Paypal (PYPL) Earnings Call Insights and the inside running on the new CEO

The stock, now on lowest P/E on record and 17% FCF yield, is anticipating additional (large) downgrades. This report analyzes the earnings call and an investigation into the new CEO.

The following report was generated with the Earnings Call Transcript Analysis workflow and associated follow-on research from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Back in November ‘25, I wrote a detailed post examining what was happening to the PYPL share price. After an upbeat Q3 result and call which saw the stock rally 10%, it fell 23% over the following 3 weeks. This seemed at odds with management’s statements at the Q3 result and aligned with the timing of PYPL’s likely post results roadshow where clearly insto’s were hearing a far more negative story than managements speech at Q3. So I undertook to find out what was going on. I was not a holder of PYPL at the time but it was on my turnaround watchlist.

You can read the article linked, but it unearthed issues with the FY26 guidance at the time that have now come home to roost and have taken the head of the CEO. My largest mistake was to think that the issues were “in the price”. I hate that statement when sales traders throw it at me because it smacks of a lack of detail - “what issues, what magnitude?”. However I fell into the trap of still believing in the medium term turnaround guidance and bought a very small position. Thats in the past and I still hold it today because its a small starter that keeps me focused. I’ve abandoned stocks in the past in similar disgust, only to regret that decision later when issues are handled by new management.

So what are the issues that have been revealed in this result, who is the new CEO, does he have the skills to turn the business around and what do analysts think right now"? All this is analyzed below, using the Inferential Investors AI workflows to anchor the research:

1. Executive Summary

Strategic Pivot & Leadership Shock: In Q4’25, PayPal announced the sudden departure of CEO Alex Chriss, appointing Enrique Lores as the new CEO (effective March 1, 2026). The Board cited execution speed and focus as the primary drivers for the change.

Guidance Reset & Withdrawal: Management withdrew the multi-year 2027 outlook provided at Investor Day, citing a “more demanding environment” and execution lags.

Branded Checkout Deceleration: Online Branded Checkout TPV growth decelerated significantly from 5% in Q3’25 to 1% in Q4’25 (currency-neutral), driven by U.S. retail weakness, competition, and slower product deployment.

2026 Outlook is Cautious: The preliminary 2026 guide forecasts low-single-digit revenue growth and flat-to-slightly down Transaction Margin (TM) dollars, reflecting a “transition year” of heavy investment.

Venmo & PSP Strength: Despite branded weakness, Venmo revenue grew ~20% in 2025, and Enterprise Payments (PSP) returned to double-digit volume growth in Q4.

Investment Ramp: Management plans ~3 points of headwind to TM dollar growth in 2026 from targeted investments in experience, presentment, and selection (rewards).

Sentiment Shift: Tone shifted dramatically from “operating from a position of strength” in Q3 to “execution has not been what it needs to be” in Q4.

Capital Allocation: Share repurchases remain a priority ($6B in 2025; ~$6B guided for 2026), alongside a newly initiated dividend.

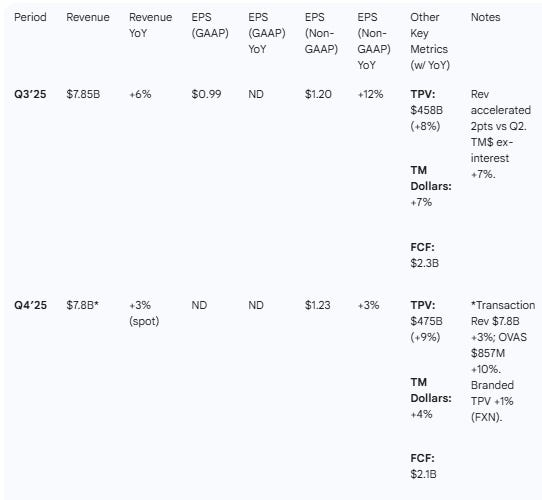

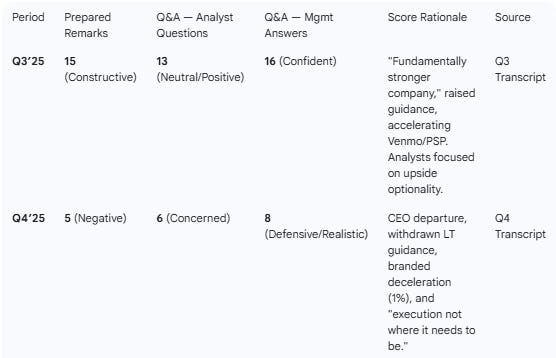

2. Results & YoY Growth

Table 1 — Results & YoY Growth

Note: Q4 Revenue is derived from Transaction Revenue ($7.8B) + OVAS ($857M) explicitly cited in text, totaling ~$8.66B. However, the transcript explicitly states “4Q revenue grew 4%... Full year revenue... $33.2 billion” [Q4, p.9]. Text above uses the specific line items cited.

