Getting Under the $HOOD

A Forensic Look at Robinhood Markets Inc.

Important Note: The Inferential Investor does not provide financial advice. Any discussions on stock and market views are made from an educational standpoint and to demonstrate techniques and capabilities of AI, are indicative and may be subject to change. No recommendation, either direct or implied is made with regards to the suitability of any stock mentioned for investment. It is recommended to refer to our full disclaimer here and always do your own research, but I welcome you to follow this substack as another input into a well rounded investment process.

Rocket-HOOD

When a stock wins the popular imagination, investors are tempted to admire the shimmering surface and forget to probe the structure beneath. Robinhood Markets Inc. ($HOOD) has become synonymous with democratized trading, meme stock fervor, commission-free access to Wall Street and the current uber-bull market. But as Benjamin Graham insisted, “behind every stock is a business.” It is the business, not the ticker symbol, that we must examine with clear eyes.

Robinhood’s 2024 annual report and the growth to date in 2025 tells a triumphant story. For the first time, the company reported a full-year GAAP profit: net income of $1.41 billion, a stunning reversal from the prior year’s loss of $(541) million. Revenue surged to $2.95 billion, up 58% year-on-year, led by a 364% spike in cryptocurrency trading income. At the same time, costs were trimmed by 21%, and management unveiled a billion-dollar buyback program. On the surface, this reads like a startup graduating into the big leagues.

Yet a forensic review reveals some rust under the glossy exterior paint.

The company’s operations consumed cash in 2024, not produced it.

Receivables ballooned as market valuations reached an extreme.

Dependence on volatile markets deepened.

Regulatory shadows lengthened.

Governance remained tilted heavily toward founders.

In this essay we will walk through Robinhood’s strengths and weaknesses - not merely by reciting numbers, but by asking the questions most fundamental investors insist upon: What is real and what is accounting smoke? What is sustainable and what is transitory? What does the prudent investor gain and what risks does he or she assume?

Profitability or Mirage?

In 2024 Robinhood crossed the symbolic line into reported profitability. Net income stood at $1.41 billion, a $2 billion swing from 2023. To casual observers, this milestone suggests that the platform has finally proven its economic model.

But a fundamental analyst must reconcile income with cash. Here the story shifts dramatically. Operating activities in 2024 consumed $(157) million) of cash, a reversal from +$1.18 billion the prior year. Free cash flow was -$(207) million). Thus, Robinhood’s “profits” were accrual-based earnings - not dollars in the bank.

The culprit was receivables. Amounts due from users exploded from $3.5 billion in 2023 to $8.2 billion in 2024, a 136% rise primarily driven by a huge surge in margin lending. That single line item swallowed cash as quickly as the income statement created it.

Here we see a textbook case of what Graham called earnings of low quality. A business that consumes cash even in its best year of reported income may not be considered particularly durable. The distinction is vital: dividends, buybacks, and reinvestment for growth require cash, not accruals.

Fueling the margin boom: Receivables and Risk

Why the surge in receivables? Robinhood has been expanding credit-based products - margin lending, the Gold Card, and other user financing. The company’s Margin Book grew 139% to reach $7.9 billion, outpacing transaction based revenues; its credit card revenues hit $24 million in 2024 - small but growing.

This shift means Robinhood now resembles, in part, a consumer lender in a sector where its collateral has shown many instances of falling 50% or more in value in short spaces of time. Lending businesses thrive in good times, when collateral holds its value and borrowers pay on time, but they unravel swiftly in downturns. The company’s provision for credit losses rose to $76 million in 2024, up from $43 million the prior year, a small but telling signal. These are reasons that broker-dealers, particularly those with retail margin books and less developed risk management protocols, traditionally trade at low P/E multiples (often 10-15x).

Consider the implications. In a market downturn, heavily margined customers can default. If rapidly falling security prices erode collateral, receivables can turn to write-offs. Thus, Robinhood’s cash strain is not just a timing issue - it represents increasing exposure to the financial health of its user base and the volatility of crypto, options and stock markets at a time when valuations are at extremes.

For investors, this is not a theoretical concern. During the dot-com bust and the 2008 crisis, broker-dealers that extended easy credit to clients learned that what appeared to be solid assets with conservatively collateralized margin loans, could swiftly become a source of large losses and capital destruction.

Cash Flow Conversion: The Red Flag of 2024

Free cash flow is the acid test of an enterprise. Robinhood failed that test in 2024 (but is doing better so far in 2025). As I’ve mentioned, against $1.41 billion of net income in 2024, cash flow from operations was negative. The ratio of cash flow to net income was –11.1%, underscoring how little of reported profit was convertible to spendable dollars.

The point is this: Investors often forgive temporary cash shortfalls if they are funding high-return reinvestment that delivers sustainable growth in the future. But here, capital expenditure was only $50 million, modest for a company of Robinhood’s scale. Much of the gap came not from bold reinvestment that generate sustainably higher earnings in the future, but from the swelling receivables / margin lending book and non-recurring accounting items, such as a $369 million deferred tax benefit and reversal of a $55 million regulatory accrual.

