FOMC Oct 25: Fed Halts QT, Cuts Rates, and Reveals a Divided Committee

December cut expectations appear appropriate but market may be too dovish on 2026

This report has been generated using The INFERENTIAL INVESTORS “Monetary Policy Tracking and Central Bank Sentiment” analysis workflow in the Professional Prompt Library. Included in this workflow is a red-line assessment of successive statement changes, evolution view of key statements on policy objectives, sentiment and term frequency analysis, reaction function and market pricing assessment, synthesis of scenario rate paths.

Executive Summary

October Decision: The FOMC cut the federal funds rate by 25 basis points to a new target range of 3.75%–4.00%1. This was the second consecutive 25 bps cut22.

Key New Language: The most significant change was the announcement that the Committee will “conclude the reduction of its aggregate securities holdings on December 1”3. This signals a definitive end to Quantitative Tightening (QT).

Core Rationale: The Fed’s reaction function has pivoted. It is now acting on a “shift in the balance of risks,” 4explicitly noting that “downside risks to employment rose in recent months”5.

Labor Market Pivot: The Fed’s view of the labor market has softened materially since July, when it was called “solid”666. It is now characterized by slowing job gains and an unemployment rate that has “edged up”77.

Sentiment Score: The FOMC’s dovish pivot is quantifiable. On a 0-20 scale (0=Max Dove, 20=Max Hawk), sentiment has fallen from a neutral-dovish 9.0 in July to a clearly dovish 5.0 in September, and sits at 6.0 in October (reflecting a new hawkish dissent).

Split Dissent: For the first time in this cycle, the dissents were split. Stephen I. Miran voted for a more dovish 50 bps cut 8, while Jeffrey R. Schmid voted for a hawkish pause (no change)9.

Market Pricing: Markets are pricing in another 25 bps cut at the final 2025 meeting in December with high probability. Pricing for 2026, however, appears more dovish than the Fed’s last official projections (SEP), implying 75-125 bps of further cuts.

Bottom Line: Market pricing for the December meeting is appropriate. The Fed is in a “risk management” easing cycle driven by labor market fears. However, pricing for 2026 may be too dovish, as sticky inflation and a split committee (evidenced by Schmid’s dissent) suggest the Fed will be more cautious than markets expect.

1. Redline Statement Analysis

The evolution of the FOMC’s language reveals a clear pivot from a hawkish hold to a dovish easing cycle, driven entirely by a deteriorating labor market outlook.

A. T-2 (July 30, 2025) → T-1 (Sept 17, 2025)

Employment (Dovish): <del>”labor market conditions remain solid”</del> 10→ “Job gains have slowed, and the unemployment rate has edged up” 11

Inflation (Hawkish): <del>”Inflation remains somewhat elevated.”</del> 12→ “Inflation has moved up and remains somewhat elevated.” 13

Risk Management (Dovish): <del>”attentive to the risks to both sides of its dual mandate.”</del> 14→ “attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.“ 15

Policy Decision (Dovish): <del>”maintain the target range”</del> 16→ “lower the target range by 1/4 percentage point“ 17

B. T-1 (Sept 17, 2025) → T (Oct 29, 2025)

Growth (Neutral Upgrade): <del>”growth of economic activity moderated in the first half of the year.”</del> 18→ “economic activity has been expanding at a moderate pace.“ 19

Employment (Neutral): <del>”Job gains have slowed... unemployment rate has edged up”</del> 20→ “Job gains have slowed this year... unemployment rate has edged up... more recent indicators are consistent with these developments.“ 21

Risk Management (Dovish): <del>”in light of the shift in the balance of risks”</del> 22→ (Language moved to decision paragraph: “in light of the shift in the balance of risks” 23).

Balance Sheet (Major Dovish): <del>”continue reducing its holdings”</del> 24→ “decided to conclude the reduction of its aggregate securities holdings on December 1.“ 25

FOMC Sentiment Trend

2. Sentiment Score (0–20 Scale)

Sentiment is scored from 0 (Max Dovish) to 20 (Max Hawkish), based on lexicon, policy action, and dissents.

