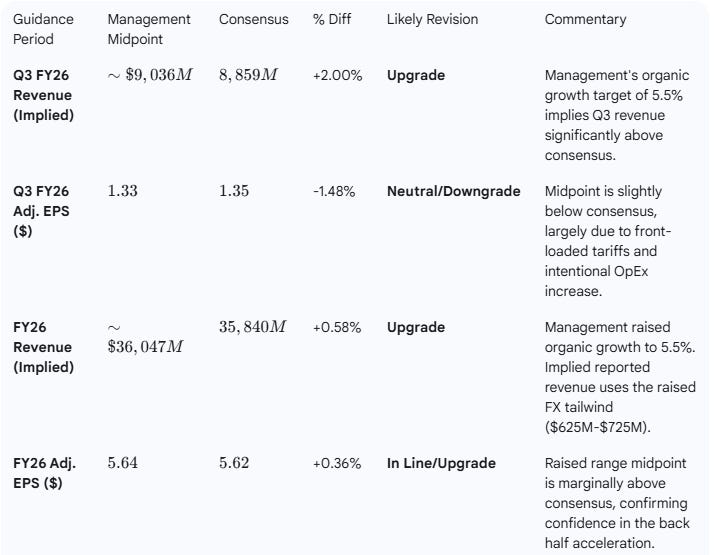

Analyst Revisions Assessment:

Analyst revisions are likely to be a Moderate Upgrade for Revenue (FY and Q3) and Neutral for EPS (Q3) but trending toward an Upgrade on FY EPS.

The full-year EPS guidance was raised to a new range of $5.62 to $5.66. The consensus was already at the low end of this new range at $5.62. The raise confirms confidence in the full-year target, suggesting the mid-point of $5.64 is now the appropriate target, translating to a slight upgrade. The below-consensus Q3 EPS midpoint is accepted by management as due to front-loaded costs and tariffs, validating the higher full-year target.

🛑 What is missing?

While the report was strong and detailed, a few pieces of information that could impact market expectations were somewhat sparse or not fully quantified:

Quantification of RDN and Altaviva™ Revenue: While management described both Symplicity™ RDN and Altaviva™ as “massive, multi-billion-dollar opportunity[s]” and indicated a sprint for commercialization, they noted RDN revenue has not been significantly incorporated into the back-half guidance. The market would benefit from a more concrete, even if broad, initial revenue target for the H2 FY26 launch/ramp of these two major growth drivers.

Detailed FY26 Gross Margin Outlook: Management stated they expect the full-year adjusted gross margin to be “roughly flat ex-tariffs” and down “roughly 40 basis points including the tariffs impact”. While trends for CAS and Diabetes mix headwinds are noted as expected to improve over time, a more specific numerical range or further granular breakdown of the magnitude of the mix/efficiency components for H2 would improve modeling confidence.

Timeline for Hugo™ US Launch/Approval: The US launch for Hugo™ in the back half of the fiscal year with a urology indication is a critical upcoming event. A more specific window for the anticipated FDA approval would better inform investor models, rather than just “back half of this fiscal year”.

Executive Summary Output

Stock: MDT

Quarter: Q2 FY26

Result: Beat consensus on both revenue (+1.09% reported) and adjusted EPS (+3.82%).

Other key performance indicators:

Cardiovascular Organic Growth: Accelerated to +9.3%, the strongest in over a decade (excluding pandemic comps).

Cardiac Ablation Solutions (CAS): Revenue growth accelerated sharply to 71% (YoY).

Adjusted Gross Margin: Expanded +70 basis points (YoY) to 65.9%.

Major Regulatory Wins: Final CMS National Coverage Determination (NCD) for Symplicity™ RDN for hypertension; US FDA approval for Altaviva™ for incontinence.

Growth Momentum: Accelerating.

MD&A Tone: More Confident. The tone shifted from anticipating an inflection in Q1 to celebrating that the “acceleration is indeed underway” in Q2. The narrative emphasizes successfully scaling manufacturing and making strategic increases in sales and marketing OpEx to capitalize on “game-changer” growth drivers like PFA and RDN.

Guidance: Raised FY26 Organic Revenue growth to 5.5% (from 5.0%) and raised the FY26 Adj. EPS range to $5.62 to $5.66 (from $5.60 to $5.66).

Analyst Impact: Consensus Upgrade. The raised guidance, particularly the full-year revenue increase and confirmation of the high end of the EPS range, will drive analysts to upgrade their models, especially for revenue. The Q3 EPS target is viewed as a controlled investment phase.

Conclusion: Strong execution and growth acceleration, with cash deployed to seize market share. Medtronic’s Q2 results firmly validate management’s strategy, moving from an anticipated inflection point to a period of genuine, accelerated growth, primarily fueled by the PFA franchise and regulatory breakthroughs in RDN and Altaviva™. The strategic willingness to increase OpEx investment demonstrates management’s confidence in translating top-line momentum into future leveraged earnings, signaling a positive underlying trajectory for the stock’s next phase of durable growth and portfolio focus ahead of the Diabetes separation.