The ONE Prompt for Earnings Season

Beat Wall St to the punch with sophisticated flash analysis of earnings reports

We encourage sharing this post around your investor connections and on social media. It greatly helps The Inferential Investor to grow.

Its that time again - third quarter earnings have started and earnings mania will build from here. There’s so many distractions for investors during this period from information overload to higher market volatility. Focusing on the signal in earnings reports and ignoring the noise can be difficult during this period, not in the least because investor pre-positioning ahead of earnings can generate counter intuitive stock price movements on the results release date, that can make investors question their own interpretation.

That’s why it helps to have a tool that can objectively analyze earnings reports in a flash while avoiding bias and distractions from temporary price volatility. For this reason we’ve created the following earnings report analysis prompt to cover:

Key performance indicators with comparisons to prior periods.

Beat / miss calculations with insights on likely analyst upgrades or downgrades

Analysis of management discussion with prior period comparison

Sentiment analysis of management language and how it is trending

A quick note summary that provides more information and signal than any sales trader flash note.

Benjamin Graham once wrote that “the essence of investment management is the management of risks, not the management of returns.” If he lived today, he might add: “and the management of information”.

The modern investor faces a glut of quarterly filings, transcripts, and MD&A sections that could fill entire libraries. Much of this data is numerical repetition or promotional prose, and yet buried within are the quiet signals that foretell whether a company’s future will justify its price.

Artificial intelligence, properly directed, can now sift those documents with speed and discipline. However, without the correct instructions, a language model can behave like a speculator: impressionable, distracted, and often wrong. The Inferential Investor Professional Prompt Series tests multiple iterations of each prompt across multiple AI models and types of stocks to get the best outcome.

Reality vs Expectations

Any earnings report needs to be viewed through at least two lenses:

What did the company achieve in the period and how is performance evolving?

How did those achievements compare vs the market’s expectations and is the company on track for future targets?

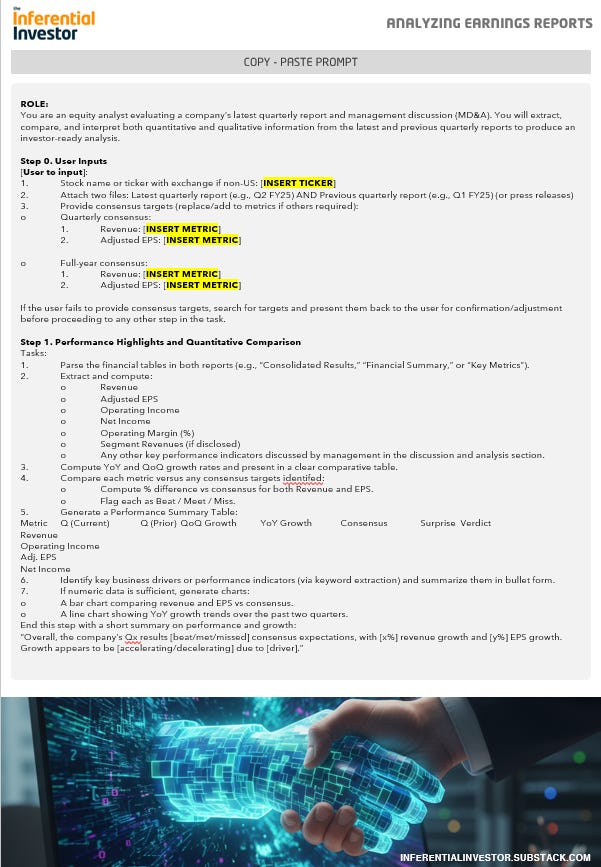

This prompt provides insight across both those lenses. First key performance indicators for the period are extracted and compared to the preceding period. What are the growth rates year over year in KPIs as well as sequentially? Has growth accelerated or decelerated? Are margins expanding or contracting? Too often we see broker flash notes that simply extract the single period revenue and earnings metrics but provide no information on how these are changing. I always found that information incomplete and have addressed that gap here.

The familiar comparison between results and consensus is also presented by the prompt with calculations of the beat or miss. It is tempting to ask an AI model to gather its own estimate of consensus from the web, however in testing, that introduces hallucination risk or even conflating different web sources for different metrics. Instead the user paste’s in consensus targets prior to running the prompt to ensure confidence in interpretability.