3. Investor Summary Table

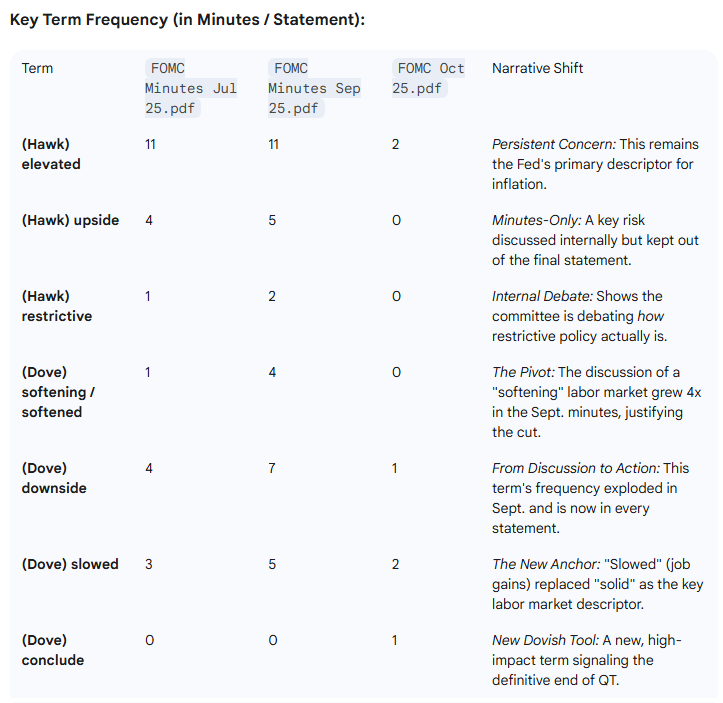

4. Term Frequency & Key Themes

This analysis tracks key hawkish and dovish terms across the full Minutes (for July and September) and the Statement (for October) to show the evolution in the committee’s focus.

Note: Counts for July and September are from the comprehensive meeting minutes (~15-18 pages), while the October count is from the 3-page policy statement. This discrepancy highlights the shift, as terms that were previously only in the discussion (minutes) have now entered the decision (statement).

TF/IDF Theme Evolution:

July (Minutes): The dominant theme was “tariffs”. The committee was grappling with an external, inflationary supply shock and its “uncertain” effects66. The labor market was still seen as “solid”67. The key conflict was inflation (from tariffs) vs. slowing growth68.

September (Minutes): The theme of “tariffs” faded, replaced by “labor”, “employment”, and “downside” risks69. The narrative pivot was entirely internal, focusing on the “softening” 70 domestic job market. This pivot justified the first rate cut71.

October (Statement): The most important terms are now about action and division. “Conclude” 72and “December 1” 73 (ending QT) are high-signal, definitive policy changes. The other key terms are the names of the dissenters, “Miran” 74and “Schmid”75, indicating the new theme is a committee that agrees on the dovish direction but is split on the pace.

5. Interpretation of the Fed’s Reaction Function

Across the last three meetings, the Fed’s reaction function has explicitly shifted from inflation-first to dual-mandate risk management.

In July, the committee was still in a hawkish stance, using “solid” labor conditions 76as the justification to “maintain” rates and focus on “elevated” inflation77.

The September meeting was the pivot. The committee cut rates despite adding the hawkish phrase “Inflation has moved up”78. This was only possible because they simultaneously added, for the first time, “judges that downside risks to employment have risen”79. This change, combined with the softening language on jobs (”slowed,” “edged up”)80, confirms the reaction function now places equal, if not greater, weight on preventing a labor market downturn.

The October meeting cemented this new function. The 25 bps cut was a continuation 81, but the decision to “conclude the reduction of its aggregate securities holdings” 82 is a powerful dovish signal. It shows the Fed is now willing to use both of its main tools (rates and balance sheet) to support the economy, even as inflation “remains somewhat elevated”83. The split dissent 84 is the new battleground: no longer if they should ease, but how fast.

Most Salient Lines:

(July 30): “...labor market conditions remain solid. Inflation remains somewhat elevated.” 85 (The old regime: solid jobs permit an inflation focus).

(Sept 17): “Job gains have slowed, and the unemployment rate has edged up but remains low.” 86 (The new labor market reality).

(Sept 17): “...judges that downside risks to employment have risen.” 87 (The justification for the pivot).

(Sept 17): “In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range...” 88 (The official “risk management” pivot).

(Oct 29): “The Committee decided to conclude the reduction of its aggregate securities holdings on December 1.” 89 (Confirmation of the dovish stance, adding a new tool to the mix).

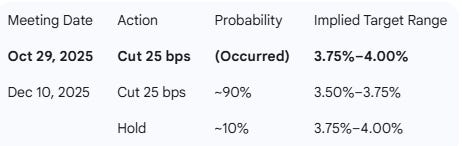

6. Market Pricing vs. Fed Signals

As of October 30, 2025, market pricing reflects high confidence in the Fed’s new dovish path, though it may be pricing a more aggressive cycle than the committee is prepared to signal.

Market-Implied Policy Path (CME FedWatch Tool & Futures):

Year-End Target Rate:

Year-End 2025: 3.50%–3.75% (implying one more 25 bps cut).

Year-End 2026: Market pricing implies a trough around 3.00%, with some traders pricing in 75-125 bps of cuts during 2026. This is more dovish than the Fed’s last median “dot plot” from September, which projected a 2026 median of 3.4%.

Conclusion on Pricing:

For December 2025: Appropriate. The market is correctly interpreting the Fed’s “risk management” pivot and the announced end of QT 90 as a clear signal for one more cut to end the year.

For 2026: Too Dovish. The market appears to be front-running a recession or a significant labor market collapse. The Fed, while dovish, remains “attentive” to inflation 91and is now split, with a new hawkish dissent (Schmid) arguing for a pause92. The Fed will likely be more “data-dependent” and cautious in 2026 than current market pricing suggests, creating a risk that the Fed disappoints dovish expectations.

7. Scenario Paths & Watchlist

Base Case (70%): Cut, then Pause.

Triggers: Labor market continues to soften (unemployment drifts to 4.4%-4.5%), but non-linearly. Core inflation remains sticky around 3%.

Policy Path: Fed cuts 25 bps in December, as priced. It then pauses in Q1 2026 to assess the impact of its 75 bps of cuts and the end of QT 93, citing Schmid’s concerns94. It resumes with two more 25 bps cuts in 2026.

Watchlist: Monthly non-farm payrolls, unemployment rate, Core PCE.

Dovish / Downside (20%): Accelerated Cuts.

Triggers: A “no hire, let’s fire” scenario. The government shutdown-delayed data shows a sharp miss in payrolls, and unemployment breaks 4.5%+.

Policy Path: Miran’s view gains traction95. The Fed cuts 50 bps in December and signals an aggressive easing cycle into 2026, fully validating market pricing.

Watchlist: Weekly initial jobless claims, “low hire, low fire” anecdotes, consumer credit defaults.

Hawkish / Upside (10%): December Pause.

Triggers: Sticky inflation 96and resilient growth 97 cause the Fed to balk. The labor market stabilizes, and inflation ticks up.

Policy Path: The Fed surprises markets with a pause in December, siding with Schmid’s dissent98. Powell emphasizes that the “shift in risks” is complete and policy is now “data-dependent” on inflation.

Watchlist: CPI/PCE inflation (especially core services), GDPNow readings, wage growth (AHE).

Analysis generated by the professional engineered investment analysis workflows of THE INFERENTIAL INVESTOR. www.inferentialinvestor.com