AMD Q4 FY25 Earnings Analysis Report

Messy result with good guidance. Expense growth and PC/Gaming weakness in focus even as data center revenues accelerate.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Updates: The following report has been updated for guidance color provided on the earnings call. Errata: a statement that PC/Gaming/Embedded declined in Q4 (in the original flash earnings report) has been clarified to be a sequential decline expected in Client for Q1.

Executive Summary

Stock: AMD (Advanced Micro Devices Inc)

Quarter: Q4 FY25

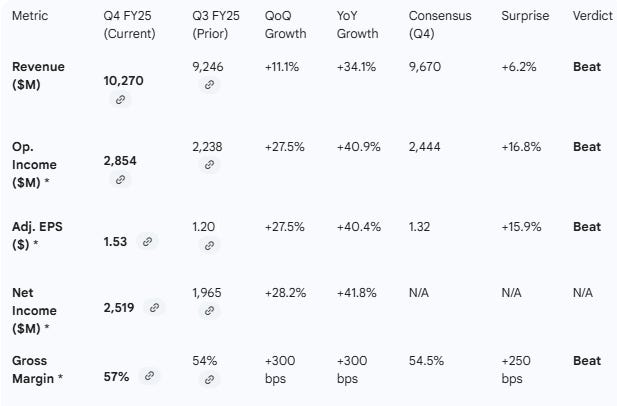

Result: Beat consensus significantly on all key headline reported metrics however the result is messy. Headline Revenue of $10.27B beat expectations by ~6.2%, and Adjusted EPS of $1.53 beat by ~15.9%.

However, the results were bolstered by a one-time benefit from an inventory reserve release and unguided sales of Instinct MI308 to China (stated as a net positive impact of $360m).

Authors note: Excluding the one time inventory charge release and China sales, normalized non-GAAP gross margin was 55% according to the earnings release. This is still a beat versus consensus of 54.5% consensus expectation.

It is less clear at the Operating Income and EPS lines. The GAAP / Non GAAP reconciliations notes report the net benefit at the gross profit line to be $430m, raising the question whether the $360m is post tax.

If we use the $430m normalization reported in the gross margin note and apply to the Operating Income line, then AMD was roughly in line at earnings, removing the beat for the quarter. This would suggests that operating expenses were higher than expected by the market.

Growth Momentum: Headline revenue grew 34.1% YoY and 11.1% QoQ. The annualized QoQ rate however is unreliable to extrapolate with AMD a seasonal business in the non data center segments.

Data Center revenue grew 39% YoY and 24% QoQ, confirming the rapid ramp of the MI300/MI400 AI accelerator series.

Client and Gaming revenues showed strong year over year growth (see table) however this was a sequential decline and Embedded revenues were up only 3% YoY.

MD&A Tone: Highly Optimistic. Management shifted from “outstanding” progress in Q3 to describing 2025 as a “defining year” in Q4, with high confidence in the “rapid scaling” of their AI franchise entering 2026.

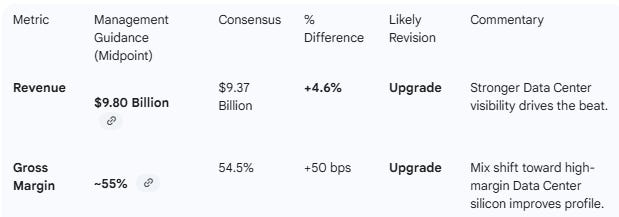

Guidance: Above Consensus. Q1 FY26 revenue guidance of $9.8B (+/- $300M) is ~2%-8% above street expectations (low to high revenue guidance range), signaling continued market share gains and strong AI demand. This represents annual growth of 32% at the midpoint (35% at the upper end given recent history of revenue beats). This also includes a 1% positive impact from China sales which wouldn’t be in consensus numbers.

Additional Guidance color from the earnings call:

Longer term guidance remains very strong with the launch of the MI450 in 2H 2026 marking an inflection point for the company in the words of the CEO. The company has reiterated targets of growing revenue at greater than 35% annually over the next 3-5 years, expanding OP margins and generating EPS of >$20 in that timeframe. Within the data center segment they see revenue growing at >60% annually over the same timeframe and the AI business being “tens of billions” in annual revenue by 2027. Under Q&A the CEO stated that this growth rate was possible for 2026. One analyst mentioned the street target of high $20bn AI revenue for 2027.

The MI450 ramp will be 2H loaded, particularly towards Q4 2026.

Analyst Impact: Likely Upgrades. The combination of a beat-and-raise quarter, record free cash flow, and strong forward guidance for Q1 should drive positive revenue revisions. Earnings revisions will be more muted with higher expenses driven by R&D evident.

Conclusion: AMD is executing well in the Data Center pivot but each quarter there are a lot of moving parts. While the Q4 gross margin beat (57%) was aided by a $360M inventory reversal, the underlying margin of ~55% and revenue guidance suggest the core business is healthier than consensus modeled.

However, the normalized earnings comparison suggests that expenses are running ahead continually. Consensus has $2.82bn of operating expenses for Q1 however, the call reported this to be expected at $3.05bn. The company is effectively establishing itself as the clear secondary source to the market leader in AI compute and growth is strong, however clean earnings beats and revenue growth acceleration remain elusive.

