2026 AI Best Practice for Investment Research Survey

Thank you for responding to our first of a kind survey looking into the investment research practices of investors using artificial intelligence tools. This is a private link for you only, as a respondent, so please do not share around. At a future point in early 2026, I will be publishing the results more widely, but as an appreciated respondent, you receive these first.

You hopefully will have received your notification that your complimentary 1 week premium subscription to the Professional Prompt Library has been activated. I really appreciate your participation in this survey.

We received a reasonably strong response to the survey with 70 respondents completing the entire survey, comprised of a mixture of individual investors and those working professionally as part of an investment team with the balance tilted toward individuals.

Key Takeaways

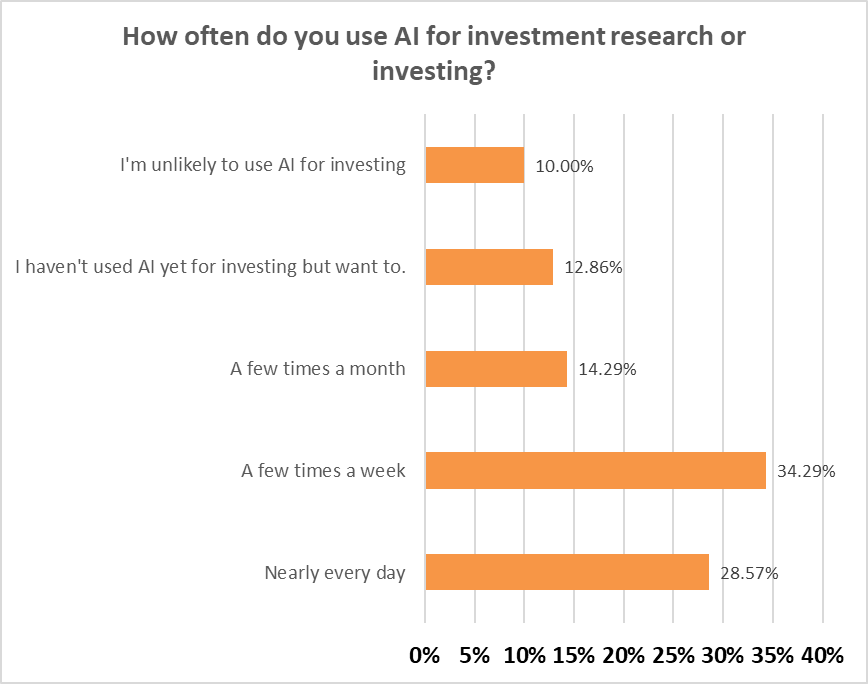

Adoption of AI for investment research has accelerated with approximately 63% of respondents using an AI tool multiple times a week and nearly 30% every day. Only 23% of the 70 respondents had not yet tried AI for investment research with more than half those intending to try it and 10% (7) indicating they were unlikely to adopt it.

Takeaway: AI is clearly being viewed as a core tool for investors of both professional and retail backgrounds.

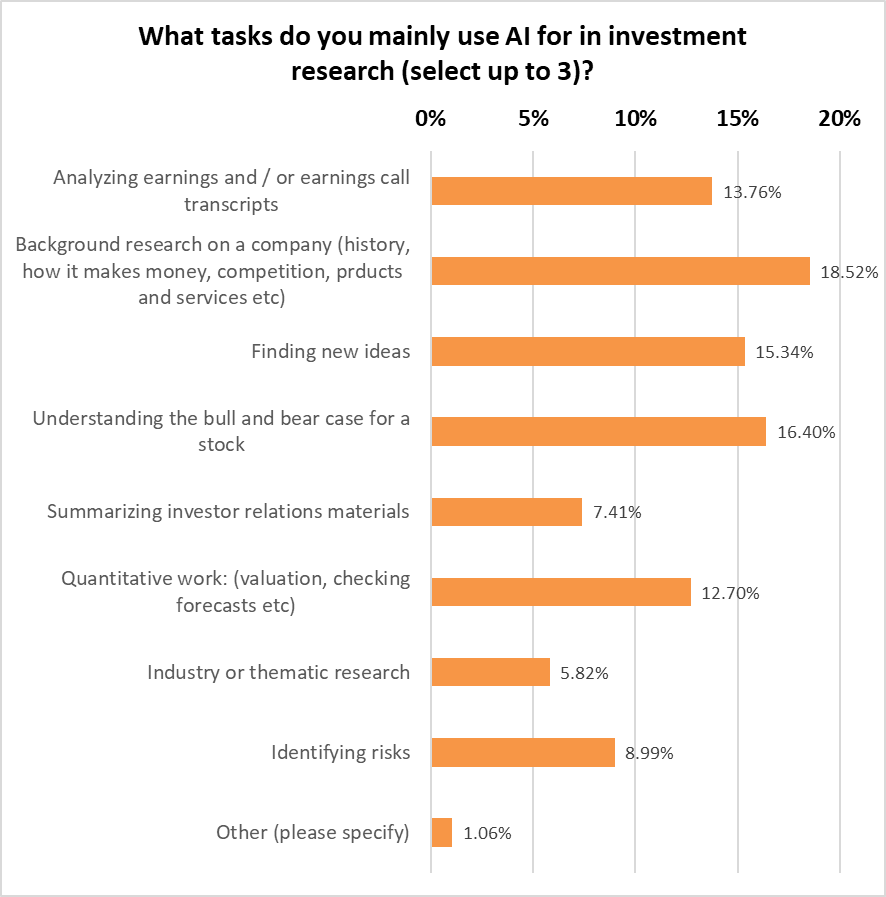

The most common tasks investors use AI for are background research on companies (#1), finding new ideas (#2) and analyzing earnings and call transcripts (#3). Notably, professional investors are far less likely to use AI to find ideas while for individual investors it is their primary use.

Risk identification and quantitative work (valuations, checking forecasts etc) are areas that are still lower on the adoption curve. This is interesting as they are higher on the value-added curve but require more sophisticated prompting techniques and data access to complete reliably - but I would expect with the right tools, these use cases to rise over time.

Takeaway: Most investors still see AI as a research assistant - summarizing and gathering information and news and web searching. More sophisticated users are already adopting AI for its advanced reasoning capabilities crucial for risk synthesis and more quantitative analysis - this is only likely to increase however new tools are likely required given friction with prompting techniques.

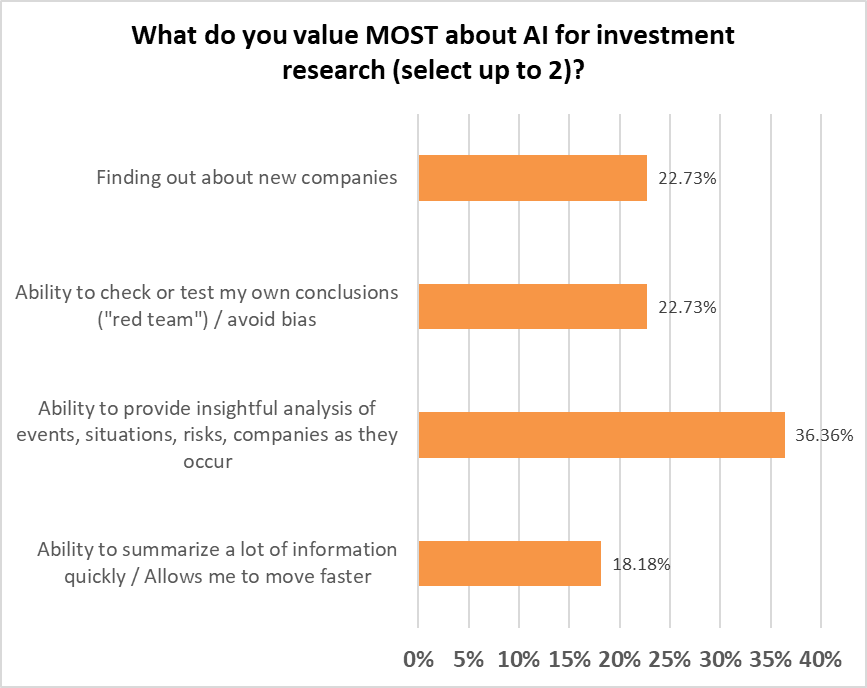

Of most value to investors are AI’s capabilities to provide insightful analysis of events (#1), to find out about new companies and check or test investment conclusions (equal #2).

