Amazon.com Inc (AMZN) Q4 FY25 Earnings Analysis: Capex and Guidance shocks

$200bn capex shock and Q1 OP guidance below consensus on investment led expense growth

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

This analysis evaluates Amazon.com, Inc. (AMZN) following its Q4 2025 earnings release on February 5, 2026, comparing results against the previous Q3 2025 period and market consensus.

Performance Highlights and Quantitative Comparison

Amazon delivered a solid but not earth shattering quarter, characterized by accelerating growth in AWS and stable performance in North America. Revenue and OP came in 1-2% ahead of consensus however reported non GAAP EPS was in-line. The result however includes various one time expenses (asset impairements, severance and lawsuit costs) that if normalized would see OP rise to $27bn.

Performance Summary Table

Segment Performance breakdown

AWS: Revenue reached $35.6B, growing 24% YoY (an acceleration from 20% in Q3).

North America: Revenue of $127.1B, up 10% YoY (compared to 11% in Q3).

International: Revenue of $50.7B, up 17% YoY (an acceleration from 14% in Q3).

Advertising: Revenue grew 22% YoY to $17.7B.

Key Business Drivers

AWS Acceleration: CEO Andy Jassy noted AWS reached its fastest growth in 13 quarters.

Custom Silicon: The chips business (Trainium and Graviton) now has a combined annual revenue run rate of over $10 billion.

AI Monetization: Rufus, the AI assistant, helped deliver nearly $12 billion in incremental annualized sales.

Performance Summary: Overall, Amazon’s Q4 results beat consensus expectations on reported revenue and operating income, with 14% revenue growth. Top line growth appears to be accelerating due to the re-acceleration of AWS (up 24%) and strong triple-digit growth in the custom AI chip business. OP normalized for one time expenses also exceeded consensus, however it is notable that there were similar one time expenses in Q3 incl legal settlement and severance, so they appear as recurring.

Guidance is dealt with below.

Management Discussion & Analysis (MD&A) Comparison

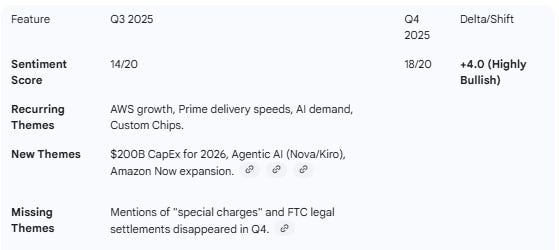

Management Discussion (Current Quarter - Q4 2025): Management focused heavily on the structural shift toward AI and the success of custom silicon. CEO Andy Jassy highlighted that AWS growth is driven by massive demand for AI and core infrastructure. The narrative emphasized “agentic AI,” with the launch of Nova and Bedrock AgentCore to help customers build autonomous workflows. Management also signaled a massive investment cycle, projecting $200 billion in capital expenditures for 2026 to capture AI and satellite opportunities.

Management Discussion (Prior Quarter - Q3 2025): In Q3, the tone was more balanced between cost discipline and AI investment. While AI was “driving meaningful improvements in every corner of the business,” the quarter was also impacted by significant special charges: a $2.5 billion legal settlement and $1.8 billion in severance. The focus was on fulfillment network innovation and reaching the fastest delivery speeds ever for Prime members.

Sentiment and Thematic Analysis

Tone Shift: Compared to Q3, management’s tone in Q4 became significantly more aggressive and optimistic. The caution surrounding legal settlements and severance in Q3 was replaced by a “full-throttle” investment stance for 2026, prioritizing AI infrastructure and capacity.

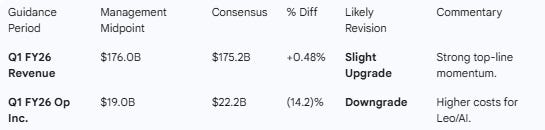

Guidance Evaluation and Consensus Implications

Amazon provided Q1 2026 revenue guidance with a midpoint of $176.0B.

Guidance Comparison Table

Growth Assessment:

Q1 2026 Implied YoY Growth: ~13% (at midpoint).

Previous Quarters: Q4 2025 (14%), Q3 2025 (13%).

Analyst Impact: While revenue remains robust, the operating income guidance of $16.5B–$21.5B is below the $22.2B consensus. Analysts will likely model lower margins in the near term due to the $200B CapEx plan and $1B in higher year-over-year Amazon Leo (satellite) costs. Amzon is back to a phase of heavily investing for future long term returns however that will come at the cost of near term margins.

What is missing?

Gross Margin Transparency: While Amazon reported net sales and operating income, it does not explicitly break out a “Gross Margin” percentage in the summary tables, which was a specific metric for consensus ($48.5%).

Anthropic Gain Volatility: Q3 net income was heavily bolstered by a $9.5B pre-tax gain from Anthropic. In Q4, despite similar net income, the contribution from investment gains was less emphasized, creating some noise in “true” earnings growth.

Project Kuiper (Leo) Monetization: While management highlighted technical speeds and commercial agreements, there is still limited visibility on when the $1B in scaled costs for 2026 will turn into meaningful revenue.

Executive Summary

Stock: AMZN (Amazon.com Inc)

Quarter: Q4 2025

Result: Beat consensus on revenue ($213.4B vs $211.2B) and small Beat on operating income ($25.0B vs $24.6B).

Performance Summary: Revenue growth momentum is accelerating, particularly in the high-margin AWS segment, which grew 24% YoY. Full-year 2025 revenue reached $716.9B, a 12% increase. However, Free Cash Flow decreased to $11.2B for the TTM due to a $50.7B surge in AI-related property and equipment purchases and will decline in 2026 based on the capex guidance.

Management Commentary: Management shifted from a defensive posture in Q3 (addressing legal charges) to an aggressive offensive in Q4. The key message is that Amazon is now an “AI-first” company, intending to spend $200B in 2026 to build the world’s leading AI and satellite infrastructure.

Guidance Implications: Expect revenue upgrades but operating margin downgrades. Management’s Q1 operating income guidance midpoint of $19B sits a hefty ~14% below market expectations as the company front-loads investment.

Conclusion:

Amazon has successfully re-accelerated AWS and proved AI can drive retail sales (via Rufus). However, investors must now brace for a massive capital intensive cycle. The business trajectory is strong at the top line, but the stock’s next phase will be determined by how quickly the $200B investment translates into incremental operating cash flow.

The $200bn capex number is absolutely wild. AWS reaccelerating to 24% growth is bullish but margins taking a hit in Q1 makes sense given that investment load. Im curious how long it takes for that capex to translate into actual cash flow - feels like were in for a multi-year payoff timeline here.