Eli Lilly & Company (LLY) Q4 FY25 Earnings Call Insights: Great performance, decelerating growth

Strong result with guidance ahead. Key risk to the stock is decelerating growth off a high base and increased pricing headwinds dragging on the multiple.

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Executive Summary

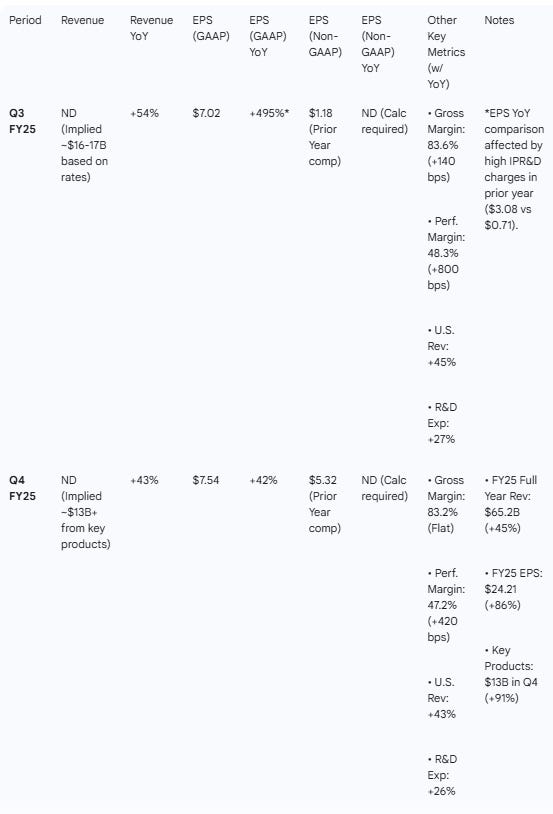

Growth Trajectory: Eli Lilly continues to deliver hyper-growth, with Q3 revenue up 54% YoY and Q4 up 43% YoY. FY25 revenue reached $65.2B (+45% YoY).

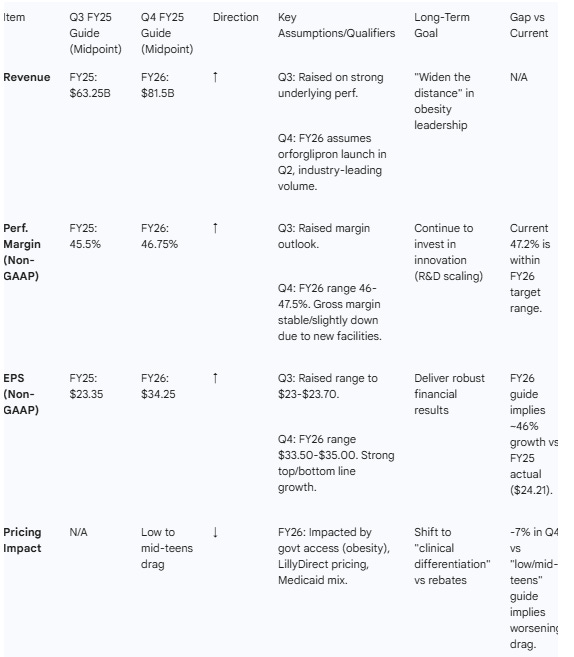

Guidance Momentum: The company issued a bullish FY26 revenue guidance of $80–$83B, implying ~25% growth at the midpoint over FY25.

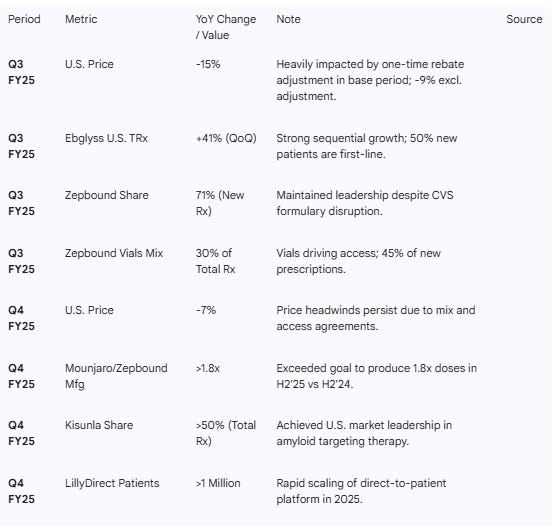

Key Drivers: Mounjaro and Zepbound remain the primary engines. Mounjaro international performance accelerated in Q3/Q4 , while Zepbound captured ~70% of new prescription share in the U.S. obesity market.

