Caterpillar (CAT) Earnings Call Analysis

Clear pivot to Picks, Shovels and Power for the AI build out

The following report was generated with the Earnings Call Transcript Analysis prompt from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

This analysis is based strictly on the provided earnings call transcripts for Caterpillar Inc. (CAT) covering Q2 2025, Q3 2025, and Q4 2025.

1. Executive Summary

Record Growth: CAT concluded 2025 with record full-year sales of $67.6B, driven by a massive 71% YoY increase in backlog to $51B.

Segment Rotation: Power & Energy (P&E) has become the primary growth engine (37% STU growth in Q4), eclipsing Construction Industries (CI) in both scale and growth rate.

Tariff Headwinds: Profitability throughout 2025 was heavily impacted by $1.7B in net incremental tariffs, which suppressed margins from the top half to the bottom half of the target range.

Guidance Trajectory: Management raised the 2026 revenue outlook to the “top end” of their 5%–7% CAGR target, signaling high confidence in backlog conversion.

Data Center Secular Tailwinds: Demand for large reciprocating engines and turbines for data centers is “unprecedented,” with CAT booking four separate orders exceeding 1GW.

Capital Allocation: CAT remains a “Dividend Aristocrat” (32 years of increases) and committed to returning “substantially all” FCF to shareholders, including a planned large Accelerated Share Repurchase (ASR) in Q1 2026.

Sentiment Trend: Sentiment has shifted from “cautious” in Q2 (initial tariff shock) to “strongly positive” in Q4 as record orders and P&E capacity expansions offset cost concerns.

2. Table 1 — Results & YoY Growth

Q4 FY25 revenue materially exceeded analyst forecasts driven by the AI infrastructure build out. Revenue of $19.1bn achieved compares against analyst expectations of $17.85bn and represents an 18% YoY growth rate.

CAT’s revenues have accelerated over the last 3 quarters

EPS of $5.16 represents a 45c beat or >10% above consensus estimate of $4.71.

FCF of $3.7bn in the quarter annualizes at nearly $15bn putting CAT currently on a 5% FCF yield.

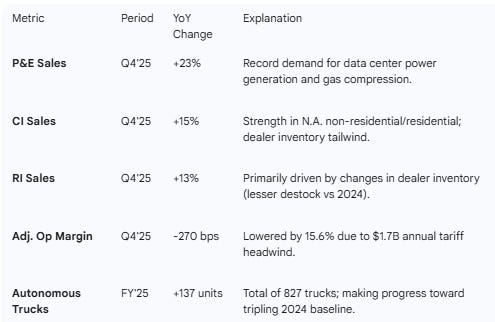

3. Table 2 — Operational & Segment Metrics

4. Table 3 — Guidance & Goals Evolution

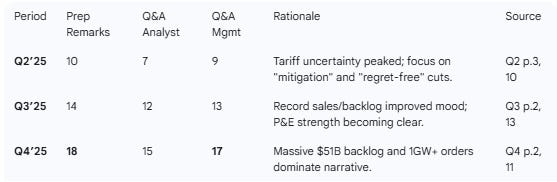

5. Table 4 — Sentiment (0–20)

Author note: Increasing management and analyst sentiment typically tracks or even leads earnings revisions which is correlated with share rice performance. CAT’s sentiment trends are positive and consistent across prepared remarks, analyst questions and Q&A. Analyst questioning on why the backlog growth only leads to 7% rev growth along with rising analyst sentiment may indicate they expect further positive revisions later in the year.

6. Thematic Summary (Prepared Remarks)

Growth Drivers: Shift from price-driven to volume-driven growth in Q4, particularly in P&E and CI.

P&E Secular Surge: Data center “Invisible Layer” (power/minerals) is the core narrative. “Monarch Compute Campus” 2GW order cited as one of the largest in history.

Tariff Complexity: Management shifted from “total mitigation” to admitting tariffs are a structural $2.6B gross cost in 2026, requiring price/cost offsets.

Operational Shifts: Rail division moving from P&E to RI to align with mining/heavy transport customers.

7. Q&A Summary

Q4’25 Theme: Backlog Quality: Analysts questioned why the $51B backlog only yields 7% growth. Mgmt Ans: 62% ships in next 12 months (lower than avg) because customers are booking 2027/28 slots due to capacity constraints.

Q3’25 Theme: Sustainability of P&E: Analysts asked about “overcapacity” risks. Mgmt Ans: This isn’t just assembly; it’s a structural need for natural gas transmission to feed the grid for AI.

Q2’25 Theme: Pricing Flexibility: Analysts asked if backlog can be repriced for tariffs. Mgmt Ans: CI/RI are competitive (limited flexibility), but E&T [Energy & Transportation] has strong pricing power and escalators.

8. Term Frequency Analysis

Author note: term frequencies identify the trend in issues for the company. CAT’s TF analysis shows growing frequency for growth oriented terms and declining uncertainty drivers.

9. Red Flags & Open Questions

Operating Margin Compression: Despite record revenue, adj. operating margin (15.6%) in Q4’25 was significantly lower than Q2’25 (17.6%) and Q3’25 (17.5%) due to tariff timing.

CapEx vs FCF: 2026 FCF is guided “slightly lower” due to a 40% jump in CapEx ($3.5B).

Service Revenue Stall: Services remained flat at $24B in 2025; management blames lower “machine rebuild activity” due to parked coal trucks.

10. Implications for the Stock

A. Expectations: The result Exceeded volume expectations but Met (or slightly missed) on margin due to the $1.7B tariff impact.

B. Exceeded/Shortfall: P&E volume and Backlog growth far exceeded Street views. Service revenue growth fell short of the 2030 glidepath.

C. Immediate Earnings: Q1’26 is expected to be the “lowest sales of the year” (seasonal), but YoY comparisons will be strong due to a $1B+ dealer inventory build.

D. Multiple Re-rating: Potential for multiple Expansion. CAT is successfully pivoting from a cyclical construction play to a secular “AI/Data Center Infrastructure” play with multi-year visibility.

Disclosure: The publisher of The Inferential Investor has a position in CAT.