AMAZON Q3 2025 Earnings Analysis Report

Beat with AWS Re-acceleration to 20% revenue growth.

The following report was generated with The INFERENTIAL INVESTOR’S Earnings Analysis Report prompt from the professional prompt library on the website www.inferentialinvestor.com. Subscribe to access these tools and stock research.

AMZN Q3 2025 Earnings Analysis (Updated)

Date: October 31, 2025

Analyst: Gemini Equity Research

Step 1: Performance Highlights and Quantitative Comparison

Performance Summary Table

Notes:

¹ Q3 2025 Adjusted Operating Income excludes $2.5 billion in legal settlement charges with the FTC and $1.8 billion in estimated severance costs.

² Q3 2025 Adjusted EPS is calculated by the analyst to exclude these charges and the $9.5 billion pre-tax gain from the Anthropic investment (using a 24.5% effective tax rate) for a like-for-like comparison to the provided operational consensus.

Key Performance Indicators & Business Drivers

AWS Re-acceleration: AWS segment growth accelerated to 20.2% YoY ($33.0B), a significant jump from Q2’s 17.5% growth and the fastest pace since 2022.

Strong AI Demand: Management cited “strong demand in AI and core infrastructure” as a primary driver. The custom AI chip, Trainium2, is “fully subscribed” and grew 150% quarter-over-quarter.

Advertising Strength: Advertising services, a high-margin business, continued its strong performance, growing 24% YoY to $17.7B.

Fulfillment & Stores Innovation: The company highlighted progress in delivering at its “fastest speeds ever” and expanding same-day grocery delivery to over 2,300 communities.

GenAI Adoption: The AI-powered shopping assistant, Rufus, has been used by 250 million customers this year, with shoppers using it being 60% more likely to purchase.

Growth Summary

Overall, the company’s Q3 results beat consensus expectations, with 13.4% revenue growth and 11.2% adjusted EPS growth (YoY). Growth appears to be accelerating, particularly in the key AWS segment, which re-accelerated to 20.2% YoY growth driven by strong demand for AI and core infrastructure.

Step 2: Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3 2025)

CEO Andy Jassy highlighted “strong momentum and growth” driven by AI improvements across every part of the business. The central theme was the tangible re-acceleration of AWS, which is growing at a pace not seen since 2022, fueled by strong AI demand and rapid capacity expansion (adding 3.8 gigawatts in 12 months). In the Stores business, Jassy emphasized continued innovation in fulfillment, aiming for the fastest-ever Prime delivery speeds and expanding same-day grocery and rural delivery services.

Management Discussion (Prior Quarter - Q2 2025)

In Q2, CEO Andy Jassy’s commentary was also heavily focused on AI, but more on its emerging applications and potential. He stated his “conviction that AI will change every customer experience is starting to play out”. He cited the expansion of Alexa+, AI models like DeepFleet for robot optimization, and the launch of developer tools like Kiro and Bedrock AgentCore. The core message was that AI progress was beginning to improve customer experiences, innovation speed, and operational efficiency.

Thematic and Tone Comparison

Sentiment Score (0-20):

Q3 2025: 18.0 (Confident, Execution-Focused, “Strong Momentum”)

Q2 2025: 16.0 (Optimistic, Developmental, “Starting to play out”)

Delta: +2.0 (Shift from optimism to confidence)

Key Themes:

Recurring: AI, AWS, Customer Experience, Fulfillment Speed, AI Agents/Bedrock.

New/Emphasized (Q3): “Re-acceleration”, “Strong Demand”, “Capacity Expansion”, “Trainium2”, “Same-Day Grocery”.

De-emphasized (from Q2): Specific product names like “DeepFleet” and “Alexa+” were absent from the Q3 CEO quote, replaced by broader statements of AI success.

Tone Shift Summary:

Compared to Q2, management’s tone in Q3 became more confident and execution-focused. The Q2 commentary centered on the potential of AI and new product launches (”conviction... is starting to play out”). In Q3, the narrative shifted to the tangible results of this strategy, specifically the “re-acceleration” of AWS growth to 20.2% YoY and “strong demand” for AI. The focus moved from launching new AI tools to AI’s role as a core driver of momentum across the entire business.

Step 3: Guidance Evaluation and Consensus Implications

Management provided guidance for Q4 2025.

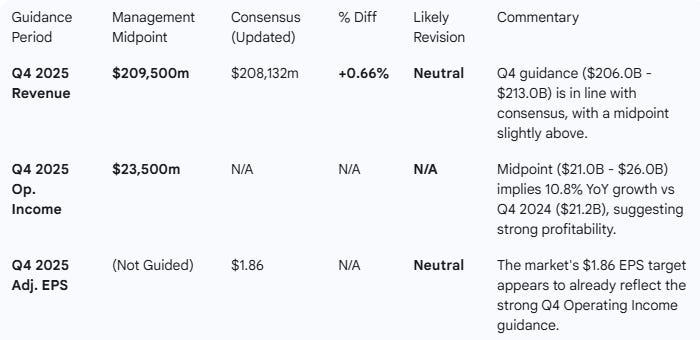

Guidance vs. Consensus Table

Implied Growth Rate

Q4 2025 Guided Revenue Growth (YoY): The $209.5B midpoint implies +11.6% YoY growth (vs. Q4 2024 revenue of $187.8B, from Q3 2025 TTM data).

Growth Trend: This represents a slight deceleration from Q3’s +13.4% and Q2’s +13.0% reported growth. However, the strong operating income guidance suggests significant margin expansion.

Step 4: What is Missing?

The Q3 report and guidance were comprehensive and addressed most pre-earnings market expectations, particularly around AWS growth and AI monetization. However, two new issues were raised:

New Severance Charges: The report disclosed $1.8 billion in new severance costs. The market may have believed large-scale layoffs were complete. This raises new questions about which divisions are being restructured and the source of future margin expansion.

FTC Legal Settlement: A $2.5 billion charge for a legal settlement with the Federal Trade Commission was announced. While the charge is now taken, it confirms a significant (and costly) regulatory headwind and highlights ongoing regulatory risk for the company.

Guidance Practice: The company provided its standard next-quarter guidance. No explicit full-year 2025 guidance was provided, which is normal for Amazon but leaves FY 2026 outlook unaddressed.

Step 5: Executive Summary (Updated)

Stock: $AMZN

Quarter: Q3 2025

Result: Beat. Amazon beat consensus on both the top and bottom lines, reporting $180.2B in revenue (+1.35% vs. consensus) and a calculated Adjusted EPS of $1.59 (+1.27% vs. consensus).

Key Performance Indicators:

AWS Revenue Growth: Re-accelerated significantly to 20.2% YoY ($33.0B), up from 17.5% in Q2.

Adjusted Operating Income: $21.7B (up 24.8% YoY), excluding $4.3B in new legal and severance charges.

Advertising Services Revenue: Grew 24% YoY to $17.7B, continuing its run as a key high-margin driver.

Growth Momentum: Accelerating. The re-acceleration in the key AWS segment is the most significant data point, confirming that the AI investment cycle is translating into top-line growth.

MD&A Tone: More Confident. The management narrative shifted from AI’s potential in Q2 to AI-driven results in Q3, citing “strong momentum” and the tangible “re-acceleration” of AWS.

Guidance: In Line with Consensus. Q4 revenue guidance midpoint ($209.5B) is +0.66% above the new consensus ($208.1B). The strong operating income guidance ($21.0B - $26.0B) appears to be already factored into the $1.86 Adj. EPS consensus.

Analyst Impact: Consensus estimates likely stable. The Q3 beat was solid, and the Q4 guidance aligns with current (updated) market expectations.

Conclusion: Amazon delivered a strong operational beat driven by the tangible re-acceleration of its key AWS growth engine. The narrative has firmly shifted from ‘waiting for AI’ to ‘AI is driving growth,’ with custom chips like Trainium2 and strong infrastructure demand fueling the 20.2% AWS growth. While new one-off charges for legal settlements and severance ($4.3B total) muddied the reported numbers, the underlying adjusted operating profit was exceptionally strong. With Q4 guidance now in line with market expectations, the report signals that Amazon’s investment cycle in AI is paying off as anticipated, supporting a stable to positive trajectory for the stock.

Step 7: Follow-up Analysis

Do you want me to adjust any other metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis