ALPHABET (GOOG) Q3 2025 Earnings Analysis

This report is generated by The INFERENTIAL INVESTOR’S Earnings Analysis Report research workflow prompt available in the Professional Prompt Library here.

or just subscribe to learn:

Stock: $GOOG (Alphabet Inc.)

Quarter: Q3 2025 (Ended September 30, 2025)

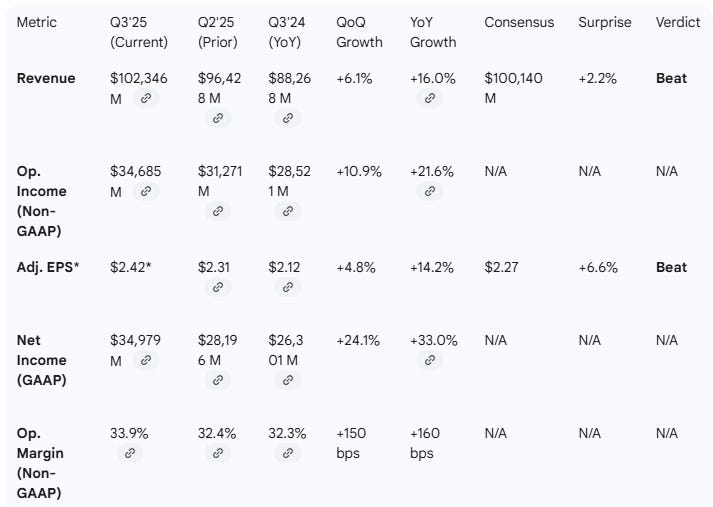

Step 1. Performance Highlights and Quantitative Comparison

Alphabet delivered a strong beat on consensus expectations, reporting its first-ever quarter with over $100 billion in revenue1. Top-line growth accelerated to 16.0% year-over-year (YoY), up from 14% in the prior quarter22.

Adjusted EPS is calculated at $2.42, beating the $2.27 consensus. This figure is derived from the reported $2.87 GAAP EPS 3by excluding a $0.68/share net gain on equity securities 4and adding back the estimated $0.23/share after-tax impact of the $3.5 billion EC fine5.

Non-GAAP operating income growth accelerated significantly to 21.6% YoY6, demonstrating strong underlying profitability.

Performance Summary Table

*Note on Adj. EPS: Q3’25 Adjusted EPS is a calculated metric. It is derived from GAAP EPS of $2.87 24, adding back the estimated after-tax impact of the $3.5B EC fine (~$0.23/share) and subtracting the reported impact of net equity gains ($0.68/share)25. Q2’25 and Q3’24 EPS are reported GAAP Diluted EPS.

Key Business Drivers & Segment Performance

Overall: Management cited “double-digit growth across every major part of our business”26.

Google Search & Other: Revenue grew 15% YoY to $56.6B27.

YouTube Ads: Revenue grew 15% YoY to $10.3B28.

Google Cloud: Revenue accelerated to 34% YoY growth (vs. 32% in Q2) to $15.2B2929292929. This segment was a key highlight, with a rapidly growing backlog quantified at $155 billion30.

Subscriptions, Platforms & Devices: Grew 21% YoY to $12.9B 31, with the company crossing 300 million paid subscriptions (led by Google One and YouTube Premium)32.

Google Network: This was the only weak spot, declining 3% YoY33.

AI Metrics: The company provided new, concrete AI metrics, including the Gemini App reaching 650 million monthly active users and Gemini models processing 7 billion tokens per minute via API34.

Summary: Overall, the company’s Q3 2025 results beat consensus expectations, with 16.0% revenue growth 35 and a 6.6% beat on calculated adjusted EPS. Growth appears to be accelerating, driven by a re-acceleration in Google Cloud 36and sustained double-digit growth in Search and YouTube3737.

Step 2. Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3’25)

CEO Sundar Pichai highlighted a “terrific quarter,” marking Alphabet’s “first-ever $100 billion quarter” with double-digit growth across all major business segments38. He emphasized strong momentum from their “full stack approach to AI,” noting the rapid global rollout of AI Overviews in Search39. Key metrics cited include Gemini processing 7 billion tokens per minute via API, the Gemini App reaching 650 million monthly active users, Google Cloud accelerating with a $155 billion backlog, and crossing 300 million paid subscriptions40. The company is “investing to meet customer demand”41.

Management Discussion (Prior Quarter - Q2’25)

In Q2, Pichai described a “standout quarter” with “robust growth”4242. The narrative was similarly focused on AI leadership, stating “AI is positively impacting every part of the business”4343. He highlighted double-digit growth in Search, strong performance in YouTube and subscriptions, and Cloud’s “strong growth in revenues, backlog and profitability,” with its annual revenue run-rate exceeding $50 billion 44. A significant announcement was the increase in 2025 capex guidance to “approximately $85 billion” to meet “strong and growing demand” for Cloud and AI45.

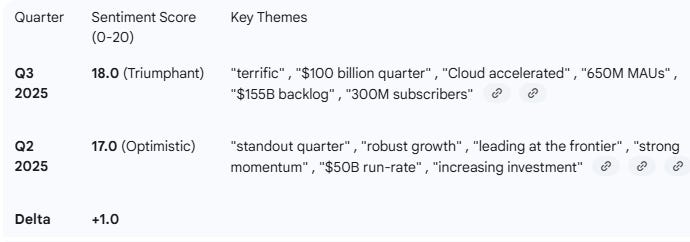

Narrative & Tone Comparison

Delta+1.0

Management’s tone remains exceptionally optimistic, increasing slightly in Q3. The core narrative is consistent, focusing on leadership and broad momentum from a “full-stack AI” approach58. Both quarters emphasized “shipping at speed” 59and “strong growth” in Search, YouTube, and Cloud606060.

The main shift from Q2 to Q3 is a move from broad statements of AI success to providing concrete, large-scale metrics. Q3’s commentary is anchored by specific user numbers (650M Gemini MAUs) 61, processing volumes (7B tokens/min) 62, and backlog ($155B for Cloud)63, signaling a transition from AI development to quantifiable, scaled deployment.

Step 3. Guidance Evaluation and Consensus Implications

Alphabet did not provide explicit Revenue or EPS guidance, which is standard practice.

The key guidance update was a significant increase in the full-year 2025 capital expenditure forecast.

New FY’25 Capex Guidance: “$91 billion to $93 billion” (Midpoint: $92B) 64

Prior FY’25 Capex Guidance (from Q2): “approximately $85 billion” 65

This represents an ~8.2% raise to the capex plan, signaling massive management confidence in future demand for AI and Cloud services and a commitment to investing heavily to meet it.

Implications for Analyst Revisions

Given the strong Q3 beat and accelerating growth, consensus estimates for Q4 2025 and FY 2025 were likely too low.

Implied Q4 Revenue Consensus: $106.5B (based on $395.5B FY consensus minus $289.0B YTD actual 66)

Implied Q4 Adj. EPS Consensus: $2.37 (based on $9.91 FY consensus minus $7.54 YTD calculated Adj. EPS)

The $106.5B Q4 revenue target seems highly achievable given the $102.3B Q3 result and accelerating momentum in Cloud. The $2.37 Q4 EPS estimate appears low compared to the $2.42 calculated for Q3.

Step 4. What Is Missing?

Explicit P&L Guidance: Alphabet provided no explicit Revenue or EPS guidance for Q4 or FY 2025 71. This is normal for the company but leaves analysts to extrapolate.

Pre-Earnings Concerns: The market had two main concerns: AI’s impact on Search margins and the growth trajectory of Cloud.

Margin Concerns: These were well-addressed. While Google Services GAAP operating margin compressed to 38.5% from 40.3% YoY 72727272, this includes the $3.5B EC fine73. Excluding the fine, the segment’s operating margin would have been ~42.5%, a healthy expansion.

Cloud Growth: This concern was “thoroughly addressed” and put to rest. Cloud revenue accelerated to 34% YoY growth 74(from 32% in Q2 75), its operating income grew 85% YoY 76767676, and management revealed a massive $155B backlog77.

New Issues: The only new “concern” is the magnitude of the Capex increase to $91B-$93B78. While this signals strong demand, it will pressure 2025 free cash flow, and analysts will need to model the out-year revenue acceleration to justify the spend.

Step 5. Executive Summary

Stock: $GOOG (Alphabet Inc.)

Quarter: Q3 2025

Result: Strong Beat.

Revenue: $102.3B vs $100.1B consensus (+2.2%) 79

Adj. EPS: $2.42 (calc.) vs $2.27 consensus (+6.6%)

Performance Summary:

Alphabet delivered its first-ever $100B quarter 80, with revenue growth accelerating to 16.0% YoY 81(from 14% in Q2 82). This was driven by strength across all key segments: Search (+15%) 83, YouTube Ads (+15%) 84, Subscriptions (+21%) 85, and a notable acceleration in Google Cloud to 34% growth 86(vs 32% in Q2 87). On a non-GAAP basis, operating income grew 21.6% YoY 88, and operating margin expanded 160 bps YoY to 33.9%89, demonstrating leverage even with high investment.

Management Commentary:

CEO Sundar Pichai’s tone was “terrific”90. The narrative (Sentiment: 18/20) shifted from Q2’s broad AI optimism to Q3’s concrete, large-scale metrics, including 650M Gemini App MAUs 91, 300M paid subscribers 92, and a $155B Cloud backlog93. The key message is that Alphabet’s “full-stack AI” strategy is now delivering quantifiable, scaled results.

Guidance Implications:

Alphabet provided no forward-looking P&L guidance. However, the company significantly raised its FY 2025 capital expenditure guidance from “~$85B” 94to a “$91B - $93B” range95. This ~8% increase signals massive confidence in AI and Cloud demand. Given the Q3 beat on both revenue and adjusted EPS, consensus estimates for Q4 and FY’25 are likely to be revised upward.

Conclusion:

This was a definitive “beat and raise” quarter, with the “raise” coming in the form of capex, not revenue. Alphabet proved it can deliver accelerating, profitable growth, with Cloud re-accelerating and non-GAAP margins expanding. The massive capex hike is a clear signal that management sees a long runway of AI-driven demand, justifying near-term free cash flow pressure for long-term market capture. The results validate the bull thesis on AI monetization and Cloud acceleration.

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis

This is easily the most professional and thorogh earnings analysis I've seen on Substack. The quantitative comparison table at the top is brilliant - it makes the beat instantly clear without having to dig through the entire report. I really apreciate how you called out the adjusted EPS calculation with the EC fine and equity gains - most people just take the headline number and run with it. The MD&A comparison with the sentiment scoring from Q2 to Q3 is genius. The shift you identified from "broad AI optimism" to "concrete, large-scale metrics" (650M Gemini MAU, 7B tokens/min, $155B Cloud backlog) is exactly the inflection that the market needed to see to believe this isn't just vapor. Your point about Cloud putting pre-earnings concerns "thoroughly to rest" with 34% growth acceleration is spot on - that was the biggest overhang and they just demolished it. The only thing I'm struggling with is how to model the CapEx raise you highlighted ($85B to $91-93B). On one hand, it signals massive demand visibility. On the other hand, it's going to pressure 2025 FCF and the market will need to see the AI revenue ramp materialize to justify it. Do you have any thoughts on what a resonable AI revenue assumption would be for 2026-2027 to make those returns work out?