Pipeline Conviction: Management expressed high confidence in the oral GLP-1 orforglipron, expecting a U.S. launch in Q2 2026 to be “market expansive” rather than cannibalistic.

Pricing Headwinds: A notable negative theme is pricing pressure. Realized price declined 7% in the U.S. in Q4 , with FY26 guidance embedding a “low to mid-teens” price drag due to government access agreements and savings programs.

Margin Strength: Non-GAAP performance margins remain robust (48.3% in Q3; 47.2% in Q4), despite R&D investment scaling.

Alzheimer’s Progress: Kisunla is now the U.S. market leader in amyloid-targeting therapies with >50% share, though absolute revenue remains modest ($109M in Q4).

Capital Allocation: Significant investment in manufacturing continues ($55B committed since 2020) to support incretin supply, with capacity constraints easing.

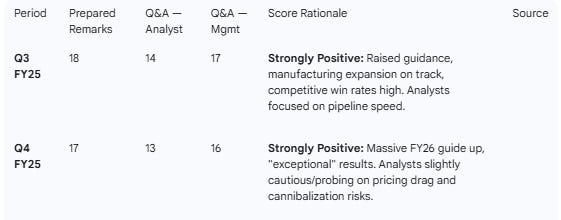

Sentiment Trend: Sentiment remains “Strongly Positive” (17/20), driven by execution on key clinical events (pirtobrutinib, retatrutide, orforglipron) and aggressive forward guidance, despite analyst probing on pricing durability.

Changes vs. Prior Call: A shift from “supply constrained” narratives to “demand creation” and “market expansion” via new form factors (vials, orals) and channels (LillyDirect, Medicare).

Table 1 — Results & YoY Growth

Table 2 — Operational & Segment Metrics

Table 3 — Guidance & Goals Evolution

Management Forward-Looking Quotes:

Q4 (FY26 Outlook): “We expect revenue to be between $80 billion and $83 billion... an increase of 25% compared to 2025.”

Q4 (Orforglipron): “We anticipate... launching orforglipron in the U.S. for treatment of obesity next year [Q2 2026].”

Q4 (Pricing): “Price is expected to be a drag on growth in the low to mid-teens.”

Q3 (Margin): “We now expect non-GAAP performance margin to be between 45% and 46% of revenue.”

Table 4 — Sentiment (0–20 Scale)

It is notable that despite the strong result, calculated sentiment scores show a decline relative to Q3. This tracks the price headwind focus.

Thematic Summary (Prepared Remarks)

Q3 FY25 Themes

Growth Drivers: Revenue grew 54%, driven by “strong volume growth of Zepbound and Mounjaro”. International Mounjaro revenue doubled in constant currency.

Pipeline Execution: “Positive results from 3 additional Phase III trials of orforglipron in type 2 diabetes” and successful head-to-head vs oral semaglutide.

Manufacturing: Expansion of API facilities in Virginia and Texas/Puerto Rico to support small molecule (orforglipron) portfolio.

Capital Structure: Distributed $1.3B in dividends and $700M in repurchases.

Risks: U.S. price declined 15% (or high single digits excluding one-offs), reflecting rebate dynamics.

Q4 FY25 Themes

Growth Drivers: FY26 guide implies 25% growth. Zepbound vials now 1/3 of total prescriptions. Kisunla claimed >50% market share in Alzheimer’s.

Strategy: Heavy focus on “consumer centricity” via LillyDirect (1M+ patients) and new form factors (KwikPen, vials).

Pipeline Velocity: “One of the largest clinical stage pipelines in our company’s history” with 14 new Phase III starts. Orforglipron submitted for approval in US and 40+ countries.

Pricing Challenges: Explicit guidance for “low to mid-teens” price drag in 2026 due to government access and Medicaid changes.

