ROBINHOOD MARKETS INC. Q3 FY25 Earnings Call Transcript Analysis

100% Revenue Growth, Focus on Product Roadmap and Global vision

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Executive Summary

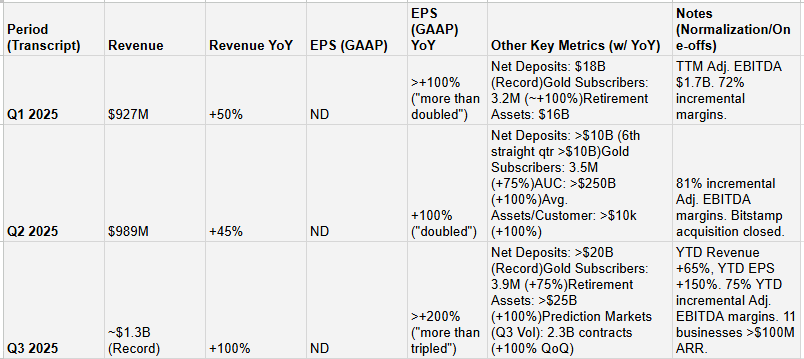

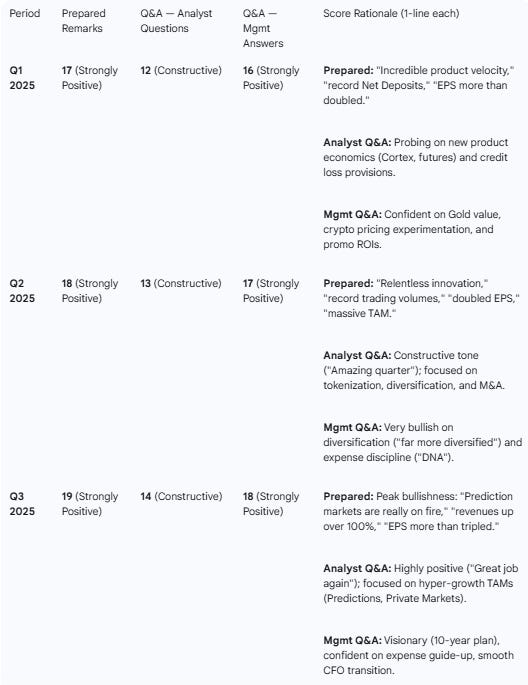

Growth Accelerating to Hyper-Speed: Robinhood’s narrative has shifted from “strong product velocity” in Q1 to “relentless innovation” and “record volumes” in Q2, culminating in “on fire” growth in Q3. Q3 2025 revenue accelerated to +100% YoY, with EPS more than tripling.

New Growth Vectors Dominating: While core growth remains strong, the story is now dominated by new, high-TAM initiatives. Prediction Markets, a product less than a year old, is already tracking at a $300M revenue run rate based on October data.

Diversification Paying Off: Management’s focus on diversification is now bearing fruit. The company highlighted 11 distinct business lines each generating over $100M in annualized revenue in Q3, up from 9 in Q2, significantly reducing its perceived cyclicality.

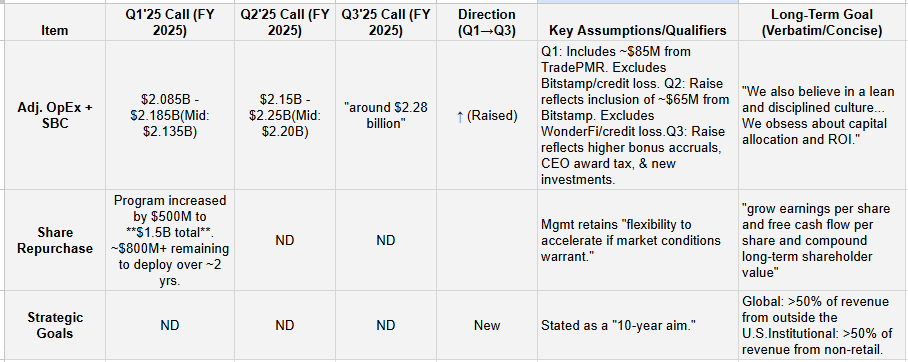

Cost Guidance Creeping Up: Full-year 2025 adjusted OpEx + SBC guidance was raised in both Q2 (to incorporate Bitstamp) and Q3. The Q3 raise (to ~$2.28B) was attributed to higher performance-based bonus accruals, one-off payroll taxes from a CEO award, and new investments in Prediction Markets and Robinhood Ventures.

Sentiment is Extremely Bullish: Management sentiment is at a peak, driven by record metrics across the board. Analyst sentiment is equally constructive, with Q&A shifting from validating new products in Q1 to probing the multi-billion dollar potential of tokenization, private markets, and prediction markets in Q3.

Tokenization & Global Strategy: The “To Catch a Token” event in Q2 firmly established tokenization and global expansion as the core long-term (10-year) strategy, aiming for >50% of revenue from non-U.S. and institutional sources.

Key Metrics (Q3 2025):

Revenue: ~$1.3B (+100% YoY)

Net Deposits: >$20B (Record)

Gold Subscribers: 3.9M (+75% YoY)

Prediction Markets (Oct): 2.5B contracts (exceeding all of Q3)

CFO Transition: The Q3 call announced the retirement of CFO Jason Warnick, to be succeeded by internal veteran Shiv Verma. The transition was presented as smooth and a continuation of the current “lean and disciplined” financial strategy.

Table 1: Results & YoY Growth

Table 2: Guidance & Long-Term Goals Evolution

Key Guidance Quotes Evolution (Most Recent First)

Q3 2025: “Looking ahead to the rest of the year, we’re tracking toward full year 2025 adjusted OpEx plus SBC of around $2.28 billion... This reflects our strong year-to-date business results... as well as some increased investment in new growth areas like Prediction Markets and Robinhood Ventures.”

Q2 2025: “Now for Bitstamp, as I’ve said previously, we expect about $65 million of costs in 2025 so we’re layering that on to our full year outlook... bringing it to **$2.15 billion to $2.25 billion**.”

Q1 2025: “...we anticipate approximately $85 million of costs from TradePMR in 2025. So, we updated our full year outlook for adjusted OpEx and SBC to **$2.085 billion to $2.185 billion**.”

Table 3: Sentiment Scoring (0–20 Scale)

Scale: 0-5 (Negative), 6-10 (Cautious), 11-15 (Constructive), 16-20 (Strongly Positive)

Management’s Key Themes (Prepared Remarks)

Q3 2025 (Most Recent)

Hyper-Growth in New Vectors: The overwhelming theme was the massive, accelerating growth from new products.

Quote: “Prediction markets are really on fire... We’ve doubled volume every quarter since then to 2.3 billion contracts in Q3. And the month of October alone was up to 2.5 billion contracts.”

Quote: “In Q3, 2 more businesses, -Prediction Markets and Bitstamp each surpassed $100 million in annualized revenue, bringing us to $11 million in total...”

Long-Term Global & Institutional Ambition: Management laid out a clear 10-year vision to fundamentally change the business mix.

Quote: “So 10 years from now, the aim is to have over half of our revenue be outside the U.S... We think we can get to over half being non-retail institutional.”

Wallet Share & Gold Acceleration: The push to capture more assets and subscribers is succeeding, with the Gold Card seeing explosive growth.

Quote: “Robinhood Gold Card, now over 0.5 million cardholders with over $8 billion in annual spend... That’s 5x growth in cardholders since the beginning of the year.”

Continued Financial Discipline (Despite Guide-Up): The incoming CFO reinforced the “lean and disciplined” culture, while the outgoing CFO explained the cost guide-up.

Quote: “This was driven by 2 items... First, stronger year-to-date results led to higher Q3 employee bonus accrual... And second, the significant increase in our stock price... triggered vesting on the... CEO market-based award.”

Quote (New CFO): “We also believe in a lean and disciplined culture... Our financial North Star is going to remain the same, grow earnings per share and free cash flow per share...”

Q2 2025

Tokenization as the Future: The crypto event in France was the centerpiece, positioning tokenization as the next major innovation.

Quote: “I think tokenization is the biggest innovation in capital markets in over a decade... Stock Tokens will do for stocks what stablecoin did for fiat currencies...”

Winning Wallet Share: Management emphasized moving upmarket and capturing more assets per user.

Quote: “Average assets per funded customer was over $10,000 for the first time, nearly doubling from a year ago.”

Disciplined Growth: The 81% incremental adjusted EBITDA margin was a key proof point of the operating model’s leverage.

Quote: “As a result, we grew revenues 45% year-over-year, drove 81% incremental Adjusted EBITDA margins, and doubled EPS from a year ago.”

Q1 2025

Proof of Product Velocity: The call focused on the launch and initial traction of many new products for active traders.

Quote: “We launched futures and prediction markets in Q1, and futures are accelerating nicely. So about 4.5 million contracts traded in April alone, which is more than all of Q1.”

Capital Return & Confidence: The buyback increase signaled strong confidence in the financial outlook.

Quote: “Given our strong performance and positive outlook, our Board has increased the authorization by $500 million, taking the program up to a total of $1.5 billion.”

Diversification Strategy: Management began highlighting the 9 businesses with >$100M in revenue, setting the stage for the diversification narrative.

Quote: “You’ve heard me say that we have nine businesses that each generate over $100 million in annualized revenues, nearly double the number we had just a couple of years ago.”

Analyst Q&A Themes & Evolution

Q3 2025 Themes

The Q3 Q&A was characterized by excitement over new, massive TAMs.

Prediction Markets: This was the dominant theme. Analysts pressed on the drivers of the explosive growth (e.g., product mix) and the competitive strategy. Management confirmed the growth, noting October volume (2.5B contracts) already surpassed all of Q3 (2.3B contracts).

Private Markets (Robinhood Ventures): Following Morgan Stanley’s acquisition of EquityZen, analysts questioned Robinhood’s strategy. Management highlighted its focus on non-accredited investors, a key differentiator, and noted strong customer demand for daily liquidity and concentrated access to top tech names.

Tokenization: Analysts continued to probe the long-term vision, asking about scalability, revenue impact (vs. PFOF), and interoperability. Vlad Tenev described a 3-phase rollout, with Phase 2 (Bitstamp secondary trading) and Phase 3 (DeFi) unlocking the main potential.

Expense Guidance: Analysts sought clarity on the 2026 run rate following the FY25 guide-up. Management committed to continued profitable growth and margin expansion, funding new investments by finding efficiencies in existing businesses.

Q2 2025 Themes

The Q2 Q&A focused on scaling, global strategy, and monetization.

Tokenization & Global Strategy: This was the top theme post-France event. Analysts asked about the regulatory path in the U.S., the structure of the offering, and competition. Management detailed its 3-phase plan and emphasized that the real U.S. opportunity is tokenizing inaccessible assets like private markets.

Crypto Monetization (Smart Exchange Routing): This was a recurring theme. Analysts probed the impact of tiered pricing on take rates. Management stated the blended rate was 58 bps in Q2 but rose to the mid-60s in July, and that smart routing was increasing revenue per trader by capturing more volume.

Business Cyclicality: Analysts directly challenged the business model’s perceived cyclicality. Management countered forcefully, pointing to its 9 $100M+ businesses and a “lean and disciplined” cost structure as key differentiators from 2021.

M&A Strategy: Analysts asked if the company would pursue larger M&A given its higher stock price. Management reiterated its “disciplined approach,” biasing toward building or buying smaller, efficient businesses that accelerate the roadmap by at least 18 months.

Q1 2025 Themes

The Q1 Q&A was focused on validating the viability and economics of newly launched products.

Deposit Promotions: Analysts dug into the economics of the 2% transfer match. Management loved the economics, noting attractive payback periods and high-value customers (avg. taxable transfer of $180,000).

Credit Card & Lending: The primary questions were about the rollout pace and credit risk. Management stressed a “measured” rollout to study behavior, with delinquency rates “very, very low” and in line with expectations.

Crypto Pricing: Analysts focused on the new “smart exchange routing” and tiered pricing. Management confirmed this was an experiment to attract high-volume traders who were previously uncompetitive, stating it’s an opportunity to grow volume, not necessarily lower the blended rate.

