APPLE Q4 2025 Earnings Analysis Report

Double beat with New Product Cycle to continue the revenue acceleration

The following report was generated with The INFERENTIAL INVESTOR’S Earnings Analysis Report prompt from the professional prompt library on the website www.inferentialinvestor.com

Equity Analyst Report: Apple Inc. ($AAPL)

Date: October 31, 2025

Quarter: Q4 FY2025 (Ended September 27, 2025)

Step 1. Performance Highlights and Quantitative Comparison

Apple’s Q4 results narrowly beat consensus revenue expectations and delivered a solid beat on adjusted EPS. Full-year 2025 results also slightly exceeded consensus targets.

Q4 Revenue: $102.47B vs. $102.25B consensus (Beat by +0.2%).

Q4 Adj. EPS: $1.85 vs. $1.77 consensus (Beat by +4.5%).

FY25 Revenue: $416.16B vs. $415.66B consensus (Beat by +0.1%).

FY25 Adj. EPS: $7.46 vs. $7.39 consensus (Beat by +0.9%).

Performance Summary Table (in millions, except per-share data)

(Note: Q4 2024 Adjusted EPS and Net Income are used for a like-for-like YoY comparison, as reconciled in the 8-K).

Key Business Drivers (Current Quarter):

Record Revenue: The $102.5 billion in revenue marked a new September quarter record.

iPhone Strength: iPhone revenue set a new September quarter record.

Services Strength: Services revenue reached a new all-time high of $28.75 billion.

New Product Cycle: Management highlighted the launch of the “best iPhone lineup ever” (iPhone 17, 17 Pro, iPhone Air), AirPods Pro 3, and a new Apple Watch lineup.

Installed Base: The installed base of active Apple devices hit a new all-time high across all products and geographies.

Shareholder Returns: The company declared a cash dividend of $0.26 per share.

Growth Summary:

Overall, the company’s Q4 results beat consensus expectations, with 7.9% year-over-year revenue growth and 13% adjusted EPS growth. Growth accelerated from Q3 levels, driven by record-setting quarters for the critical iPhone and Services segments.

Step 2. Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q4 FY25 Press Release)

The Q4 commentary was overwhelmingly positive and product-focused. CEO Tim Cook stated he was “very proud” to report a September quarter revenue record, driven by iPhone and an all-time record for Services. He expressed strong optimism for the holiday season, citing the launch of the iPhone 17 lineup, new AirPods and Apple Watch, and the new M5-powered MacBook Pro and iPad Pro as the “most extraordinary lineup of products”. CFO Kevan Parekh reinforced this, noting the quarter capped a record fiscal year ($416B in revenue) with double-digit EPS growth and a new all-time high for the installed base.

Management Discussion (Prior Quarter - Q3 FY25 10-Q)

The Q3 MD&A was far more cautious. While it noted strong performance in iPhone (Pro models) and Services, it also highlighted declines in iPad and Wearables. Critically, the Q3 discussion dedicated significant space to major risks, including:

Macroeconomic Conditions: Concerns over inflation and currency fluctuations.

Tariffs: A new section detailing U.S. Tariffs (on imports from China, India, Japan, etc.) that “can have a material adverse impact on the Company’s business”.

Legal & Regulatory Threats: Detailed updates on the EU Digital Markets Act (DMA) investigations and the U.S. Department of Justice (DOJ) antitrust lawsuit.

Tone Shift Analysis

Sentiment Score (Q4): 18/20 (Highly Optimistic)

Sentiment Score (Q3): 12/20 (Moderate / Cautious)

Sentiment Delta: +6.0 (Significantly more positive)

Narrative Comparison:

Compared to Q3, management’s tone in the Q4 earnings release became significantly more optimistic and product-focused. The Q3 MD&A was heavily balanced with cautious language regarding new tariffs, macroeconomic headwinds, and significant legal/regulatory battles (DOJ and DMA). In contrast, the Q4 press release omits all discussion of these risks, focusing exclusively on positive performance metrics (record iPhone and Services revenue) and the “extraordinary lineup” of new products heading into the holiday season.

