UPDATED: FOMC Detailed Analysis incl language tracking & sentiment: December 2025

25bps cut plus QE-Lite restarting but a fractured Fed with increasing dissent

The following report was generated with the FOMC / Monetary Policy Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

The following report has been updated for an incorrect interpretation by the model of a 3.4% target for 2025 year end which actually applies to 2026 and the major change in the summary of economic projections with respect to 2026 GDP growth.

Executive Summary: The “Fractured Ease” – QE Returns Amidst Growing Dissent

Decision & Pivot: The FOMC delivered a third consecutive 25bps cut in December to 3.50–3.75%, accompanied by a major policy shift: the restart of asset purchases (”QE-lite”) to maintain ample reserves.

The Hawkish Signal: While the action was dovish, the guidance was not. The Median Dot Plot shows rates ending 2025 at 3.6% (aligned with today’s cut) and 2026 at 3.4%. This implies the Committee sees only one more 25bps cut over the next 12–18 months.

Growth: The committee has materially raised its 2026 GDP growth forecast from 1.8% to 2.3%.

Fracture Point: Decision-making has become highly contentious. The 9–3 vote in December is the most divided since the 2005–2006 cycle. While Governor Miran continues to push for aggressive 50bps steps, the emergence of a “Pause Caucus” (Presidents Goolsbee and Schmid) signals significant resistance to further easing at this pace, particularly in light of higher GDP growth forecasts for 2026.

Market Pricing: Markets are pricing a seamless path to ~3.00% by mid-2026. However, the “Goolsbee Pivot” (a leading dove voting for a pause) suggests the floor for rates may be higher than the median dot implies, unless labor data deteriorates further.

Bottom Line: The Fed is stimulating via both rate and balance sheet channels, but the consensus is shattering. Expect high volatility around the January meeting as the “Pause” vs. “Cut” debate intensifies.

1. Redline Highlights & Material Changes

T-1 (Oct) —> T (Dec): The Return of Asset Purchases

Unemployment: Assessment worsened slightly to “edged up through September,” removing the qualifier “remained low.”

Guidance: Added specificity to the forward-looking clause: “In considering the extent and timing of additional adjustments...” (previously just “additional adjustments”).

Balance Sheet (Major): Shifted from “conclude reduction” to “initiate purchases of shorter-term Treasury securities” to maintain ample reserves.

Vote: Fracture deepens. Goolsbee joins Schmid in voting for a pause, creating a rare Dove-Hawk alliance against the center.

T-2 (Sep) —> T-1 (Oct): The Balance Sheet Pivot

Growth: Downgraded from “moderated” to “expanding at a moderate pace.”

Unemployment: Shifted from “edged up but remains low” to “edged up but remained low through August.”

Balance Sheet (Critical): Pivot from “continue reducing” (QT) to “conclude the reduction... on December 1.”

Vote: Dissents widened. Miran (dove) wanted -50bps; Schmid (hawk) wanted 0bps.

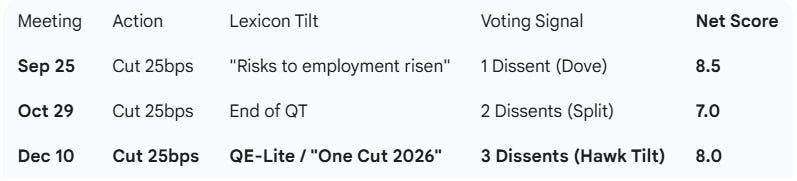

2. Sentiment Analysis (Scale 0–20)

Methodology: 0 = Unanimously Dovish (e.g., 2008), 20 = Unanimously Hawkish (e.g., 2022). Score derived from policy action (+/- 2), lexicon analysis (risk weightings), and voting cohesion.

Trend: The Fed is aggressively dovish in action (cutting + buying assets) but increasingly hawkish in voting composition and growth outlook, signaling we are nearing the “terminal velocity” of this easing cycle.

3. Investor Summary Table

4. Interpretation of Outlook & Reaction Function

4. Interpretation: The Reaction Function Has Reset

The “Stop” Signal The textual change adding “extent and timing” to the guidance , combined with the 2026 median dot of 3.4%, signals that the “extent” is nearly reached. The Fed believes it has normalized rates enough to defend the labor market.

