Objectively Assess the Strength of a Company's Moat, Business Model, Pricing Power and Resiliency

A quantitative approach using the Hamilton Helmer 7 Powers framework

Last updated: 10 December 2025

Objective:

The objective of this analysis is to evaluate a stock’s business model through the lens of Hamilton Helmer’s 7 Powers framework to identify structural, durable competitive advantages that can lead to superior returns through time. This assessment will quantify the strength of the company’s economic moat and its ability to generate sustained differential growth, margins and returns against current and future competitors.

2 variants of this prompt are presented:

A single company deep research assessment

A head-to-head variant to compare two competitors and understand which has the stronger business model and where individual weaknesses lie.

Explanation:

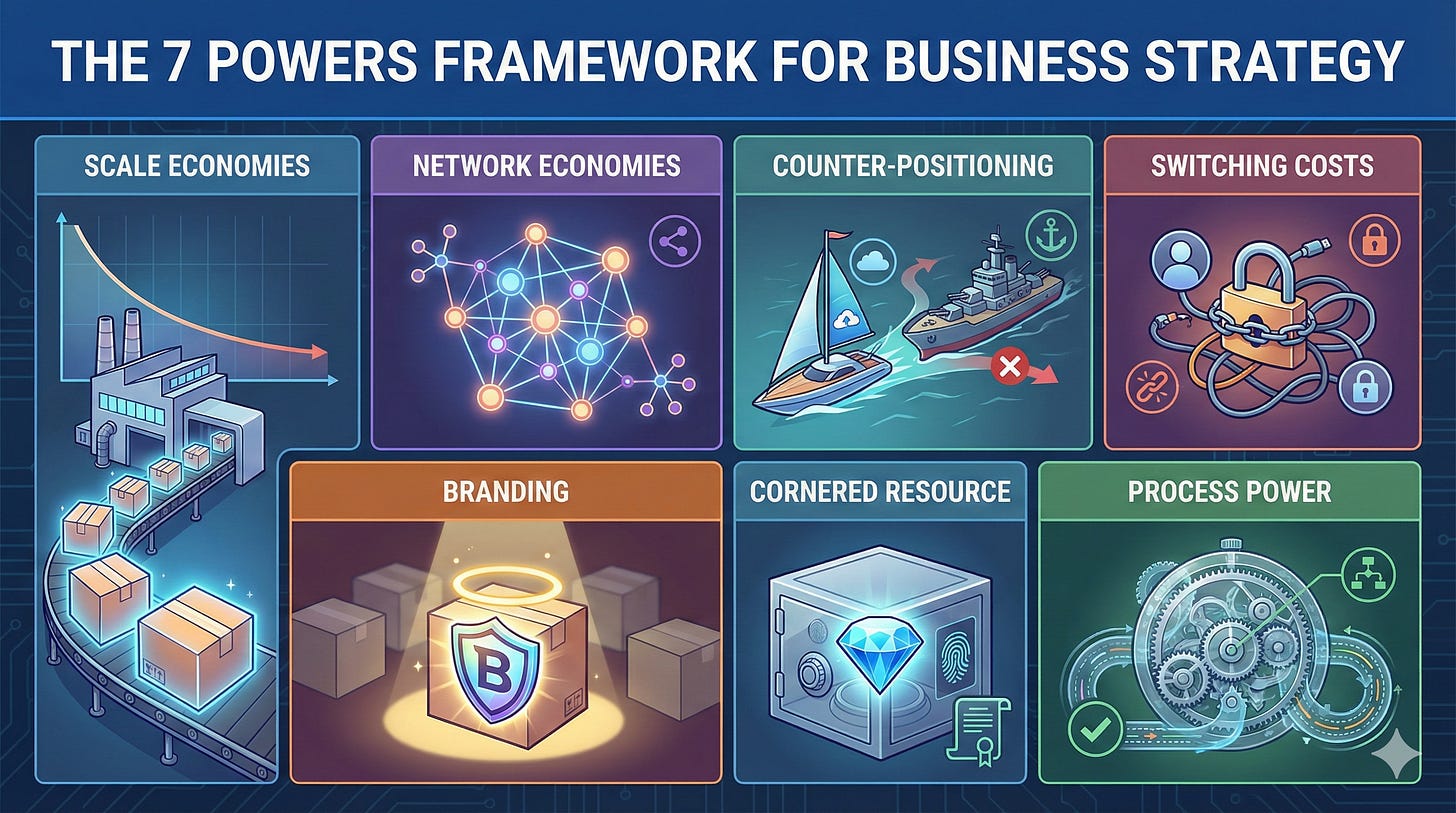

Hamilton Helmer’s 7 Powers framework is a strategic tool used to identify the structural competitive advantages that allow a business to generate persistent differential returns. These powers include Scale Economies, where unit costs decline with volume; Network Economies, where the value of a service increases for all users as more join; Switching Costs, which lock customers in due to the expense or effort of changing suppliers; and Counter-Positioning, where a new business model is adopted that incumbents cannot mimic without damaging their existing business.

The remaining powers are Branding, which allows a company to charge a premium for an objectively similar product due to customer perception; Cornered Resource, involving preferential access to a scarce and valuable asset; and Process Power, which stems from embedded, hard-to-replicate operational processes that yield superior efficiency or quality.

For a stock, the presence of one or more of these powers implies a durable economic “moat” that protects market share and profitability from competitors. This structural advantage often translates into higher-than-average returns on invested capital over the long term, making the company more resilient to competitive pressures. Consequently, stocks with strong powers are often valued at a premium, as investors anticipate sustained earnings growth and reduced risk of disruption.

As always, be aware that models can make mistakes. At each step, examine the response and challenge information or conclusions that appear erroneous before proceeding to any subsequent steps. If in doubt use a second model with the same prompt to verify the information and generate challenge questions and answers (CoVe process) to correct interpretations of data.

Link to blog post explanation:

N/A

Preferred Model(s):

Gemini 3+ PRO with Deep Research mode

Important Execution Notes:

Variant 1 - single company: Simply enter the company’s name where indicated and run.

Variant 2 - head-to-head: Replace the names of Companies A and B where indicated

Indicative Sample Output:

Copy/Paste Prompt Set:

Important note: Subscribers can use this prompt set for their own analysis. However, the prompt is copyrighted by The Inferential Investor, paywalled, and must not be shared without permission.