Margin books rise and fall with markets and in rapid market downturns can generate losses. So the problem lies in the fact that in cash terms, margin growth consumed the record profit. Technically, that cash should come back when the margin book reduces, but in accelerating lending into an over-extended tech stock bubble, that cash may end up being consumed by losses in any rapid downturn in markets. Really, this is an issue with credit risk decisions and timing. Should management be rapidly expanding margin credit when the market P/E is at historical extremes? If management get this decision wrong and it backfires, it will raise the hypothetical question of whether the “profit” ever really existed in the first place?

As a balance to this its worth noting that by Q2 2025, large operating cash inflows had reasserted themselves. Operating cashflow for the three months ended June 30 was a massive $3.5bn with a noticeable slowdown in the growth of the margin book - perhaps management are taking note of currently elevated margin risks due to valuations?

Its also notable however that this is actually derived from HOOD lending out more of the securities under their custody to others and a large increase in the payables to their users.

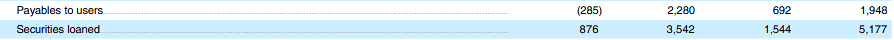

Extract from the HOOD Q2 25 Cashflow statement:

The second and fourth columns are cash inflows (in millions) for the three and six months ended 30 June 20025 respectively:

This inflates cash on the Robinhood balance sheet temporarily but both are increases in liabilities which raises the concern this is may be just a timing cashflow. Its only if the payable terms and securities lending thresholds are sustainable that shareholders can “bank” that cash as permanent. Only time will tell.

Benjamin Graham would remind us that “the investor is shielded from gross disappointment by the margin of safety.” Where cash burn and large period to period cash fluctuations hide beneath accrual earnings, the margin of safety may be thin.

Revenues Built on Upward Market Momentum

Robinhood’s revenue mix illustrates both dynamism and fragility. In 2024:

Transaction-based revenues: $1.65 billion, up 110%, fueled by a 364% jump in crypto trading.

Net interest revenues: $1.11 billion, up 19%.

Other revenues (subscriptions, fees): $195 million, up 29%.

This profile, whilst showing impressive growth figures that clearly are capturing investor attention (Zack’s reported that HOOD 0.00%↑ this week was their most searched stock), reveals a business tied tightly to market volatility and recent, arguably unsustainable speculative fervor. Risky options trading and volatile cryptocurrencies delivered $1,400 million, or 85% of transaction based revenues. When speculative enthusiasm wanes, and market momentum fails, these revenue pillars crumble.

The auditor, Ernst & Young, underscored this fragility by flagging “Transaction-based revenues” as a Critical Audit Matter. Such warnings are rare and significant; they tell investors that even the auditor struggled to gain assurance over the complexity and concentration of this revenue stream.

Moreover, dependence on a single counterparty can compound the hazard: Citadel Securities accounted for 12% of total revenues in Q2 2024 and had been as high as 16% in the recent past. Investors should recall the lesson of Long-Term Capital Management, Archegos and other concentrated counterparty stories: when one player dominates your flows, you inherit their fortunes.

Governance: Founders First, Shareholders Second

Robinhood operates under a dual-class share structure. The founders hold Class B shares with 10 votes each, securing control of more than 50% of the company’s voting power. They also have a voting agreement to act in concert with each other to ensure a voting block.

In practice, this means public investors are minority partners without meaningful influence. Whether on compensation, acquisitions, or strategic redirection, the founders’ will prevails. This layered arrangement makes Robinhood a public company in name only. A shareholder demand letter in 2024 sought investigation into past misconduct related to the 2021 trading restrictions and data breaches. Yet with voting power concentrated, outcomes depend more on the founders’ discretion than on shareholder voice.

Graham’s principle applies: “The chief losses to investors come from the purchase of low-quality securities at times of favorable business conditions.” A low-quality security is not just one with weak finances but also one where governance undermines minority rights.

Legal and Regulatory Clouds

Robinhood has rarely been far from the regulator’s gaze. In 2024 alone, the company:

Settled with the SEC for $45 million over record keeping, AML, and cybersecurity issues.

Paid $3.9 million to California’s Attorney General over crypto asset delivery.

Received a Wells Notice from the SEC regarding certain cryptocurrencies listed on its platform.

A Wells Notice is no mere formality - it signals that enforcement action is probable. Outcomes could include injunctions, fines, or forced changes in business practices. For a firm that derived nearly a quarter of revenue from crypto trading in 2024, the consequences could be severe.

Investors must recognize this not as a remote tail risk but as a recurring cost of business. Since its founding, Robinhood has faced numerous fines, settlements, and inquiries. Each consumes management bandwidth, legal fees, and sometimes capital. More importantly, each underscores that the business model pushes against the edges of regulatory tolerance.

Stock-Based Compensation and Dilution

In 2024, Robinhood expensed $304 million in stock-based compensation (SBC). While down from a one-off-inflated $871 million in 2023, dilution continues. Weighted-average diluted shares rose to 906 million, from 891 million the prior year.

The company repurchased 10 million shares for $257 million under a billion-dollar buyback program. Yet this sterilized only about two-thirds of shares issued via restricted stock units. Net dilution persisted.

Here lies a paradox: management presents buybacks as a shareholder benefit, yet in practice they only partially offset employee grants. At a share price of $125, the analysis suggests it would cost $2 billion annually to fully neutralize SBC.

Thus, investors face an ongoing transfer of value: employees are compensated handsomely, while shareholders are asked to fund the repurchases that keep dilution in check.

The Bright Spots under the HOOD

It would be unjust to portray Robinhood as wholly fragile. Several strengths merit attention:

Revenue growth and accounting profit swing: These trends are well flagged. There are few stocks so positively leveraged to the current momentum market conditions. Of course, this works in reverse as well.

Cost Discipline: Operating expenses fell 21% in 2024 even as revenue surged, a sign of management focus and core operating system improvements after years of bloat.

Strong User Engagement: Transaction volumes soared and continue to do so in 2025. Options and crypto activity suggest a loyal, if risk-seeking, base.

Assets under custody grew 88% in the year and have continued to grow in 2025, supported however by deferred customer incentive schemes.

Product Expansion: Index options, futures, and the Robinhood Legend service show a move to capture more sophisticated traders.

International Ambition: Entry into the UK and EU, and a Singapore headquarters, reflect an aspiration to become global. While fraught with risk and regulators who are arguably less tolerant of businesses operating at the edge of licensing limits than in the US, expansion offers optionality.

Capital Flexibility: The company maintains $3 billion in revolving credit facilities and had net capital in excess of SEC requirements of $2.36 billion at year-end. This cushion reduces near-term solvency fears.

These positives give Robinhood a chance to sustain growth but due to transaction revenue reliance, only if markets cooperate, regulators relent, and execution and credit risk management remains sharp.

The Principles for the Prudent Investor

From this forensic review, several lessons emerge.

Cash Is King. Earnings mean little without cash conversion. Robinhood’s divergence between income and operating cash in 2024 is a red flag that should dominate valuation discussions. Effectively it shows that the cost of Robinhood growing is very high. Cash earnings backing will return when Robinhood’s growth slows. However, as that will be driven by weaker market conditions, this can inevitably translate to lower earnings multiples and a lower share price.

Beware of Volatility Dependency. Businesses whose revenues spike only when markets are turbulent are inherently speculative. Robinhood is leveraged not just to the economy but to the psychology of retail traders.

Governance Matters. Dual-class shares create principal-agent risks. An investor buying Robinhood must accept that their voice counts for little.

Regulation Is a Sword of Damocles. Companies operating at the frontier of financial services must factor in regulatory costs as a permanent part of the model. For Robinhood, these costs are not incidental, they are arguably structural and recurring.

Dilution Is a Real Expense. Stock-based pay may not drain cash immediately, but it shifts ownership over time. Unless fully offset, investors’ slice of the pie shrinks even if the pie grows.

Conclusion: Investing or Speculating?

Robinhood’s very name evokes populist energy, giving the tools of Wall Street to the masses. Yet the intelligent investor must distinguish between romance and reality.

The reality is a company reporting record profits while cash flows out, riding momentum driven trading trends that history shows cannot last forever, absorbing regulatory blows, and governed by a structure that subordinates minority shareholders. The positives - cost control, new products, international expansion - may offset these weaknesses, but only if multiple uncertain conditions hold: continued market momentum, successful integration of acquisitions, and regulatory tolerance.

For some, Robinhood remains an exciting speculation on the democratization of finance and the resilience of retail traders. However, it is worth recognizing that the speculators who are high users of Robinhood, are the same investors borrowing from Robinhood on margin and recycling some of that leverage into buying Robinhood stock at ever increasing prices. That is a perverse and circular incentive for the company - extend more credit and potentially generate more demand for their own stock. A potential unwind of that circularity could be very messy in volatile markets.

It has been said that “the essence of investment management is the management of risks, not the management of returns.” Under the hood, Robinhood presents more risks than its glossy exterior styling suggests. Investors must decide whether those risks are priced into the stock, or whether, as so often in market history, enthusiasm has raced ahead of fundamentals.

I encourage you to review the 38 page attached PDF report from II’s forensic analysis prompt, applied to Robinhood ($HOOD). This demonstrates the detailed insights these proprietary professional analysis techniques can achieve for any investor with a few minutes work.

As always,

Inference never stops. Neither should you.

Andy West

The Inferential Investor

Note: The author has no long or short exposure to HOOD 0.00%↑ at the date of publication

Great reads. Thank you for sharing this content publicly.

No problem - I'll continue more like this. A new technique first followed by some application of it on topical stocks or events. Hopefully, I can build the audience!