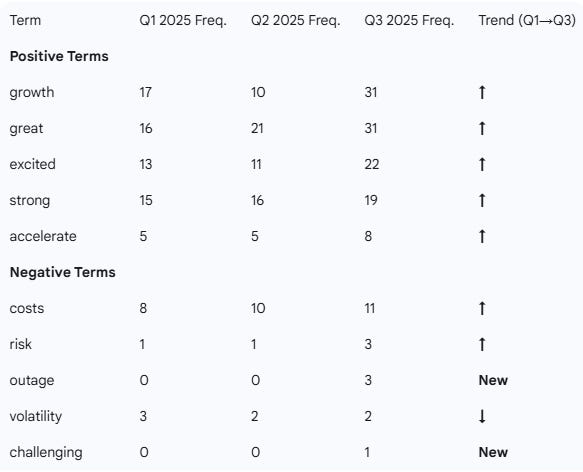

Term Frequency Tracking

Positive & Negative Term Frequency (Q3’25 Terms Tracked Across Calls)

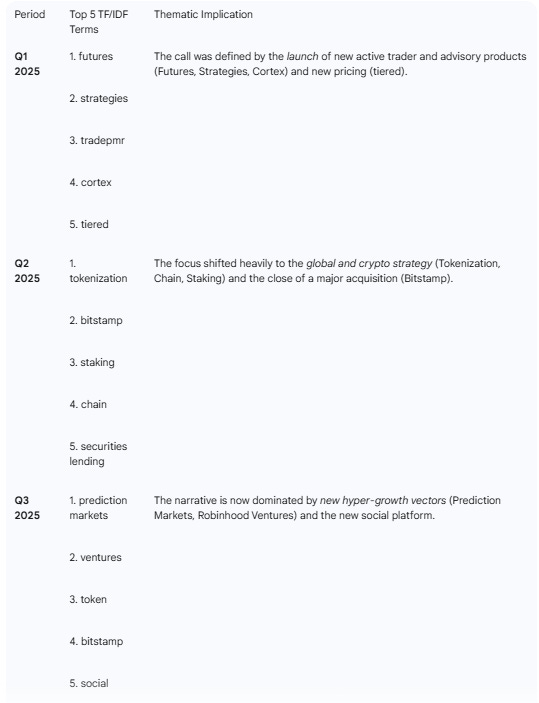

TF/IDF Key Theme Evolution (Top 5 Terms per Call)

The narrative is now dominated by new hyper-growth vectors (Prediction Markets, Robinhood Ventures) and the new social platform.

Analysis: The TF/IDF terms perfectly map the company’s strategic evolution. Q1 was about launching new products. Q2 was about establishing the new global/crypto vision. Q3 is about scaling new, high-growth businesses that have found product-market fit.

Red Flags & Open Questions (from Q3 2025 Call)

Consecutive Expense Guidance Increases: Full-year 2025 Adjusted OpEx + SBC guidance was raised for the second consecutive quarter (from $2.135B mid in Q1, to $2.20B mid in Q2, to ~$2.28B in Q3). While management provides “good” reasons (performance bonuses, growth investments), this consistent upward creep in costs warrants close monitoring to ensure discipline is maintained through the CFO transition.

CFO Transition: The retirement of CFO Jason Warnick introduces executive transition risk. Although the successor, Shiv Verma, is a 7-year internal veteran who affirmed the “lean and disciplined culture”, any CFO change can precede shifts in reporting, capital allocation, or financial strategy.

External Platform Risk: The Q&A session revealed a recent AWS outage that led to “degraded app performance”. While management noted the system was more resilient than in prior years, it highlights a significant operational dependency on third-party infrastructure.

Product Timeline Ambiguity: Management announced several new products at its HOOD Summit (shorting, multiple accounts, Robinhood Social). In Q&A, it was confirmed that shorting—a key feature for active traders—is “not yet rolled out to external customers”, and timelines for Robinhood Social were vague (”challenging to forecast precisely the impact”).

Follow-On Analysis Options

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings report analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis