Assessing Consensus Forecast Achievability Part 2 - CoT prompts for NVDA

Chain-of-Thought prompting delivers impressive insights for investors

In Part 1 of this two part post, I put ChatGPT-5 through a tough test: could a single-pass prompt assess whether Nvidia’s 2026 consensus forecasts were actually achievable? The model identified growth drivers and spun plausible scenarios from both narrative insights and financial data. But the verdict was clear - its conclusions fell short, dragged down by simplistic methods and shallow reasoning compared to how a human analyst would approach the task.

Now, in Part 2, I raise the stakes. By applying a structured chain-of-thought prompt, I’ll show how layering reasoning can transform AI analysis, adding rigor, sharpening accuracy, and producing conclusions investors can actually use.

Forecast achievability isn’t just an academic exercise, it’s the heartbeat of investing. Since earnings growth and surprise remain consistent drivers of excess stock returns, harnessing AI as your research partner in this process has the potential to reshape how analysts gain an edge.

Once again, full prompt responses are contained in the Appendix at the bottom with extracts and my commentary presented in the body.

Chain of Thought Prompt Test:

So how do we move beyond the limitations of a single-pass prompt and push the model toward sharper business insight, trend analysis, and forecast evaluation? Enter Chain-of-Thought prompting. By breaking the task into deliberate steps, the model is nudged to dig deeper, layering narrative context with quantitative checks and refining its reasoning as it goes. This structured approach doesn’t just add rigor, it mirrors the way human analysts infer and iterate when the goal is to reach strong, defensible conclusions.

CoT Prompt A:

You are a fundamental equity analyst for a Wall St investment bank. You are required to analyze the financial results of NVDA in light of the most recent earnings releases and earnings call transcripts to ascertain the likelihood of the company achieving the current consensus revenue ($206bn) and EPS forecasts ($4.50) for fiscal year 2026. You will be instructed step by step to go through a series of tasks to undertake this assessment. Use insights at each stage to build your final view.

Confirm that you can read and understand the attached excel file with both historic (Q1 FY2023 - Q2 FY2026) and forecast (Q3 and Q4 FY2026) income statement information for NVDA and wait for the next step.

Prompt A sets the role, task, and goal for the analysis, so the model follows a clear step-by-step framework. I upload a spreadsheet with 14 historical quarters and two forecast quarters for NVDA - covering revenue, gross profit, operating expenses, operating income, and non-GAAP EPS - so the model works from source data rather than scraping. The model’s reply is intentionally minimal: it confirms the brief, displays the parsed file for a quick sanity check, and then waits for the next instruction.

CoT Prompt B:

Gather and summarize concisely the recent strategic and business trends affecting the company’s growth over the last four quarters from management commentary in the last four earnings results and earnings call transcripts. Supplement the insights with information from reputable news, financial blogs and accessible broker reports. Ensure you examine aspects that are relevant to growth in revenues, expenses, margins and earnings per share.

In this prompt response (refer appendix), the model distills the drivers behind recent results including product cadence, pricing, margins, operating spend, and the strategic/geopolitical backdrop, into a tight summary. It also flags that competitive pressure remains balanced, which matters given Nvidia’s dominant share in AI accelerators and rivals’ push to build substitutes.

This step gives the next phase of analysis real context, so we’re not just extrapolating growth rates in a vacuum. In transformer models like ChatGPT, self-attention stacks context across inputs and outputs; front-loading a narrative frame often improves the quality of subsequent quantitative reasoning.

The key takeaways at the end of Prompt B reproduced below, show the model has already synthesized a workable understanding of Nvidia’s business and trend lines that is significantly deeper than what the single-pass prompt produced.

From Q3–Q4 FY25 into Q1–Q2 FY26, NVDA’s growth stayed overwhelmingly data-center led, with a clean Hopper→Blackwell hand-off, rising systems/networking attach, and expanding sovereign AI demand. China export controls created a Q1 FY26 charge and some mix pressure, but did not derail top-line momentum. Non-GAAP gross margins held in the low-70s despite those charges and the early Blackwell ramp, reflecting pricing power and full-stack differentiation. EPS stepped down in Q1 due to the charge, then re-normalised with Q2’s record quarter and a strong Q3 revenue guide (~$54B) that excludes any China H20 contribution — all of which frames a still-favourable setup for revenue, margin, and EPS trajectory into 2H FY26

CoT Prompt C:

Analyze the most recent historic results (attached in excel file in columns from Q1 FY2023 to Q2 FY2026) and link them to those business insights.

In doing this analysis, examine, concisely summarize and provide insights linked to the prior business trends in revenue and EPS growth rates, calculate margins and examine how they are changing, as well as Opex/sales trends.

Look across the data and note any evidence of predictable quarter to quarter seasonality in the growth rates of revenue, expenses, EPS and gross and operating margins. If such evidence exists, highlight why any seasonality is appearing with reference to product, segment and margin mix and how it typically affects growth and margins in Q3 and Q4 of each year.

From the quarterly data, calculate and append to the spreadsheet annual totals for each line item for each fiscal year in the file. Calculate the growth rates in Revenue and EPS required in Q3 and Q4 FY2026 required to hit consensus targets. Note both the YoY and QoQ growth rates required for this.

The analysis at this stage deepens considerably as the model overlays financial trends onto the business context already established. It presents a clear summary of revenue growth and margin behaviour. It calculates and presents a synthesized overview of quarter to quarter seasonality (missed in the single pass), noting its existence and detailing resons for it. The model’s calculations are appended to the excel file for the investor to examine themselves for further insight.

This step, facilitated by a staged CoT conversation, surfaces important insights that were missed in the single pass test and prepares the next step. Here’s the seasonality summary for Nvidia as an example. Using AI for this makes it lightening fast:

Seasonality: what’s “typical” and why it matters for 2H ramps

Averaging QoQ moves by fiscal quarter across the series in your file shows:

Sales QoQ avg: Q1 +16.2%, Q2 +22.5%, Q3 +14.1%, Q4 +12.0%.

Opex QoQ avg: Q1 +24.7%, Q2 –1.4%, Q3 +8.6%, Q4 +8.3%.

EPS QoQ avg: Q1 +10.2%, Q2 +30.6%, Q3 +26.3%, Q4 +25.9%.

Interpretation linked to business mix:

Today’s seasonality is data-center–led rather than old gaming holiday cycles. We see the strongest sequential revenue step-ups in Q2–Q3, consistent with hyperscaler deployment waves and NVIDIA’s annual architecture cadence (Hopper→Blackwell). Opex tends to flatten in Q2 versus Q1 as operating scale kicks in, producing outsized EPS acceleration in Q2–Q4. Your file’s Q3/Q4 FY26 forecasts (rev +16.8% / +12.0% QoQ; EPS +18.1% / +13.7% QoQ) line up well with these historical seasonal averages.

At this stage, the model has made an assessment of contextual business trends and linked those to the financial evidence in the income statement. It has extracted insights on the underlying rate of growth excluding the China charges, the seasonality profile of the business and the required financial hurdles for hitting FY2026 consensus targets.

The final step is to bring this together to construct scenarios for 2H FY2026 and compare these to consensus forecasts to assess achievability and any upside opportunity or downside risk.

CoT Prompt D:

Using all insights gained thus far, provide an analysis of achievability of consensus forecasts for the fiscal 2026 full year period which require the company to achieve $206.5b and EPS growth to $4.51. In doing this analysis, show all calculations and state the basis of any assumptions made:

1. Provide a scenario using year on year growth extrapolation for Q3 and Q4 revenue and EPS metrics using the underlying rates of growth achieved in Q2 (YoY) and that implied in Q3 guidance (YoY).

2. Provide a scenario based on quarter on quarter growth rate extrapolation for both revenue and EPS, noting seasonality and being careful on the impact of the export controls on the Q2 sequential revenue growth rate that makes it unrelaible as a basis for Q3 and Q4.

3. Provide an unside scenario if US export licences for China are achieved - what revenue and EPS could be achieved? Include the sources for any incremental reveneues being assumed in this scenario and show calculations and verification of the incremental margins being assumed.

4. Note any identified risks to the forecasts and provide a plausible downside scenario based on these factors and the insights gained through all steps in the analysis.

Conclude by making an assessment of whether consensus forecasts are achievable and whether there exist risks to the upside and downside with a recommendation on where the balance of those risks lies. Indicate your confidence level on a range of 0-100 and potential level of revenue and EPS surprise from your base case scenario and any other scenarios you see as realistic.

