Visa Inc Q4 FY25 Results Analysis

Steady growth, in line, no surprises.

Generated with Inferential Investor’s Earnings Analysis Report Workflow from the prompt library:

Stock: Visa (NYSE: V)

Quarter: Q4 FY2025

Result: Beat

Visa reported Q4 FY2025 results that beat revenue consensus and met expectations for adjusted EPS. The company’s key business drivers remained stable and robust, and management issued fiscal year 2026 guidance that is broadly in line with analyst expectations.

Consensus Comparison: Beat revenue consensus by 1.0% and met Adjusted EPS consensus (beating by 0.3%).

Growth Momentum: Stable. Key drivers, including Payments Volume, Cross-Border Volume, and Processed Transactions, showed consistent year-over-year growth, similar to the prior quarter.

MD&A Tone: Consistently positive. The strategic narrative shifted to be more specific, highlighting its “Visa as a Service” stack and positioning the company as a “hyperscaler” in payments1.

Guidance: In Line. Management’s new guidance for FY 2026 is in line with consensus for both revenue and EPS, suggesting neutral revisions.

Step 1. Performance Highlights and Quantitative Comparison

Visa’s Q4 revenue grew 12% YoY (11% constant-dollar) to $10.7 billion, driven by continued growth in payments volume, cross-border volume, and processed transactions222222222.

GAAP Net Income and Operating Income were down 4% 333and 3.2% respectively, but this was due to a special item: an $899 million litigation provision recorded during the quarter4. On an adjusted (Non-GAAP) basis, Net Income grew 7% 555and Adjusted EPS grew 10% to $2.98666.

Performance Summary Table

Key Business Drivers (YoY Growth, Constant Dollar)

Growth in Visa’s key operating metrics, which drive revenues, remained stable and strong compared to the prior quarter.

Payments Volume: 9% in Q4 21(vs. 8% in Q3 22)

Cross-Border Volume (Total): 12% in Q4 23(vs. 12% in Q3 242424)

Cross-Border Volume (Ex. Intra-Europe): 11% in Q4 25(vs. 11% in Q3 262626)

Processed Transactions: 10% in Q4 27(vs. 10% in Q3 282828)

Full-Year 2025 Performance

For the full fiscal year 2025, Visa also beat consensus targets.

FY25 Revenue: $40.0B 29 vs. $39.89B consensus. (Beat)

FY25 Adj. EPS: $11.47 30 vs. $11.44 consensus. (Meet)

Summary: Overall, the company’s Q4 FY25 results beat consensus expectations on revenue and met them on EPS31. Growth appears to be stable, with key business drivers like Payments Volume (9% 32), Cross-Border Volume (12% 33), and Processed Transactions (10% 34) remaining robust and consistent with the prior quarter.

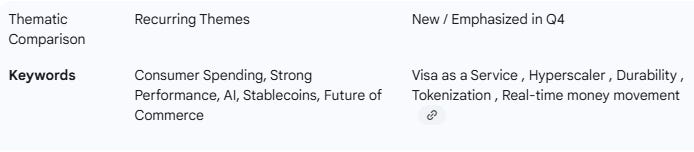

Step 2. Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q4 FY25)

CEO Ryan McInerney attributed the strong quarter to “continued healthy consumer spending,” which drove a 12% increase in net revenue35. For the full year, he highlighted net revenue of $40 billion, underscoring the “durability” of the business model36. The strategic focus was clearly articulated: investing in the “Visa as a Service stack” to serve as a “hyperscaler” across the payments ecosystem37. Management is focused on leading the transformation being reshaped by “Al-driven commerce, real-time money movement, tokenization and stablecoins”38.

Management Discussion (Prior Quarter - Q3 FY25)

In Q3, the message was similar, with the CEO highlighting a “strong quarter” with 14% net revenue growth39. The narrative focused on the resilience of “consumer spending,” noting “continued strength in discretionary and non-discretionary growth in the U.S.”40. The strategic focus was also on innovation in “Al and stablecoins” as key drivers for shaping the “future of commerce”41.

Narrative & Tone Comparison

Sentiment Score (Q4): 17/20 (Confident, Strategic)

Sentiment Score (Q3): 17/20 (Confident, Resilient)

Sentiment Delta: 0.0

Compared to Q3, management’s tone in Q4 remained consistently positive and confident. The core message of resilient consumer spending and strength in key business drivers was unchanged. The primary shift was in strategic language: Q4 introduced more specific terminology, positioning “Visa as a Service” as a “hyperscaler” 42and explicitly naming “tokenization” and “real-time money movement” alongside “AI” and “stablecoins” as key transformation drivers43.

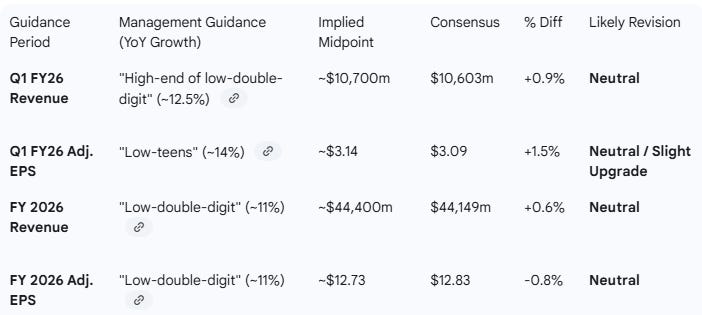

Step 3. Guidance Evaluation and Consensus Implications

Management provided a new financial outlook for the first quarter and full fiscal year 202649. This guidance is on a Non-GAAP Adjusted Constant-Dollar basis50.

To evaluate this, I compared the implied dollar values (based on FY25 actuals) to the consensus estimates.

Q1 FY26 Base: Revenue $9,510m51, Adj. EPS $2.75 52

FY 2026 Base: Revenue $40,000m53, Adj. EPS $11.47 54

Summary: The company’s outlook is almost perfectly in line with market expectations. The Q1 2026 guidance is slightly ahead of consensus, while the full-year 2026 guidance brackets consensus estimates. This suggests that analyst models are well-calibrated, and consensus revisions will likely be neutral.

Step 4. What is Missing?

The Q4 reporting package appears comprehensive.

Guidance: Full guidance for Q1 FY26 and FY 2026 was provided, meeting expectations59.

Market Issues: Management addressed key investor concerns, including the health of the consumer (”healthy consumer spending” 60) and its strategy for new technologies (AI, stablecoins, etc.)61.

New Issues: The large $899 million litigation provision 62 was the main driver of the GAAP earnings miss. This was clearly disclosed, explained as a special item, and reconciled in the non-GAAP figures63, which is what the market primarily values.

Capital Returns: The company gave a clear update on capital returns, including $6.1B in repurchases and dividends in Q4 64and a 14% increase to the quarterly dividend65.

No significant information appears to be missing from the reports.

Step 5. Executive Summary

Stock: V 0.00%↑ Quarter: Q4 2025 Result: Beat

1. Consensus Comparison:

Visa beat Q4 revenue consensus by 1.0% ($10.72B vs $10.62B) and met Adjusted EPS expectations ($2.98 vs $2.97). For the full fiscal year 2025, the company also beat revenue and met EPS consensus68.

2. Performance Summary:

QoQ growth was modest (5.4% revenue, 0.0% Adj. EPS), while YoY growth remained strong at 12% for revenue and 10% for Adj. EPS. Key business drivers were stable: Payments Volume grew 9% YoY, Cross-Border Volume grew 12% YoY, and Processed Transactions grew 10% YoY, all consistent with Q3 trends.

3. Management Commentary:

Management’s tone remains highly confident. The narrative continues to lean on “healthy consumer spending”. The strategic message was refined this quarter, with management introducing new language to describe its strategy, such as building a “Visa as a Service stack” to become a “hyperscaler” in payments.

4. Guidance Implications:

Management introduced FY 2026 guidance for “low-double-digit” growth in both revenue and Adj. EPS73. This guidance is directly in line with pre-earnings consensus, which called for ~11% revenue growth and ~12% EPS growth. Analyst revisions are expected to be neutral.

5. Conclusion:

Visa delivered a clean “beat and hold” quarter. Operational execution is strong, and the underlying business drivers are stable and predictable. The significant GAAP earnings miss was entirely due to a one-off litigation provision, which the market will likely ignore. The 2026 guidance reinforces a continuation of the steady, low-double-digit growth story. The stock’s next phase will likely be driven by sentiment on the consumer and further evidence of its “hyperscaler” strategy paying off.

Further Analysis

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis

Great breakdown of Visa's Q4 results! I appreciate how you highlighted the 'hyperscaler' positioning and the strategic focus on tokenization and real-time money movment. The litigation provision context was especially helpful for understanding the GAAP vs. non-GAAP performance. Looking forward to seeing how their AI-driven commerce initiatives play out.