Table 2 — Operational & Segment Metrics

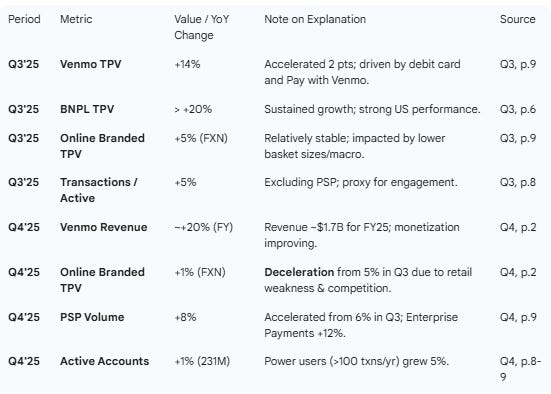

3. Guidance & Goals Evolution

Table 3 — Guidance & Goals Evolution

Management Forward-Looking Quotes (Q4’25):

“We are no longer committing to the specific outlook for 2027 we laid out at Investor Day last year.” [Q4, p.7]

“For 2026, we expect these targeted growth investments to represent approximately 3 points of headwind to TM dollar growth.” [Q4, p.9-10]

“Our guidance reflects slightly positive to low-single-digit branded checkout growth for the full year [2026] as we rebuild the momentum.” [Q4, p.10]

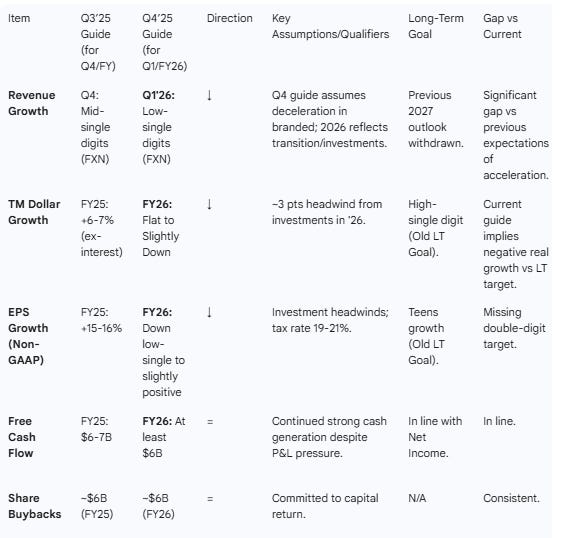

4. Sentiment Scoring (0–20)

Table 4 — Sentiment Analysis

This is about the sharpest decline in sentiment I’ve seen on a stock since running these analyses. It raises the risk of further downgrades as remedial actions are never without cost.

5. Thematic Summary (Prepared Remarks)

Q3 2025: “Stabilization to Acceleration”

Growth Drivers: Venmo and BNPL were highlighted as key accelerators. Venmo revenue grew >20% and TPV +14%. BNPL TPV grew >20%.

Quote: “PayPal is a fundamentally stronger company today than it was two years ago... focus and execution have enabled us to drive a positive inflection.” [Q3, p.3]

Strategy: Heavy focus on “Anywhere, Everywhere” (Omnichannel). Launched “PayPal Everywhere” in the US.

Quote: “Our strategy is to meet our customers everywhere they shop, whether online, in-store or agentic.” [Q3, p.4]

Margins: TM dollar growth was broad-based across Branded, PSP, and Venmo.

Quote: “Our TM dollar growth... is coming from a far more balanced mix across our business.” [Q3, p.3]

Capital Allocation: Initiated a dividend for the first time alongside buybacks.

Quote: “I’m also excited to announce that we are initiating a dividend.” [Q3, p.3]

Q4 2025: “Execution Reality Check”

Challenges (Branded Checkout): Online branded checkout decelerated sharply to 1% growth. Management cited US retail weakness, international headwinds (Germany), and slow product deployment.

Quote: “We have not moved fast enough or with the level of focus required... branded checkout TPV grew 1%... down from 5%.” [Q4, p.2]

Management Change: The Board replaced CEO Alex Chriss with Enrique Lores to “accelerate execution.”

Quote: “Our execution has not been what it needs to be... The Board’s appointment of Enrique reflects a clear commitment to strengthening performance.” [Q4, p.2]

Strategic Pivot: Focus shifted to “Strategic Merchants” (top 25% of volume) rather than broad deployment. Priorities narrowed to Experience, Presentment, and Selection.

Quote: “We were too optimistic about how quickly we could drive change... To date, we’ve been optimizing for every merchant, and that approach has slowed our ability.” [Q4, p.2, 4]

2026 Investment Year: 2026 is framed as a reset year with heavy investment in rewards (PayPal Plus) and checkout integration.

Quote: “We are no longer committing to the specific outlook for 2027... we think it’s prudent for now to provide financial guidance 1 year at a time.” [Q4, p.7]

Changes in Management Commentary (Q4 vs Q3):

The narrative collapsed from a successful turnaround story in Q3 to an admission of execution failure in Q4. In Q3, management claimed they had moved from “defense to offense.” By Q4, the language reverted to “stabilize and strengthen,” acknowledging that product rollouts (Fastlane, biometric checkout) were slower than planned and that merchants required more “hands-on” support than anticipated. The confidence in the 2027 targets evaporated, leading to their withdrawal.

6. Q&A Summary (Q4 2025)

Dominant Theme: CEO Change & Structural Issues in Branded Checkout.

Topic: CEO Change Rationale

Question (Tien-Tsin Huang, JPM): Is the CEO change primarily for execution or strategy? Is there a risk of wholesale strategy change?

Answer (Jamie Miller): The decision is based on execution. Progress in innovation is good, but “execution is just too slow.” Enrique Lores (incoming CEO) brings disciplined execution and deep context as former Chair.

Topic: Branded Checkout Adoption Issues

Question (Ramsey El-Assal, Cantor): Why is merchant adoption slow? Is it incentives or competition?

Answer (Jamie Miller): We were trying to do it “across all merchants all at the same time.” Now shifting to dedicated teams for strategic merchants. Requires combining latest integration with upstream presentment (BNPL buttons) and co-marketing.

Topic: Timeline for Improvement

Question (Darrin Peller, Wolfe): When will TM dollars improve? Back half of 2026?

Answer (Steven Winoker): Investments hit Q1 and continue through the year. Not calling for a back-end loaded year; guidance is flat/slight decline for full year.

Topic: 2026 Guidance & Transition

Question (Sanjay Sakhrani, KBW): What parts can turn the corner in 2026? Was Enrique involved in setting the guide?

Answer (Steve Winoker/Jamie Miller): 2026 assumes ~3% Opex growth and ~3pt TM headwind from investment. Enrique was “deeply involved” in setting the guide and strategy.

Topic: Competition & Price

Question (Harshita Rawat, Bernstein): Can branded turn around given intensified competition? Can you grow earnings if branded doesn’t improve?

Answer (Jamie Miller): Even with low-single-digit branded growth in 2025, PYPL delivered mid-teens EPS growth. Diversified assets (Venmo, PSP) allow for growth even if branded is slow.

7. Term Frequency Tracking

Most Negative Terms (Q4 ‘25 Context):

“Slower” / “Slowed” (Used to describe execution and deployment)

“Headwinds” (referencing Germany, Travel, Retail)

“Weakness” (US Retail)

“Decline” (TM dollars guidance)

“Gap” (Narrowing the gap with market growth)

Most Positive Terms (Q4 ‘25 Context):

“Venmo” (Strong monetization growth)

“PSP” (Profitability improvement)

“Dividend” (Capital return)

“Biometric” (Conversion lift driver)

“Agentic” (Future growth vector)

TF/IDF Evolution (Q3 to Q4):

Q3: “Omnichannel,” “Inflection,” “Acceleration,” “Dividend,” “Everywhere.”

Q4: “Execution,” “Enrique,” “Presentment,” “Headwind,” “Strategic Merchants.”

Narrative Shift: The terminology shifted from “Expansion/Acceleration” (Q3) to “Correction/Execution/Focus” (Q4). The high frequency of “Execution” in Q4 correlates with the CEO change explanation.

8. Red Flags & Open Questions

Red Flag: Withdrawal of 2027 Outlook: A major capitulation on long-term targets less than a year after Investor Day suggests internal models were significantly off or market conditions have deteriorated beyond the company’s ability to adapt quickly.

Red Flag: Branded Checkout Deceleration: Dropping to 1% growth implies PayPal is losing significant market share in e-commerce, which is generally growing mid-to-high single digits.

Red Flag: “Execution” Issues: The repeated admission that “execution has not been what it needs to be” raises concerns about the company’s cultural ability to ship product updates (e.g., Fastlane, Biometrics) at the speed of competitors like Apple Pay or Stripe.

Red Flag: Tax Rate Headwind: Q4 EPS missed partly due to “higher-than-expected tax rate,” and 2026 guides for 19-21%, a structural headwind to earnings.

Open Question: Will the new CEO (Enrique Lores) undertake a restructuring or cost-cutting exercise beyond what has already been done?

9. Implications for the Stock

A. Result Composition vs Expectations:

The Q4 result falls significantly short of expectations. While EPS grew 3%, the core growth engine (Branded Checkout) nearly stalled (1% growth). The guidance for 2026 (flat/down TM dollars) is a stark contrast to the “acceleration” narrative pitched in Q3.

B. Areas of Outperformance/Underperformance:

Outperformance: Venmo (revenue +20%) and PSP (volume +12%) are performing well.

Underperformance: Online Branded Checkout is the critical failure point. The “flywheel” is not spinning fast enough to offset macro/competitive pressures.

C. Implications for Next Period:

Expect downward revisions for Q1 and FY26 estimates. Revenue growth is guided to low-single digits (anemic for a tech/fintech play), and earnings growth is essentially paused to fund investments.

Who is the new CEO, Enrique Lores?

Enrique Lores is a seasoned technology executive best known for his long tenure at HP Inc., where he rose from an intern to President and CEO. He has recently been appointed as the next President and CEO of PayPal, effective March 1, 2026.

Prior to his appointment at PayPal, Lores served as the CEO of HP Inc. starting in November 2019. He is recognized for his operational discipline and for architecting complex corporate transformations, most notably the historic split of Hewlett-Packard Company in 2015.

Enrique Lores: Curriculum Vitae

Summary

A global business leader with over 30 years of experience in the technology sector. Known for driving strategic transformations, simplifying complex organizations, and leading large-scale mergers and acquisitions.

Professional Experience

PayPal Holdings, Inc.

Incoming President & CEO (Effective March 1, 2026)

Chair of the Board (July 2024 – Feb 2026)

Board Member (Served on the board for nearly 5 years prior to appointment as CEO)

HP Inc. (formerly Hewlett-Packard)

President & CEO (Nov 2019 – Feb 2026)

Led a Fortune 100 company with operations in over 170 countries.

Executed a strategy focused on modernizing the core business, expanding into adjacent markets, and driving digital transformation.

President, Imaging, Printing & Solutions (2015 – 2019)

Led the company’s largest and most profitable business segment ($20B+ revenue).

Oversaw the acquisition of Samsung’s printer business in 2017.

Separation Management Office Leader (2014 – 2015)

Key architect of the split of Hewlett-Packard into two Fortune 50 companies (HP Inc. and Hewlett Packard Enterprise).

Senior Vice President & General Manager, Business Personal Systems (2013 – 2014)

Senior Vice President, Worldwide Customer Support & Services (2011 – 2013)

Senior Vice President, Worldwide Sales & Solutions Partner Organization (2008 – 2011)

Vice President & General Manager, Large Format Printing (2003 – 2008)

Various Engineering & Leadership Roles (1989 – 2003)

Began career as an engineering intern in 1989.

Education

MBA, ESADE Business School (Barcelona, Spain)

Degree in Electrical Engineering, Polytechnic University of Valencia (Spain)

Board & Advisory Memberships

PayPal Holdings, Inc. (Board of Directors)

Silicon Valley Leadership Group (Board Member)

ESADE Business School (International Advisory Board)

Atlantic Council (International Advisory Board)

Business Roundtable (Member)

World Economic Forum (International Business Council)

Tenure at HP Inc:

Under Enrique Lores’s leadership as CEO of HP Inc. (November 1, 2019 – February 2026), the company’s share price experienced significant volatility, effectively “round-tripping” from its starting level to a peak during the pandemic, before falling back to near its initial price by the time of his departure.

Share Price Performance (Nov 2019 – Feb 2026)

Start of Tenure: On November 1, 2019, when Lores officially took over as CEO, HP Inc. (HPQ) stock was trading at approximately $17.78.

Peak Performance: The stock rallied significantly during the COVID-19 pandemic, driven by a surge in demand for PCs and printers. It reached all-time highs in the $35–$40 range at various points between 2022 and 2025.

End of Tenure: Following news of his departure for PayPal in early February 2026, HP shares traded in the $18.80–$19.80 range.

Overall Return: The share price appreciation over his ~6-year tenure was minimal, showing a nominal gain of roughly 6% to 11% (excluding dividends). This represents a significant underperformance compared to the broader technology sector and S&P 500 during the same period.

