PFIZER INC. Q3 FY2025 Earnings Call Transcript Analysis

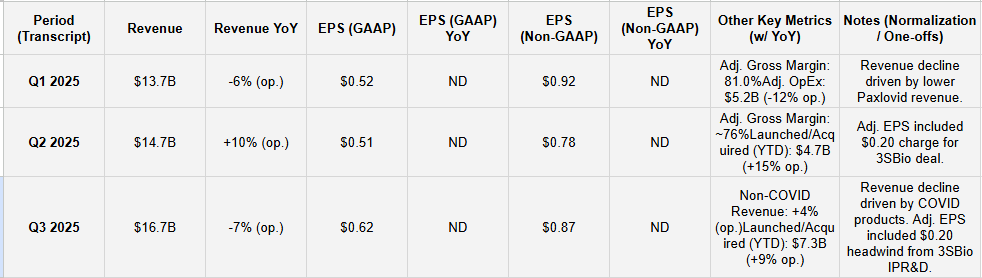

Non-COVID commercial growth inflection and 13% FCF yield. Drags from Metsera bid war and COVID decline

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Executive Summary:

Policy Overhang Resolved: The key change in Q3 was the “landmark agreement” with the US government. This removes major uncertainty by providing a “three-year grace period from certain US tariffs” in exchange for US manufacturing investment.

Aggressive M&A Pivot: Pfizer is aggressively pursuing the Metsera (obesity) acquisition, calling Novo Nordisk’s competing offer “illusory” and an illegal “catch and kill” attempt to “destroy” competition.

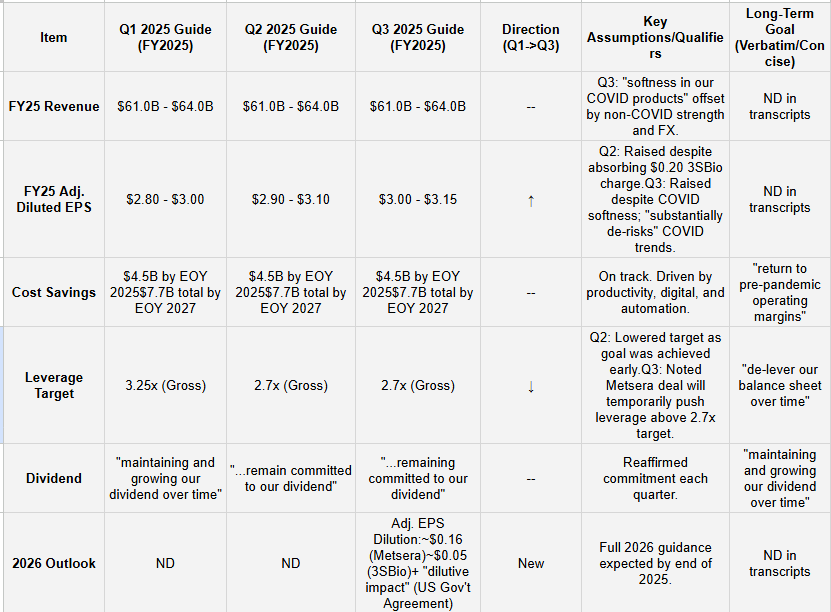

FY25 EPS Guidance Raised Again: Adjusted EPS guidance was raised for the second consecutive quarter, moving to $3.00-$3.15 in Q3, up from $2.90-$3.10 in Q2. This reflects strong cost control and non-COVID performance.

COVID Revenue De-Risked: FY25 revenue guidance remains $61B-$64B. However, Q3 management noted “softness” in COVID products and stated the raised EPS guidance “substantially de-risks the current lower-than-anticipated COVID trends”.

2026 Dilution Flagged: Management provided an early look at 2026, flagging expected Adj. EPS dilution of ~$0.16 from the pending Metsera deal, ~$0.05 from the 3SBio deal, and an unquantified “dilutive impact” from the new US government agreement.

Pipeline Investment: Pfizer is spending to build its pipeline. It closed the 3SBio (oncology) deal in Q3 and is funding the Metsera acquisition, signaling a clear strategy to acquire external R&D.

Cost Savings On Track: The $4.5B net cost saving program is on track to be delivered by year-end 2025, with the total $7.7B target by 2027 unchanged. This efficiency is funding the EPS beats.

Leverage Target Reversal: After lowering the gross leverage target from 3.25x to 2.7x in Q2, management stated in Q3 that the Metsera deal will push leverage above the 2.7x target temporarily.

Key Pipeline Updates: Q3 saw very strong Phase 3 data for Padcev in muscle-invasive bladder cancer. However, the next-gen 25-valent adult PCV vaccine’s Phase 3 start was delayed from 2025 to 2026, pending FDA alignment.

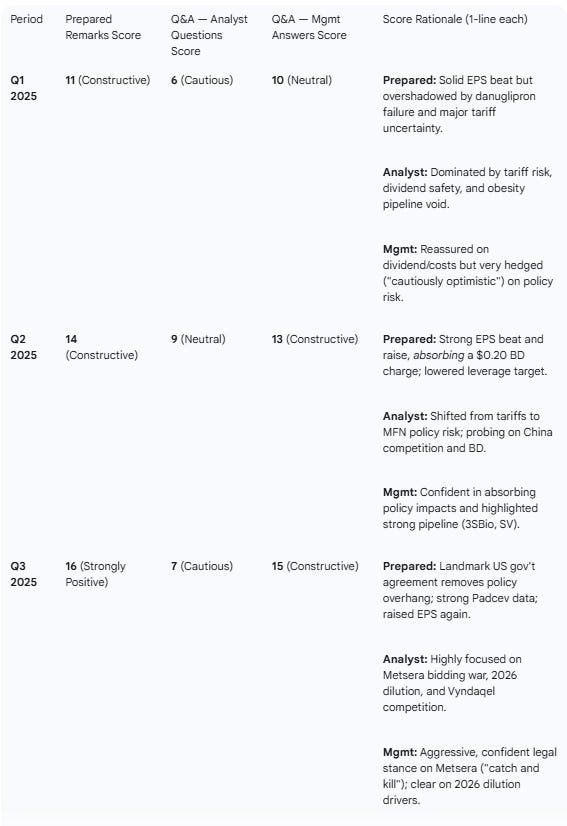

Analyst Focus Shift: Q&A focus has dramatically evolved: Q1 was dominated by tariff risk and the danuglipron failure; Q2 shifted to MFN policy and the 3SBio deal; Q3 was almost entirely focused on the Metsera bidding war.

Table 1: Results & YoY Growth (Stacked)

Table 2: Guidance & Long-Term Goals Evolution

Management’s Key Forward-Looking Quotes (Most Recent First):

Q3 2025:

“I’d like to emphasize our adjusted diluted earnings per share guidance substantially de-risks the current lower-than-anticipated COVID trends.”

“Specifically, we currently expect the Metsera transaction to be approximately $0.16 dilutive to 2026 adjusted EPS.” (Also noted $0.05 dilution from 3SBio).

Q2 2025:

“...we are raising our full year ‘25 Adjusted diluted earnings per share guidance by $0.10. This includes absorbing a $0.20 charge for acquired in-process R&D associated with the upfront payment for the 3SBio transaction.”

Q1 2025:

“...excluding the potential impact related to future tariffs and trade policy changes, we are currently trending toward the upper end of our Adjusted diluted earnings per share guidance.”

Table 3: Sentiment (0–20 Scale)

Management’s Key Themes (Prepared Remarks)

Q3 2025 (Most Recent)

M&A & Policy Resolution (Dominant Themes):

Metsera Acquisition: Management aggressively defended the proposed acquisition, stating, “We believe that Novo Nordisk offer is illusory and cannot constitute superior proposal... it violates antitrust laws”. They noted the “unprecedented” early FTC termination clears the path for the deal.

US Government Agreement: A “landmark agreement” was announced, which “removes uncertainty on two critical policy fronts”. This includes a “three-year grace period from certain US tariffs” in exchange for US manufacturing investment.

Pipeline Advancement:

Oncology (3SBio): Highlighted the 3SBio (SSGJ-707) deal, noting “deep experience” in development and plans to leverage “unique combination regimens”.

Oncology (Padcev): Touting new Phase 3 data showing Padcev + pembro “reduced the risk of recurrence and death by at least half” in certain muscle-invasive bladder cancer patients.

Financial Execution:

Guidance: “Our business is performing well and we are raising the range of our adjusted diluted EPS guidance for full-year 2025, while also remaining committed to our dividend.”.

Cost Control: “By committing to focus simplification and leveraging technology across our business, we are accelerating progress and improving productivity.”.

Commercial Performance:

Non-COVID: Solid non-COVID growth (+4% op.) driven by key brands like Nurtec (+22% op.) and international Prevnar (+17% op.).

COVID: Acknowledged revenue decline due to “lower infection rates”.

Q2 2025

Strong Financial Performance:

“With our strong year-to-date performance, we are raising our Adjusted diluted EPS guidance for full-year 2025...”. This raise “includes absorbing a $0.20 charge for acquired in-process R&D associated with the upfront payment for the 3SBio transaction”.

Capital Allocation & Balance Sheet:

“Our gross leverage at the end of the second quarter was approximately 2.7 times, which we are now setting as our new target, down from 3.25 times.”.

Pipeline (BD & Internal):

3SBio Deal: Announced the in-licensing of SSGJ-707 (PD-1/VEGF bispecific) from 3SBio, calling it a “seamless fit within Pfizer’s oncology strategy”.

Seagen Assets: Highlighted Sigvotatug vedotin (SV) as a “driver of growth later this decade” and ELREXFIO’s potential to “increase the addressable population, approximately fivefold”.

Policy Navigation:

“...the company’s guidance absorbs the impact of the currently imposed tariffs from China, Canada and Mexico as well as potential price changes this year based on the letter received on July 31 from President Trump.”.

Q1 2025

R&D Productivity & Pipeline Reset:

“Now, I will turn to our top strategic priority in 2025, improving R&D productivity...”.

“Discontinuing the development of danuglipron, one of the candidates in our obesity portfolio, although difficult, was the right decision for the company.”.

Cost Savings Program:

“...we remain on track to deliver on our goal of at least $4.5 billion in cumulative net cost savings... by the end of this year.”.

Announced an additional $1.2B in net savings by 2027 and $500M in R&D (to be reinvested), for a total of $7.7B in savings.

Policy Uncertainty (Tariffs):

“The pharmaceutical industry is currently navigating a complex global landscape shaped by rapidly evolving trade and tariff policies.”.

“Let me now spend a few minutes on our 2025 guidance which remains unchanged, and to be clear, does not include the potential impact of future changes in trade and tariff policies.”.

Analyst Q&A Themes & Evolution

The focus of analyst questioning shifted significantly across the three quarters, moving from external risks to proactive strategy and M&A battles.

Q3 2025 (Most Recent):

Metsera Bidding War (Dominant): This topic overshadowed all others. Analysts sought clarity on the legal process, Pfizer’s backup plan if the deal fails, the strategic rationale given the “me-too” appearance of the assets, and the justification for the price given pricing pressure in the obesity class.

Commercial Competition: Analysts probed the sequential decline in Vyndaqel sales, forcing management to explain the offset between strong TRx volume growth and new gross-to-net (GTN) headwinds from payer contracting.

2026 Dilution: Analysts asked for framing on 2026 guidance, specifically the impact of the MFN (US Gov’t) deal. Management confirmed dilution from the agreement and new BD but deferred full guidance.

Q2 2025:

MFN (Most Favored Nation) Policy: The dominant policy theme shifted from tariffs (Q1) to the new MFN letter from President Trump. Analysts asked how Pfizer’s guidance absorbed this new risk.

BD Strategy & Capacity: With the 3SBio deal announced, analysts focused on Pfizer’s remaining BD capacity (guided to ~$13B), leverage target (lowered to 2.7x), and future M&A priorities, especially obesity.

China Competition: A new theme emerged, with analysts asking about the threat from Chinese biotechs and the optics of in-licensing from China (3SBio) amid policy tensions.

Seagen Integration: Analysts probed the value drivers of the Seagen deal beyond Padcev, focusing on pipeline assets like SV.

Q1 2025:

Tariff Risk (Dominant): This was the primary theme. Analysts repeatedly pushed for quantification of the risk from the “232 investigation”, which management declined to provide, stating guidance did not include future tariff impacts.

