Memory Semiconductor Deep Dive: What's happening outside the Tier 1 stocks

How AI is changing the memory sector, elongating the cycle and where the risks lie.

The following report was generated with the assistance of the Thematic and Industry Supply Chain Workflow from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is an indicative and preliminary stock screen, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

A Comprehensive Analysis of the Tier 2 Memory Ecosystem (2025-2026)

Executive Summary

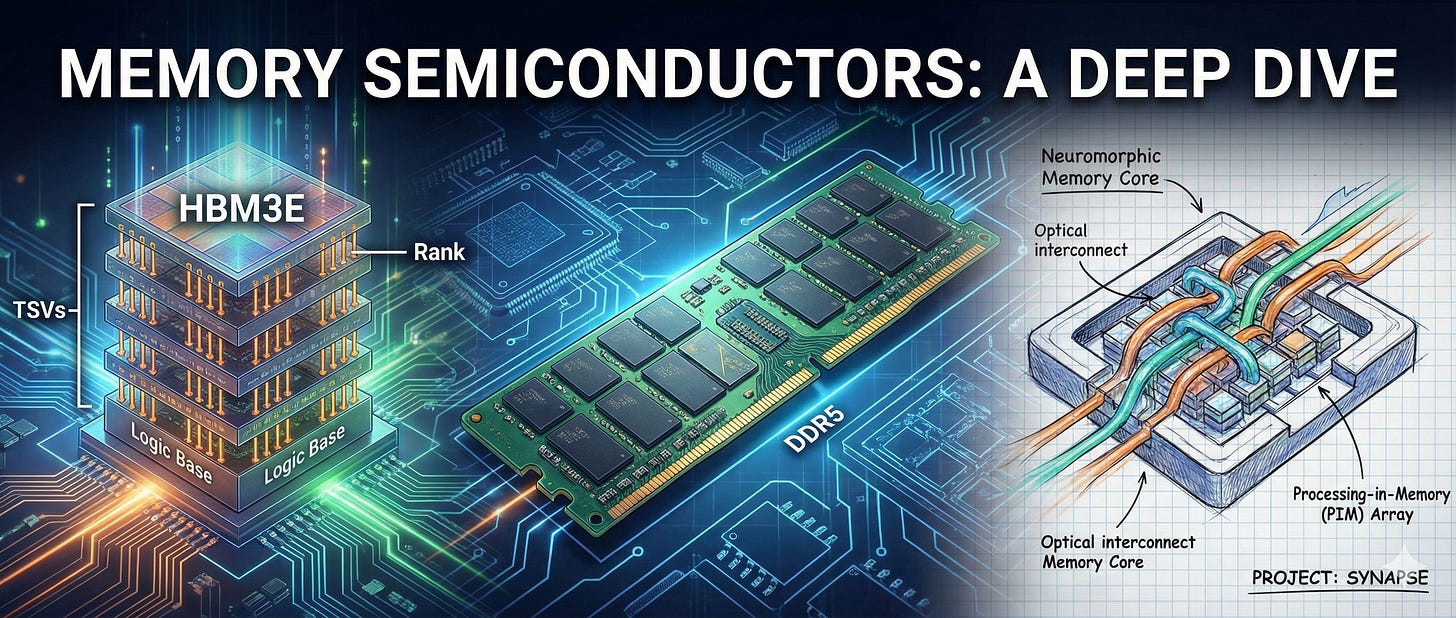

The global semiconductor memory industry is currently navigating a period of unprecedented structural dislocation. For the past decade, the industry narrative has been dictated by the synchronized capex and technology cycles of the “Big Three”—Samsung Electronics, SK Hynix, and Micron Technology. However, the generative AI boom is changing this market structure. As the industry titans aggressively pivot their manufacturing footprint toward High Bandwidth Memory (HBM) to service the insatiable demand of hyperscale AI accelerators, a massive, structural vacuum has formed in the market for standard and specialty memory.

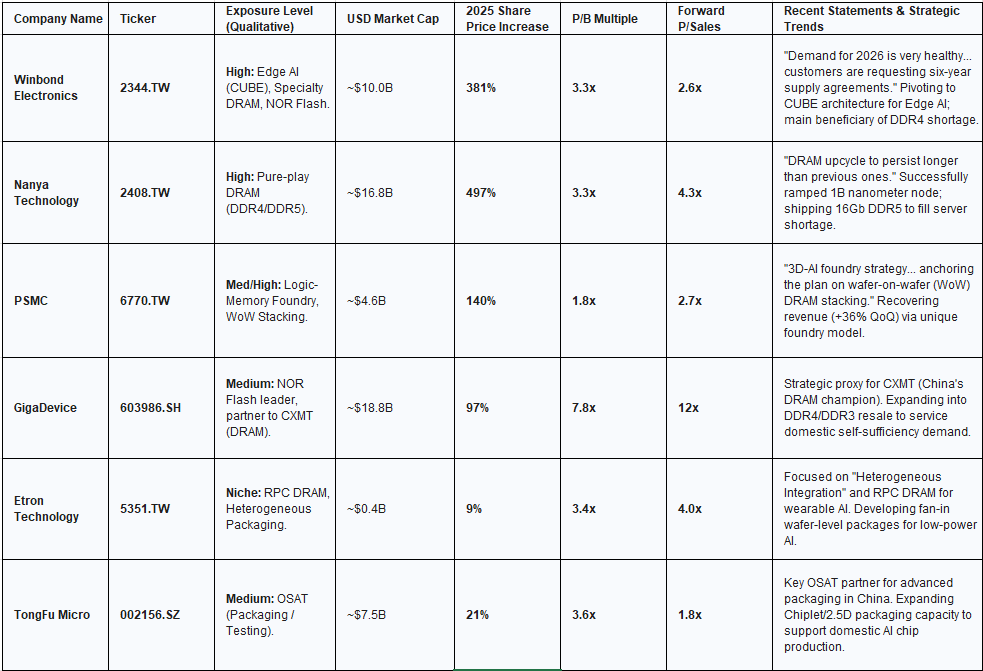

This research report provides a detailed analysis of the “Tier 2” memory ecosystem. These are the independent manufacturers outside the Big Three who are capitalizing on this capacity void. Our analysis indicates that while the headlines belong to HBM, the tide is floating all boats with companies like Winbond Electronics, Nanya Technology, and Powerchip Semiconductor Manufacturing Corp (PSMC) major beneficiaries as well. These firms have already witnessed stock price appreciations ranging from 90% to over 400% year-to-date (YTD) in 2025, driven not by the production of HBM itself, but by the pricing power regaining in the commodity sectors (DDR4, DDR5, LPDDR) that Tier 1 players are pivoting away from.