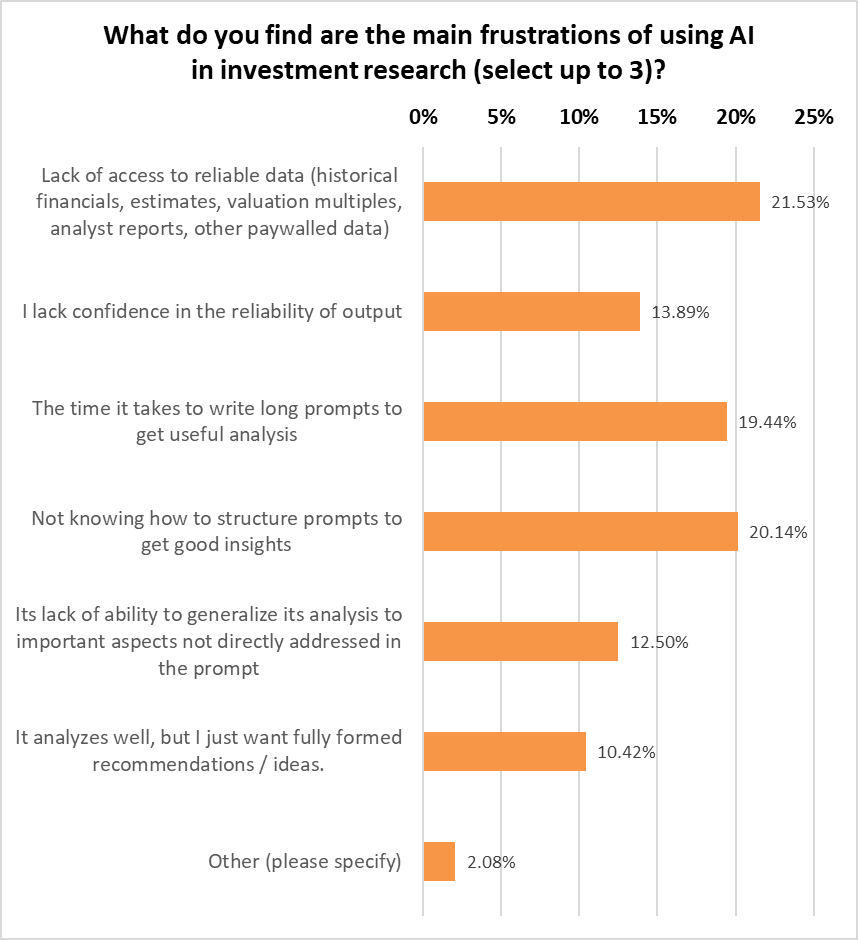

The greatest frustrations for investors in using AI center on lack of reliable data access (#1) given most high value investment relevant data is paywalled and prompt engineering (sophistication of prompts and friction in writing, storing prompts).

Takeaway: Investors recognize that tasks requiring reasoning provide them with greater value / insight but are being frustrated by gaps in the source material AI models are able to work with to achieve this.

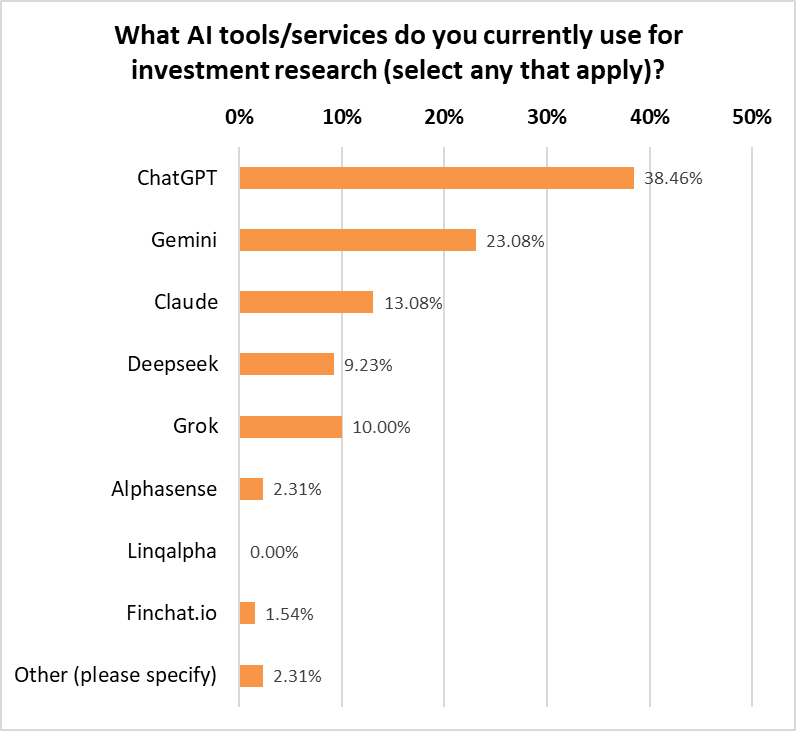

In terms of AI tools that investors are using, many investors are already using at least two tools on a regular basis, suggesting a growing appreciation of the differential capabilities of AI models. ChatGPT unsurprisingly retains top spot with Gemini catching up, likely assisted by the release of Gemini 3 and the integration and improved use of Google web search (dovetailing with background research being the #1 use case). Claude comes in at 3rd spot. Deepseek and Grok are being equally used across this response sample but are a distant 2nd tier.

Takeaway: There is a dichotomy between what investors are most commonly using AI for and their most common model choice. Gemini, with its strong Google search integration and multi-modal capabilities likely better suits the most common use cases for investors currently but the brand power of ChatGPT is winning, despite a clearly observed deficiency in web search RAG that is critical for really detailed background / company research tasks. I see this as indicative of a continued catch up of market share for Gemini as investors do sufficient testing to observe this in practice.