Key Drivers & Capital Allocation

Aggressive Buybacks: While the share price remained relatively flat over the full tenure, Lores pursued an aggressive capital return strategy. Under his leadership, HP committed to repurchasing at least $1 billion in shares per quarter for extended periods to support the stock price and improve earnings per share (EPS). In Fiscal 2025 alone, the company returned 66% of its free cash flow to shareholders through dividends and buybacks.

Market Context: The stock’s performance was heavily influenced by the cyclical nature of the PC market. After the pandemic-driven boom, the company faced “slowing demand,” “rising costs,” and a “normalization” of the hardware market, which weighed heavily on the stock in his final years.

Dividends: HP maintained and increased its dividend during his tenure (e.g., to $0.30 per share in late 2025), meaning the Total Shareholder Return (TSR) would be higher than the price return alone, though still lagging the broader market.

Reaction to Departure

Upon the announcement of his resignation to join PayPal on February 3, 2026, HP Inc. shares fell approximately 5.5%, with analysts citing increased “execution risk” during the transition.

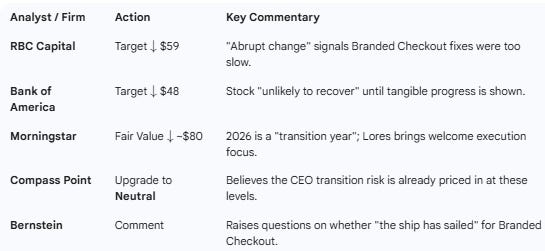

How have analysts reacted to the news of the new CEO appointment?

The reaction from analysts to the appointment of Enrique Lores has been overshadowed by the simultaneous release of weak guidance, resulting in a sharply negative immediate market response. While Lores is respected for his operational discipline at HP, analysts have largely viewed his appointment as a signal of a prolonged “transition period” rather than a quick fix.

The stock plummeted ~20% following the announcement, and analyst reactions can be categorized into three main themes:

1. Widespread Price Target Cuts & Downgrades

Most analysts reacted by slashing price targets, viewing the leadership change—coupled with the withdrawal of 2027 financial targets—as a sign that the turnaround will take much longer than anticipated.

RBC Capital: Slashed its price target from $91 to $59, citing the “abrupt CEO change” as a signal that the pace of change in Branded Checkout was moving too slowly.

Bank of America: Cut its target from $68 to $48, stating that “most of the damage is done” but the stock is unlikely to recover until new leadership demonstrates tangible progress.

HSBC & Canaccord Genuity: Both downgraded the stock to Hold, with Canaccord lowering its target to $42, expressing concern over e-commerce share losses.

Morningstar: Expects to lower its fair value estimate by ~15% (to roughly $80), noting that while Lores’ experience is a positive, 2026 is now set to be another “transition year”.

2. Cautious Optimism on Lores’ Operational Discipline

Despite the negative stock reaction, some analysts see Lores’ background as a potential long-term positive, specifically regarding cost control and capital return.

Buyback Focus: Some analysts, such as those cited by Bitget, highlighted Lores’ aggressive share repurchase strategy at HP as a blueprint for PayPal. They expect him to use PayPal’s strong free cash flow ($6B+) to aggressively retire shares while the valuation is low.

Execution vs. Innovation: There is a divide in sentiment regarding his skillset. While acknowledged as a “seasoned executive” who focuses on profitability, critics worry he lacks the product innovation background needed to fight agile fintech rivals like Stripe or Apple Pay.

Board Confidence: Morningstar noted appreciation for the Board’s willingness to act quickly to replace Alex Chriss, viewing Lores’ deep context as a Board member (and Chair) as a factor that could shorten his learning curve.

3. Speculation on Strategic Breakups

A notable minority of analysts have interpreted the choice of Lores—who architected the historic split of Hewlett-Packard in 2015—as a signal that structural changes could be on the table.

Potential Split? Analysts at Bernstein and Morningstar discussed whether Lores’ appointment suggests the Board is considering a breakup of the company (e.g., spinning off Venmo or Braintree) to unlock shareholder value, given Lores’ specific experience with the HP/HPE split.

Summary of Sentiment

In short, Wall Street has placed PayPal in the “penalty box,” viewing the CEO change not as a catalyst for immediate growth, but as confirmation that deep execution issues remain unresolved.

Disclosure: the publisher holds a position in PYPL.

Really solid breakdown of the Lores appointment. That branded checkout deceleration (5% to 1%) in one quarter is brutal, especially when ecommerce is still growing mid-single digits. His HP track recrod shows he can manage costs but that stock went sideways for 6 years. The risk here is PYPL becomes acash cow focused on buybacks instead of actually winning back share from competitors.