Operational Metrics: Gross margin stable at 83.2% but expected to be “stable to slightly down” in 2026 due to new facility costs coming online.

Changes Evident in Current Quarter (Q4 vs Q3)

Management’s tone shifted from celebrating supply catch-up (Q3 emphasis on capacity) to aggressive demand stimulation and market expansion (Q4 emphasis on LillyDirect, vials, and oral launches). While Q3 noted pricing declines, Q4 quantified a significant future drag (low to mid-teens) as a strategic tradeoff for volume. The discussion on Alzheimer’s (Kisunla) became more concrete in Q4, citing market leadership rather than just approval.

Selected Quotes on Themes (Q4):

“We delivered robust revenue growth... and helped over 70 million people around the world.”

“We expect to deliver industry-leading volume growth driven by our key products, partially offset by lower realized prices.”

“Zepbound self-pay vials, now makes up 1/3 of new patient starts... proud of our ability to bring these important medicines to patients at a cost of only $50 per month.”

Q&A Summary (Q4 FY25 Focus)

Key Topics:

Orforglipron (Oral GLP-1): Launch timing, cannibalization risks, and manufacturing.

Pricing/Elasticity: Impact of government access, Medicaid, and cash-pay markets.

International Growth: Sustainability of Mounjaro’s OUS ramp.

Pipeline: Eloralintide (amylin), Retatrutide, and Combinations (I&I).

Detailed Q&A (Latest Transcript - Q4):

Orforglipron Metrics:

Analyst (Evan Seigerman): What metrics define success for orforglipron launch a year from now?

Mgmt (Ken Custer): Focus is on “market expansion.” Early competitor data (oral Wegovy) suggests patients are new starts, not switches. Key metrics: Real-world patient satisfaction and adherence due to simple profile (no food/water restrictions).

International Regulatory Timelines:

Analyst (Courtney Breen): Any accelerated pathways for orforglipron OUS to launch in 2026?

Mgmt (Patrik Jonsson): Generally expecting launch in first half of 2027. Some exceptions (e.g., UAE) in late ‘26.

Mounjaro International Ramp:

Analyst (Chris Schott): How to think about growth off the strong Q4 base ($3.3B)?

Mgmt (Patrik Jonsson): Q4 is a solid base. 2026 growth driven by market expansion (75% of business is out-of-pocket weight management) and deeper reimbursement for Type 2 diabetes (currently 9 markets).

Immunology Strategy:

Analyst (Seamus Fernandez): Why not attack immunology as aggressively as obesity given the cash generation?

Mgmt (Dan Skovronsky): We are “reinvesting some of the proceeds from the obesity opportunity” into I&I and Oncology. “Thumb on the scale” for investment. Excited about combinations (e.g., Taltz + Zepbound).

Guidance & Medicare:

Analyst (Terence Flynn): Assumptions for Medicare volume ramp and commercial opt-ins?

Mgmt (Lucas Montarce): Access expected no later than July 1. Will take time to build, but $50 co-pay is compelling. Expect 10-20% of current LillyDirect patients (seniors) to move to Medicare coverage.

Pricing & Contracting:

Analyst (Asad Haider): View on contracting environment and price elasticity?

Mgmt (Ilya Yuffa): Coverage stable entering 2026. Transparent regarding price drags. Seeing increased utilization with lower entry prices (e.g., $299 vials). Orforglipron will launch with entry price similar to oral sema.

Cannibalization vs. Market Expansion:

Analyst (Steve Scala): Does guidance imply orals grow the market or cannibalize?

Mgmt (Lucas Montarce): Competitor data shows market expansion. Guide assumes expansion.

Term Frequency Tracking

Positive Terms (Q4 Focus):

Growth: High frequency (referenced in revenue, volume, and pipeline contexts).

Expansion/Expand: Used heavily regarding manufacturing, international markets, and indications.

Launch: Significant focus on Orforglipron, Kisunla, and international Mounjaro.

Robust: Describes revenue, uptake, and pipeline data.

Lead/Leadership: Referenced regarding obesity market share and Alzheimer’s.

Negative/Cautionary Terms (Q4 Focus):

Price/Pricing: High frequency (often associated with “decline,” “drag,” “erosion”).