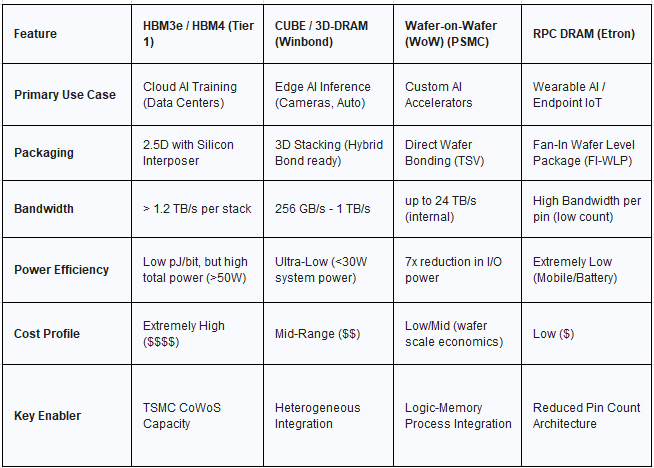

Furthermore, a technological divergence is underway. While Cloud AI demands the raw throughput of HBM, the burgeoning “Edge AI” sector, comprising AI PCs, smartphones, and automotive ADAS, requires a different architectural approach. This report details how Tier 2 players are pioneering alternative high-bandwidth solutions, such as Winbond’s CUBE (Customized Ultra-High Bandwidth Element) and PSMC’s Wafer-on-Wafer (WoW) stacking, which offer HBM-like performance at a fraction of the power and cost.

The following document synthesizes financial data, earnings transcripts, and technical roadmaps from late 2025 to provide a definitive guide to the “Rest of the Memory Market.” It explores the operational exposure, valuation metrics, and strategic outlook for these emerging power players, offering deep insights into the second-order effects of the AI hardware revolution.

