United Health confirms 2026 return to growth

Q3 FY25 Result Analysis and Management Discussion NLP insights

The following analysis is the response from The Inferential Investor’s Earnings Report Analysis workflow prompt that can be accessed for paid subs via the prompt library. These outputs take 60s to generate when the report drops. We specifically guide investors to examine the insights from the NLP processing of management discussion and earnings call prepared remarks.

Equity Research Quick-Take: UNH Q3 2025 Results

Stock: $UNH (UnitedHealth Group)

Quarter: Q3 2025 (Ended September 30, 2025)

Date: October 29, 2025

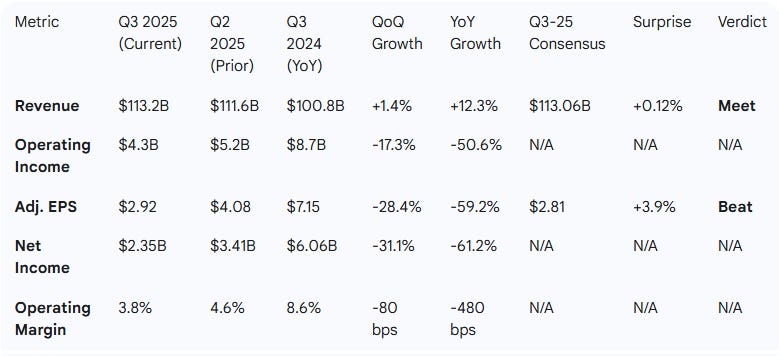

Step 1: Performance Highlights and Quantitative Comparison

Performance Summary Table

Q3 2025 Performance vs. Consensus

Revenue: $113.2B reported vs. $113.06B consensus

Adjusted EPS: $2.92 reported vs. $2.81 consensus

Key Performance Drivers (Q3 2025)

Medical Cost Ratio (MCR): The consolidated MCR was 89.9%1919. This was the most critical metric for the quarter. Management stated this level was “in line with expectations outlined in the second quarter”20202020, suggesting that the severe medical cost trends identified in Q2 have stabilized and not worsened.

Segment Performance:

UnitedHealthcare (UHC): Revenue grew 16% YoY to $87.1B, driven by growth in Medicare & Retirement and Community & State segments21212121.

Optum: Revenue grew 8% YoY to $69.2B, driven primarily by strong growth in the Optum Rx pharmacy services business22222222.

Operating Costs: The operating cost ratio rose to 13.5% (from 13.2% YoY)23. This was attributed to over $450 million in new investments for broad-based employee incentives and technology to support future growth 24.

Cash Flow: Cash flow from operations was very strong at $5.9B, or 2.3 times net income25252525.

Capital Position: The debt-to-capital ratio remained stable at 44.1% 262626, even after absorbing the $3.4B net cash disbursement for the Amedisys transaction, which closed in August272727.

Growth Summary

Overall, the company’s Q3 results Beat consensus expectations on Adjusted EPS ($2.92 vs $2.81) and Met revenue ($113.2B vs $113.06B)2828. However, profitability remains under severe pressure, with Adjusted EPS declining 59.2% YoY and operating margins contracting by 480 basis points29292929. This severe margin compression, which began with the Q2 reset, continues as expected, driven by persistently high medical cost trends (MCR at 89.9%) and Medicare funding cuts30303030. The key takeaway is one of stabilization, not further deterioration.

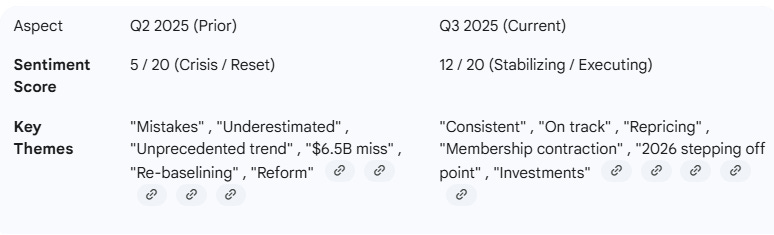

Step 2: Management Discussion & Analysis (MD&A) Comparison

Management Discussion (Current Quarter - Q3 2025)

Sources: Q3 2025 Press Release & Q3 2025 Earnings Call Remarks

Management’s narrative focuses on “strengthening performance and positioning for durable and accelerating growth in 2026 and beyond”31. CEO Stephen Hemsley stated the enterprise is advancing on the “improvement paths first discussed in July” 32, emphasizing new leadership, strengthening underperforming businesses (Optum Health/Insight), and recommitting to the company’s mission333333. The key challenge acknowledged is the “historically high” but consistent medical cost trend, which remains in line with the (revised) expectations set in Q23434.

A major focus is on the 2026 repricing actions, which are now “on track” to drive margin improvement at UnitedHealthcare35. This includes pricing for a ~7.5% Medicare Advantage (MA) trend in 2025 and an anticipated 10% trend in 202636363636. However, this will come at the cost of membership, with an expected contraction of approximately one million MA members 37and a two-thirds reduction in ACA enrollment38. Management also warned that Medicaid margins will likely decline further in 2026 due to insufficient state funding39. At Optum, the focus is on “getting back to the basics” of value-based care (VBC) by narrowing networks 40404040and exiting unprofitable contracts 41, with VBC membership expected to shrink by approximately 10% in 202642.

Management Discussion (Prior Quarter - Q2 2025)

Sources: Q2 2025 Press Release & Q2 2025 Earnings Call Remarks

The Q2 discussion was a major “kitchen sink” reset. After suspending guidance in May 43, management re-established a significantly lower full-year outlook44. The tone was one of radical change and humility, with the CEO embarking on a “rigorous path back to being a high-performing company” 45and admitting to significant “pricing and operational mistakes”46. The core narrative was underestimating an “unprecedented medical cost trend” 47, which was measured in both intensity of services and unit prices48484848.

Management quantified the miss, stating 2025 medical costs were $6.5 billion more than anticipated 49, setting a new 2025 MCR target of 89.25%50. At UnitedHealthcare, this was driven by underpricing MA (expecting 7.5% trend vs. 5% assumption) 51and ACA morbidity52. At Optum Health, earnings were $6.6 billion below expectations, driven by V28 headwinds, poor enrollment mix, and high medical trends 53. The recovery plan involved aggressive 2026 repricing (assuming a 10% MA trend) 54, exiting PPO plans 55, and a full re-evaluation of the Optum VBC model 56.

MD&A Thematic Shift

Tone Shift Summary:

Compared to Q2, which was a major “reset” call admitting to significant “operational and pricing mistakes”69, management’s tone in Q3 shifted from crisis management to stabilization. The Q2 call was defined by shock and humility, quantifying massive earnings shortfalls (a $6.5B medical cost miss at UHC, $6.6B at Optum) 707070and a “generational pullback” in Medicare funding71. In Q3, the tone is one of steady execution on the “improvement paths first discussed in July”72. The key message is that while medical cost trends remain “historically high,” they are now consistent with the new (lower) expectations73737373. The focus has moved from identifying the problem to executing the painful solution, which includes significant 2026 membership losses (1M in MA, 10% in Optum VBC) in exchange for margin recovery7474.

Step 3: Guidance Evaluation and Consensus Implications

Management updated its Full-Year 2025 guidance and provided critical, confirming commentary on 2026.

Step 4: What Is Missing?

The Q3 report and call successfully addressed the market’s primary concern: medical cost trends. The confirmation that MCR was “in line” 80 and not accelerating further was the most important data point. However, several new issues and gaps emerged:

Quantified 2026 Membership Losses: The biggest new disclosure was the cost of margin recovery. Management explicitly guided for a contraction of ~1 million Medicare Advantage members 81 and a ~10% shrink in Optum VBC membership 82 for 2026. This confirms the strategy is “margin over growth.”

Worsening Medicaid Outlook: The tone on Medicaid deteriorated. In Q2, management noted a “lag” 83; in Q3, they explicitly guided for margins to “decline further” in 2026 due to insufficient state funding84.

Amedisys Contribution: The Amedisys transaction closed on August 1485, but management provided no specific detail on its Q3 financial contribution or its expected impact on 2026 guidance.

Future Charge: The CEO mentioned an upcoming non-GAAP, “low single digit billion dollar” non-cash charge related to restructuring (consolidating locations, reducing international footprint) that will be finalized in Q4868686868686868686. This remains an unquantified item.

Step 5: Executive Summary

Stock: $UNH

Quarter: Q3 2025

Result: Beat & Raise.

1. Consensus Comparison:

UNH reported Q3 Adj. EPS of $2.92, 3.9% above the $2.81 consensus87. Revenue of $113.2B was in line with the $113.06B consensus88.

2. Performance Summary:

The quarter confirmed a stabilization following the massive Q2 “kitchen sink” reset. While YoY profitability metrics remain extremely poor (Adj. EPS -59.2%, Op. Margin -480 bps)89898989, this was expected. The critical Medical Care Ratio (MCR) came in at 89.9% 9090, which management described as “in line with expectations”91919191. This strongly suggests the severe medical cost trends identified in Q2 have stabilized and not accelerated.

3. Management Commentary:

The tone shifted significantly from crisis (Q2) to stabilization (Q3). The Q2 call was defined by admissions of “pricing and operational mistakes” 92and quantifying a $6.5B medical cost miss93. The Q3 call focused on being “on track” 94 with the recovery plan. The core message: the problem is understood, and the 2026 repricing is underway. This repricing will be severe, with management flagging new expectations for significant membership contraction in 2026 (approx. 1 million in Medicare Advantage 95, 10% in Optum VBC 96) to restore margins.

4. Guidance Implications: Net Positive.

FY 2025: Management raised the floor for FY 2025 Adj. EPS to “at least $16.25,” (up from $16.00), moving it above the $16.22 consensus97. This signals confidence in the second-half plan.

FY 2026: In a significant de-risking move, management explicitly endorsed the current 2026 analyst consensus as a “likely stepping off point”98989898, removing a major overhang of uncertainty.

5. Conclusion:

UNH’s Q3 result was a “sigh of relief” quarter. While the headline numbers are extremely poor YoY, they met the drastically lowered expectations set in Q2, indicating that the crisis in medical cost trends has stabilized. Management has successfully shifted the narrative from “what went wrong” to “here is the (painful) fix.” By raising 2025 guidance and, more importantly, endorsing 2026 consensus, UNH has drawn a line in the sand, signaling that the earnings trough is understood and the path to margin recovery—via aggressive repricing and membership sacrifice—is underway.

Step 7: Follow-ups

Do you want me to adjust any of the metrics in this AI-generated output and have the report updated?

I can also provide, using the proprietary prompts from The INFERENTIAL INVESTOR:

Detailed earnings transcript analysis

A comprehensive Equity Research Report

Financial statement analysis with red flags and forensic checks

Segment Performance Breakdown — show revenue/EPS by business unit.

A comprehensive initiation report on the stock

Specialist industry analysis

If you want to generate these insights within a minute of results being released for EVERY stock you follow, consider becoming a paid sub. There’s 2 more days on our 50% discounted launch offer!

Andy West, The Inferential Investor

This analysis really captures the 'stabilization not deterioration' narrative that UNH is pushing. The Q2 to Q3 tone shift is huge - from admiting operational mistakes to confidently endorsing 2026 consensus. However I'm skeptical about the 'margin over growth' strategy working smoothly. Loosing 1M MA members in a single year is massive, and it's gonna be interesting to see if competitors can absorb that capacity without their own MCR problems. The Optum VBC shrinkage is also worrying for the long-term thesis - isn't value-based care supposed to BE the future?