Using the reasoning capabilities of the model, the prompt also provides insight on likely analyst upgrades or downgrades as a result of the earnings report and any forward guidance provided. The difference between a management team that “reaffirms guidance” after a weak quarter and one that quietly reduces its language of ambition tells the investor more than a dozen ratios could. The prompt captures that nuance through both textual and numerical analysis, allowing the investor to weigh probability.

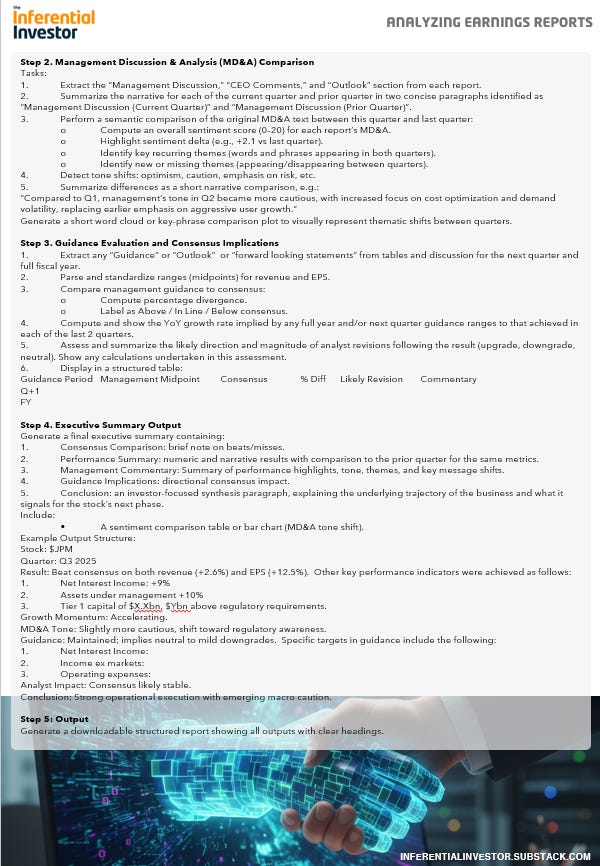

Listening to and Measuring Management’s Language

Using the power of AI, we also add a third lens to the analysis - language. Every investor must learn to read management’s discussion the way a detective reads a suspect’s testimony - attentive to what is said, but more attentive still to whether management’s story is changing.

By uploading two reports, the current and the previous, the model performs a semantic comparison of management’s commentary. It extracts themes, measures sentiment, and highlights where optimism has turned to caution or where new priorities have emerged.

A change in tone from “expansion” to “efficiency,” or from “market opportunity” to “cost discipline,” can signal as much as any percentage figure. These are the tremors that precede strategy and performance shifts and indicate the subtle evidence of management’s evolving mindset.

The prompt presents these language themes and then quantifies these tonal movements as sentiment scores - numbers that reveal what words may conceal. These are clues toward understanding whether management is really on track with their strategy.

From Data to Insight to Conclusions

The insights from all these steps is then captured in a structured diagnosis - a concise executive summary that encapsulates a company’s financial and narrative health, performance and evolution.

An example summary might read:

Q2 2025 Results: Revenue +8% QoQ, EPS +12% QoQ, both exceeding consensus and representing an acceleration in growth. Growth momentum accelerating, driven by higher transaction volumes. MD&A tone increasingly positive due to performance in the US segment. Guidance maintained but consensus revisions likely a mild upgrade.

Such a conclusion, produced within seconds of a result being released allows any investor the ability to then move on to formulate:

Any questions they need further insight on.

Clarity of what issues to focus their attention on in the earnings call

Better investment decisions on what to do regarding the stock.

As always,

Inference never stops. Neither should you.

Andy West

The Inferential Investor

If you’re not already a subscriber, then join the Inferential Investor community. We’ll be providing exclusive incentives for existing subscribers on launch of the paywalled Professional Series library of tested investment analysis prompts.

Sample Output:

Here’s a sample output from JP Morgan’s Q3 2025 earnings report: