Claude Opus 4.6: Agentic Equity Analyst capabilities at a whole new level.

By reading this article, readers acknowledge the terms of our full legal disclaimer. The information provided herein is for educational and general informational purposes only and does not constitute professional financial or investment advice nor a recommendation to trade in any stock mentioned.

Anthropic released Opus 4.6 on Wednesday 5th of February and caught my eye with claims that they had designed it to aid in financial research. So I undertook to subscribe to a PRO account and take it for a spin using the Inferential Investor deep research workflows to see how it performs.

TL;DR - get an account now. For equity research, Opus 4.6, taken through detailed multi-step earnings analysis and earnings call workflows, produced a stunning level of accuracy, insight and information presentation that outperformed my previous favorite - Gemini 3.

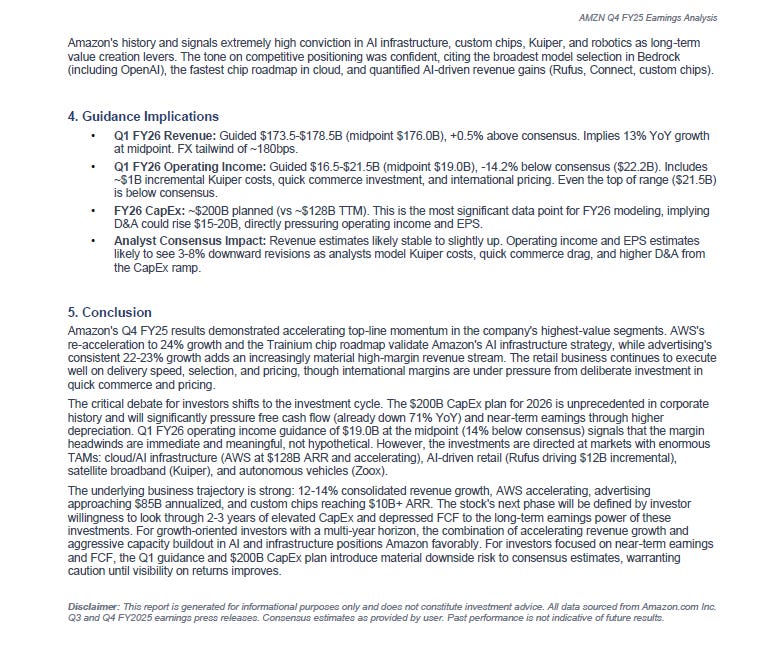

Attached below is a PDF report created using Opus 4.6 for Amazon’s Q4 Earnings report. I’ve also linked right at the bottom, my original Amazon earnings analysis report created using Gemini 3 so you can compare. Both were created from exactly the same prompt, consensus estimates and source documents. What you’ll see on a complete read and comparison of both is:

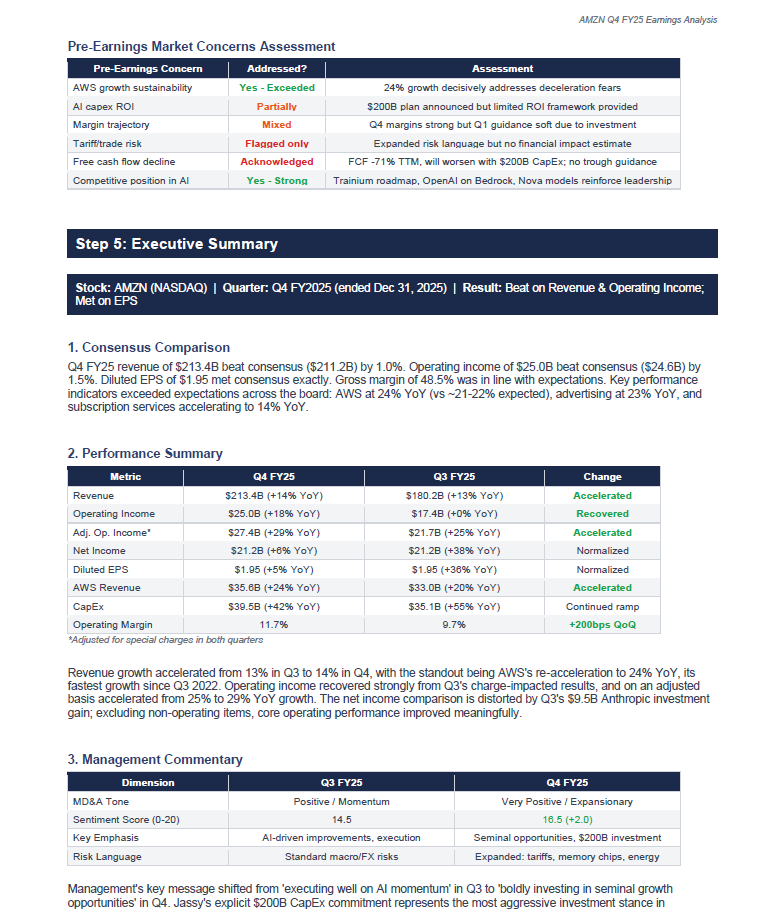

The Opus report extracts useful details from the source documents (earnings press releases and financial accounts), that are skipped / missed by Gemini

The first pass reasoned analysis and conclusions are deeper, more insightful and more mature. In the original report generated by Gemini, I have edited the language and analysis to tighten it and focus it on the really material issues. In the Opus report, I feel no such need. The conclusion presented at the end of the Amazon PDF by Opus is particularly nuanced for investors of different types and shows the model’s maturity in this financial domain.

Instruction attunement: The Opus report has addressed all aspects of the prompt workflow whereas Gemini 3 regularly skips or “hedges” its response to aspects such as analyst estimate revision assessments.

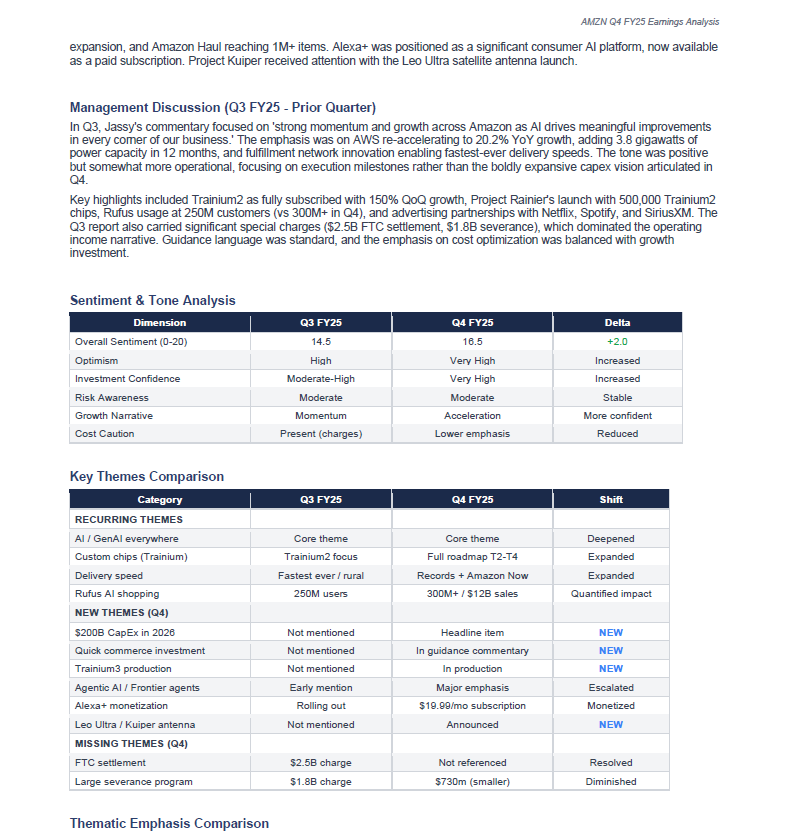

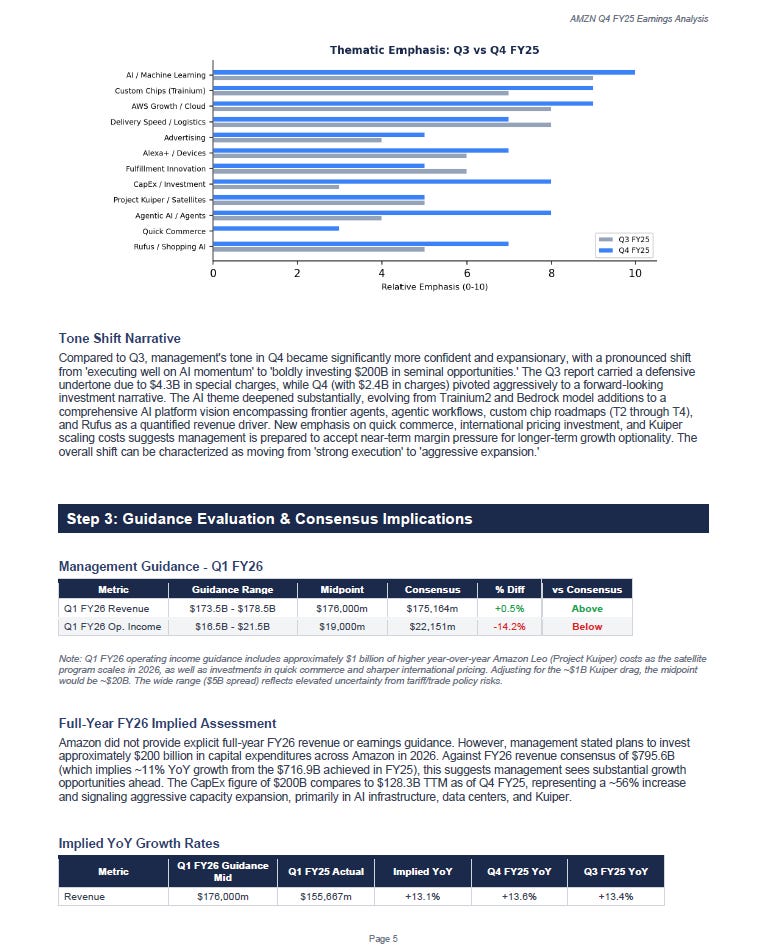

Chart generation: Opus produces excellent visual data artifacts with some good examples in the Opus Amazon report. This assists analysts in interpreting signals within the earnings data. Gemini is still text only outputs.

Synthesizing these observed benefits into stats and comparing across models shows Opus 4.6 on benchmark analysis has leapt ahead of its prior versions and competitors for specific finance evaluations:

That table basically summarizes where the step ups lie. Its better at finding the right information, its better at reasoning through complex financial analysis and it can create good first-pass documents including PDFs, excel spreadsheets and powerpoint slide decks to automate workflows more seamlessly.

Follow this link to see the full capabilities of Opus 4.6 for various financial research tasks including modelling: Claude Opus 4.6 for Finance.

For enterprise users, that page also highlights the connectors Anthropic is building into its models so you can connect it within your organization to Capital IQ data, earnings transcripts etc. Unfortunately this doesnt help individual users as those data sources are still too expensive for the average investor - but it shows the direction of travel of Anthropic. The company is positioning Claude in all its forms as the agentic enabler of all the work that you do, day to day.

I want to hear what you think about these two reports. Let me know in the comments which version you like better: Opus 4.6 or Gemini 3.

Amazon.com (AMZN) Q4 FY25 Earnings Analysis (Opus 4.6 version)

Full PDF to download:

Extracts:

Would you mind sharing how to do this in Claude

Thank you for sharing your informed opinion, Andy.

I was literally hoping a few hours ago a publication from you about Claude.

Have a great weekend!