Nike Inc ($NKE) Q2 FY26 Result and Earnings Call Analysis

Headline beat obscures worse than expected gross margin and China outlook. Turnaround to take longer.

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

Executive Summary

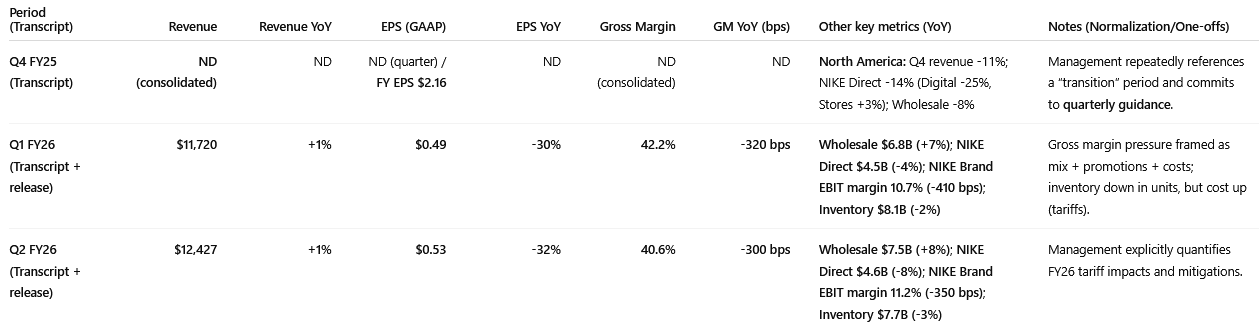

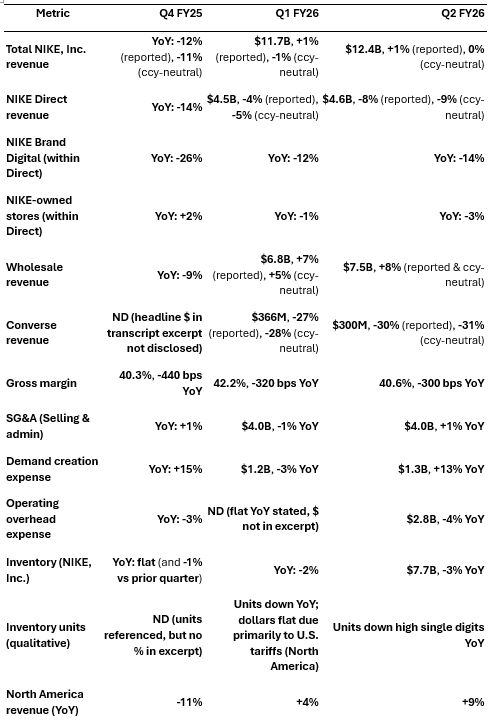

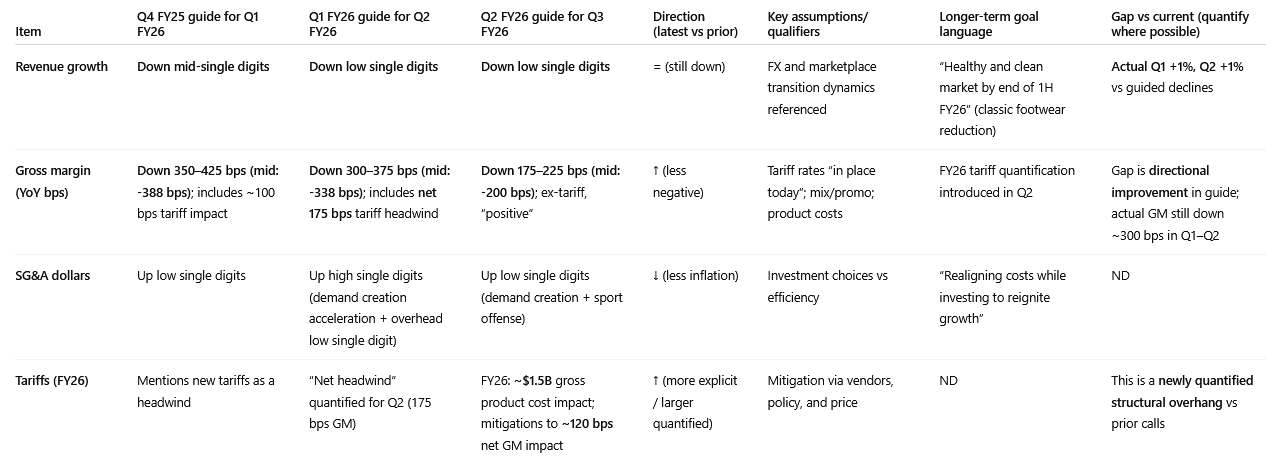

Top line has stabilized faster than management guided. Q1 FY26 and Q2 FY26 revenues each grew ~1% YoY (-0.5% FX neutral), despite the prior call guiding for a decline in each case (Q4 guided Q1 “down mid-single digits,” Q1 guided Q2 “down low single digits”).

The mix shift is the story. Wholesale is growing (Q1 +7% YoY, Q2 +8% YoY), while NIKE Direct is shrinking (Q1 -4% YoY, Q2 -8% YoY). This is consistent with “resetting” NIKE Digital and leaning back into wholesale partners. But the Direct deterioration accelerated.

Profitability is still under pressure. Gross margin fell ~300–320 bps YoY in Q1 and Q2, and EPS fell ~30–32% YoY in both quarters. Q3 guidance is for ~200bps decline in GP margin year over year (while market was expecting a 75bp improvement vs Q3 FY25 - a large gap)

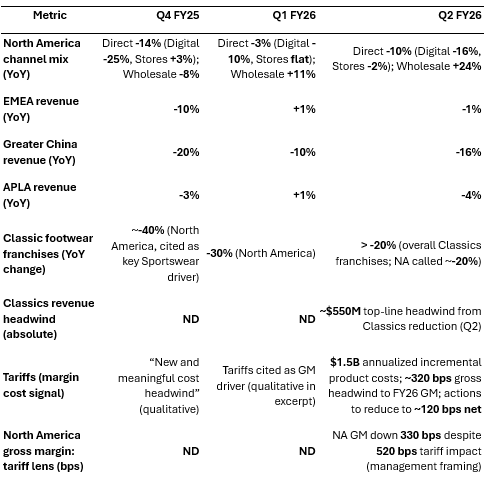

Tariffs continue to be a structural headwind in the narrative and in the math. Management quantified ~$1.5B incremental gross product cost impact in FY26 from “new incremental tariffs,” with mitigations reducing the net impact to ~120 bps of gross margin.

Inventory is being brought down, but “cost per unit” is rising. Inventory was $8.1B (-2% YoY) in Q1 and $7.7B (-3% YoY) in Q2, with both releases citing units down but product costs up, driven by higher tariffs in North America.

Geography is uneven. In both Q1 and Q2, Greater China declined double digits (Q1 -10% YoY, Q2 -16% YoY), while North America grew.

Guidance remains cautious on margins, but implies “less bad” YoY pressure next quarter. Q3 guide: revenue down low single digits, gross margin down ~175–225 bps (and “positive” ex-tariff product-cost impact). Revenue guide is in line with consensus but the margin guide is significantly worse.

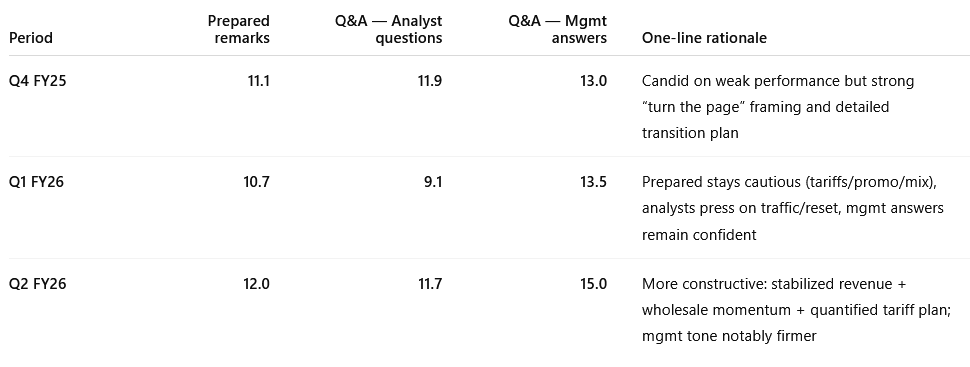

Tone is improving in management answers faster than in analyst questions. Sentiment scoring (0–20) shows Mgmt Q&A improving to the strongest level in Q2, while analyst questions remain probing and cautious around the reset, traffic, margins, China and the path back to growth.

Investor takeaway: Turnaround taking longer than consensus expectations have baked in. Gross margins and China the weak spots both in Q2 and guided for Q3. Consensus downgrades to follow, pushing out the timeline for the earnings rebound. Multiple could face renewed pressure.

Table 1 — Results & YoY Growth (stacked by transcript)

Units: $ in millions unless noted. “ND” = not disclosed in the attached transcript/release.

Source anchors are Transcript/Release + page, and whether it is Prepared or Q&A.

(click to expand)

Table 2 — Operational & Segment Metrics

Table 3 — Guidance & Goals Evolution

Midpoints shown only where numeric ranges are disclosed. Qualitative guides remain qualitative.

(click to expand)

Selected forward-looking quotes (3–5 per period, most recent first):

Q2 FY26: “We expect Q3 revenues to be down low single digits…” (Prepared p.7).

Q2 FY26: “We expect Q3 gross margins to be down approximately 175 to 225 basis points… excluding… tariffs, gross margin expansion would be positive…” (Prepared p.7).

Q2 FY26: “The new incremental tariffs… represent approximately $1.5 billion of incremental costs… net… approximately 120 basis points…” (Prepared p.5).

5) Table 4 — Sentiment (0–20)

Management sentiment is improving but analysts remain cautious with misses on key expectations in margins and China and limited forward visibility being provided.

Thematic Summary (Prepared Remarks)

Q2 FY26 (most recent)

Growth drivers: wholesale momentum and North America stabilization; management explicitly ties reduced liquidation to the Q3 outlook. (Q2 FY26 transcript Prepared p.7).

Challenges: tariffs and ongoing drag in Greater China and Converse called out in the outlook. (Q2 FY26 transcript Prepared p.5, p.7).

Margins: GM pressure continues near-term, but management argues ex-tariff product margin improves (important “quality of improvement” claim). (Q2 FY26 transcript Prepared p.7).

Operations: inventory down YoY with tariff-driven cost inflation partially offsetting unit reductions. (Q2 FY26 earnings release p.2).

Strategy: “sport offense” and marketplace elevation are positioned as the recovery architecture. (Q2 FY26 transcript Prepared p.7).

Q1 FY26

Growth drivers: wholesale returns to growth while direct remains negative, consistent with rebalancing channels. (Q1 FY26 earnings release p.1).

Challenges: gross margin decline and EPS contraction show the reset is still “costly” in near-term earnings. (Q1 FY26 earnings release p.4).

Operations: inventory down in units, costs up (tariffs in North America). (Q1 FY26 earnings release p.2).

Outlook posture: Q2 guide still down on revenue and sharply down on margins. (Q1 FY26 transcript Prepared p.7).

Q4 FY25

“Win Now” actions and classic franchise reduction: management explicitly describes the classic-footwear reduction as a material revenue headwind (“almost a $1 billion headwind” in Q4 from accelerated declines). (Q4 FY25 transcript Prepared p.6).

Geography sequencing: “momentum… building in North America and EMEA,” China “will take longer.” (Q4 FY25 transcript Prepared p.5).

Guidance discipline: commits to quarterly guidance during transition. (Q4 FY25 transcript Prepared p.6).

Q&A Summary — themes and evolution (most recent first)

Q2 FY26 — What analysts pressed, what management answered

Theme: Tariffs and the credibility of mitigation

Analysts explicitly asked whether the $1.5B tariff headwind could be “fully mitigated.” Management responded that mitigation is “largely within our control” but “a significant amount of work.”

Theme: Classic footwear cleanup and gross margin vs promotions

Analysts asked about the “tradeoff” between gross margin and lapping promotions; management described near-term margin dynamics as still pressured by the transition and liquidation.

China:

The CEO indicated that a structural reset is continuing including better retail execution, premium positioning, and new capabilities. The reset is slower than desired. No specific timeline given

Q1 FY26 — Q&A focus shifts to traffic and channel reset execution

Theme: NIKE Digital traffic, marketing effectiveness

Analysts highlighted “negative organic traffic” and asked why paid marketing didn’t offset it; management explained why the reset is “not a linear progression,” pointing to “sharp reductions in supply” and “franchise management.”

Theme: A clearer “path back” vs still a transition

Management emphasizes they are “not going to fly blind” and intends to keep giving quarterly guidance.

Q4 FY25 — Q&A anchored on timing and confidence in returning to growth

Theme: “How do we get back to growth”

Analysts asked directly about returning to growth and why FY26 isn’t expected to. Management answered with sequencing and the idea that progress won’t be “linear.”

Theme: Inventory obsolescence and regional issues (Greater China)

Analysts asked about “inventory obsolescence.” Management acknowledged unique pressures, particularly in Greater China (not contemplated 90 days earlier).

Evolution across calls: The Q&A moves from “timing of return to growth” (Q4) → “proof of execution in digital/traffic and franchise reset” (Q1) → “tariff mitigation credibility and margin quality” (Q2). That sequence is what you would expect when a turnaround narrative shifts from strategy to implementation to exogenous cost shock.

Red Flags & Open Questions (most recent focus)

Tariffs are not a one-quarter issue. Management quantified a large FY26 gross product cost impact and admits it requires “a significant amount of work” to mitigate. The risk is not just the magnitude but the execution dependence. (Q2 FY26 transcript Prepared p.5; Q&A excerpt ).

Margin recovery relies on “ex-tariff” framing. Management argues product margin improves excluding tariff cost impact. Investors should watch whether that improvement shows up in reported gross margin once promotions and mix are accounted for. (Q2 FY26 transcript Prepared p.7).

Digital reset and traffic remain a credibility test. Analysts explicitly called out negative organic traffic and the non-linear nature of the reset. That is usually where turnarounds fail, not in strategy decks but in customer behavior. (Q1 FY26 Q&A excerpt ).

Greater China remains structurally weak in the numbers. Two consecutive double-digit declines, and Q4 commentary that China “will take longer.” (Q1 FY26 earnings release p.2; Q2 FY26 earnings release p.2; Q4 FY25 transcript Prepared p.5).

Disclosure gaps (for this exercise): Q4 FY25 transcript as provided does not disclose consolidated Q4 revenue, consolidated gross margin, or Q4 EPS in the text we can source here. Under your rules, these remain ND and should be verified in the FY25 Q4 earnings release / 10-K (not attached).

Implications for the stock

A) Did the composition meet/exceed/fall short of expectations?

While revenue and EPS beat street estimates, more importantly, Nike Direct and China revenues deteriorated and gross margin and EBIT fell short. Q3 Guidance was for low single digit revenue declines (vs +1% consensus) and gross margins to be down YoY which is ~200bps below street estimates.

B) What exceeded vs fell short (internally, vs guidance and narrative)?

Exceeded: revenue stabilization and wholesale momentum relative to prior guides (Q1 and Q2).

Fell short: gross margin, EBIT and EPS trajectory remain meaningfully negative YoY; tariffs add a new quantified overhang; Greater China is worsening. (Q1/Q2 releases p.2–p.4; Q2 FY26 transcript Prepared p.5).

C) Implications for next-period earnings growth (Q3 FY26)

Q3 guide implies lower revenue and still negative gross margin YoY, but less severe than Q1/Q2 (-175 to -225 bps vs ~-300 bps recently). That points to sequential improvement in margin pressure, though not a return to growth in earnings yet. While sequentially improving, consensus earnings will be revised down as they were expecting better gross margins YoY.

D) Any reason to expect the multiple to change?

A multiple usually expands when the market believes the “E” inflection is near and risks are shrinking. Here, management is trying to sell progress ex-tariffs, but the tariff shock is itself a risk multiplier because it is large and execution-dependent. Net, the transcript evidence supports some improved confidence, but the evidence is not meeting expectations. There is a possibility that Nike’s multiple will continue to derate until the market can see gross margins rebounding and China stabilizing.