The Imminent Solid State Shift, aka "Toyota's Revenge"

How Solid State Batteries are set to upend the competitive landscape again in EVs and potential winners and losers

By reading this article, readers acknowledge the terms of our full legal disclaimer. The information provided herein is for educational and general informational purposes only and does not constitute professional financial or investment advice nor a recommendation to trade in any stock mentioned.

The electric vehicle (EV) industry is about to undergo its most significant technological pivot since the introduction of the Tesla Model S. For the last decade, the lithium-ion battery has been the workhorse of electrification. But as we move through 2026, a new standard is emerging from the labs and hitting the asphalt: the solid-state battery (SSB). This game changing technology for the automotive industry has only been a science experiment for the last 7 years, however as this note details, certain companies have invested in years of cumulative R&D to get to this point, while others, often those with the most invested in more traditional lithium ion technology, have dismissed the technology and lag the SSB leaders by years.

With major automotive OEMs like Toyota and Mercedes-Benz finally playing their hands, and startups like Verge Motorcycles actually delivering product to customers, the competitive dynamics of the automotive industry are set to markedly change again - just as they did when the first modern EV appeared.

Here is the landscape of the solid-state shift and what it means for the future of automotive companies.

1. Lithium-Ion vs. Solid State

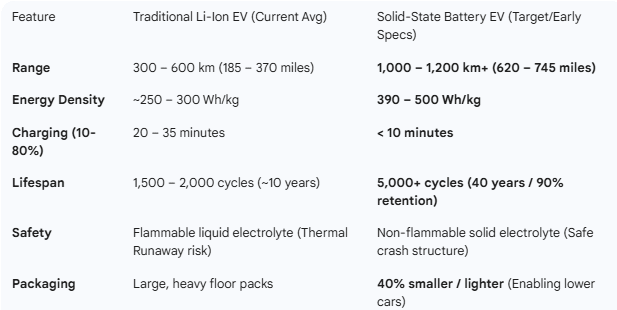

To understand the disruption, we must first map the capabilities. Traditional lithium-ion batteries use a liquid electrolyte to move ions between the cathode and anode. This liquid is heavy, flammable, and limits energy density. Solid-state batteries replace this with a solid material (ceramic, glass, or sulfide), unlocking a step-change in performance.

The implications of SSBs for vehicle performance and marketability are enormous. More than double the range (over 1,000kms), one third or less of the charging time (under 10 minutes) and four times the lifecycle (40 years potentially vs 10 for traditional Li-ion). Gone is the range anxiety. Gone is the inconvenience of long charging times. Gone is the huge hidden cost most EV drivers try not to think about, in replacing their battery after 10 or so years (or accepting a very low resale value).

Remember the moment the first smartphone appeared that made a phone the center of your life? Your old Motorola was suddenly a brick. Market share shifted overnight. The benefits of SSBs to automotive mobility represent such a change as they directly address all the major pain points of owning a traditional lithium ion based battery EV. Back when the first smartphone was released, it didn’t matter that the phone was up to 10x the price of a standard Motorola. The benefits were clear and the death warrant was signed for standard mobiles. SSBs represent that challenge to todays’s EVs.

That means that having proprietary and patent protected SSB technology gives your future products a massive competitive edge. When a car purchaser walks into a showroom and is presented with a vehicle that has 4x the life (and therefore resale value holds), twice the range and loads more lifestyle convenience, any salesperson is going to have a very hard time explaining why you might consider a legacy EV instead, even with a discount. This suggests that by the time SSBs hit the mass market, the choice will be akin to the shift from legacy mobile phones to smartphones - sudden and permanent.

The implications for design are also massive. Because SSBs don’t require the heavy cooling jackets and safety armor of liquid batteries, they allow for lower, sleeker sports cars and lighter city vehicles, reversing the trend of EVs becoming heavy “tanks.” This makes way for revamped, more modern designs that will quickly make todays EVs look as dated as the Tesla Model 3 made ICE vehicles look.

Despite these clear competitive advantages that are set to change the market dynamics in the automotive industry once again, EV heavyweights like Tesla are lagging the trend. They have steadfastly refused to invest in SSB development as they focus on monetizing their significant investments in production lines and R&D on legacy battery tech. One company however, has taken a completely different strategy in the last 10 years and over 2026 and 2027 is set to reveal what it has achieved.

2. The Sleeping Giant Wakes: Toyota’s Master Plan

For years, critics accused Toyota of lagging significantly behind in the EV race. While Tesla and BYD scaled lithium-ion production, Toyota stubbornly focused on hybrids. It had led this engine efficiency revolution with the development of its hybrid synergy drive which doubled efficiency from the late 1990’s. Toyota’s hybrid technology and patents led to market share gains and a brand reputation for efficient, environmentally friendly automobiles.

Many assumed that would lead Toyota to also winning the electrification race. Instead, the company adopted the position that Li-ion batteries were only a transition technology with too many disadvantages to fit the Toyota brand ethos of decarbonization, long lifespan, value stability and reliability. Toyota famously took the view that electric vehicles actually only made sense once the electricity grid was significantly decarbonized. I guess some progress has been made there.

Consequently, Toyota effectively decided to skip the “liquid electrolyte wars” to pour its R&D budget into the next generation of SSBs which promised to solve all the pain points of Li-ion technology. This decision was not without cost to its market share over this period. But that strategic move looks set to pay off in terms of its leadership as SSBs hit the market.

It must be highlighted at this point that Toyota has again followed the same strategy with SSBs that was so successful with with hybrid drives for them. They have taken their time to perfect the technology, test it, let it fail and correct it, before releasing it. In addition, and unlike all other automotive company’s, Toyota has been developing SSBs wholly in house (within the Toyota Group) amassing 1700 to 2000 active patents (across 516 patent “families” which better represent the number of actual “inventions”) specifically related to SSBs.

By comparison, SSB pure plays such as Quantumscape and Factorial have 300 and 150 patents and applications respectively (but much fewer actually granted). The nearest to Toyota is Panasonic with 450-500 SSB patents.

This patent comparison demonstrates the level of investment Toyota has put into its SSB strategy and their level of readiness compared with others.

Toyota has been working to position itself as the global leader in this emerging technology and is not beholden to many other parties as they own the largest portion of the intellectual property chain.

Key Milestones & Claims:

The “Verification Year” (2026): Toyota has officially moved from lab research to pilot production. The company is currently building verification vehicles that are “All Solid State Battery” (ASSB).

Commercial Launch (2027-2028): The first Toyota SSBs will hit the market, likely in their higher price Lexus brand.

Mass Production (2030): Full-scale mass market availability is targeted for models to be released in 2030. This may drive a massive model revamp as this period arrives to capitalize on all the advantages SSBs provide.

Performance: Toyota claims a cruising range of 1,000 km initially, rising to 1,200 km in second-generation cells, with a charge time of 10 minutes or less.

I highly recommend watching this youtube video on Toyota’s SSB developments:

The Competitive Shift:

Toyota’s strategy poses a lethal threat to EV incumbents. By retaining high margins on hybrids while others fought a price war on Li-ion EVs, Toyota has preserved the capital needed to leapfrog the market. If Toyota launches a Corolla-sized EV in 2030 (only 4 years, their normal model cycle) that charges in 5-10 minutes and lasts 40 years, the depreciation curve of a standard Tesla Model 3 or BYD Seal could collapse overnight.

3. Mercedes-Benz:

While Toyota makes headlines, Mercedes-Benz is arguably further ahead in real-world validation. Partnering with US-based Factorial, Mercedes has been aggressively testing its next-generation technology.

Developments & Milestones:

Factorial “Solstice” Cells: In late 2025, Mercedes began integrating Factorial’s “Solstice” all-solid-state cells into test fleets.

The 1,200km Run: In a stunning demonstration in August 2025, a modified Mercedes EQS equipped with solid-state cells completed a real-world drive from Stuttgart, Germany to Malmö, Sweden (1,205 km) on a single charge, arriving with range to spare.

Road Testing: As of February 2026, Mercedes has officially begun public road testing of these fleets, targeting a late-2020s series production launch.

This positions Mercedes to dominate the luxury segment, where buyers will pay a premium for “gas-equivalent or beating” range and convenience. However, Mercedes is reliant on Factorial’s technology and development pathways and does not have any exclusivity over the technology. They are an investor and as such have influence and likely manufacturing “priority” but that is as far as it extends.

4. OEM First Movers: Verge, Stellantis, and Geely

While the giants prepare, smaller players are already moving metal.

Verge Motorcycles (Production): The Finnish manufacturer Verge has beaten the auto industry to the punch. The Verge TS Ultra, delivered to customers starting early 2026, is a production vehicle featuring a solid-state battery pack from Donut Lab. It offers a “motorcycle-impossible” range of 375 miles and charges in just 25 minutes. Early reviews call the performance “insane,” validating that the tech works outside a lab.

Stellantis (Dodge/Jeep): Stellantis is launching a demonstration fleet of the Dodge Charger Daytona in 2026 using Factorial’s solid-state cells. This validation fleet is a critical step toward their target of mass production in 2028.

NIO (Semi-Solid): We cannot ignore NIO, which currently has thousands of 150 kWh semi-solid state packs (manufactured by WeLion) on the road. While expensive to buy, their rental model allows users to swap into these packs for long trips, offering a real-world range of over 1,000 km today. These are not ASSBs but demonstrate movement in the SSB direction.

5. Pure Plays: QuantumScape, Factorial, and Solid Power

The other side of this revolution is a group of both publicly traded and pre-IPO battery companies.

Factorial Energy: Rapidly becoming the industry favorite. In Jan 2026, they secured major investment from POSCO to secure their supply chain. With validated partnerships with Mercedes, Stellantis, and Hyundai, they are rumored to be preparing for a major US IPO later in 2026. Their “FEST” platform is achieving energy densities of 390 Wh/kg+ (versus Toyota’s claimed 450-500 Wh/kg. By comparison, Tesla’s 4680 betery has 244-270 Wh/kg).

QuantumScape (VW Group partial ownership): After years of delays, QuantumScape met its 2025 commercial goals, delivering high-volume B-samples to launch partner Volkswagen (PowerCo). Their “anode-free” lithium-metal design promises high density, but integration into VW’s mass-market MEB platform is still likely a 2027+ story.

Solid Power (BMW/Ford partnership): Adopting a sulfide-based electrolyte approach, Solid Power has delivered demonstration cells to BMW. A BMW demonstrator vehicle is expected on roads later in 2026. Their unique angle is a “drop-in” manufacturing process that uses existing Li-ion factory tools to keep costs down.

Costing: Currently, SSB cells are estimated to cost 3-4x that of Li-ion ($300-$400/kWh). However, companies project cost parity with Li-ion (~$70-$80/kWh) by 2030 as scale ramps up.

6. Battery Incumbents: CATL, BYD, Samsung SDI and LG Energy Solutions

The Lithium-ion battery leaders are not sitting idle. They are aggressively hedging their bets. However, with perhaps the exception of Samsung SDI, they, like many companies anchored by a legacy technology, appear to be behind Toyota and the Pure Plays.

CATL: The world’s largest battery maker has adopted a “dual-track” strategy. They are mass-producing “Condensed Matter” batteries (a semi-solid variant) in 2026 for high-end EVs and aviation (claiming 500 Wh/kg). True all-solid-state batteries are slated for “small batch” production in 2027.

BYD: The Chinese giant has been more conservative, stating that all-solid-state mass production is a 2030 target. However, they will launch demonstration vehicles in 2027. BYD’s current strategy is to squeeze cost efficiency out of their LFP “Blade” batteries to dominate the low-to-mid market.

Samsung SDI: Perhaps the most aggressive of the traditional players, Samsung is targeting the robotics market first in 2026 (powering humanoid robots) before moving to EV mass production in 2027.

LG Energy Solution (LGES) has a robust, active development program for solid-state batteries, aiming for commercialization of sulfide-based solid-state cells by 2030, with semi-solid battery production planned for 2026-2027. The company is actively researching high-capacity, safe sulfide-based cells and launching pilot lines for these and other next-generation technologies.

7. Tesla’s Dilemma

This leaves Tesla in a precarious, albeit profitable, position. To date, Tesla has dismissed SSBs, with Elon Musk focusing entirely on the 4680 cylindrical cell and reducing costs (the “unboxed” process).

Tesla is betting that “good enough” range (350 miles) at a cheap price beats “extreme” range (700 miles) at a high price. However, as Mercedes and Toyota introduce vehicles that charge as fast as filling a gas tank and last 40 years, Tesla risks losing its crown as the “tech leader.”

Its possible that SSB developments aimed at humanoid robotics may be Tesla’s entry to the SSB market, however this is not a stated strategy of the company. Toyota has taken years of development to get to industry leading energy density in its SSB prototypes. This will be very difficult for Tesla to replicate and in all likelihood they will end up competing with other manufacturers for SSB capacity from the major battery companies.

Tesla’s EV leadership has to date been built on being seen as having developed the best battery tech. It is impossible to maintain that brand position if you are just another customer of a battery company supplying all your competitors with the same specifications. This is just another data point suggesting that Tesla’s strategic priorities have shifted away from vehicles entirely. The company’s focus has moved elsewhere.

Conclusion: Winners and Losers of 2026-2030

We are witnessing the bifurcation of the EV market. Initially:

The Low End: Will remain dominated by LFP lithium-ion batteries (BYD, Tesla Model 2/3) where price is king.

The High End: Will rapidly shift to Solid State (Mercedes, Toyota/Lexus, Porsche) where performance defines the brand.

However as volumes grow, SSB prices will fall with mass market product launches targeted for only 4 years from now. Due to the clear advantages of SSBs over Li-ion batteries, those who are leading the shift are likely to benefit in market share and as I’ve pointed out, the surprising leader seems to be Toyota.

Watch list for the next 12 months:

Keep a close eye on the Factorial IPO (which could shape up to be the hottest clean-tech listing of 2026) and the first media drives of the Toyota and Mercedes SSB fleets. For legacy automakers like Toyota, this is their “Empire Strikes Back” moment. For Tesla, it is the first time in a decade they are not the ones setting the pace.

Andy West

The Inferential Investor