Step 3. Guidance Evaluation and Consensus Implications

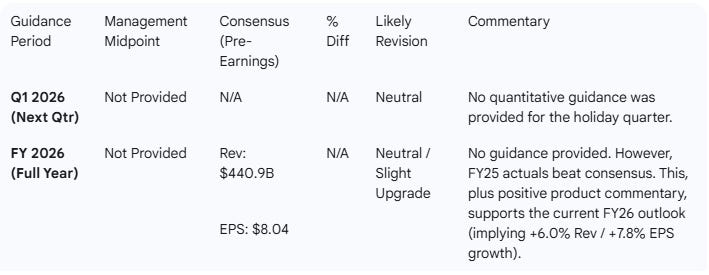

Apple provided no explicit quantitative guidance for the upcoming quarter (Q1 2026) or the full fiscal year (FY2026) in its 8-K press release.

The only forward-looking commentary was qualitative, such as management being “excited to be sharing our most extraordinary lineup of products as we head into the holiday season”.

Implications for Consensus:

With Q4 and FY25 results slightly beating consensus, the existing FY26 estimates are validated, at a minimum.

Management’s highly optimistic qualitative commentary on the new product cycle provides support for the ~6-8% growth implied by FY26 consensus.

The lack of negative guidance, combined with the beat, suggests analyst revisions will likely be Neutral to Slightly Positive. The key variable remains the impact of tariffs and legal issues, which were not addressed.

Guidance & Consensus Table

Step 4. What is Missing?

The Q4 8-K press release was notable for what it omitted. The market was (and is) highly focused on several key risks that were explicitly detailed in the prior quarter’s 10-Q filing.

No Quantitative Guidance: The most significant missing piece is formal revenue and margin guidance for Q1 2026. This is the company’s most important quarter, and its absence leaves analysts to rely on qualitative sentiment.

No Risk Commentary: The press release completely omitted any mention of the major risks detailed in the Q3 10-Q. Investors were awaiting updates on:

Tariffs: The Q3 report warned of “material adverse impact” from new U.S. tariffs. The Q4 release provided no update on this.

Legal Battles: The Q3 report detailed ongoing threats from the DOJ antitrust lawsuit and EU DMA investigations. The Q4 release was silent on these.

Macroenvironment: The Q3 report mentioned “inflation, interest rates and currency fluctuations”. This was not addressed in the Q4 release.

Information Shortfall: The 8-K release functions as a positive financial summary, but it fails to address the major operational and legal overhangs that were a key focus for investors heading into the report. These topics will be the primary focus of the analyst earnings call.

Step 5. Executive Summary

Stock: $AAPL

Quarter: Q4 2025

Result: Beat. Q4 consensus was beaten on revenue by 0.2% ($102.5B vs $102.3B) and on EPS by 4.5% ($1.85 vs $1.77). Full-year FY25 results also slightly beat consensus estimates.

Performance Summary:

Revenue grew 7.9% YoY to $102.5B, an acceleration from the prior quarter. Growth was driven by a September quarter record for iPhone and an all-time record for Services. Operating margin expanded both QoQ and YoY to 31.65%.

Management Commentary:

Management’s tone was highly optimistic, focusing on the “extraordinary lineup” of new products (iPhone 17, M5 chips) for the holiday season. This marks a significant positive shift from Q3, where the MD&A was heavily weighted with cautious language on tariffs, macro-pressure, and legal/regulatory threats. The Q4 press release notably omitted any mention of these risks.

Guidance Implications:

Neutral. Apple provided no quantitative guidance for Q1 2026 or FY2026. Given the modest Q4 beat and positive product commentary, analyst consensus for FY26 (implying ~6% revenue growth) appears stable.

Conclusion:

Apple delivered a solid end to a record-breaking fiscal year, driven by the enduring strength of its two main pillars: iPhone and Services. Management is signaling strong confidence in its new product cycle. However, the complete silence on the significant tariff and regulatory risks detailed last quarter leaves a major gap. Investors must now look to the earnings call transcript for clarity on these headwinds, which remain the primary risks to the consensus outlook.

Step 7. Follow-up Analysis

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis (once the transcript is available)

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis