Alphabet Inc (GOOGL) Earnings Call Insights

Monetizing AI search, continued innovation and expansion of Gemini, rising depreciation but management pointing to expanding operating margin nonetheless.

The following report was generated with the Earnings Call Transcript Analysis workflow from the professional prompt library on The INFERENTIAL INVESTOR.

Subscribe to access these tools and stock research.

Important Disclaimer: The following stock discussion and analysis is subject to The Inferential Investor’s Disclaimer. It is indicative, designed to be educational and instructive on advanced techniques for AI in investment research and is not in any respect financial advice or an investment recommendation.

This analysis is based strictly on the provided Alphabet Inc. (GOOGL) earnings call transcripts for Q2 2025, Q3 2025, and Q4 2025.

1. Executive Summary

Revenue Milestone: Alphabet surpassed an annual revenue run rate of $400 billion in Q4 2025, having delivered its first-ever $100 billion quarter in Q3 2025.

AI Monetization: AI has transitioned from a research phase to a primary revenue driver. Cloud AI products are now generating billions in quarterly revenue, with Cloud revenue growth accelerating from 32% in Q2 to 48% in Q4.

Search Resilience: Despite fears of AI cannibalization, Search growth accelerated throughout the year, ending at 17% YoY in Q4, driven by the expansionary nature of AI Overviews and AI Mode.

Cloud Explosion: Google Cloud is the standout segment, with a backlog increasing from $106B (Q2) to $240B (Q4), a 55% sequential jump in the final quarter.

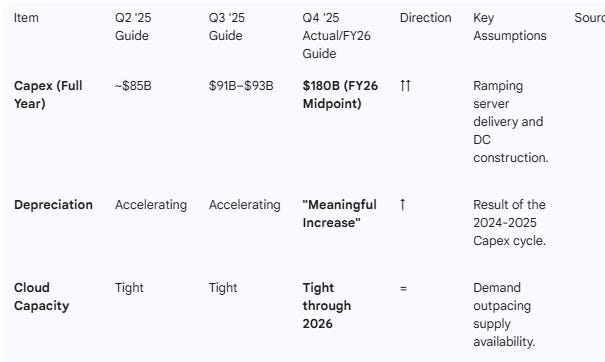

Capex Intensity: Management significantly raised 2025 Capex from an initial estimate of $75B to a final $91.4B. For 2026, guidance suggests a massive step-up to $175B–$185B.

Margin Dynamics: Operating margins remained healthy (~31-32%), but are facing headwinds from accelerating depreciation (up 38% in 2025) and higher data center operations costs. Industry leading and proprietary infrastructure drove 78% reduction in Gemini serving unit cost in 2025. Google Cloud operating margin doubled.

YouTube Strategy: YouTube surpassed $60B in annual revenue. A “twin engine” strategy is being used to convert ad-supported users to higher-margin subscriptions (now over 325M total paid subs).

Guidance Trajectory: Management maintains a “strongly positive” outlook on demand but warns of a “tight supply environment” for compute capacity lasting into 2026.

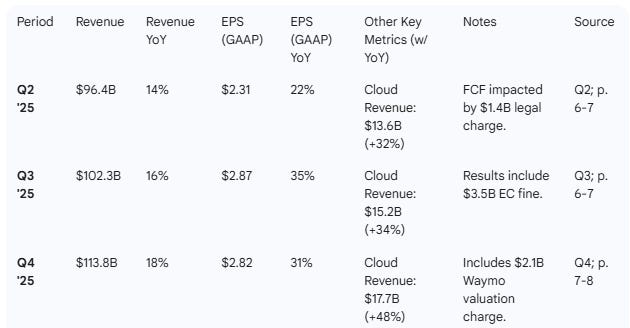

2. Table 1 — Results & YoY Growth

Greater detail on actual performance metrics from the accounts is contained in the separate Earnings Analysis report linked below.

3. Table 2 — Operational & Segment Metrics

For greater detail refer our full Earnings Analysis report with greater segment discussion:

4. Table 3 — Guidance & Goals Evolution

Long-Term Goal: Management aims for an AI-first “Universal Search” experience. Current performance shows Search queries in AI Mode are 3x longer than traditional search, indicating a shift toward complex, high-utility sessions that are just beginning to be monetized.

