Coherent Corp Q2 FY26 Earnings Call Insights: "Step function in bookings, > 4x book to bill"

Growth acceleration and record bookings with growth visibility extending into 2028

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

1. Executive Summary

Growth Acceleration: Revenue growth accelerated from 19% YoY (pro forma) in Q1 to 22% YoY (pro forma) in Q2, driven by exceptional AI Datacenter demand.

Datacenter Dominance: Datacenter revenue growth accelerated significantly from 4% sequentially in Q1 to 14% sequentially in Q2, with YoY growth reaching 36%.

Capacity Expansion: Aggressive ramp of 6-inch Indium Phosphide (InP) fabrication is a central theme. The company is on track to double internal capacity by calendar year-end, with 6-inch yields already exceeding 3-inch yields.

Record Bookings: The company reported a “step function” increase in bookings in Q2, with a book-to-bill ratio exceeding 4x in the Datacenter segment.

Strong Visibility: Customer forecasts now extend into CY2028, with significant backlog coverage for CY2026 and CY2027.

Guidance Up: Q3 FY26 guidance implies continued strong sequential growth. Management stated FY27 revenue growth rate is expected to exceed the FY26 rate.

Margin Expansion: Non-GAAP Gross Margin improved to 39.0% in Q2 (+77 bps YoY), driven by yield improvements, pricing optimization, and mix, moving toward the long-term target of >42%.

Industrial Recovery Signs: While Industrial revenue was flat sequentially in Q2, a pickup in semi-cap equipment orders signals a return to growth in the June quarter (Q4).

Portfolio Optimization: Divestitures (Aerospace & Defense, Munich materials processing) are complete, deleveraging the balance sheet (1.7x net leverage) and proving accretive to margins.

Sentiment: Sentiment is strongly positive (Score: 18/20), characterized by terms like “extraordinary,” “unprecedented,” and “record-breaking” regarding demand, with confident responses to supply constraints.

2. Results & YoY Growth

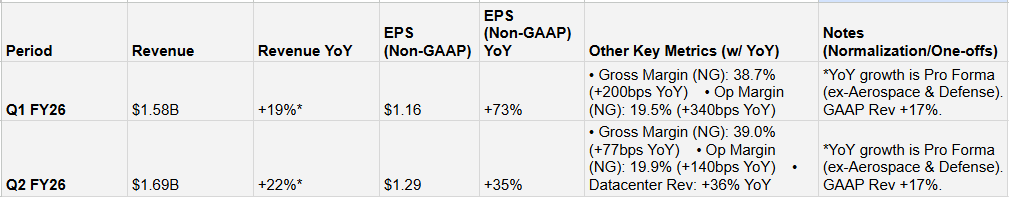

Table 1 — Results & YoY Growth

Note: Management emphasizes Pro Forma revenue growth to account for the divestiture of the Aerospace & Defense business.

3. Operational & Segment Metrics

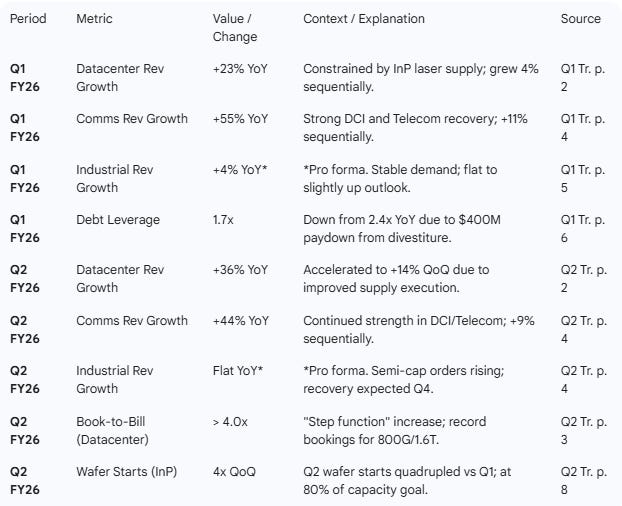

Table 2 — Operational & Segment Metrics

4. Guidance & Long-Term Goals Evolution

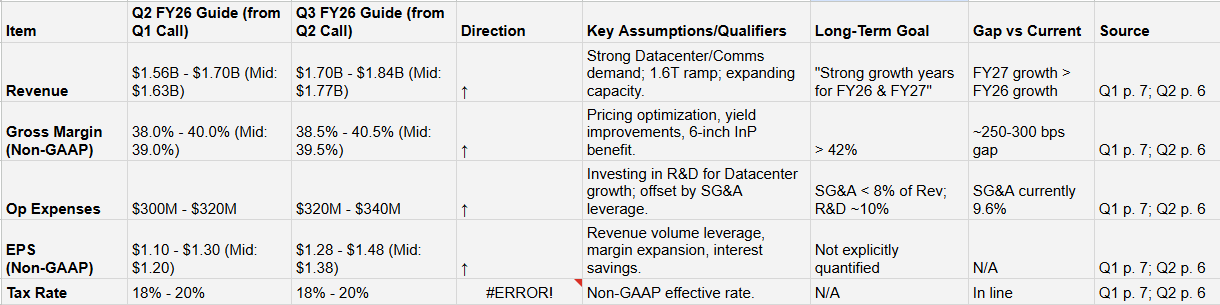

Table 3 — Guidance & Goals Evolution

Key Management Quotes on Outlook:

Q2 Call (CEO): “We expect our fiscal ‘27 revenue growth rate to exceed our fiscal ‘26 growth rate.” (p. 2)

Q2 Call (CEO): “Most of our calendar ‘26 is booked out and calendar ‘27 is filling very, very quickly.” (p. 7)

Q2 Call (CEO): “I don’t foresee the supply/demand getting back in balance this calendar year... [or] next calendar year.” (p. 12)

Q1 Call (CEO): “We see potential widespread adoption of these materials to address the thermal and power challenges posed by ever larger AI data centers.” (p. 5)

5. Sentiment Scoring (0-20)

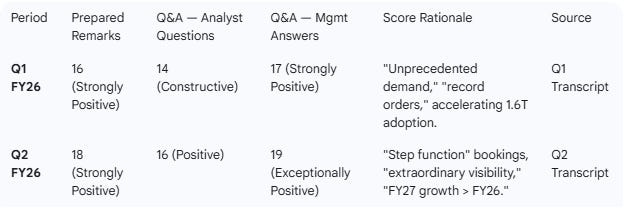

Table 4 — Sentiment (0-20)

Commentary: Sentiment notably hardened from Q1 to Q2. While Q1 was very positive, Q2 featured superlative language (”extraordinary,” “step function,” “blowing through”) regarding bookings and forward visibility. Management’s confidence in the 6-inch InP ramp transitioned from “promising early yields” in Q1 to “executing ahead of plan” in Q2.

6. Thematic Summary (Prepared Remarks)

Q1 FY26 Themes:

AI Datacenter Demand: “Unprecedented demand” for 800G and 1.6T transceivers. 1.6T adoption is accelerating. [Q1 p. 2]

Supply Constraints: Datacenter growth (4% seq) constrained by Indium Phosphide (InP) laser supply. [Q1 p. 2]

Capacity Expansion: Aggressive ramp of 6-inch InP capacity at Sherman, TX and Jarfalla, Sweden. 6-inch yields > 3-inch yields. [Q1 p. 3]

Portfolio Optimization: Completed sale of Aerospace & Defense; announced sale of Munich industrial tooling division to focus on core growth. [Q1 p. 5]

Industrial Stability: Industrial segment stable despite macro; growth expected in semi-cap and display over long term. [Q1 p. 5]

Q2 FY26 Themes:

Accelerating Growth: Datacenter revenue accelerated to 14% sequential growth; bookings saw a “step function” increase (>4x book-to-bill). [Q2 p. 2-3]

Supply Execution: Significant increase in InP capacity; on track to double internal capacity by year-end. Wafer starts quadrupled QoQ. [Q2 p. 3, 8]

Future Visibility: Guidance for FY27 growth to exceed FY26. Bookings extending into CY2028. [Q2 p. 2]

New Products: Significant PO for CPO solution with high-power CW laser; OCS backlog grew sequentially. [Q2 p. 3-4]

Industrial Turn: Signs of recovery in Industrial, led by semi-cap orders. Expecting sequential growth in June quarter. [Q2 p. 2, 4]

Changes in Management Commentary (Q2 vs. Q1):

In Q2, the narrative shifted from managing constraints to capitalizing on acceleration. While supply was a “constraint” in Q1, Q2 commentary focused on the successful “execution” of the ramp and “accelerating” sequential growth. The visibility horizon extended significantly—from “record orders” in Q1 to specific mentions of “calendar ‘28” forecasts and “booked out” status for CY26 in Q2. Additionally, the Industrial commentary turned more bullish, moving from “stable/cautious” in Q1 to explicitly calling a recovery ramp starting in the June quarter.

7. Q&A Summary (Q2 FY26)

Theme: Demand Visibility & Durability

Question (Samik Chatterjee - JPMorgan): Characterize visibility/duration of demand and book-to-bill.

Answer: Visibility is “extraordinary.” Bookings extend through CY26 and deep into CY27. Long-term forecasts from customers reach into CY28. LTAs (Long Term Agreements) are securing supply/demand guarantees.

Question (Thomas O’Malley - Barclays): What is driving the >4x book-to-bill?

Answer: Majority driven by 800G and 1.6T. 1.6T is accelerating. Also strong contributions from OCS and CPO.

Theme: Supply Constraints & Capacity Ramp

Question (Samik Chatterjee - JPMorgan): How to think about the InP capacity ramp milestones?

Answer: On track to double capacity by year-end. Wafer starts (leading indicator) are already at 80% of target capacity. Q2 wafer starts quadrupled vs Q1.

Question (Thomas O’Malley - Barclays): When will the industry reach supply/demand equilibrium?

Answer: Not this year, not next year. “Sustained long period of supply-demand imbalance” expected due to scale-up needs.

Question (Michael Mani - BofA): Margin impact of 6-inch ramp?

Answer: 6-inch cost is ~50% of 3-inch. Benefit starting in Q3, increasing throughout the year as mix shifts to ~50% 6-inch by year-end.

