Know Your AI Model - for Investors

When to Use ChatGPT vs Gemini to get the best intelligence from Investment Research and Analysis Tasks

Executive Summary

The rise of AI has changed how individual investors research companies, interpret financial data, and understand markets. But not all AI models are the same. ChatGPT (OpenAI) and Gemini (Google/Alphabet) have distinct strengths, architectural differences, and behavioral tendencies that make each better suited to specific investment research tasks.

ChatGPT excels at structured analysis, chain-of-thought reasoning, financial synthesis, prompt engineering, data-driven workflows, detailed Q&A, and investment-grade writing.

Gemini excels at fast document ingestion, summarization across many Google-indexed sources, extracting factual elements from large text blocks, and performing search-adjacent tasks.

Understanding when to use each model is no different from knowing when to use a DCF vs a multiples-based valuation. Each model is a tool, and better investors know which tool matches the task.

Practice Note: As you read through this you will come to appreciate why I maintain a subscription to both ChatGPT and Gemini and have both models open on different screens at all times. Learn to swap between them, porting inputs and outputs to and fro and you will become a AI investment research black belt. From experience, I can attest it truly deepens the insights you gather.

ChatGPT vs Gemini: Architecture & Capability Comparison

While both models are advanced LLMs, each reflects the philosophy of the ecosystem in which it was built.

ChatGPT (OpenAI)

Architecture focus: reasoning, planning, multistep logic, long-form synthesis.

Strengths:

Deep analytical reasoning

Scenario modelling

Financial interpretation (drivers, sensitivities, catalysts)

Prompt engineering, iterative workflow refinement

Creating structured templates (e.g., “equity research memo,” “DCF setup”)

Narrative clarity and explanation

Weaknesses:

Far less natively integrated with live search - in investment research where up to date data is critical, need to watch for revision to memory (outdated data).

Sometimes slower with very large document ingestion unless guided with RAG-style specialist pre-processing prompts (see Inferential Investor prompt library)

Gemini (Google)

Architecture focus: retrieval-enhanced tasks, extraction, summarization, and grounding in web-indexed data.

Strengths:

Multi-document summarization

File ingestion (PDFs, slides, webpages)

Quick extraction of facts (numbers, KPIs, dates)

Search-like tasks

Good for “first pass” information gathering

Weaknesses:

Weaker deep reasoning, especially financial interpretation

Less reliable for multi-step investment logic or valuation narratives

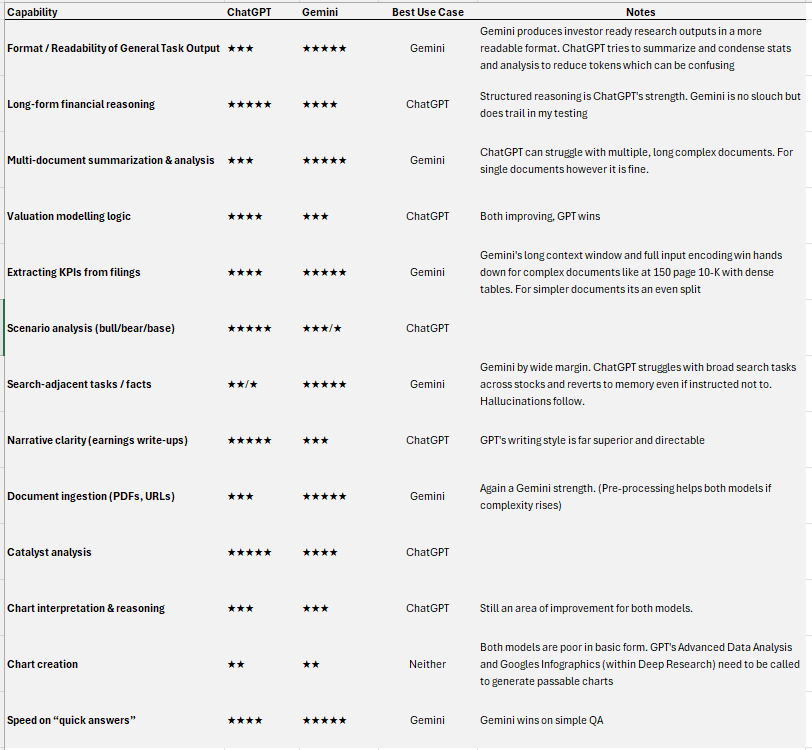

Capability Comparison Table

Short version:

If you need analysis, use ChatGPT.

If you need extraction/summarisation, use Gemini.

Which Model to Use for Common Investment Research Tasks

Below are the most common tasks everyday individual investors perform and which AI model performs each best, with simple example prompts.

Summarizing Earnings Reports

Winner: Gemini

Gemini’s strength is high-speed ingestion and summarization. It quickly extracts KPIs, year-on-year changes, segment commentary, and guidance.

Why Gemini is better:

Parses long PDFs efficiently.

Pulls out structured metrics fast.

Great for first-pass reading of 10-Qs, slides, press releases.

Example Prompt (Gemini):

“Summarize this earnings press release into bullet points. Extract revenue, segment revenue, EPS, margins, guidance changes, and management’s key themes.”

Detailed Earnings Analysis & Interpretation

Winner: ChatGPT

ChatGPT excels at connecting dots: trends, guidance credibility, market expectations, valuation implications, and catalysts.

Why ChatGPT is better:

Stronger reasoning and financial interpretation.

Can translate raw KPIs into “what matters for the stock.”

Generates high-quality investor-grade analysis.

Example Prompt (ChatGPT):

“Using this transcript and financial report, identify the 5 most important forward-looking signals, whether guidance is conservative or aggressive, and how this affects the next quarter’s revenue and EBITDA trajectory.”

Forecasting & Sensitivity Analysis

Winner: ChatGPT

Gemini struggles with the more complex end of multi-step financial logic. ChatGPT is far better at building scenario trees, modelling assumptions, sensitivities, and iterative refinements.

Why ChatGPT:

Handles multivariate interactions (e.g., cloud consumption, pricing, FX, capex cycles).

Strong chain-of-thought reasoning.

Can build forecast templates and adjust them interactively.

Example Prompt (ChatGPT):

“Build a revenue model for Microsoft Azure using the last four quarters. Identify the top 3 growth drivers and create bull/bear/base scenarios.”

Screening for Long/Short Ideas

Winner: ChatGPT and Gemini DUAL MODEL approach

Idea generation based on quantitative and qualitative cues, management tone, momentum, or fundamental and sentiment inflection is reasoning-heavy but also web search heavy to incorporate data recency.

Why ChatGPT:

Better at reading tone and sub-text.

Connects narrative + data.

Can merge sentiment, KPIs, guidance quality, and valuation.

However, broad searches across stocks tax GPT’s retrieval capabilities and result in fall back to memory (old data). This can result in hallucinations. Needs closr verification of outputs accordingly.

Why Gemini:

Far better at searching across hundreds of stocks and earnings reports, news sources etc at a time given integration into google search.

Connects narrative + data reasonably well.

Can also merge sentiment, KPIs, guidance quality, and valuation however the more variables, the more GPT will beat it.

Example Prompt (ChatGPT or Gemini):

“From last week’s earnings reports, identify stocks with improving fundamentals, growing ROIC, and below market valuation ratios, that the market is under-reacting to. Provide a comprehensive long thesis for the top two. State rationale for choosing these over others and show discarded candidates with rationale”

Extracting Data Points from Filings and Documents

Winner: Gemini

If you need to rip out numbers, Gemini is faster and more accurate.

Why Gemini:

Native strength in factual extraction.

Efficient with long documents.

Example Prompt (Gemini):

“Extract all the financial KPIs mentioned in this 10-Q and organize them into a table.”

Writing Investment Memos, Reports & Research Notes

Winner: ChatGPT

ChatGPT produces polished writing, editorial discipline, and clean logical structure. For any narrative deliverable, OpenAI’s models are far superior.

Why ChatGPT:

Better writing quality.

Clear argumentation and explanation.

Suitable for publishing-grade memos.

Example Prompt (ChatGPT):

“Write a 1-page investment memo summarising NVIDIA’s Q3 earnings, including thesis, drivers, risks, catalysts, and valuation.”

Quick Facts, Definitions & Market Info

Winner: Gemini

For lightweight tasks like “What’s the EV of Tesla?” or “When is Apple reporting?”, Gemini’s search-like grounding makes it faster and more reliable.

Example Prompt (Gemini):

“Give me the next earnings date for Amazon and its last quarter’s revenue.”

Choosing the Right Model: A Practical Workflow for Individual Investors

A simple, effective workflow for investors:

Gather information with Gemini.

Summaries

Key KPIs

Facts and dates

Document ingestion

Analyse, interpret and synthesise with ChatGPT.

Forecasting

Thesis construction

Idea ranking

Writing memos

Valuation commentary

Iterate the analysis with ChatGPT.

Update assumptions

Build scenarios

Challenge your own views

Use Gemini for double-checking factual details and verifying recent data.

This hybrid approach mirrors the workflow of a professional analyst: first gather, then interpret, then refine.

Conclusion

In investment research, the quality of your analysis depends not just on the data, but on the tools you use to extract and interpret it. ChatGPT and Gemini are complementary. Gemini is your data-gathering engine, ideal for document digestion and factual retrieval. ChatGPT is your reasoning and synthesis engine, ideal for valuation logic, earnings interpretation, and writing.

Everyday investors who learn to match the model to the task and become adept at swapping interim outputs between models at different stages of analysis, will research faster, interpret better, and make more informed decisions. Ultimately, “knowing your AI model” becomes as important as knowing your stocks.

As always,

Inference Never Stops. Neither should you.

Andy West

The Inferential Investor