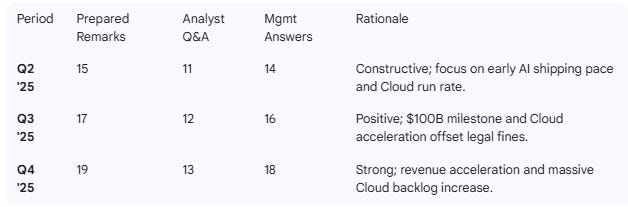

5. Table 4 — Sentiment (0–20 Scale)

Authors note: fairly consistent sentiment increases across management prepared remarks and Q&A responses. Analyst sentiment is improving but remains materially below management with Q&A focus on capex, margins and ROI.

6. Management’s Key Themes (Q4 Prepared Remarks)

Expansionary Search: AI is not cannibalizing search; it is expanding it. Users are asking longer, more complex questions and using multimodal (voice/image) inputs.

Cloud as AI Engine: 95% of top 20 SaaS companies now use Gemini. The segment is benefiting from a “full stack” advantage (Chips + Models + Platform).

Infrastructure Efficiency: Despite the cost, unit serving costs for Gemini dropped 78% in 2025 through optimization.

Capital Allocation: Waymo received a $16B investment round to accelerate global expansion into cities like London and Tokyo.

7. Analyst Q&A Themes & Evolution

Q4 ‘25 Focus

Topic: Agentic Commerce. Analysts questioned the progress of “agentic” products (AI agents that can do tasks) and agentic commerce. Management highlighted the Universal Commerce Protocol as the foundation for seamless transactions.

Topic: Maintaining leadership in LLMs: Analysts questioned how Gemini can maintain its position amid rapid innovation and TPUs as an external revenue stream. Management indicated fast and continued innovation in model training, multimodality and agent capabilities. TPUs are part of Google’s offering.

Topic: Monetization of AI Search and Partnerships: Analyst questioned how Alphabet will monetize longer search sessions. Management stated they are expanding ad quality and relevance enabling ads on longer complex queries. New ad formats being offered providing new revenues.

Topic: Capex ROI. With the jump to $180B Capex guidance, analysts pushed for return metrics. Management cited the $240B backlog and Cloud margin expansion (30.1%) as proof of efficiency.

Topic: Gemini App Usage and Monetization: Analysts questioned whether there is evidence of cannibalization of search by Gemini, and how to monetize. Management indicated they see the app and search AI mode as complementary, expanding overall query volume

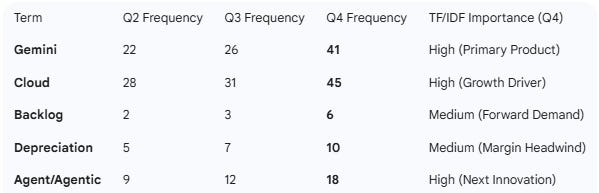

8. Term Frequency Tracking

Growth oriented terms increasing in frequency tracking revenue acceleration. However depreciation is clearly a new and rising focus.

9. Any Red Flags?

Supply Constraints: Repeated warnings that Alphabet will remain “supply constrained” through 2026 despite doubling Capex. This suggests potential revenue being left on the table.

Depreciation Spike: The growth rate in depreciation is expected to “accelerate” and “meaningfully increase” in 2026, which will pressure operating margins.

Lapping Headwinds: YouTube growth (9%) was noticeably slower in Q4 due to “lapping the strong spend on U.S. elections” in 2024.

10. Implications for the Stock

Expectations: The Q4 result likely exceeded market expectations on the top line (18% growth) and Cloud performance, but the Capex guidance ($180B) may be a “sticker shock” for some investors.

Immediate Term: Revenue and Cloud growth are accelerating. However, EPS growth may face pressure in Q1 ‘26 due to the “accelerating growth rate in depreciation”.

Stock Multiple: Alphabet is proving it can monetize AI better than peers (evident in the Cloud backlog and growth and 78% decrease in the unit (token) cost of Gemini), but the depreciation warnings, near term margin impact and “supply constraint” narrative present as a possible a cap on further near-term upside.

Related reading by the Inferential Investor:

Disclosure: The publisher is a holder of GOOGL.

This analisys of Alphabet's earnings really made me think about the future of AI infrastructure. Given the massive Capex step-up for 2026, what are your thoughts on the most significant long-term ROI drivers for that investment?

Appreciate the detailed breakdown! The depreciation spike warnings are worrying tho - feels like classic mgmt trying to manage expectations downward while actual operations r crushing it. I picked up some shares after reading ur structural cost advantage piece and honestly its been a great entry point.