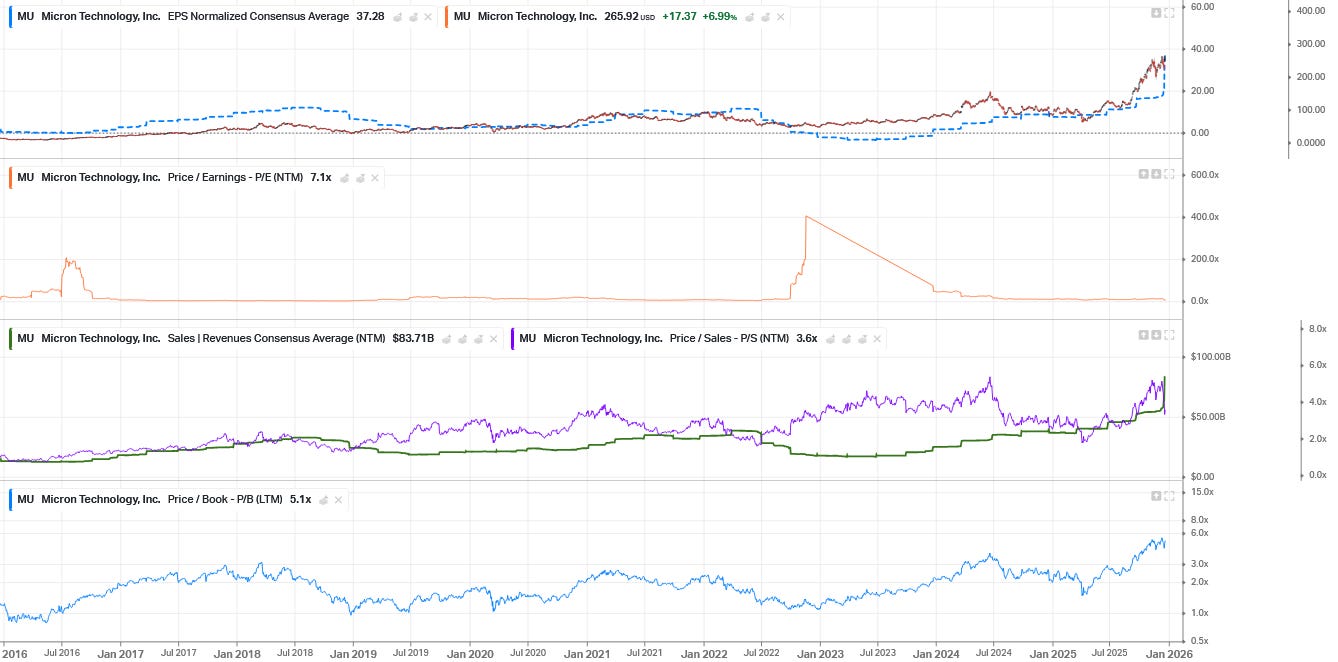

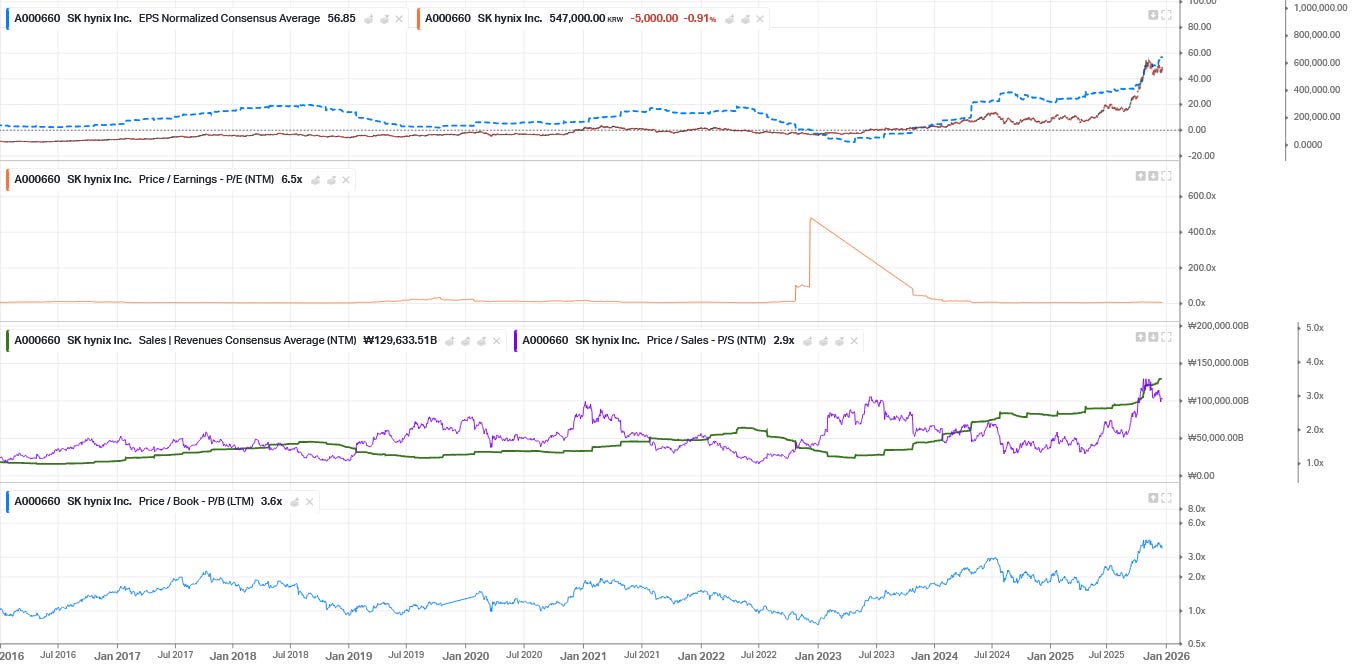

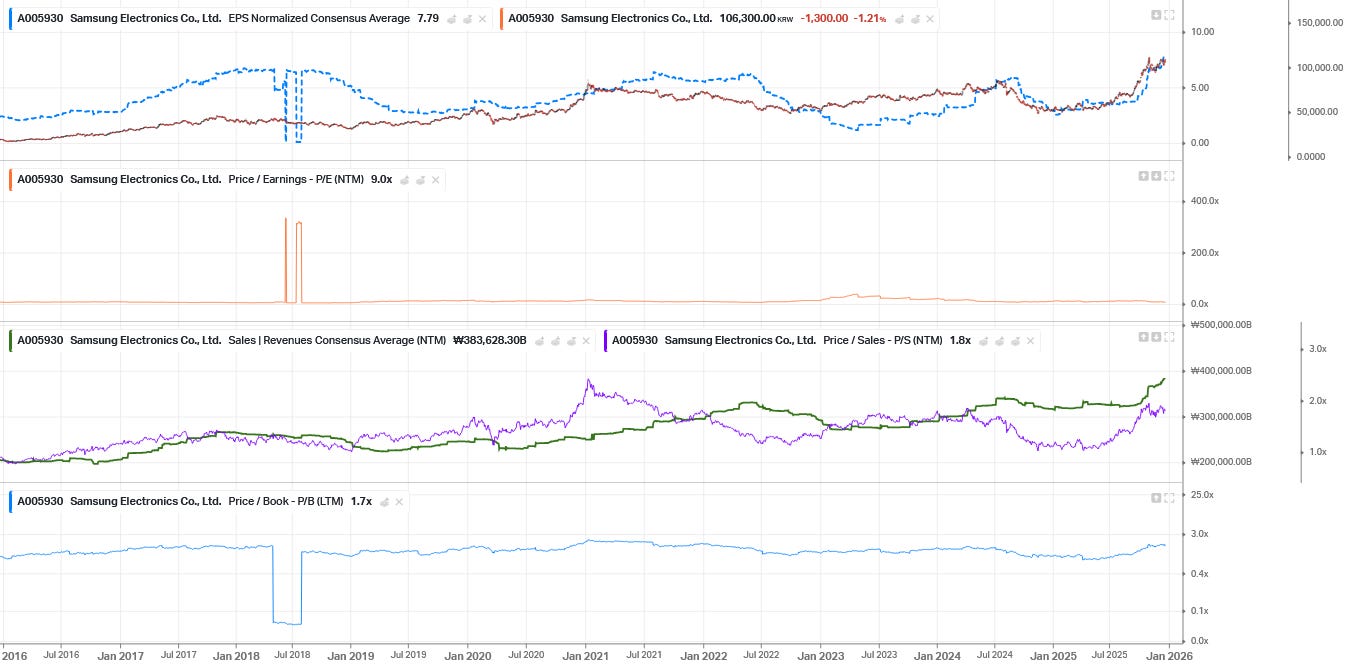

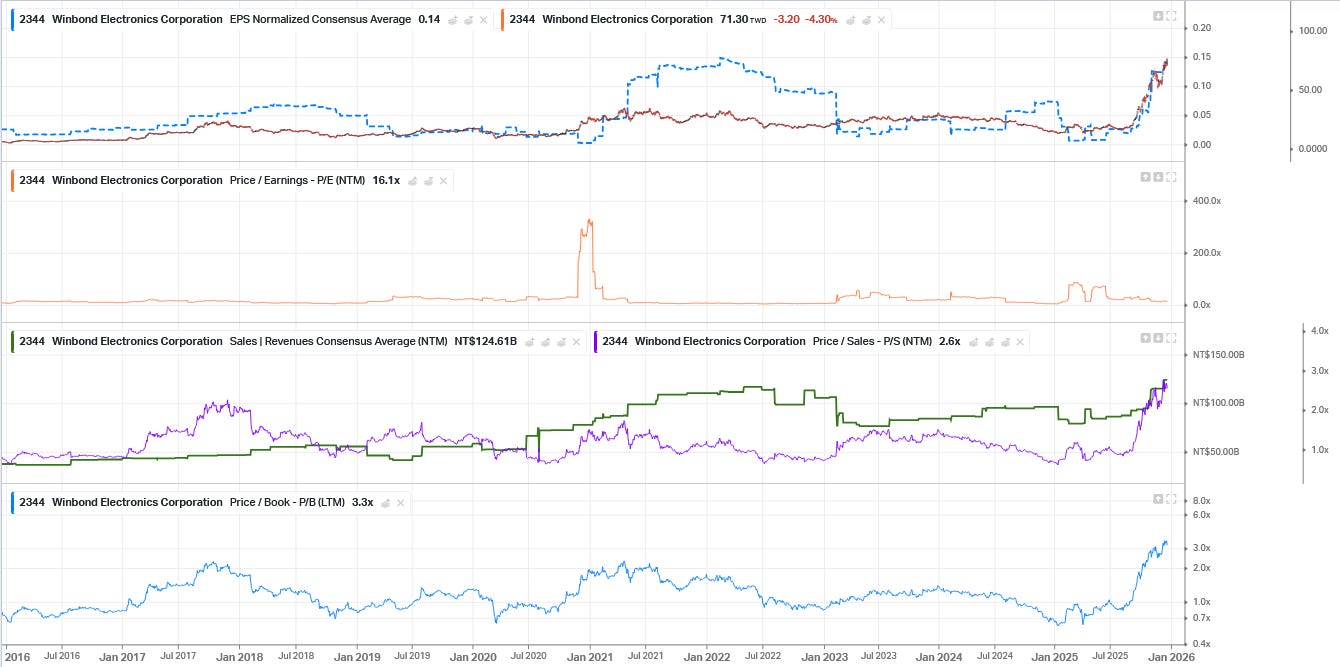

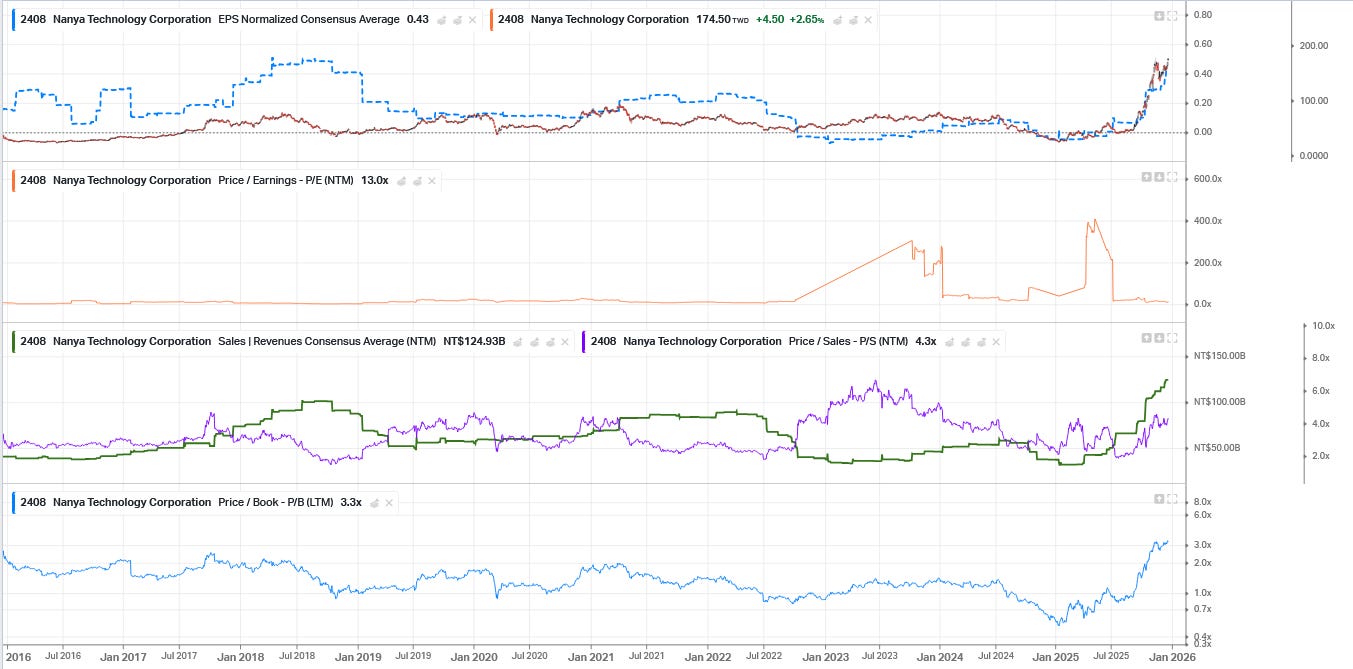

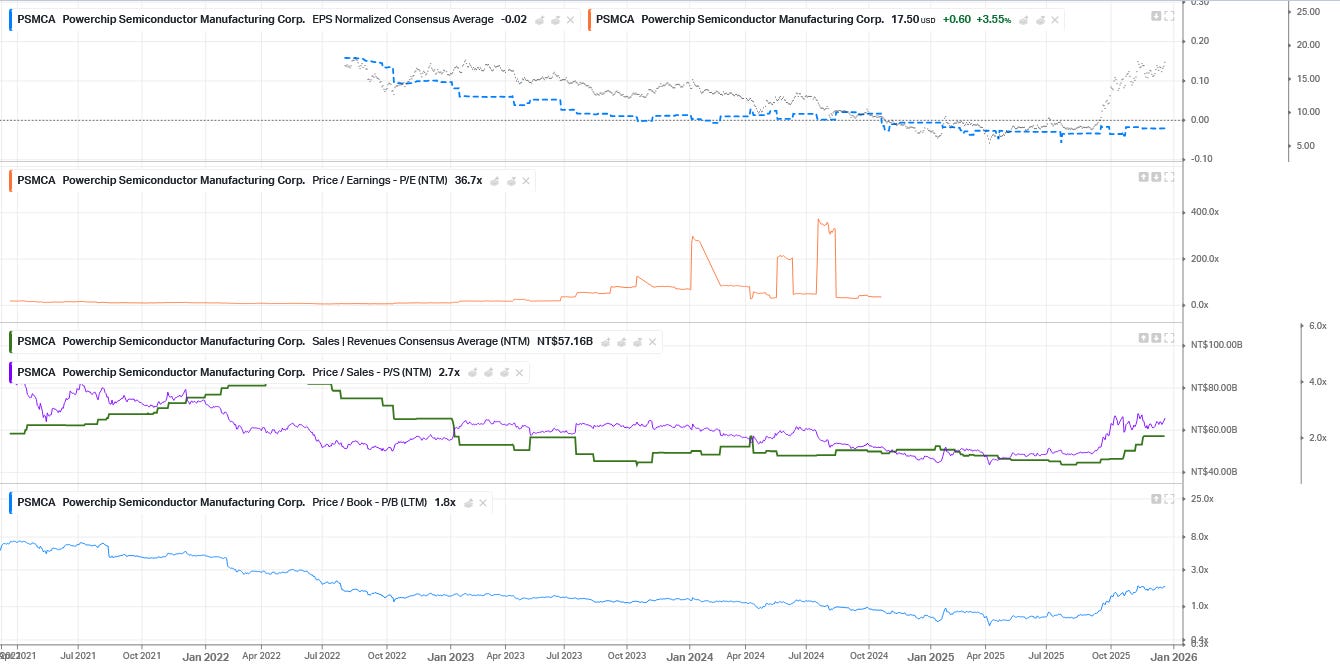

Valuations and Risks: 2025 has seen the vast bulk (if not all) of the sector re-rate already occur with most stocks rallying to P/Sales and P/Book multiples in line with or above prior peak cycles. The major question for investors is whether further upside exists. In prior cycles, memory sector stock prices have ceased rising well ahead of the cycle earnings peak, which can be seen in the appendix where I’ve scoped out 10 year histories of each company’s multiples. Price/Book is often the best indicator in this sector, not the usual earnings multiples and with Price/Book multiples now as high as they are, the inevitable conclusion is that investors have reacted quickly to signs of demand / supply imblance and industry news of price increases and priced a typical full cycle impact. Stock prices need even “higher for longer” ROIC projections to experience further appreciation.

If further opportunity exists in the sector, it lies further out the risk curve now amongst names where skepticism has been deeper, but which may still benefit as the AI industry searches for low power, highly efficient memory solutions for new AI applications. Company anecdotes are indeed suggesting a longer cycle due to the vast, synchronized investments occurring globally in AI infrastructure and the developments in AI still to come through Edge AI and AI devices.

The key risk to watch is state sponsored investment in China massively scaling memory capacity in DRAM and HBM2 which is called out as a risk for 2027. It is instructive to note that in past cycles, memory stocks have started to derate as the earnings cycle approaches its last half to third of the earnings upcycle - much like commodity mining stocks. The current earnings cycle for these stocks is approximately 6-9 months old suggesting it still has runway, particularly if AI demand vs industry capacity is as significant as companies are indicating.

The Macro-Structural Landscape: An HBM Vacuum Effect

To understand the resurgence of Tier 2 manufacturers, one must first dissect the physical and economic reality of the HBM manufacturing process and its impact on global bit supply. The 2025 “Memory Supercycle” is distinct from previous cycles because it is driven by a supply-side shock rather than purely demand-side elasticity.

2.1 The Physics of Displacement: Wafer Cannibalization

The production of HBM is exceptionally wafer-intensive. Unlike standard DRAM, which involves processing a single wafer to produce functional dies, HBM requires the fabrication of a logic base die followed by 8, 12, or even 16 layers of DRAM dies stacked vertically using Through-Silicon Vias (TSVs).

The 1:3 Ratio: Industry analysis suggests that producing one bit of HBM capacity consumes approximately three times the wafer capacity of standard DDR5.1 This is due to the larger die sizes required for TSV interconnects, the yield losses associated with stacking complex 3D structures, and the need for a dedicated logic base layer.

Capacity Migration: Throughout 2024 and 2025, Samsung, SK Hynix, and Micron have systematically converted their most advanced DRAM lines (1-alpha and 1-beta nodes) from DDR5 production to HBM3e and HBM4. This massive reallocation of cleanroom space and lithography tools was necessary to meet the demands of NVIDIA and AMD, but it came at a steep cost to the rest of the market.

The “Plain Vanilla” Shortage: By late 2025, the displacement of capacity resulted in a severe shortage of “standard” memory. Distributors reported “panic double-ordering” for DDR4 and LPDDR5 modules, products that were previously considered commoditized.1 A mid-tier server OEM reportedly stated they “cannot source DDR5 at any price,” as lead times stretched from weeks to months.

2.2 Inventory Collapse and Pricing Power

The financial implication of this capacity shift has been a restoration of pricing power to the Tier 2 players who maintained their focus on standard DRAM.

Inventory Correction: Global DRAM inventory levels, which sat at a bloated 31 weeks in early 2023 following the post-COVID demand crash, collapsed to a critical low of roughly 8 weeks by late 2025.2 This rapid destocking was accelerated by AI-driven server upgrades that require massive amounts of standard DDR5 alongside HBM.

ASP Explosion: Spot and contract prices for DDR4 modules reportedly doubled year-over-year in certain channels by Q4 2025.3 For Tier 2 manufacturers like Nanya Technology and Winbond, whose fabs are fully depreciated, this price surge translates almost entirely to bottom-line profit, driving the massive margin expansion observed in their Q3 2025 earnings.

2.3 “Edge AI” Divergence

While the HBM shortage grabs headlines, a parallel trend is reshaping the technical roadmap for Tier 2 players: the rise of Edge AI.

The Thermal Wall: HBM is designed for liquid-cooled data centers. It is too hot, too expensive, and requires too complex a substrate (interposer) for edge devices like smartphones or IoT cameras.

The Opportunity: There is a “missing middle” in the memory hierarchy—applications that need more bandwidth than LPDDR5X can provide (roughly 8.5 Gbps/pin) but cannot afford the power or dollar cost of HBM. This is the precise beachhead that companies like Winbond (with CUBE) and PSMC (with WoW) are attacking. They are creating “AI-customized” memory that offers high bandwidth (256GB/s to 1TB/s) within a consumer power envelope (<30W).

Comparative Exposure & Valuation Matrix

The following table summarizes the key Tier 2 manufacturers identified in this research. It highlights their exposure to the current market themes, their market capitalization, and their valuation metrics as of December 2025.

Deep Dive Analysis: The Taiwan Trio

The epicenter of the “Tier 2” resurgence is Taiwan. Unlike the Korean IDMs who are vertically integrated giants, Taiwan’s memory sector is characterized by specialization and agility. These companies have mastered the art of “Value-Added Memory,” moving away from pure commodity cycles to specialized, high-margin niches.

4.1 Winbond Electronics (2344.TW): The Edge AI Architect

The 400% Rally Explained

Winbond Electronics has been a standout performer of 2025, with its stock price appreciating by approximately 381% YTD. This explosive growth is not merely a reflection of rising memory prices but a re-rating of the company from a “legacy memory maker” to a “critical AI infrastructure provider.”

Technological Crown Jewel: CUBE

At the heart of Winbond’s strategy is the Customized Ultra-High Bandwidth Element (CUBE). As AI inference moves from the cloud to the edge, devices require memory that offers high bandwidth without the crippling power consumption of HBM.

Architecture: CUBE utilizes 3D TSV stacking to connect DRAM dies directly to the SoC (System on Chip) or through a silicon interposer, similar to HBM but optimized for lower power and cost. It provides bandwidth ranging from 256 GB/s to 1 TB/s, which is significantly higher than LPDDR5X, yet it fits within the thermal constraints of edge devices.

The “Hybrid Bond” Advantage: Winbond positions CUBE as a “Hybrid Bond” ready solution. This allows it to be stacked directly on top of logic processors (3D stacking) rather than just next to them (2.5D), drastically reducing the distance data must travel. This minimizes latency and reduces power consumption by nearly 7x compared to traditional I/O implementations.

Market Fit: This technology is seeing rapid adoption in “AI PCs,” high-end surveillance cameras, and automotive ADAS systems, effectively creating a new market segment between commodity DRAM and HBM.

Structural Shortage & The 6-Year LTA

Financially, Winbond is benefiting immensely from the “Big Three” exiting the DDR3 and DDR4 markets.

Supply Security: With Samsung and Hynix cutting legacy capacity, industrial and automotive clients, who cannot easily redesign their systems for DDR5, are facing an existential supply crisis.

Unprecedented Contracts: In a recent investor conference, Winbond President James Chen revealed that customers are now requesting six-year supply agreements.6 In the memory industry, where contracts are typically quarterly or annually, a six-year commitments provides unprecedented revenue visibility and justifies the stock’s valuation premium.

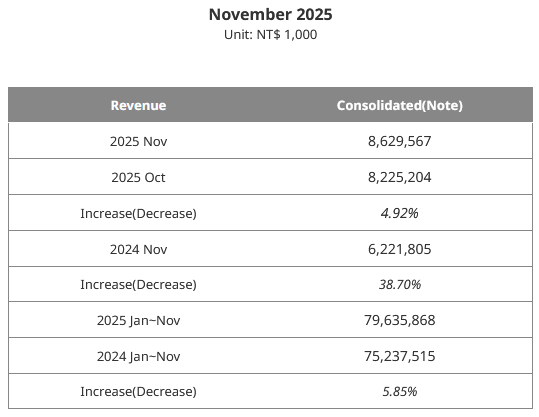

Financial Velocity: This pricing power is evident in the numbers. Winbond’s monthly revenue for November 2025 reached NT$8.63 billion, a three-year high representing a 38.7% year-over-year increase and showing the expected acceleration over the year. The company has successfully swung from a loss to profitability, with gross margins stabilizing near 30% and expected to expand as CUBE shipments ramp up.

Winbond Monthly Revenue Trend

Taiwanese companies report monthly revenues to the exchange

4.2 Nanya Technology (2408.TW): The Heir to the Commodity Throne

Operational Renaissance

Nanya Technology is the purest play on the traditional DRAM cycle outside of the top three and this has already been recognized by the market with the stock up nearly 500% in 2025. For years, Nanya was viewed as a “trailing edge” manufacturer, always one or two process nodes behind. In 2025, however, this “lag” became its greatest strategic asset.

The 1B Node and DDR5 Strategy

While Tier 1 players moved to 1-beta and 1-gamma nodes specifically for HBM, Nanya focused on perfecting its 1B process node (roughly equivalent to the industry’s 10nm-class) for standard DDR5.

Filling the Server Void: As hyperscalers demanded more HBM, the supply of standard 16Gb DDR5 RDIMMs (essential for the CPU side of AI servers) tightened. Nanya timed its technology transition perfectly, entering mass production of 16Gb DDR5-6400 modules in late 2025 just as the shortage peaked.

Product Mix Shift: By the end of 2025, Nanya reported that 1B node products would account for over 30% of its total bit output. This mix shift is crucial because DDR5 commands a significant price premium over DDR4, driving ASP expansion.

Financial Turnaround

Nanya’s financial recovery in 2025 has been stark.

Revenue Surge: In Q3 2025, Nanya reported revenue of TWD 18.78 billion, a staggering 78.4% quarter-over-quarter and 130.9% year-over-year increase.

Profitability: The company swung from a net loss to a net profit of TWD 1.56 billion in Q3, with gross margins recovering to 18.5%.

Guidance: Management has guided that the current “DRAM upcycle” will persist longer than historical norms (1-2 years) due to the structural displacement of wafers to HBM. They expect the DDR4 shortage to act as a floor for profitability while DDR5 provides the growth engine.

4.3 PSMC (6770.TW): The “3D AI Foundry”

Redefining the Foundry Model

Powerchip Semiconductor Manufacturing Corp (PSMC) is unique in that it operates an “Open Foundry” model for memory. Unlike Nanya or Winbond, which design and sell their own chips, PSMC manufactures memory for other designers. In 2025, PSMC pivoted aggressively to position itself as a “3D AI Foundry.”

Wafer-on-Wafer (WoW) Stacking

PSMC is attacking the HBM hegemony by offering a lower-cost, highly integrated alternative known as Wafer-on-Wafer (WoW) technology.

The Technology: Instead of the complex 2.5D packaging used in HBM (where chips sit side-by-side on an interposer), WoW involves bonding a full wafer of DRAM directly onto a full wafer of logic processors using TSVs, before dicing them into chips.

Performance Metrics: PSMC claims this architecture can achieve internal bandwidths of up to 24 TB/s—vastly exceeding standard memory interfaces—while reducing I/O power consumption by roughly 7-fold.

Democratization of AI: This technology is particularly attractive for mid-sized AI chip startups and edge AI designers who cannot secure allocation for TSMC’s CoWoS capacity (which is fully booked by NVIDIA/AMD). By partnering with design houses like AP Memory, PSMC provides a turnkey solution for integrating high-bandwidth memory directly into AI accelerators.

Financial Recovery

After a challenging period in 2023-2024, PSMC is showing signs of gradual recovery.

Growth: Taiwanese companies report monthly revenues. Recent months have shown PSMC revemues on an accelerating track, albeit lagging the broader industry:

PSMC Monthly Revenues and YoY growth rate

PSMC is still loss making with widening losses as demand has increased in the last two quarters. It remains a high risk play but if execution is strong, its worth watching due to its lower valuation, lag on the industry rally.

Valuation: Trading at a P/B of ~1.8x, PSMC is significantly cheaper than Winbond or Nanya reflecting its far junior status, losses and less attractive logic foundry core. This discount also likely reflects the execution risks associated with its foundry model transformation but at the same time is a potnetial opportunity amongst a peer set that arguably shows far less room to rally (see Appendix valuation charts).

The China Factor: Geopolitics and Self-Sufficiency

No analysis of the memory sector is complete without addressing the rise of China. US export controls have restricted China’s access to extreme ultraviolet (EUV) lithography, preventing them from competing in the cutting-edge HBM4 race. However, this has forced Chinese capital into the “good enough” memory segments—DDR4, LPDDR4/5, and HBM2—creating a powerful new axis of supply.

5.1 CXMT (ChangXin Memory Technologies): The Shadow Giant

Although ChangXin Memory Technologies (CXMT) is not publicly traded, it is the gravitational center of the Chinese memory industry.

Aggressive Expansion: Reports indicate that CXMT’s market share in DRAM could surge to 10% globally in 2025, doubling from 5% the previous year. The company has achieved yields of nearly 80% on its domestic DDR5 process, a remarkable feat given the equipment restrictions.

The $42 Billion IPO: CXMT is targeting a massive IPO in Shanghai with a valuation of up to $42 billion. The capital raised will be used to further expand capacity, with plans to begin mass production of HBM2/3 alternatives by 2026.

Strategy: CXMT is effectively the “Samsung of China,” backed by state funds to ensure that domestic Chinese electronics manufacturers (Xiaomi, Oppo, Lenovo, BYD) have a non-Western source of memory.

5.2 GigaDevice (603986.SH): The Strategic Proxy

For public market investors, GigaDevice serves as the primary vehicle for exposure to the CXMT ecosystem.

The “Virtual IDM” Model: GigaDevice, originally a Flash memory and MCU designer, has formed a deep strategic alliance with CXMT. Its founder, Zhu Yiming, is also the CEO of CXMT, creating a symbiotic relationship. GigaDevice markets and sells private-label DRAM manufactured by CXMT, allowing it to offer a complete “memory + compute” portfolio (MCU + Flash + DRAM) to its clients.15

Domestic Dominance: As Chinese OEMs aggressively “de-risk” their supply chains by removing Korean and American components, GigaDevice is the primary beneficiary. The company is expanding its DDR3 and DDR4 product lines to capture this captive market demand.27

Valuation Premium: GigaDevice trades at a massive premium (P/S ~12x, P/B ~7.8x) compared to its Taiwanese peers. This “patriotism premium” reflects the market’s belief that GigaDevice will dominate the vast Chinese internal market, insulated from global competition by government policy.

Technology Deep Dive: Beyond HBM

The “Bifurcation” of the memory market is driven by physics. The following section contrasts the architecture of Tier 1 HBM against the Tier 2 innovations.

Insight: Tier 2 players are not trying to beat Samsung at the “Process Node Game” (shrinking transistors). They are winning the “Packaging Game.” Etron’s RPC DRAM, for example, is designed to be packaged inside the same casing as a tiny AI processor for smart glasses, utilizing a high-bandwidth interface with a reduced pin count to save space and cost. This focuses on system-level performance rather than raw component speed.

Financial Analysis and Valuation

The valuation disparity between Tier 2 players offers insight into market expectations.

Winbond @ 3.3x P/B: The market has awarded Winbond a high P/Book multiple because of its DRAM exposure and as it views the “CUBE” technology as a secular growth engine as AI moves to the edge, not just a cyclical recovery. The 6-year LTAs provide a level of certainty that justifies multiples equivalent to prior peak cycle. The market expects operating margins to grow to 25% over 2026 after its first profitable quarter in Q3.

Nanya @ 3.3x P/B: Nanya’s valuation (same P/B, higher P/Sales) reflects an ongoing turnaround with earnings rebounding from more depressed levels. It is priced now for peak earnings and must prove that. Q3 results showed a much needed profit inflection. The upside here is potentially questionable given a 500% rally in 2025. Etron’s Chairman has specifically warned about the magnitude of new China DRAM capacity additions. The market sees higher earnings growth ahead for Nanya than Winbond with operating margins growing into the 40-50% range in 2026 and higher revenue growth due to the stock’s more pure DRAM exposure. This comes at the expense of future risk from China capacity in this segment.

The “Skepticism” Discount (PSMC @ 1.8x P/B): Despite the “3D AI” narrative, PSMC trades at a discount. This likely reflects investor caution regarding its execution history and the capital intensity of maintaining both logic and memory fabs. It also reflects the revenue growth gap PSMC exhibits vs the other two counterparts. However, this also presents the deepest “value” play if their WoW technology gains widespread adoption. PSMC’s P/B multiple is not yet at peak levels (last seen a decade ago for this stock).

Risks and Future Outlook (2026-2027)

While the near-term outlook (12-18 months) is directionally positive for revenue and earnings in the sector due to the HBM vacuum, distinct risks loom on the horizon.

8.1 The “China Flood” Risk (2027)

The most significant threat to the Tier 2 thesis is the unchecked expansion of CXMT. While current shortages are acute, CXMT’s capacity is growing exponentially.

Scenario: By 2027, if CXMT successfully brings its new fabs to full utilization, it could flood the global market with subsidized DDR4 and DDR5. This would specifically target the profitability of Nanya and Winbond, who rely on these mature nodes for cash flow. There is a reason the majors are converting DRAM capacity to HBM where China is more constrained due to difficulties of obtaining the necessary EUV machines.

Mitigation: Tier 2 players must aggressively move up the value chain (e.g., Winbond to CUBE, Nanya to specialized DDR5) to escape the commoditization trap of the “China Flood.” This may not be enough however as we’ve already seen that all prices are interlinked.

8.2 The “Supercycle” Reversion

The current shortage is somewhat artificial, created by the diversion of capacity to HBM. DRAM typically exhibits a longer useful life of up to 10 years compared to HBM and GPUs which bear higher thermal loads. Hence industry supply additions can hit the supply/demand balance in DRAM quickly versus products with shorter lifecycles, where demand recycling is a greater component.

Scenario: If the AI capex bubble bursts, or if Samsung/Micron aggressively overbuild HBM capacity (leading to a glut), they might convert lines back to standard DRAM to maintain utilization. This would bring the massive scale of the Big Three back into competition with the Tier 2s, crushing margins.

Indicator: Investors should watch lead times for HBM4. As long as HBM is sold out, the Tier 2 “safe haven” likely remains intact.

Conclusion

The “Memory Supercycle” of 2025 is a tale of two markets. While the “Big Three” fight a capital-intensive war for the AI Cloud, a lucrative, high-margin opportunity has also opened for Tier 2 players in the AI Edge and Specialty markets.

Winbond Electronics is an “Edge AI” play, with a unique technology (CUBE) that solves a critical physical problem for the next generation of devices. Nanya Technology offers the purest exposure to the structural supply deficit in commodity DRAM, serving as the “supplier of last resort” for the world’s servers but requires the market to embrace a “longer cycle” mentality to justify further P/B multiple expansion, which may be challenged by eyes being on the China capacity build out. PSMC and GigaDevice offer specialized, albeit riskier, avenues for growth through foundry innovation and geopolitical positioning, respectively. Etron, is a small niche (and speculative) operator which could benefit if AI wearables really catch on (OpenAI’s AI device plans being something to watch out for).

The monthly revenue growth trends for the Taiwanese companies show that the memory supercycle is broadening out and should be monitored by investors in addition to newsflow on HBM and DRAM lead times and price trends.

In memory - always keep in the back of your mind that it is a somewhat commoditized sector where global investors are accustomed to being fast in and fast out. Buy-siders who specialize in these sectors maintain newsflow alerts and constant channel checks to navigate this dynamic. It is an exciting space but requires a highly active research process. AI can assit with that with both ChatGPT and Gemini able to set up agentic news and data trackers operating for you behind the scenes.

Appendix: Watch the fast cycle effect on the multiples

Micron Technology (P/Sales, P/E, P/Book multiple trends last 10 years)

SK Hynix (P/Sales, P/E, P/Book multiple trends last 10 years)

Samsung Electronics (P/Sales, P/E, P/Book multiple trends last 10 years)

Winbond (P/Sales, P/E, P/Book multiple trends last 10 years)

Nanya Technology (P/Sales, P/E, P/Book multiple trends last 10 years)

PSMC (P/Sales, P/E, P/Book multiple trends last 10 years)

Regarding the topic of the article, this structural vacuum for standard memory is fascinating. Do you think the Tier 2 gains are sustainable long term or just a temporary side effect of the HBM rush? Your insight into these market dynamics is truly brilliant.

This is a really well researched breakdown of the tier 2 memory space. The point about the 1:3 wafer ratio for HBM vs DDR5 is something I hadn't seen quantified before and it really drives home why companies like Nanya are seeing such strong tailwinds. What's interesting is how fast this has moved - I remember looking at Winbond earlier this year when it was still considered a legacy player, and now it's pivoted into being an edge AI story with CUBE. The 6-year LTAs are kind of wild too, that's basically unheard of in this indusrty. One thing I'm watching closely is whether the Tier 1 guys will actually stick with HBM focus or if they'll flip back to standard DRAM once margins compress on HBM as supply catches up. That timing is probly the biggest wildcard for how long this window stays open for the Tier 2s.