Author’s note: From an investor perspective taking into account AMD’s elevated forward P/E of 43x, and recent announcements of compute deals with OpenAI and others, clearer evidence of revenue growth rate and earnings growth acceleration may have been expected in guidance.

Performance Highlights and Quantitative Comparison

AMD delivered a record-breaking quarter, driven by rapid growth in Data Center demand. Note that Q4 Non-GAAP Gross Margin and Operating Income benefited from a $360 million release of previously reserved inventory related to US export controls. Excluding this, Non-GAAP Gross Margin would have been ~55%, which is still ahead of the 54.5% consensus.

Key Drivers:

Data Center revenue ramp: Revenue hit a record $5.4B, up 39% YoY, driven by strong demand for EPYC processors and Instinct GPUs.

Inventory Reversal Benefit: A $360M benefit from the release of MI308 inventory reserves significantly boosted Q4 profitability margins.

Client Strength: Client business revenue grew 34% YoY to $3.1B, fueled by Ryzen processors.

Performance Summary Table (these figures are as reported and include the $360m - $430m benefit)

(Note: “Client & Gaming” are combined in Q4 presentation tables, though broken out in text: Client $3.1B, Gaming $843M )

Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q4 FY25): CEO Lisa Su characterized 2025 as a “defining year” with record revenue and earnings. The narrative focused heavily on “momentum” entering 2026, specifically the “rapid scaling” of the Data Center AI franchise and “accelerating adoption” of EPYC and Ryzen CPUs. CFO Jean Hu emphasized the achievement of record free cash flow and the ability to deliver “profitable growth at scale”.

Management Discussion (Prior Quarter - Q3 FY25): In Q3, the tone was celebratory regarding an “outstanding quarter” with broad-based demand. The narrative highlighted the “clear step up” in growth trajectory driven by the partnership with OpenAI (deploying 6GW of GPUs) and Oracle (50k GPUs). The focus was on “expanding compute franchise” and the initial ramp of the AI business.

Semantic Comparison & Sentiment Shift:

Sentiment Score: +2.0 (increasingly Positive). Q3 was strong, but Q4 reflects realized success rather than projected success. The language shifted from “step up in growth” (Q3) to “strong momentum” and “record results” (Q4).

Recurring Themes: “Record revenue,” “AI accelerators,” “EPYC,” “High-performance computing.”

New Themes (Q4): “Inventory release” (financial benefit), “Yotta-scale AI” (Helios platform at CES), “Profitable growth at scale.”

Tone Shift: The caution regarding “mixed demand” seen in previous quarters (embedded/gaming) has largely dissipated, replaced by a confident focus on the Data Center dominance.

Guidance Evaluation and Consensus Implications

Management provided Q1 FY26 guidance that exceeds current market consensus, suggesting that the AI ramp is accelerating faster than analysts modeled.

Note: Full year FY26 guidance was not explicitly provided in the extracted snippets, limiting the table to Q1.

Implied Growth: The Q1 revenue guide of $9.8B implies 32% YoY growth, roughly maintaining the high-growth pace set in Q4 (+34%)

Analyst Revisions:

Revenues will be upgraded but higher expenses and non data center softness will mute the extent of earnings upgrades. Acceleration in the data center segment however will be seen as a greater positive than the offsetting sequential weakness in other segments. Price targets will be rolled forward however and may be raised.

What is missing?

Full Year FY26 Concrete Guidance: While Q1 guidance is strong, a specific full-year revenue or EPS target range for FY26 is missing from the earnings release and presentation snippets. The market likely expected a full-year outlook given it is the end of the fiscal year.

Gaming Segment Visibility: While Data Center is booming, the Gaming segment remains a drag (Gaming revenue was only $843M in Q4). Detailed commentary on when this segment might bottom out is sparse compared to the AI enthusiasm.

Inventory Normalization: While the inventory release boosted Q4, clear guidance on “clean” gross margins for the remainder of FY26 (beyond Q1) would clarify the underlying profitability trend without one-off benefits.

Conclusion

AMD has successfully transitioned from “promising AI competitor” to the clear secondary source of compute for AI data centers. Its launch of the MI400-450 range later this year with the indicated performance specs, coupled with deals with OpenAI and others support this development and continued strong growth in the high margin data center segment.

The Q4 results however were mixed, with revenues strong but normalized earnings in line. While the massive earnings beat was aided by a $360M inventory reversal, the core business health is undeniable: Data Center revenue is accelerating (+39% YoY), and the company is guiding Q1 FY26 revenue nearly 5% above consensus. Operating expense growth needs to be explored further.

Investors should view the inventory benefit as a one-off, but the 55% normalized gross margin guidance for Q1 indicates that structural profitability is improving due to a richer mix of AI silicon sales. With the OpenAI partnership ramping and new rack-scale solutions (Helios) launching, AMD remains poised for a strong FY26 but may need to start delivering clean double beats to justify the multiple.

Disclosure: The publisher holds a position in AMD.