ARISTA NETWORKS INC. Q3 2025 Earnings Analysis Report

Q3 Beat on revenue and EPS but sequential margin decline guided and a slowing top line growth likely overshadows and may catalyze EPS downgrades.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Stock: Arista Networks (NYSE: ANET)

Quarter: Q3 2025 (Ended September 30, 2025)

Result: Beat (but Cautious Guidance, Slowing)

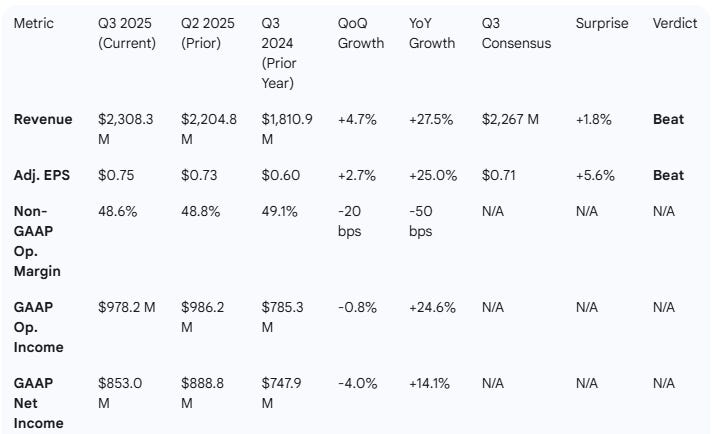

1. Performance Highlights & Quantitative Comparison

Arista Networks reported strong Q3 2025 results, beating consensus estimates on both revenue and earnings per share.

Q3 Revenue: $2,308.3 million, a 1.8% beat against the $2,267 million consensus.

Q3 Adjusted EPS: $0.75, a 5.6% beat against the $0.71 consensus.

Performance Summary Table

The table below compares Q3 2025 performance to the prior quarter (Q2 2025) and the prior year (Q3 2024).

Key Performance Drivers (Q3 2025)

Strategy Resonance: Management stated its “centers of data strategy” is “resonating well” with both customers and analysts, highlighting a “superior client to campus to cloud/data and AI centers experience”.

Strong Demand: The 25% non-GAAP EPS growth was attributed to “strong demand” and “disciplined execution” of the company’s strategic roadmap.

AI Product Innovation: The company announced several new AI-focused initiatives:

AI Agents: New agents designed to streamline network operations.

CloudVision AI: An observability blueprint to provide end-to-end visibility and security for modern AI workloads.

ESUN Collaboration: A new open OCP workstream, Ethernet for Scale-Up Networks (ESUN), to deliver open-standards solutions for scale-up AI networks.

Leadership Appointments: The company expanded the role of Kenneth Duda to President and CTO and appointed Tyson Lamoreaux as SVP of Cloud and AI Networking to oversee cloud and AI systems engineering.

Growth Summary

Overall, the company’s Q3 2025 results beat consensus expectations. However, momentum is showing signs of normalization. The 27.5% year-over-year revenue growth represents a deceleration from the 30.4% YoY growth posted in Q2 2025. This slowing trend is also reflected in the sequential (QoQ) growth, which was a modest +4.7%.

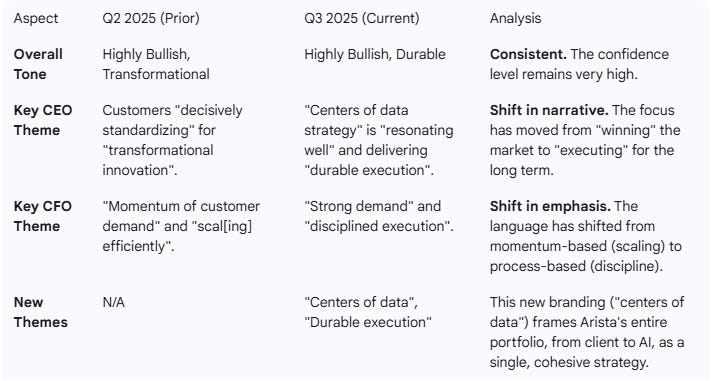

2. Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3 2025)

CEO Jayshree Ullal emphasized the success of the newly branded “centers of data strategy”, positioning it as a key driver of customer adoption. The commentary focused on Arista’s role as a “strategic networking provider” capable of “continued durable execution”. CFO Chantelle Breithaupt echoed this, linking the strong 25% EPS growth directly to “strong demand” and “disciplined execution”. The overall message was one of confident, sustainable execution.

Management Discussion (Prior Quarter - Q2 2025)

In Q2, the tone was more focused on market capture and financial milestones. CEO Ullal stated customers were “decisively standardizing” on Arista’s platform for “transformational innovation”. The key qualitative highlight was Arista’s position in “data-driven AI networking”. CFO Breithaupt celebrated Non-GAAP operating income crossing $1 billion for the first time, highlighting the “strength of our business model” and “momentum of customer demand”.

Comparative Analysis & Tone Shift

Compared to Q2, management’s tone in Q3 remained highly confident and bullish. The core message shifted from emphasizing market capture (i.e., customers “decisively standardizing”) to emphasizing sustainable, long-term performance (i.e., “durable execution” and “disciplined execution”). The introduction of the “centers of data strategy” provides a new strategic wrapper for the company’s entire client-to-cloud/AI portfolio.

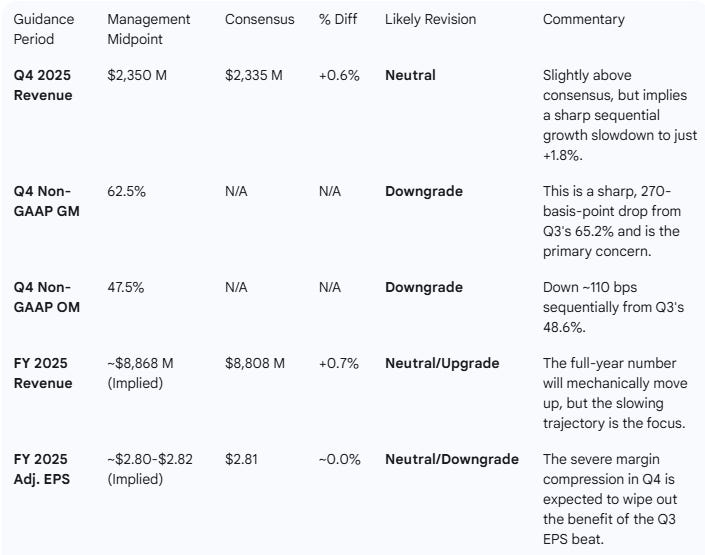

3. Guidance Evaluation and Consensus Implications

Arista provided Q4 2025 guidance that was mixed. While the revenue outlook was slightly above consensus, the margin outlook was notably weak, implying further growth deceleration.

Q4 Revenue Guidance: $2.3 billion to $2.4 billion. The $2.35 billion midpoint is 0.6% above the $2,335 million consensus.

Q4 Non-GAAP Gross Margin Guidance: 62% to 63%.

Q4 Non-GAAP Op. Margin Guidance: 47% to 48%.

The Q4 revenue guidance implies a significant sequential growth slowdown. The midpoint of $2.35B represents only +1.8% QoQ growth over Q3’s $2,308.3M, a sharp drop from the 4.7% QoQ growth seen in Q3.

Likely Analyst Revisions

The weak margin guidance will likely offset the modest revenue beat, leading to neutral or downward EPS revisions for Q4 and FY2025.

Implied FY25 Revenue: $8.868B (Q1-Q3 actuals + Q4 guidance mid) vs. $8,808M consensus.

Implied FY25 Adj. EPS: The significant drop in guided margins (both gross and operating) will likely cancel out the revenue beat, leaving implied EPS in line with or slightly below the $2.81 consensus, despite the Q3 beat.

Conclusion: The Q3 beat is overshadowed by a cautious Q4 outlook. The weak margin guidance and slowing sequential revenue growth will likely force analysts to lower their Q4 profitability estimates, putting downward pressure on full-year 2025 and 2026 consensus EPS.

4. Post-Earnings Stock Reaction

Despite beating Q3 estimates, the stock dropped in after-hours trading. This negative reaction was driven almost entirely by the weak forward-looking guidance for Q4 2025, which signaled both margin compression and slowing growth.

Weak Q4 Gross Margin Guidance: This was the primary catalyst. The guidance of 62-63% was a significant and unexpected drop from the 65.2% reported in Q3 and 65.6% in Q2. This sequential decline of over 250 basis points sparked immediate concerns about pricing pressure, a less favorable product mix (e.g., higher AI sales at lower margins), or rising costs.

Slowing Revenue Growth: The Q4 revenue guidance midpoint of $2.35B implies only 1.8% sequential growth over Q3. This is a sharp deceleration from the 4.7% sequential growth seen in Q3 and the 10.0% seen in Q2, confirming a “normalization” trend that does not support a high-growth stock premium.

Flat-to-Down Operating Margin: The Q4 non-GAAP operating margin guidance of 47-48% is also down from the 48.6% reported in Q3 and 48.8% in Q2. For a stock valued on growth, margin expansion is expected, not compression.

High Expectations: Arista’s stock was priced for perfection. A simple “beat” on Q3 and an “in-line” revenue guide for Q4 were not enough. The market was expecting a significant beat and a strong raise, and the weak margin outlook did the opposite.

5. What Is Missing?

The Q3 2025 report was comprehensive, but the key missing piece was a clear management explanation for the severe Q4 margin compression.

Margin Justification: The press release does not explain why non-GAAP gross margins are expected to fall from 65.2% to ~62.5% in just one quarter. Investors are left to speculate whether this is due to (a) temporary product mix shift, (b) a new, permanent pricing environment, or (c) rising component costs. This lack of clarity is a significant concern.

Demand Durability: While management used terms like “durable execution”, the slowing sequential revenue guidance counters this narrative. The report did not provide enough qualitative comfort to offset the weak quantitative outlook.

6. Executive Summary

Result: Mixed. Arista reported a solid Q3 beat on revenue (1.8%) and adjusted EPS (5.6%). However, this beat was completely overshadowed by a weak Q4 2025 guidance.

Performance & Growth: Q3 revenue grew 27.5% YoY, a deceleration from 30.4% YoY in Q2. This slowing momentum is confirmed by the Q4 revenue guidance, which implies sequential (QoQ) growth will slow from 4.7% in Q3 to just 1.8% in Q4.

Management Commentary: Management’s tone remains bullish, introducing a new “centers of data strategy” to frame its long-term plan. However, this confident narrative is at odds with the cautious Q4 financial outlook.

Guidance & Stock Impact: Guidance is the key story. The company guided Q4 non-GAAP gross margins down to 62-63%, a sharp drop from Q3’s 65.2%. This, combined with slowing revenue growth, led to the stock trading down significantly in the after-market session. The Q3 beat will be offset by downgrades to Q4 and FY2025 EPS estimates due to this margin compression.

Conclusion: Arista is a victim of its own success. After a long run of explosive growth, the company’s Q4 outlook signals a clear “normalization” of both growth and profitability. The severe, unexplained margin compression is a new, material concern for investors, signaling that the phase of easy beats and raises is likely over.

Would you like me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using proprietary prompts:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit

A comprehensive initiation report on the stock

Specialist industry analysis