The “Pause Caucus” is the Real Center Although Goolsbee and Schmid dissented, the Median Projection suggests they are closer to the consensus than the decision implies.

Voters: Cut to 3.6%.

Median Projection: Stay at 3.6% (implied) through year-end with little further downward adjustment in 2026.

Implication: The Committee acquiesced to Powell for this meeting, but the “Median Voter” essentially agrees with the dissenters that the cutting cycle should pause.

“The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months.” (Dec 10, Paragraph 2)

QE-Lite as the Offset The launch of “purchases of shorter-term Treasury securities” is the dovish concession to balance the hawkish rate path. They are tightening the rate outlook but loosening the liquidity outlook to prevent financial plumbing stress.

“The Committee judges that reserve balances have declined to ample levels and will initiate purchases of shorter-term Treasury securities as needed...” (Dec 10, Paragraph 5)

5. Term Frequency Analysis

Top 5 Terms (Dec 25): “Inflation” (6), “Committee” (9), “Policy” (6), “Employment” (3), “Risks” (3).

Emerging Themes (TF/IDF):

“Purchases” / “Treasury”: The dominance of these terms in Dec vs. “Reducing” in Sep highlights the regime change from tightening liquidity to supplying it.

“Ample”: Used to justify the floor for reserves; a key keyword for the end of QT.

“Goolsbee”: His name appearing as a dissenter is statistically significant; usually a reliable dove, his shift makes “Hold” a credible risk for Jan 2026.

6. Market Pricing vs. Fed Signals

Implied Path (Futures) vs. Fed Dots

Year-End 2025: Market 3.60% (Aligned).

Year-End 2026:

Market: ~3.00% (Pricing recession risk or aggressive normalization).

Fed Median: 3.40% (Pricing a soft landing with higher neutral rates).

Conclusion: Market is Too Dovish / Complacent. The market is fighting the Fed. Investors are pricing in ~60–75bps of cuts in 2026. The Fed is explicitly promising only 25bps.

Risk: If Jan/Feb inflation data is sticky (Core PCE > 0.2% MoM), the market will be forced to reprice up to the Fed’s 3.4% line. This would trigger a bear-flattening in Treasuries (2-year yields rising faster than 10s).

7. Scenario Paths (2026 Outlook)

Scenario A: “The Hard Pause” (Base Case, 55% Prob)

Trigger: Unemployment holds <4.5%; Core PCE >2.5%.

Fed Path: Pause in January. No cuts in March. Maybe one final cut in June 2026 to hit the 3.4% target.

Market Implication: Bearish for Front-End Rates. 2yr yield jumps to 3.75%. USD rallies as “Fed divergence” vs ECB/BOJ widens.

Scenario B: “Labor Crack” (Dovish Risk, 30% Prob)

Trigger: Payrolls negative or Unemployment >4.6%.

Fed Path: The “Median” is abandoned. The Fed cuts 50bps in Q1 2026, chasing the market toward 3.00%.

Market Implication: Bull Steepener. Bonds rally, but Equities struggle on growth fears.

Scenario C: “Inflation Resurgence” (Hawkish Tail, 15% Prob)

Trigger: “QE-Lite” over-stimulates financial conditions; commodities spike.

Fed Path: 2026 cuts are removed entirely. The next move is debated as a Hike.

Market Implication: Risk Off. Stocks and Bonds sell off together (correlation = 1).

Top Watchlist:

Jan Payrolls: Must stay >100k to support the “Pause” thesis.

Reserve Balances: Watch if the Fed increases the purchase cap; more liquidity = equity tailwind.

Brilliant breakdown of the fracture dynamics within the Committee. The Goolsbee shift is particuarly telling because it flips the usual dove-hawk calculus when a typically accomodative voter joins the pause camp, it signals the floor might actually be structural rather than just sentiment. But here's what might get underpriced: if markets keep front-running dovishness that isn't coming, we could see liquidty conditions tighten faster than the dot plot suggests just from positioning unwinds alone.

Looking even further ahead, Powell's term as chairman ends in May, and that may have further implications on Fed independence.