Coherent Corp (COHR) Q2 FY26 Earnings Analysis - Double beat & guidance ahead, but is it enough?

Key Takeaways

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Executive Summary: Coherent Corp (COHR) Q2 FY26 Analysis

Coherent Corp delivered a double beat in Q2 FY26, exceeding consensus estimates for both revenue and adjusted EPS. The performance was underpinned by 34% growth in the Datacenter & Communications segment, fueled by AI-related demand, which more than offset continued softness in the Industrial market (which management sees turning).

Notably, management’s outlook for Q3 FY26 is above consensus, signaling potential analyst upward revisions. Investors need to distinguish between the reported revenue growth in Q2 of 17% and the pro-forma of 22% which is adjusted for the sale of the Aerospace and Defense business in Sept 2025 and also impacts the Q3 guidance.

The real question is, considering recent share price performance - is it enough?

Performance Highlights & Quantitative Comparison

Performance Summary Table

Key Performance Indicators:

Pro-forma revenue growth of 22% YoY. Impact of the Aerospace segment sale in Sept 2025 to continue to be a factor in growth rate comparisons for another 3 quarters

Operating Margin (Non-GAAP): 19.9% (up from 19.5% in Q1).

Capital Expenditure: Ramped up to support capacity expansion for AI demand.

Debt Management: Paid down $400M in debt during Q1 and continued refinancing to lower interest expenses.

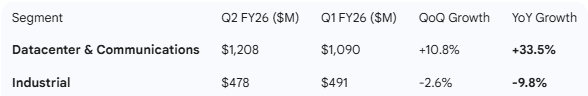

Segment Revenue Breakdown

Performance Summary: Coherent’s Q2 results beat consensus expectations across the board. Revenue growth of 17.5% YoY was significantly driven by the 33.5% surge in Datacenter & Communications. Growth appears to be accelerating as the company scales production capacity for AI-related transceivers and components. Annualized QoQ growth in the Datacenter segment is >40% pa in Q2, supporting this acceleration dynamic.

Management Discussion & Analysis (MD&A) Comparison

Management Narrative

Management Discussion (Current Quarter - Q2 FY26): CEO Jim Anderson highlighted “another quarter of strong demand” in the datacenter segment and, crucially, projected that this momentum would carry through fiscal 2027. CFO Sherri Luther emphasized that significant revenue and margin expansion are driving EPS growth, and the company is aggressively increasing capital investment to meet the AI-driven demand curve.

Management Discussion (Prior Quarter - Q1 FY26): In Q1, the narrative focused heavily on the initial Al-related datacenter demand and the successful sale of the Aerospace & Defense business. The tone was positive but slightly more focused on the immediate fiscal year’s growth and balance sheet strengthening through debt repayment.

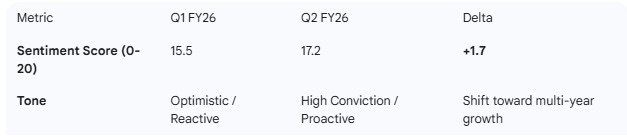

Semantic & Tone Analysis

Recurring Themes: AI-related datacenter demand, production capacity expansion, gross margin expansion.

New Themes (Q2): “Improving demand in Industrial segment,” “Through fiscal 2027,” “Ramping capital investment”.

Tone Shift: Management has moved from discussing recovery and divestitures to a clear expansion footing. The explicit mention of growth into FY27 suggests high visibility into customer orders for AI infrastructure.

Authors note: This sentiment increase appears muted compared to what the share price performance has implied about the Coherent outlook.

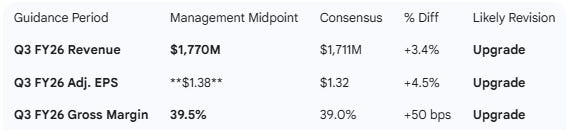

Guidance Evaluation & Consensus Implications

Guidance vs. Consensus Table

Guidance also includes:

Non GAAP gross margin of 38.5%-40.5% ( slightly high than consensus: 39%)

Non GAAP Operating Expenses of $320m-$340m (also higher than consensus: $316m)

Tax rate of 18%-20%

Analyst Impact: Given that the Q3 guidance midpoint is ~4% above consensus for both revenue and earnings, and the Industrial segment is cited as “improving,” analysts are likely to raise their full-year FY26 and FY27 estimates. The implied YoY “reported” revenue growth for Q3 is ~18% (based on $1.77B midpoint vs $1.498B in Q3 FY25), showing sustained momentum compared to Q1 and Q2.

This guidance is based on a reported framework with the sale of the Aerospace business still impacting comps. Pro-forma revenue growth (removing the segment from the prior period) implied by this guidance is likely closer to 24% YoY.

What is Missing?

Specific Industrial Recovery Timeline: While management noted “improving demand,” they did not provide a specific quarter for when the segment returns to YoY growth.

Product Roadmap Detail: The market was looking for more granular details on the 1.6T transceiver ramp-up. While mentioned as a “demonstration” in Q1, an update on commercial volume production schedules for Q3/Q4 was relatively sparse in the Q2 release.

Interest Expense Savings: While CFO Luther mentioned refinancing, a specific dollar-value projection for interest expense reduction in the second half of FY26 was not provided.

Executive Summary Synthesis

Result: Beat consensus on revenue (+2.7%) and Adjusted EPS (+6.6%).

Growth Momentum: Accelerating. The Datacenter segment grew 33% YoY, with annualized QoQ growth suggesting further acceleration and management extended their “strong growth” forecast into FY2027.

Guidance: Strong. Q3 guidance is above market expectations, likely supporting a series of price target upgrades.

Conclusion: Coherent is successfully navigating a bifurcated market. The “AI tailwind” in Datacenter & Communications is proving to be more than a short-term spike, with management now citing visibility into 2027. With the Industrial headwind appearing to bottom out and the balance sheet improving, financial metrics are accelerating. However the stock has massively outperformed and with the current market environment, the real question for the stock price is whether this guidance and performance is enough?

Disclosure: the publisher holds a position in Coherent Corp.