Dividend Safety: Following the stock’s weakness, analysts directly questioned the dividend’s safety. Management was firm: “the dividend remains a critical component”.

Obesity Pipeline Void: Following the discontinuation of danuglipron, analysts pushed for the “go-forward” strategy in obesity and what Pfizer was looking for in external assets.

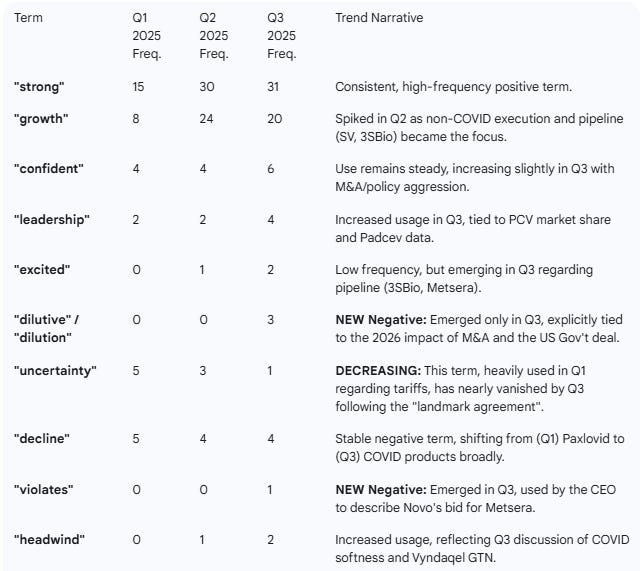

Term Frequency Tracking (Selected Terms)

This table tracks the frequency of 5 positive and 5 negative terms identified in the most recent (Q3 2025) transcript, showing their usage across all three calls.

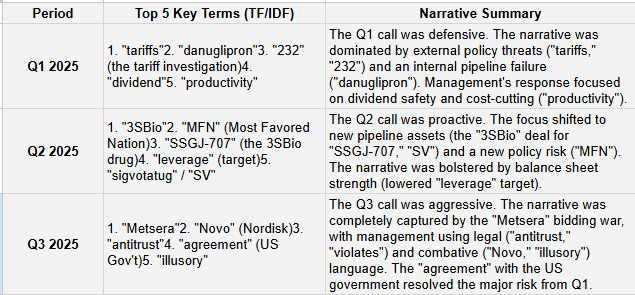

TF/IDF Key Term Evolution (Top 5 Important Terms)

TF/IDF (Term Frequency-Inverse Document Frequency) identifies terms that are uniquely important to each specific transcript, revealing the central theme of each call.

Red Flags & Open Questions (from Q3 2025 Transcript)

M&A Execution Risk: The Metsera deal is now in a public, contested battle. Management is using highly aggressive legal language (”violates antitrust”, “catch and kill”). This introduces significant execution, legal, and financial risk.

Material 2026 Dilution: Management has explicitly guided to three separate dilutive impacts for 2026: ~$0.16 from Metsera, ~$0.05 from 3SBio, and an unquantified “dilutive impact” from the US Gov’t agreement. The cumulative impact is a key open question for the 2026 guidance.

Pipeline Delay (PCV-25): The adult 25-valent pneumococcal vaccine Phase 3 start, previously set for 2025, has been delayed to 2026. The new caveat, “if the FDA aligns with our approach”, suggests potential regulatory uncertainty or a change in development strategy that was not present in prior commentary.

Leverage Reversal: After management celebrated lowering the gross leverage target to 2.7x in Q2, they confirmed in Q3 that the Metsera deal “is expected to be above the 2.7 times target”. This temporarily reverses the deleveraging progress.

Vyndaqel GTN Headwinds: While management stressed strong volume/demand for Vyndaqel, they confirmed in the Q&A that this volume growth was “offset by two gross-to-net headwinds”, including new “payer contracting”. This indicates intensifying pricing/rebate pressure.

COVID Franchise Softness: Management clearly stated “softness in our COVID products” and “lower-than-anticipated COVID trends”. While the EPS guide was de-risked, the low end of the $61B-$64B revenue range is now dependent on this weak trend.

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis