ADVANCED MICRO DEVICES Inc. Q3 FY25 Earnings Analysis Report

Double beat, accelerating data centers segment & above consensus guide for Q4 revenues. However DC margins fell and higher "whisper" expectations for Q4 revenues were not met, dragging on the stock.

The following report was generated with the Earnings Analysis Report prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Equity Analyst Report: AMD (NASDAQ: AMD)

Quarter: Q3 2025 (Ended September 27, 2025)

Date: November 5, 2025

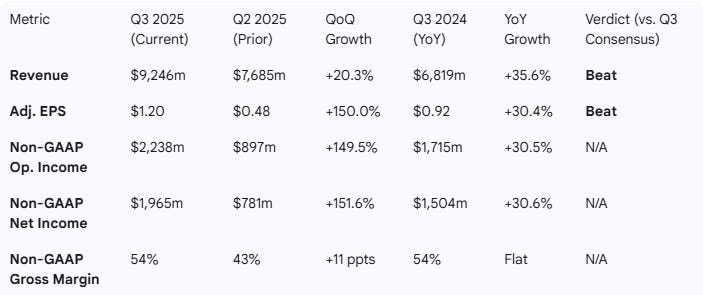

Performance Highlights and Quantitative Comparison

Q3 2025 Consensus Comparison

Revenue: $9.25B vs. $8.75B consensus (+5.7% Beat)

Adj. EPS: $1.20 vs. $1.17 consensus (+2.6% Beat)

Performance Summary Table (Non-GAAP)

Note: The dramatic QoQ margin and profit growth is largely due to Q2 2025 results including an $800 million inventory charge. Excluding that charge, Q2’s Non-GAAP gross margin would have been ~54%, indicating Q3’s underlying margin is stable and strong.

Segment Revenue Performance

Key Performance Drivers (Q3-25)

Overall: The quarter was marked by record revenue and profitability. Growth was driven by broad-based demand across Data Center AI, Server (EPYC), and PC (Ryzen) businesses.

Data Center (YoY Growth: +22%): Growth was “primarily driven by strong demand for 5th Gen AMD EPYC™ processors and AMD Instinct™ M1350 Series GPUs”. Large scale new partnership announcements with OpenAI ( 6GW of AMD GPUs ramping from 1H 2026) and Oracle (50,000 GPU supercluster deploying in Q3 2026). Data Centre operating margins however fell from 29% (Q3 24) to 25% (Q3 25) on higher operating expenses, constraining Op Income from the segment.

Client and Gaming (YoY Growth: +73%):

Client: Posted a record $2.8 billion in revenue (+46% YoY) driven by record sales of Ryzen™ processors and a richer product mix.

Gaming: Grew 181% YoY, driven by higher semi-custom revenue and strong demand for Radeon™ gaming GPUs.

Embedded (YoY Growth: -8%): This remains the one area of YoY weakness, though management noted the “demand environment strengthened” sequentially across multiple markets.

Growth Summary

Overall, the company’s Q3 2025 results beat consensus expectations, with revenue surpassing estimates by 5.7% and adjusted EPS beating by 2.6%. Growth appears to be accelerating dramatically on a sequential basis, with 20.3% QoQ revenue growth and 150% QoQ EPS growth. While this QoQ jump is amplified by a prior-quarter inventory charge, the strong underlying YoY revenue growth of 35.6% confirms a powerful ramp driven by all key business units.

Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3 2025)

Management’s commentary is exceptionally bullish. CEO Dr. Lisa Su called it an “outstanding quarter, with record revenue and profitability”. The key message is that the company has hit an inflection point, marking “a clear step up in our growth trajectory”. This step-up is attributed to the combination of the expanding core compute franchises (EPYC and Ryzen) and, crucially, a “rapidly scaling data center AI business”. CFO Jean Hu reinforced this by noting “record quarterly revenue” and “record free cash flow”.

Management Discussion (Prior Quarter - Q2 2025)

Commentary in Q2 was cautiously optimistic. The narrative was bifurcated: management highlighted “strong revenue growth” and “robust demand” in its core server and PC businesses, but this was overshadowed by the $800 million inventory charge related to U.S. export restrictions on AI GPUs for China. The focus was forward-looking, with the CEO stating AMD was “well positioned to deliver significant growth in the second half of the year”, pinning hopes on the ramp of the next-generation M1350 accelerators.

Narrative & Thematic Shift Analysis

Compared to Q2, management’s tone in Q3 shifted from cautiously optimistic to overtly bullish. The Q2 narrative was defined by resilience despite the $800 million China-related inventory charge, with management pointing to a future ramp in the second half. In Q3, that ramp has clearly materialized.

The central theme is no longer about managing export restrictions; it’s about a “rapidly scaling data center AI business”. This confidence is validated by the announcement of massive, concrete strategic partnerships that were absent in Q2:

New (Q3): A strategic partnership with OpenAI to deploy 6 gigawatts of AMD GPUs.

New (Q3): A partnership with Oracle for an initial deployment of 50,000 GPUs in its OCI supercluster.

The language changed from being “well positioned” to delivering an “outstanding” quarter, signaling a new, higher growth trajectory has begun.

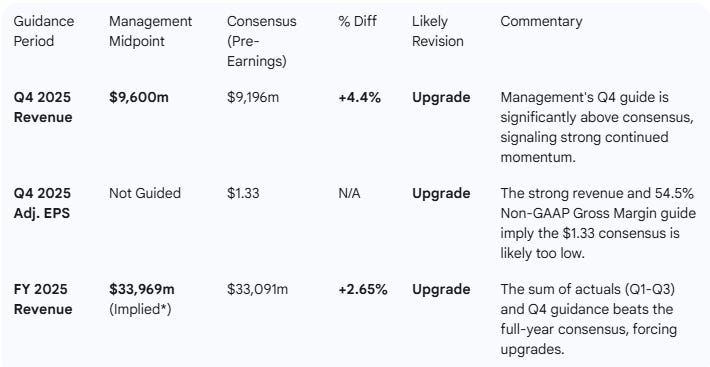

Guidance Evaluation and Consensus Implications

Management provided a strong outlook for the fourth quarter, exceeding analyst expectations.

Guidance & Consensus Comparison

*Implied FY25 Revenue = Q1 Actual ($7.44B) + Q2 Actual ($7.69B) + Q3 Actual ($9.25B) + Q4 Guide ($9.60B)

Implied Growth Trajectory

Q2 2025 (Actual): +32% YoY

Q3 2025 (Actual): +35.6% YoY

Q4 2025 (Guided): ~25% YoY

The 25% YoY growth guided for Q4 represents a slight deceleration from Q3’s 35.6%. This is likely due to a tougher Q4 2024 comparison, but the 4% sequential growth off a record Q3 demonstrates strong absolute momentum.

Market Concerns Addressed in Q3

The Q3 report and presentation were comprehensive and addressed the market’s primary pre-earnings questions.

Concern 1: The AI Ramp: The market needed to see that the AI (Instinct) business was genuinely ramping.

Verdict: Addressed & Exceeded. The report not only showed strong Data Center growth but announced two “hyperscale” customer wins (OpenAI and Oracle), a definitive validation.

Concern 2: China Export Restrictions: After the $800M Q2 charge, investors needed clarity.

Verdict: Addressed. The report clarifies this is no longer an unknown risk. Q3 results and Q4 guidance are baseline and exclude the restricted M1308 GPU revenue. The company is achieving its “step up” in growth without this business, making the performance more impressive.

Concern 3: ZT Systems Divestiture: The market was awaiting the close of the deal announced in Q2.

Verdict: Addressed. The Q3 report confirmed the “completion of the divestiture” of the manufacturing business to Sanmina, closing the loop on this transaction.

Remaining Weakness: The only missing piece of the growth story is the Embedded segment, which was down 8% YoY. While small, it is the only segment not participating in the broad-based growth.

Market Reaction & Analyst Context

Despite the strong beat and positive guidance, AMD’s stock traded down in after-hours trading in a classic “sell the news” reaction. This negative pressure was driven by three main factors:

Extreme Expectations: The stock entered the report with a very high valuation (P/E ~150) after a massive run-up of over 100% year-to-date and 28% in the last month alone. The stock was priced for perfection, and any minor blemish would be scrutinized.

“Whisper Number” Miss: While the Q4 revenue guidance of $9.6 billion was 4.4% above the official consensus of ~$9.2B, it reportedly fell short of a more aggressive “whisper number” rumored to be as high as $9.8 billion. For a stock with such high momentum, simply beating the consensus was not enough; investors were hoping for a guide that “crushed” all expectations.

Analyst & Market Concerns: Analysts noted that inventory levels materially increased, with days outstanding rising from 139 in Q2 to 158 in Q3. This, combined with a broader market apprehension about high valuations across the AI sector, created a headwind and encouraged investors to take profits rather than bid the stock up further.

Outstanding Concerns

The Q3 report and presentation were comprehensive and addressed most of the market’s primary pre-earnings questions (the AI ramp, China restrictions, and the ZT Systems divestiture). However, one area of weakness remains:

Embedded Segment: The only missing piece of the growth story is the Embedded segment, which was down 8% YoY and reportedly missed consensus estimates. While small, it is the only segment not participating in the broad-based growth, and management will likely face further questions on its path back to growth.

Executive Summary

Stock: $AMD (NASDAQ: AMD)

Quarter: Q3 2025

Result: Beat. Q3 Revenue of $9.25B (+35.6% YoY) beat consensus of $8.75B by 5.7%. Non-GAAP EPS of $1.20 (+30.4% YoY) beat consensus of $1.17 by 2.6%.

Performance Summary: The company reported record revenue and profitability. Growth was driven by a 22% YoY increase in Data Center revenue (to $4.3B) and a 73% YoY surge in Client and Gaming revenue (to $4.0B). The Data Center segment was fueled by strong demand for EPYC server CPUs and Instinct M1350 AI GPUs, while the Client segment posted record sales of Ryzen processors.

Management Commentary: Management’s tone shifted from “cautiously optimistic” in Q2 to “decidedly bullish” in Q3. CEO Lisa Su declared the quarter “a clear step up in our growth trajectory”, driven by the core compute franchise and a “rapidly scaling data center AI business”. This confidence was underpinned by new, large-scale strategic partnership announcements with OpenAI (to deploy 6-GW of AMD GPUs) and Oracle (an initial 50,000-GPU deployment).

Guidance Implications: Upgrade. Management guided Q4-25 revenue to a midpoint of $9.6B, which is +4.4% above the $9.196B consensus. The implied full-year 2025 revenue from this guidance is $33.97B, approximately 2.7% higher than the pre-earnings consensus of $33.09B. This will force analysts to upgrade FY25 revenue and EPS estimates.

Market Reaction: Amidst a broader sell off in high valuation names and the AI thematic, AMD has followed in after hours trading. This is likely due to extremely high expectations with whisper expectations of Q4 revenues being $9.8bn, despite published consensus being below this. Analyst commentary has also focused on rising inventory levels.

Conclusion: AMD’s Q3 results and Q4 guidance signal a major growth inflection. Having fully absorbed the Q2 China-related headwinds, the company is now firing on all cylinders, with its core PC and Server businesses performing at record levels. More importantly, the AI (Instinct) business has transitioned from “potential” to a “rapidly scaling” reality, validated by marquee customer wins. The “clear step up” mentioned by management appears to be the start of a new, AI-driven growth cycle. The business is performing strongly, however expectations may have gone too far.

Step 7: Follow-up Analysis

This report was generated based on the provided documents.

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis

The whisper number miss concept really captures what happened here better than just looking at consensus. When a stock runs 100% YTD and trades at 150 PE, meeting official estimates isn't enough anymore. The OpenAI and Oracle partnerships are genuinely transformational, but inventory days jumping from 139 to 158 gave profit takers the excuse they neded to trim positions after such a strong run.