Offset: Often paired with volume offsetting price declines.

Discontinuation: Mentioned in Retatrutide trial context (adverse events).

Drag: Specifically used to quantify the pricing impact on 2026 revenue.

Friction: Used regarding consumer access and payer barriers.

Narrative Shift: The frequency of “Supply” and “Shortage” has decreased significantly compared to historical norms (though manufacturing remains a topic), replaced by “Launch,” “Price,” and “Consumer.” This indicates a shift from supply-chain crisis management to commercial execution and demand generation.

TF/IDF Analysis (Top 5 Unique Themes per Transcript)

Q3 FY25 Unique Themes:

Rebate Adjustment: (Specific to Q3 financials explaining price decline).

CVS: (Discussing formulary disruption specific to that quarter).

Facilities/Virginia: (Specific manufacturing announcements).

ATTAIN/ACHIEVE: (Specific Orforglipron trial readouts highlighted).

Breakthrough: (Reference to specific designations).

Q4 FY25 Unique Themes:

Orforglipron: (Dominant forward-looking theme for 2026).

Guide/Guidance: (Focus on the new FY26 numbers).

Medicare: (Upcoming access expansion in mid-2026).

Vials: (Zepbound form factor gaining share).

LillyDirect: (Platform scale reaching 1M+ patients).

Red Flags & Open Questions

Pricing Erosion: The “low to mid-teens” price drag guidance for 2026 is significant. While volume is expected to offset this, the magnitude of erosion suggests aggressive discounting or mix shift (Medicaid/Government) is required to sustain share.

Retatrutide Tolerability: While efficacious, Retatrutide showed “higher discontinuation rates due to adverse events in people with lower baseline BMI” in Phase III. This may limit its label or adoption in less severe populations compared to tirzepatide.

Verzenio Plateau: Management explicitly stated “market penetration has reached a plateau” for Verzenio in the U.S.. This turns a former growth engine into a mature/flat asset.

Medicaid Coverage Loss: Mention of “key states like California removing obesity coverage” in 2026 is a direct headwind to access.

Implications for the Stock

A. Performance vs. Expectations

The results for Q4 are strong. Q4 revenue growth of 43% and a massive 25% growth guide for FY26 (midpoint $81.5B) sit at the very top end of expectations. The EPS guide of $33.50–$35.00 for FY26 exceeds consensus and represents strong operating leverage (+40% YoY).

B. Areas of Strength vs. Weakness

Strength: Volume growth is overpowering price declines. The pipeline (Orforglipron, Retatrutide) is de-risking rapidly. International Mounjaro is booming.

Weakness: Pricing power is eroding (-7% realized price in Q4, worsening in FY26). Mature assets (Verzenio, Trulicity) are flattening or declining. Calculated sentiment scoring is actually sequentially a slight decline on Q3 across management remarks and analyst answers, reflecting the pricing headwinds.

C. Immediate Implications

Revenue and earnings growth will remain elevated (vs long term history, but a deceleration on the last 2 high growth years) in the immediate periods due to the launch of Zepbound KwikPen, continued international rollout, and the upcoming Orforglipron launch.

D. Valuation & Multiple

A risk for the stock is that despite the “growth runway” visibly extending via Orforglipron (oral) and Retatrutide (next-gen), preventing the “patent cliff” fear often seen in pharma, the expectation that growth peaked in 2024 and is gradually receding (notwithstanding it currently remains high by historical standards) may drag on the multiple. While LLY could conceivably beat FY26 guidance, it still likely decelerates from FY25’s 86% EPS growth with growing pricing headwinds and a higher base to cycle.

LLY traded for years on a 20x multiple until the launch of obesity drugs. It is currently on 33x forward (already down from a peak of 60x in FY24) with strong but decelerating growth. Typically that can see multiples derate over time.

Disclosure: the publisher is a holder of LLY.

Really thorough breakdown of LLY's earnings dynamics. The tension between volume growth and pricing erosion is the key story here and you nailed it. What strikes me is how the multiple could compress even with solid fundamentals if the market gets spooked by decceleration off such a high base. The shift from supply constraints to demand creation is also an underrated narrative pivot. Ive been watching how competitors respond and LLY seems to be executing pretty well overall.