AI vs Wall Street: 8 AI-Researched Stock Ideas from Q3 Earnings Season

Explore 5 Turnaround / Value Long ideas and 3 Underperform / Shorts generated by Artificial Intelligence

Introduction to AI vs Wall St

I’ve been engineering, testing and optimizing this prompt set for a while to replicate what I did for my Hedge Fund at every earnings season - apply a strict set of identification and selection criteria that operationalize my investment process and cover fundamental business trends and strategy, earnings analysis, guidance, valuation, surprise and management tone and sentiment to identify potentially compelling new Long and Short ideas.

The result is this first release of a series I am calling, “AI vs Wall St”. Can AI, using its research, reasoning and analysis capabilities, identify strong candidates for potential longs and shorts when guided on process and criteria? I fundamentally believe it can by leveraging a human + machine collaborative approach. While the results of these “short-list” ideas will only be proven over time, have a read of the summary investment theses in this post and tell me your thoughts. I already own one of these stocks since its earnings report (W US), and after further work, may invest in others on the list.

In the Inferential Investor Professional Prompt Library, there are actually 3 variants of this New Idea Smart Screen workflow designed to surface new ideas according to style and risk tolerance:

Earnings Momentum with acceleration or deceleration as a catalyst for further stock price performance;

Stock Inflection Point candidates (positive and negative changes to business trends);

Fundamental Turnarounds and Reversal candidates - stocks usually near lows or highs respectively with a strategic plan being executed or facing a significant emerging business challenge.

Stock Screening in the AI age

Think of this prompt set as a highly sophisticated “AI Smart Screen”. Conventional stock screens are blunt tools returning lists of stocks on purely quantitative criteria with no context attached to them. If a stock is growing 25% pa but is only on 15x, then surely there’s a reason? As Benjamin Graham would point out, its highly unlikely you just found something no one else has looked at by using FinViz. Inevitably you do the research and find the reason - there’s a massive regulatory risk or they just lost a large customer and actually, earnings are cum-downgrade. The reality is, in anything but rampant bull markets, stocks screens are often highly inefficient idea generators.

Where this New Idea Smart Screen is clearly superior is that, using the capabilities of AI, we can build in important contextual criteria as well, that filters out the situations described above and aligns the candidates with credible turnarounds. This is really important in turnaround investing. Turnarounds offer massive potential upside when you get them right (particularly timing), but they can also fail to deliver, exposing you to further downgrades and even lower stock prices if the strategic plan is not credible. With AI, the key criteria shifts from pure valuation/pricing (stock at multi-year lows), to business strategy, context, plans and execution signals.

What is a Turnaround for the purposes of our AI screen?

The prompt has AI scan for stocks at 52 week or multi-year lows, that have enacted a turnaround strategy at least 6 months prior, often with new management. It requires the stock to have delivered its first beat, positive surprise or upgrade on a critical key metric like revenue or earnings after a protracted spell of disappointment, to minimize the probability of further re-basing. It overlays the business drivers with the strategic turnaround plan to assess degree of achievement and it examine management’s language for sequential improvement in tone and sentiment that signals that the plan is succeeding. This, coupled with earnings and guidance analysis and overlayed with valuation considerations forms a comprehensive “Smart Screen” for these ideas.

Can AI Identify Shorts?

On the Underperform side, the AI looks for potential reversal candidates. Stocks that were past heroes, that have run into significant business or strategic headwinds. I find AI less capable in the pure, early identification, short ideas department - likely because its training data set is fairly thin on those examples compared with longs and successful turnaround case studies. However, it does surface some interesting potential ideas, but I note that these require greater investor research to assess probability of success. AI is far better on the short side at identifying momentum shorts - those stocks that have already downgraded once or twice, where the stock has already fallen, but where earnings momentum is still decidedly negative.

The Proof of the Pudding is in the Eating

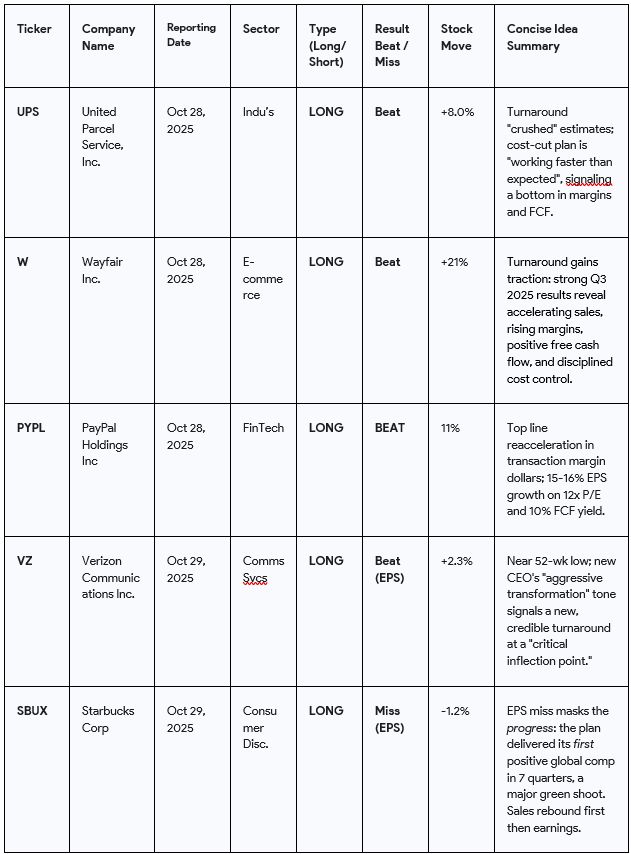

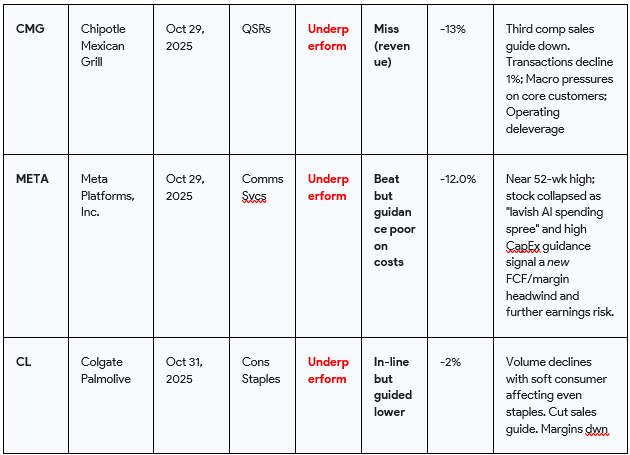

Today, this post attaches and highlights 5 key long candidates and 3 underperforms from the big recent week of earnings (27-31 October) that contained the mega-cap tech names. To me there’s some exciting names on this list. The summary table is copied below, but the full report with thesis details is attached as a PDF. I have deliberately used the “Turnaround” variant of the prompt set to surface differential ideas that are usually inherently less crowded than the usual AI/Tech, already at highs, earnings and price momentum trades. When markets are at highs and valuations become stretched, it becomes attractive to search for returns amongst inherently less beta-correlated names.

Enjoy the report. Let me know feedback with likes, replies, questions, bravo’s or even turd emoji’s. Its all appreciated.

Andy west

The Inferential Investor

Please note the Disclaimer in the Report as these are not intended to be fully researched investment theses nor stock recommendations - they are an intelligent smart screen where AI reasoning has been brought to bear on a set of criteria to identify an indicative short list of potential candidates for further research individually. The Inferential Investor does not provide financial advice or recommendations on any stock mentioned. The designation of a stock as “Long” or “Underperform” denotes the AI’s assessment of a generally positive or negative set of circumstances that align with set criteria but does not indicate a recommendation to buy or sell. We specifically flag that AI can make errors and that investors must complete their own research.

Your AI turnaround screen methodology perfectly captures why MU would surface as a compelling candidate right now. Memory stocks like Micron hit multi-year lows, enacted clear strategic capacity discipline, and just delivered their first major earnings beat with improved managment tone around the memory supercycle. The qualitative signals R L mentions are exactly what differentiate MU from traditional value traps - this isn't just cyclical recovery but structural transformation as memory becomes critical AI infrastructure. Traditional screens miss that MU's 'turnaround' is really about paradigm shift from commodity DRAM to strategic HBM partnerships.

The integration of AI into turnaround analysis is particularly intresting when you consider how traditional metrics often miss the qualitative signals. Your framework for filtering out false positives through management tone and strategic execution markers addresses one of the biggest issues with conventional value screens. Curious to see how these candidates perform as market conditions evolve.