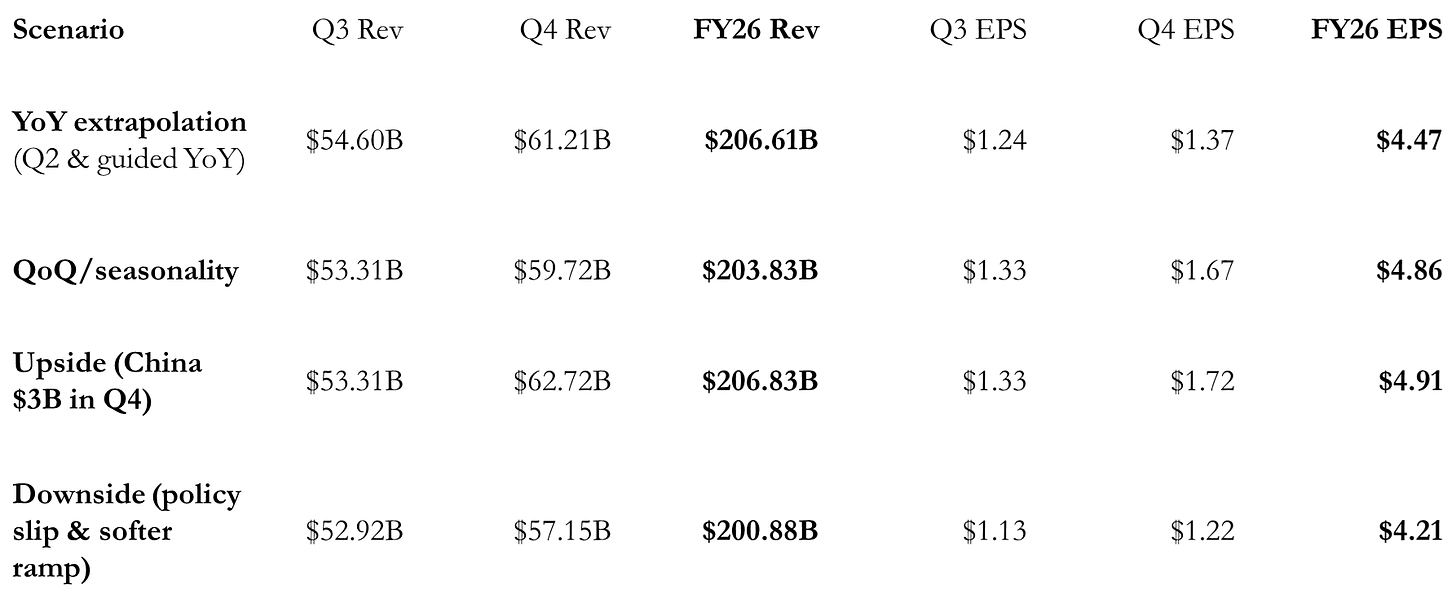

The final prompt is the synthesis step, where the model shows the value of a staged CoT approach. It builds multiple scenarios that blend recent trends, management guidance, YoY and QoQ growth, and seasonality. It also quantifies upside from a potential restart of China exports and sets a realistic downside case. The scenarios are summarised as follows:

Base case scenario 1 — YoY extrapolation

Extrapolating recent YoY growth meets the revenue target, but EPS lands a touch short. This is already stronger than the single-pass run, which only said a “strong Q4” was needed. Here, we show why: Q4 FY25 EPS grew more slowly than revenue, lifting the hurdle for Q4 FY26. With strong expected revenue growth, operating leverage, and normal seasonality, that EPS gap looks more like noise than signal.

Base case scenario 2 — QoQ with seasonality

Using QoQ seasonality from a Q2 base yields a slightly lower revenue path but a clear EPS beat. That revenue shortfall is less concerning, because it understates the current trajectory management describes. The Q3 guide, the company’s history of beating its own revenue guide, and robust YoY growth all counter it. Applying seasonality to EPS points to beats in both Q3 and Q4.

Base case conclusion

Taken together, the most sensible base case uses YoY extrapolation for revenue and and combination of YoY and seasonality for EPS. On that blend, FY26 revenue is a meet or small beat, with greater upside on EPS. In other words, even without China exports, consensus looks achievable with moderate upside.

China export resumption

The upside case quantifies potential China sales and, importantly, factors in the new 15% governmental take the model surfaced unprompted, then recomputes margins taking this into account. Assuming a conservative $3B in Q4, adjusted for timing, the uplift is material and would be a material share-price catalyst. It also shows the workflow value of this staged approach in a noisy, real-world setting.

Downside case

The downside is mechanical but useful for risk sizing: a ~3% revenue shortfall for the year can translate to a ~6% EPS miss, concentrated in Q4 given timing. It would pressure the stock if it occurred, but the scenario remains low-probability in the absence of a clear catalyst.

Where I land

The model’s own base case shows a small beat. Bringing human inference to bear, I sit slightly above that on both revenue and EPS, given Q4 seasonality, strong hyperscaler capex, and order-book color. A next refinement would be to bake explicit revenue and EPS surprise calculations into each scenario which is worth adding to the prompt set.

Conclusion to the Prompt Tests

If you are still with me after this lengthy post then I commend you for your dedication to learning how to best employ AI into your investment analysis workflows.

Bottom line: Chain-of-Thought prompts beat single-pass prompts for real investment work. They mirror how an analyst actually thinks, step by step, and the model responds with deeper, more accurate analysis.

The framework is simple. Ask the model to do what you would do: define the task, load verified data, build context, quantify trends, test scenarios, then judge achievability. Each step compounds the quality of the next.

You can reuse this prompt set across most stocks with light edits for company specifics. I intend on publishing a tested prompt library in time so you can get sophisticated outputs fast, without reinventing the wheel.

Inference never stops. Neither should you.

Andy West

The Inferential Investor

Appendix - Complete Prompt Responses

Response to Prompt B - Narrantive Business Trend Insights

Here’s a concise, four-quarter roll-up of the strategic and business trends management has flagged — plus corroboration from reputable coverage — organised by the levers that matter for revenue, expenses, margins and EPS.

Revenue growth drivers (last 4 quarters)

Hyperscaler & “sovereign AI” demand stayed the engine. Data Center remained ~the entire story, comping up strongly each quarter: Q4 FY25 revenue $39.3B (DC $35.6B), Q1 FY26 $44.1B (DC $39.1B), Q2 FY26 $46.7B (DC $41.1B). Management repeatedly pointed to broad-based hyperscaler spend and growing sovereign AI projects. NVIDIA Investor RelationsNVIDIA Newsroom+1

Product cycle tailwind: Hopper → Blackwell (and Blackwell Ultra/Rubin on deck). NVDA signalled a smooth, high-demand transition to Blackwell with sequential DC growth and specific call-outs that “Blackwell Data Center revenue grew 17% QoQ” in Q2 FY26; guidance for Q3 FY26 implied another step-up as Blackwell ramps. NVIDIA NewsroomYahoo Finance

Systems & networking mix is rising. Management emphasised NVLink/NVL72 and full-stack systems as attach expands; coverage highlights networking/system sales as a material contributor in Q2 FY26. Tom's Hardware

Gaming/Client recovered but remains secondary. Gaming posted record Q2 FY26 ($4.3B) aided by new RTX 50-series boards, but contribution to total growth is modest vs DC. Tom's Hardware

Expense & opex themes

Inventory and purchase-obligation charges tied to China rules. In Q1 FY26, NVDA booked a ~$4.5B charge linked to U.S. export restrictions (H20) and flagged a potential near-term revenue headwind; this flows through COGS/other costs rather than opex. Investopedia

Operating expense discipline. While opex isn’t the swing factor quarter-to-quarter, management commentary and pressers show operating leverage as revenue scaled; no outsized step-ups were highlighted versus the structural gross-margin moves. NVIDIA Investor RelationsNVIDIA Newsroom

Gross margin & mix

Non-GAAP GM sustained in the low-to-mid-70s, with puts/takes. Q2 FY26 non-GAAP GM landed ~72–73%; China-related charges and early Blackwell ramp created some compression vs peak levels, but management still frames margins as structurally strong given mix (HPC/AI systems, networking, software). Yahoo FinanceTom's Hardware

Transition costs vs pricing power. The Blackwell launch carries initial cost headwinds, yet NVDA continues to signal pricing power from performance leadership and full-stack value, supporting margin durability as yields improve through the ramp. Business Insider

EPS dynamics

Beat-and-raise cadence intact ex-charges. Q4 FY25 and Q1–Q2 FY26 all came in strong on revenue; EPS volatility largely reflects the China-related charge in Q1 FY26. Without it, NVDA noted EPS would have been higher (press and coverage detail this). NVIDIA Investor RelationsInvestopedia

Guide points still constructive. Q2 FY26 guide for Q3 pointed to ~$54B revenue despite excluding any China H20 units, implying operating leverage persists into 2H FY26. Yahoo Finance

Strategic context & risks to the growth algorithm

Geopolitics (China) = headline risk and real dollars. Management repeatedly addressed U.S. export controls shutting out advanced shipments to China; inventory write-downs and lost sales are tangible, though NVDA stresses diversification (sovereign AI in U.S./EU/ME and enterprise). Business InsiderInvestopedia

Competitive backdrop elevated but manageable (so far). Despite noise around rival models and accelerators, NVDA reiterated unprecedented demand for Blackwell and the annual cadence (Blackwell → Blackwell Ultra → Rubin), signalling an intent to defend share via rapid platform cycles. Business Insider

Customer capex remains the flywheel. Results and commentary across the four quarters consistently tie NVDA’s growth to hyperscaler and enterprise AI capex cycles; near-term signals remain robust. NVIDIA Investor RelationsNVIDIA Newsroom+1

One-paragraph synthesis (what changed over the last four quarters?)

From Q3–Q4 FY25 into Q1–Q2 FY26, NVDA’s growth stayed overwhelmingly data-center led, with a clean Hopper→Blackwell hand-off, rising systems/networking attach, and expanding sovereign AI demand. China export controls created a Q1 FY26 charge and some mix pressure, but did not derail top-line momentum. Non-GAAP gross margins held in the low-70s despite those charges and the early Blackwell ramp, reflecting pricing power and full-stack differentiation. EPS stepped down in Q1 due to the charge, then re-normalised with Q2’s record quarter and a strong Q3 revenue guide (~$54B) that excludes any China H20 contribution — all of which frames a still-favourable setup for revenue, margin, and EPS trajectory into 2H FY26.

Response to Prompt C - Financial Trend Analysis

Below is a concise readout that ties the last four quarters’ results to the business trends you asked about, seasonality analysis plus the Q3/Q4 FY26 growth required to hit consensus.

What the last four quarters say (Q3–Q4 FY25, Q1–Q2 FY26)

Top line & mix

Revenue stepped up each quarter but decelerated in Q2 FY26 as Blackwell ramp costs and mix noise hit margins: $35.1B → $39.3B → $44.1B → $46.7B (QoQ +16.8%, +12.1%, +12.0%, +6.1%). This mirrors management’s narrative: hyperscaler/sovereign AI demand is the engine; the Hopper→Blackwell transition is underway and sets up 2H ramps.

File forecasts for 2H imply the product cycle tailwind reasserts: Q3 FY26 $54.6B and Q4 FY26 $61.1B, mapping to QoQ +16.8% and +12.0%, right in line with the seasonal pattern we measure (see below).

Margins & opex discipline

Gross margin: 75.0% → 73.5% → 61.0% → 72.7%. The Q1 FY26 dip is consistent with the China-related charges/transition costs noted by management; Q2 FY26 re-normalises toward low-70s as yields/mix improve.

Operating margin: 66.35% → 64.88% → 52.82% → 64.53%. Pattern matches the GM story: temporary compression in Q1 FY26, recovery in Q2 FY26 as full-stack pricing power and networking attach support profitability.

Opex leverage: Opex/Sales improved from 8.65% → 8.62% → 8.18% → 8.17% over the last four quarters—consistent with management’s steady opex posture while revenue scales.

EPS dynamics

Non-GAAP EPS: $0.81 → $0.89 → $0.81 → $1.05 (QoQ +19.1%, +9.9%, –9.0%, +29.6%). Q1 FY26 absorbed the charge; Q2 FY26 rebounded with margin normalisation and scale.

File forecasts imply Q3 FY26 $1.24 and Q4 FY26 $1.41, continuing sequential EPS growth into 2H as Blackwell ramps and mix improves.

Seasonality: what’s “typical” and why it matters for 2H ramps

Averaging QoQ moves by fiscal quarter across the series in your file shows:

Sales QoQ avg: Q1 +16.2%, Q2 +22.5%, Q3 +14.1%, Q4 +12.0%.

Opex QoQ avg: Q1 +24.7%, Q2 –1.4%, Q3 +8.6%, Q4 +8.3%.

EPS QoQ avg: Q1 +10.2%, Q2 +30.6%, Q3 +26.3%, Q4 +25.9%.

Interpretation linked to business mix:

Today’s seasonality is data-center–led rather than old gaming holiday cycles. We see the strongest sequential revenue step-ups in Q2–Q3, consistent with hyperscaler deployment waves and NVIDIA’s annual architecture cadence (Hopper→Blackwell). Opex tends to flatten in Q2 versus Q1 as operating scale kicks in, producing outsized EPS acceleration in Q2–Q4. Your file’s Q3/Q4 FY26 forecasts (rev +16.8% / +12.0% QoQ; EPS +18.1% / +13.7% QoQ) line up well with these historical seasonal averages.

FY totals appended & consensus bridge (what’s needed in Q3/Q4 FY26)

I appended Annual Totals for FY2023–FY2026 (summing quarterly line items and providing EPS sum and average). I also built a Required Growth FY26 sheet that reconciles to consensus.

H1 FY26 actuals (from your file):

Revenue: $90.805B (Q1 $44.062B + Q2 $46.743B)

Non-GAAP EPS: $1.86 (Q1 $0.81 + Q2 $1.05)

Consensus targets (FY26): Revenue $206B, EPS $4.50

Implied H2 FY26 needed to hit consensus:

Revenue needed in H2: $115.195B (= $206B – $90.805B)

EPS needed in H2: $2.64 (= $4.50 – $1.86)

File’s H2 forecasts vs. “needed”:

Q3 FY26 (file): $54.599B revenue, $1.24 EPS

Q4 FY26 needed, holding Q3 as-is to hit consensus: $60.596B revenue, $1.40 EPS

Required QoQ vs Q3: Revenue +11.0%, EPS +12.9%

Required YoY vs Q4 FY25: Revenue +54.1%, EPS +57.3%

What the file already implies:

Q4 FY26 (file): $61.129B revenue and $1.41 EPS

That exceeds the “required” hurdle by ~$0.53B revenue and $0.01 EPS, implying the file’s FY26 total is ~$206.53B revenue and $4.51 EPS, i.e., very slightly above consensus if Q3 delivers as forecast.

How this ties back to the drivers you flagged

The Hopper→Blackwell transition is visible in the 2H shape: sequential revenue re-accelerates and margins recover after the Q1 FY26 charge.

Full-stack systems/networking attach supports gross and operating margin rebuild in Q2 and into 2H.

Opex discipline plus scale = stable ~8% opex/sales, enabling EPS to outrun revenue as margins normalise.

The China export-control charge explains the one-off Q1 FY26 margin/EPS air-pocket, with normalisation evident in Q2.

Where to find everything in the workbook

Quarterly_KPIs: clean quarterly table with Sales, GP, Opex, EBIT, NI, Non-GAAP EPS, plus Gross/Operating margin, Opex/Sales, and QoQ/YoY growth.

Seasonality_QoQ_Avg: average QoQ seasonality by fiscal quarter for Sales, Opex, EPS, and margins.

Annual_Totals: FY sums and EPS sum/average.

Required_Growth_FY26: Q3/Q4 targets and the QoQ/YoY growth needed to land consensus given H1 actuals.

FY26_Consensus_Check: one-page summary of H1, H2 needed, and deltas vs your file’s H2.

Response to Prompt D: - Scenario Analysis and Forecast verification

Below is a concise, calculation-first assessment of whether FY26 consensus (Revenue $206.5B, non-GAAP EPS $4.51) is achievable, using your workbook’s quarterly history/forecasts and management guidance, then layering a policy-driven upside and a risk-aware downside. Where I cite guidance/policy, sources are footnoted.

Baseline facts we’ll use

H1 FY26 actuals (from your file): Revenue $90.805B (Q1 $44.062B, Q2 $46.743B); EPS $1.86 (Q1 $0.81, Q2 $1.05).

Q3 FY26 guidance (company): Revenue $54.0B ±2%, non-GAAP GM ~73.5% ±50 bps, tax rate ~16.5% ±1%; guidance excludes any China H20 shipments. TradingView+1

Prior-year comps: Q2 FY25 Rev $30.040B, EPS $0.68; Q3 $35.082B / $0.81; Q4 $39.331B / $0.89 (from your file).

Seasonality (from your file): Average QoQ: Revenue Q3 +14.1%, Q4 +12.0%; EPS Q3 +26.3%, Q4 +25.9%.

Diluted shares (for EPS bridge): ~24.6B (TTM into Apr-2025, split-adjusted). Finance Charts

1) YoY extrapolation scenario (use Q2 YoY & Q3 guidance YoY)

Observed/Implied YoY rates

Q2 FY26 YoY:

– Revenue: 46.743/30.040−1=+55.60%

– EPS: 1.05/0.68−1=+54.41%Q3 FY26 guidance YoY (using your file’s Q3 guide $54.599B & $1.24):

– Revenue: 54.599/35.082−1=+55.63%

– EPS: 1.24/0.81−1=+53.09%

Method:

Q3 = use your guided values (Rev $54.599B, EPS $1.24).

Q4 = apply the midpoint YoY rate 55.62% to Q4 FY25 comps.

– Q4 Rev = 39.331×(1+0.5562)=**$61.206B**

– Q4 EPS = 0.89×(1+0.5375)=**$1.368** where EPS YoY midpoint = (54.41%+53.09%) / 2 = **53.75%**

FY26 totals (YoY scenario):

Revenue: 90.805 + 54.599 + 61.206 = **$206.61B**

EPS: 1.86 + 1.24 + 1.368 = **$4.47**

Read-through: Revenue meets/edges consensus; EPS is ~$0.04 short (–0.9% vs $4.51).

2) QoQ extrapolation scenario (seasonality-based, not Q2’s noisy QoQ)

Why not use Q2→Q3 simple QoQ? Q2 sequential growth (+6.1%) was distorted by the H20 export halt/write-down and mix; management Q3 guide explicitly excludes China H20. Use the seasonal averages from your time series instead.

Apply your seasonal averages from Q2 base:

Revenue:

– Q3 = 46.743×(1+0.1405)=**$53.31B**

– Q4 = 53.31×(1+0.1202)=**$59.72B**EPS:

– Q3 = 1.05×(1+0.2634)=**$1.33**

– Q4 = 1.33×(1+0.259)=**$1.67**

FY26 totals (QoQ/seasonality scenario):

Revenue: 90.805 + 53.31 + 59.72 = **$203.83B**

EPS: 1.86 + 1.33 + 1.67 = **$4.86**

Read-through: Seasonality alone gives EPS beat but revenue shortfall (–1.29% vs $206.5B). This says margins/opex leverage plus mix can carry EPS even if revenue lands a touch light—consistent with mid-70s GM guidance into 2H. TradingView

3) Upside if U.S. export licenses for China flow in time

What changed: U.S. authorities have begun issuing export licenses for Nvidia’s H20 to China, with reports of a 15% revenue share to the U.S. government as a condition. CFO also said several China customers have attained licenses, but the 15% mechanism isn’t fully finalized. We treat the 15% as a P&L cost, not a revenue deduction, pending accounting clarity. Yahoo Finance+3Reuters+3Wall Street Journal+3

Size of the near-term opportunity (for H2 FY26):

Reuters reports China remains eager for Nvidia chips, H20 ASP ~$10–12k, and Nvidia holds “hundreds of thousands” of H20 units in inventory; Nvidia pegs China as a potential ~$50B market. Even a small release can matter for a single quarter. We assume a conservative $3B shipment in Q4 only (timing risk). Reuters

Margin/earnings assumption for incremental China sales:

Corporate non-GAAP GM guide ~73.5%; we haircut H20 to ~68% GM (lower ASP/spec).

Treat 15% revenue share as opex-like cost. Assume ~3% variable opex to fulfill.

Incremental operating margin ≈ 68% − 15% − 3% = ~50%**.

Tax rate: 16.5% (company) ⇒ incremental net margin ≈ 50%×(1−0.165)=41.75%.

Shares: 24.6B.

EPS uplift per $1B of China revenue:

ΔEPS≈1B×41.75\Delta EPS ≈ 1B × 41.75% / 24.6B ≈ **$0.0170**ΔEPS≈1B×41.75.

So $3B ⇒ +$0.051 EPS; revenue +$3B.

