Alphabet Inc (GOOGL) Earnings Analysis - Google Cloud and Search Acceleration

Solid Beat on Revenue and EPS with one time non cash charge bringing Op Income 3% below.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

This analysis evaluates Alphabet Inc.’s ($GOOGL$) performance for the fourth quarter and fiscal year ending December 31, 2025, comparing results against Q3 2025 and market consensus.

Performance Highlights and Quantitative Comparison

Alphabet delivered a landmark quarter, surpassing $100 billion in quarterly revenue for the second consecutive time and exceeding $400 billion in annual revenue for the first time.

Performance Summary Table

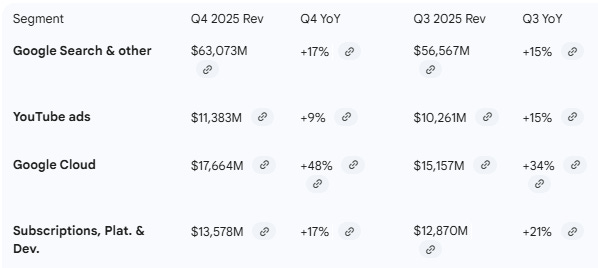

Segment Revenue & Growth

Key Performance Indicators:

Gemini Momentum: Monthly active users (MAUs) for the Gemini App grew from 650 million in Q3 to over 750 million in Q4.

Cloud Run-Rate: Google Cloud ended the year at an annualized run-rate exceeding $70 billion.

Capital Expenditures: CapEx reached $27.85 billion in Q4, up from $23.95 billion in Q3, reflecting intensified AI infrastructure investment.

Performance Summary: Alphabet’s Q4 results beat consensus on revenue and EPS, though operating income slightly missed due to a $2.1 billion non-cash compensation charge for Waymo. Growth is accelerating in Google Cloud and Search, driven by generative AI integration.

Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q4 2025)

The Q4 narrative shifted from “shipping at speed” to “tremendous momentum” and scale. Management emphasized that AI investments are now directly driving revenue “across the board”. The launch of Gemini 3 was cited as a major milestone, with a significant focus on API usage scaling to 10 billion tokens per minute.

Management Discussion (Prior Quarter - Q3 2025)

In Q3, CEO Sundar Pichai highlighted the “full stack approach to AI” and the record-time global rollout of AI Overviews. The narrative focused on “shipping at speed” and the initial success of first-party models. Financial results were impacted by a $3.5 billion EC fine, which management framed as a one-time regulatory hurdle.

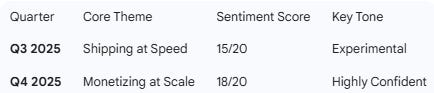

Semantic & Tone Comparison

Sentiment Score: Q3: 15/20 | Q4: 18/20 (Delta: +3.0)

Tone Shift: Management’s tone evolved from experimental/execution-focused in Q3 to confident/scale-oriented in Q4.

Thematic Shift:

Recurring: Gemini, Cloud acceleration, AI infrastructure, Subscriptions.

New in Q4: “Annual revenue >$400B,” “Gemini 3,” “10B tokens/min,” and “Waymo investment round”.

Missing in Q4: Discussion of the EC fine (which dominated Q3’s GAAP results).

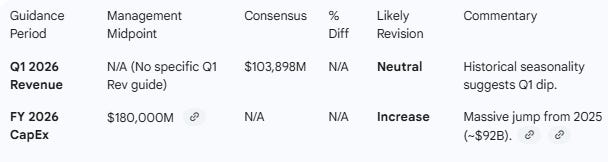

Guidance Evaluation and Consensus Implications

Alphabet provided aggressive investment guidance for 2026, signaling a commitment to AI leadership.

Guidance Table

Calculations & Implications:

CapEx Growth: Management had indicated 2025 CapEx of $91B–$93B. The 2026 guidance of $175B–$185B represents a ~96% YoY increase at the midpoint. Consensus was assuming $117bn, so this represents a large sequential step-up that will be a focus of the call.

Analyst Impact: While revenue growth is robust and consensus FY26 revenue estimates will be upgraded given the higher growth reported and accelerating momentum, the nearly doubling of CapEx will likely lead to downward revisions for FY2026 Free Cash Flow and potentially higher depreciation expense, weighing on long-term margin estimates.

Consensus was assuming Revenue growth of 14% and EBIT growth of 19% for FY26 implying operating margin expansion. Analysts are likely to upgrade revenues to reflect growth of potentially 18% on the higher base. With the acceleration being shown, nacked by the rate of investment and market share gain in cloud and AI, it is even possible that 20% revenue growth could be achieved.

Given much higher depreciation growth likely, it appears that operating margin expansion is less likely in FY26.

Further color may be provided on the call.

What is Missing?

Specific Revenue Guidance: Alphabet continues its policy of not providing specific quarterly revenue or EPS guidance, leaving the market to rely on CapEx “ranges” as a proxy for growth ambition.

Hardware Margin Transparency: Despite “double-digit growth” in platforms and devices, there is little detail on the profitability of the Pixel/Nest ecosystem versus services.

Regulatory Update: While the EC fine was discussed in Q3, Q4 provided little new detail on ongoing U.S. antitrust litigation or potential remedies, a key pre-earnings concern for investors.

Executive Summary

Stock: $GOOGL$ | Quarter: Q4 2025

Result: Alphabet delivered a solid double-beat on the top and bottom lines. Revenue of $113.8B beat consensus by 2.1%, and Diluted EPS of $2.82 beat by 6.8%.

Performance Summary:

Google Cloud: Continued its massive acceleration, growing 48% YoY in Q4 vs 34% in Q3.

Search: Growth remained resilient at 17% YoY, benefiting from AI-enhanced query volume.

Margins: GAAP Operating Margin of 31.6% remains robust despite a $2.1B charge for Waymo.

Management Commentary: The tone shifted toward aggressive scaling. CEO Sundar Pichai’s emphasis on “Gemini 3” and “10 billion tokens per minute” signals that Alphabet has moved past the defensive “AI catch-up” phase into a dominant infrastructure provider role.

Guidance & Analyst Impact: The massive 2026 CapEx guide ($180B midpoint) is a shock. Analysts will likely upgrade revenue/growth forecasts for Cloud and Search but downgrade FCF due to the significantly higher investment spend and associated depreciation. EPS upgrades may be tempered by the higher associated expense growth implied y the investment trajectory.

Conclusion: Alphabet has successfully commercialized AI, as seen in the Cloud acceleration. However, the stock is entering a high-stakes “investment phase” where revenue must grow fast enough to justify a 96% increase in capital spending. The trajectory is positive, but near-term margin pressure is possible.

MD&A Sentiment Comparison

Disclosure: The publisher holds a position in GOOGL

Outstanding breakdown of the Google Cloud accelaration - 48% YoY growth is absolutley insane and shows they're finally taking real market share from AWS. The massive CapEx jump to $180B is bold but it makes sense when you're in a land-grab phase for AI infrastructure. I've been watching the cloud wars closely as a dev and Google's Gemini integration is definately starting to show up in more enterprise pitches. The near-term margin compression risk is real though, curious to see if they can execute at this scale.