Theme: Technology Transitions (1.6T, CPO, OCS)

Question (Simon Leopold - Raymond James): When does 1.6T cross $100M/quarter?

Answer: Didn’t give specific dollar date, but 1.6T is a “key growth driver” for this year. Ramp has accelerated. Both EML and SiPh versions ramping; VCSEL 1.6T ramping 2H CY26.

Question (Ruben Roy - Stifel): CPO vs. Pluggable cannibalization?

Answer: CPO is additive. Pluggables dominate scale-out/scale-across. CPO opportunity is primarily in “scale-up” (replacing electrical links inside racks), which is “orders of magnitude larger.”

Theme: Operating Leverage & Margins

Question (Karl Ackerman - BNP Paribas): Can OpEx grow at half the rate of sales?

Answer: R&D will grow to support Datacenter opportunity (target ~10% of sales). SG&A will provide leverage (target <8% of sales).

Question (Ezra Weener - Jefferies): Pricing trends?

Answer: Good pricing environment. Pricing optimization contributed to margin expansion in Q2.

8. Term Frequency Tracking

Top 5 Positive Terms (Q2 Frequency):

Growth: 68 (vs 45 in Q1) - Significant increase indicating acceleration.

Strong: 42 (vs 38 in Q1) - Consistent emphasis on demand strength.

Demand: 38 (vs 32 in Q1) - Remains the central theme.

Record: 12 (vs 8 in Q1) - Used for revenue, bookings, and backlog.

Accelerate/Acceleration: 15 (vs 8 in Q1) - Key shift in Q2 narrative regarding revenue and 1.6T.

Top 5 Negative/Risk Terms (Q2 Frequency):

Constraint/Constrained: 4 (vs 8 in Q1) - Usage dropped as supply improved.

Debt: 10 (vs 12 in Q1) - Focus remains on deleveraging, but less urgent.

Uncertainty: 1 (vs 1 in Q1) - Macro risks mentioned but downplayed.

Flat: 4 (vs 2 in Q1) - Used to describe Industrial near-term, not broader biz.

Headwind: 2 (vs 2 in Q1) - Minimal mention of FX or other headwinds.

Narrative Shift: The frequency data confirms a shift from “Constraint” management in Q1 to “Growth” and “Acceleration” in Q2. The sharp rise in “Growth” and “Accelerate” correlates with the revenue beat and raised guidance.

9. TF/IDF Analysis (Dominant Unique Themes)

Q1 Dominant Terms:

Defense/Aerospace: (Due to divestiture discussion)

Constraint: (Focus on InP bottlenecks)

Sequential: (Modest sequential growth narrative)

Yields: (Early 6-inch validation)

Stable: (Industrial outlook)

Q2 Dominant Terms:

Bookings/Book-to-Bill: (The “step function” demand signal)

Six-inch: (The solution to supply constraints)

Scale-up: (Emerging CPO/OCS narrative)

Visibility: (Long-term forecast confidence)

Accretive: (Margin impact of divestitures and 6-inch ramp)

Analysis: The conversation moved from restructuring/fixing (Defense sale, constraints) to scaling/optimizing (Bookings, Scale-up, Margin accretion).

10. Red Flags & Open Questions

Supply Chain Execution Risk: With the CEO stating supply/demand won’t balance until after CY27, any hiccup in the 6-inch ramp or external InP sourcing could cause a significant miss against heightened expectations.

Industrial Recovery Timing: The “recovery” in Industrial is currently based on orders (semi-cap), not yet revenue. If the macro environment worsens, this anticipated H2 ramp could stall.

Capital Intensity: Capex increased to $154M in Q2 (vs $104M in Q1). Management signaled sequential increases. Free Cash Flow conversion needs to be monitored as capital intensity rises to meet demand.

Geopolitical Exposure: Manufacturing expansion in Vietnam and Malaysia is a positive diversification, but heavy reliance on global supply chains remains a risk factor in a volatile trade environment.

“Step Function” Sustainability: A >4x book-to-bill is an outlier. Investors should question how much of this is panic-ordering/double-ordering by customers fearing long-term shortages.

11. Implications for the Stock

A. Performance vs. Expectations

The results heavily exceed expectations. The acceleration in Datacenter revenue (from +4% seq to +14% seq) and the “step function” in bookings (>4x book-to-bill) are significantly more bullish than the “constrained” narrative of Q1.

B. Outperformers & Laggards

Outperformer: Datacenter is the clear standout. 1.6T adoption is happening faster than anticipated, and OCS/CPO traction provides new operational legs.

Laggard: Industrial remains flat, though the “green shoots” in semi-cap orders provide a credible path to recovery.

C. Financial Implications

Revenue: Expect double-digit sequential growth in Q3 and Q4. FY27 is explicitly guided to grow faster than FY26.

Margins: Gross margins should tick higher towards 40% as 6-inch InP volume enters the mix (50% lower cost).

Earnings: EPS leverage will be significant due to the combination of revenue scale, gross margin expansion, and SG&A discipline.

Related reading:

Disclosure: The publisher holds a position in Coherent Corp.