Apply on top of the seasonality baseline (from §2):

Q4 Rev: 59.72 + 3.00 = **$62.72B**

FY26 Rev: 203.83 + 3.00 = **$206.83B** (now above consensus)

Q4 EPS: 1.67 + 0.051 = **$1.72**

FY26 EPS: 4.86 + 0.051 = **$4.91**

Sensitivity: +$2B / +$4B China in Q4 → FY26 EPS ~$4.89 / $4.92; FY26 Rev ~$205.8B / $207.8B. TradingView+1

4) Risks & a plausible downside

Key risks surfaced in our earlier work & the record:

Policy execution/timing: The 15% revenue-share mechanics are not finalized, and license timing is uncertain; shipments could slip. Yahoo Finance

Further export restrictions (e.g., GAIN AI Act proposals or tightened performance caps) could constrain non-U.S. supply. Tom's Hardware

Ramp risks on Blackwell/networks (yield, supply), and mix shifts that dilute GM temporarily. Company guides mid-70s GM but quarter-to-quarter mix can move it. TradingView

Downside scenario (policy slippage + ramp friction):

Q3 at low end of guide: 54.0×(1−254.0×(1−2%)=**$52.92B**

Q4 only +8% QoQ (below seasonal +12%): 52.92×1.08=**$57.15B**.

EPS approximated off Q2 EPS-per-$B$ with a 5% margin haircut (GM –100bps, opex +30bps):

– EPS_per_B≈1.05/46.743=0.02247EPS ≈ 1.05/46.743

– Q3 EPS ≈ 52.92×0.02247×0.95=**$1.13**.

– Q4 EPS ≈ 57.15×0.02247×0.95=**$1.22**.FY26 totals (downside): Revenue $200.88B; EPS $4.21.

Side-by-side outcome summary

Conclusion — Achievability & risk balance

Achievability of consensus: High. Two independent paths get you there:

(i) YoY extrapolation already meets revenue and falls only ~$0.04 shy on EPS (easily closed by minor GM/opex upside), and

(ii) Seasonality path beats EPS handily but misses revenue by ~$2.7B—a gap that modest pull-ins (networking/systems) or any China licensing shipments could close. TradingViewUpside skew: If even $2–3B of H20 ships in Q4 under licenses, FY26 can print $206–207B revenue and $4.89–$4.91 EPS despite the 15% take, because flow-through remains powerful at ~50% incremental OM and ~16.5% tax. Reuters+2Reuters+2

Downside: A policy slip and/or ramp friction yields a credible $200–201B / $4.20 year—still very profitable, but below consensus.

My base case: $206.5–206.7B revenue; $4.50–$4.55 EPS (essentially your file’s path).

Revenue surprise vs consensus: ~0% to +0.1%

EPS surprise vs consensus: 0% to +1%

Confidence (0–100): 65 — drivers are broad (hyperscalers/sovereign), guidance is tight, and multiple paths clear the bar; primary uncertainty is timing/quantum of China licensing and Blackwell logistics.

Risk balance: Tilted to the upside on EPS (mix/opex leverage), balanced on revenue (small shortfall if licenses slip, small beat if they land).

Sources

Company press/guidance: Q2 FY26 results, Q3 FY26 outlook (revenue, GM, tax), and note that Q3 guide excludes China H20. NVIDIA Newsroom+1

China licensing/15% share: FT/WSJ/Reuters/Yahoo coverage of export licenses and proposed 15% revenue share; CFO commentary that mechanics not finalized. Yahoo Finance+3Reuters+3Wall Street Journal+3

China demand/ASP/inventory estimate: Reuters (H20 ASP ~$10–12k; “hundreds of thousands” in inventory; China ~$50B potential market). Reuters

Assumptions (for transparency)

YoY scenario: Q3 uses your file’s implied guide; Q4 YoY uses the midpoint of Q2 YoY and Q3 implied YoY.

QoQ scenario: Uses your computed seasonal averages (Q3 +14.1%, Q4 +12.0% revenue; Q3 +26.3%, Q4 +25.9% EPS) instead of Q2’s raw QoQ.

Upside (China): $3B H20 revenue in Q4 only; incremental OM ~50% = (H20 GM ~68% – 15% revenue share – ~3% variable opex), tax 16.5%, 24.6B diluted shares. Accounting for the 15% as P&L cost (not contra-revenue) until the company clarifies. TradingView

Downside: Q3 at low end of guide (–2%); Q4 only +8% QoQ; EPS per $B anchored to Q2 and 5% margin haircut.