New Ideas Smart Screen for Earnings Season

Use AI to Identify a carefully selected list of potential long and short candidates from the last 7 days results fitting pre-specified criteria

Last updated: 1 November 2025 (v3, adding Momentum, Inflection & Turnaround prompt variants)

Objective:

Review across earnings results from the last 7 days to identify a filtered list of potential new long and short candidates based on a set of criteria that fit either an earnings momentum & strength, fundamental inflection point or turnaround/turndown style. From this list and the summarized evidence, the investor can choose to use other I/I research prompts to deepen the analysis.

Explanation:

Things move fast during reporting season but it is a period that provides a gold mine of new information and opportunities. However, with potentially hundreds of stocks reporting each day around the world, how do you get across all the information to find the best new ideas? This is where this prompt and its variants comes in, leveraging the research and information processing capabilities of AI.

The prompt is best used in a deep research mode on a model such as Gemini that has strong web data recency. It scans across results from a rolling 7 day window, first identifying each stock that has reported. It then applies a set of filtering, assessment and ranking criteria to identify potential opportunities worthy of further research time. There are three variants for different risk appetites and investment styles. The criteria are summarized as follows (refer to the prompt itself for specific criteria):

Momentum driven scenarios

VARIANT A: EARNINGS MOMENTUM WITH ACCELERATION OR DECELERATION

Long Candidates — Earnings / Revenue growth has been >15% pa with latest result and/or guidance indicating >3 percentage point acceleration with upbeat management tone

Underperform / Short Candidates — Earnings / Revenue growth has transitioned from strong to weak showing deteriorating growth, a recent earnings miss or downgrade & continuously negative or cautious management tone.

Medium risk / return scenarios:

VARIANT B: STOCKS SHOWING FUNDAMENTAL INFLECTION POINTS

Long Candidates — Past underperformer or recent laggard. Latest result or guidance reveals newly re-accelerating growth & upgraded management tone addressing market concerns.

Short Candidates — Past outperformer with newly decelerating / deteriorating growth shown in latest result or guidance statements & negative tone.

Higher risk / return situations:

VARIANT C: TURNAROUNDS & TURNDOWNS

Long Candidates — Stocks near 52 week low with latest result, guidance and management tone suggesting a rebase is complete with newly re-accelerating growth & newly upgraded management tone.

Short Candidates — Stocks near 52 week high with latest result, guidance and management tone suggesting a material negative inflection with newly deteriorating fundamental trends and new message of risk or caution.

As always, be aware that models can make mistakes. At each step, examine the response and challenge information or conclusions that appear erroneous before proceeding to any subsequent steps. If in doubt use a second model with the same prompt to verify the information and generate challenge questions and answers (CoVe process) to correct interpretations of data.

Link to blog post explanation:

AI vs Wall St: Can AI pick turnarounds?

Preferred Model(s):

Gemini 2.5+ in Deep Research mode over ChatGPT 5+ Deep Research

However best result come from using 2 AI analysts (both models simultaneously offers an increased breadth of potential idea capture).

Note that the context window and web search capabilities of Gemini have shown the best ability to handle this complex, multi-faceted research task.

ChatGPT is worth consideration as an 2nd analyst to add breadth as it does surface some interesting candidates. However its web search functionality gets stretched on this large research task and despite instructions not to, the model can refer to past memory and produce some outdated statistics or references that compromise the analysis of certain stocks.

My preference is to use all models simultaneously. I have also added in Grok on occasion however its reasoning and articulation of ideas is not as strong and the model can ignore selection criteria that are important at times. As a recent example during Q3 2025 reporting, Grok returned 6 requested ideas for Variant C (Turnarounds & Reversals) however 3 immediately did not fit the strict share price criteria and were discarded. The other 3 ideas warranted further attention even if not articulated as well as other models.

Important Execution Notes:

Copy / paste, run with this one. Its that simple.

Re-run each week to review the results from the past 7 days

Dive deeper into candidates that appeal to you using other Inferential Investor prompts to analyze the recent result, summarize and extract insights from transcripts, generate an equity research report, value the company or perform detailed financial statement analysis

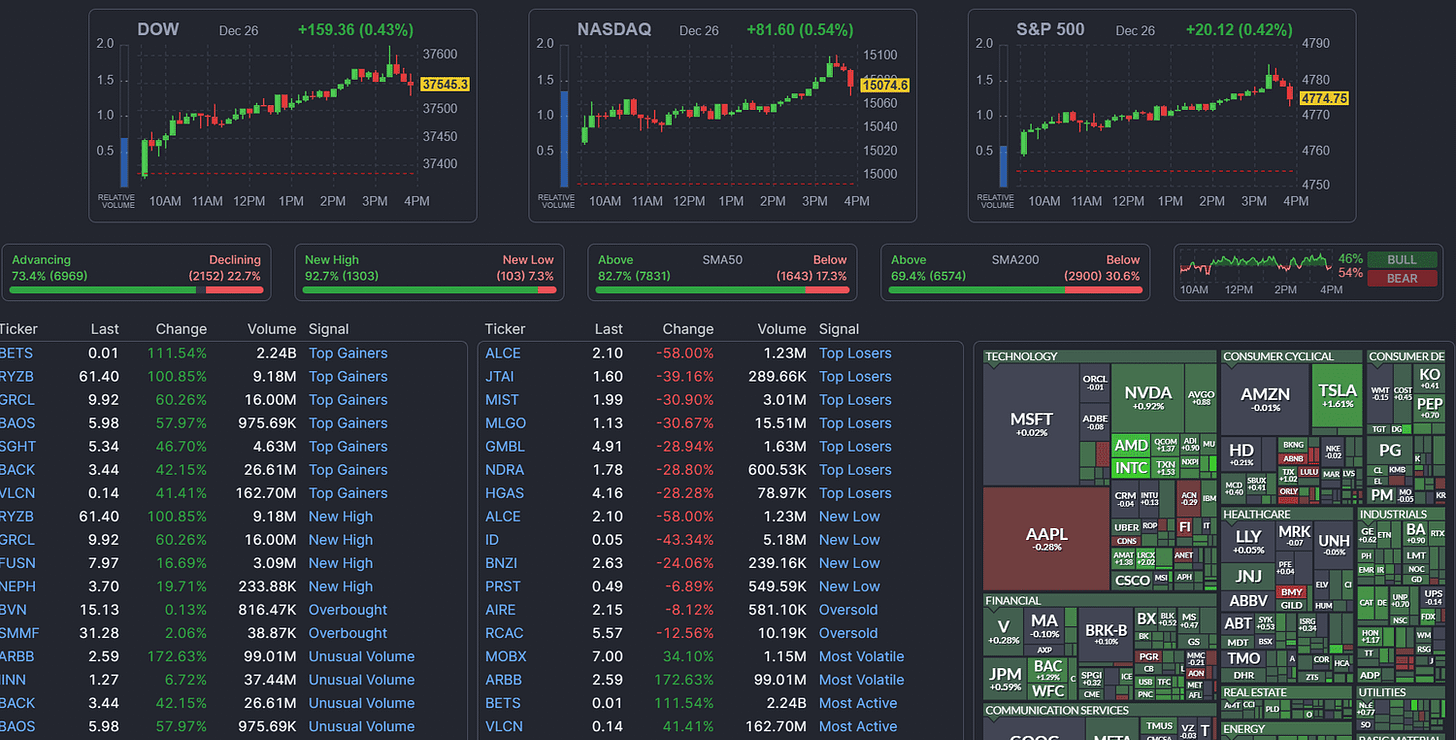

Sample Output:

Copy/Paste Prompt Sets - 3 Variants A, B & C. Scroll down to see all.

Important note: Subscribers can use this prompt set for their own analysis. However, the prompt is copyrighted by The Inferential Investor, paywalled, and must not be shared without permission.